What Is Advance Premium Tax Credit If you choose to have advance payments of the Premium Tax Credit made on your behalf you will reconcile the amount paid in advance with the actual credit you compute when you file your tax return for the year Either way you will complete Form 8962 Premium Tax Credit PTC and attach it to your tax return for the year

Form 8962 Premium Tax Credit is the tax worksheet you use to settle up your PTC situation with the IRS APTC users must check their Form 1095 A Health Insurance Marketplace Statement which The advance premium tax credit APTC is a federal tax credit you can take to lower your monthly bill for health insurance when you buy an Obamacare plan from the health insurance marketplace Key Takeaways

What Is Advance Premium Tax Credit

What Is Advance Premium Tax Credit

https://www.grantsformedical.com/wp-content/uploads/2023/01/Advance-Premium-Tax-Credit.jpg

How Does The ACA Impact Your Taxes Group Plans Inc

http://groupplansinc.com/wp-content/uploads/2020/03/PTC.png

Understanding The Premium Tax Credit Extension

https://tax.thomsonreuters.com/blog/wp-content/uploads/sites/17/2022/11/AdobeStock_422130920-scaled.jpeg

Advanced Premium Tax Credit A type of federal subsidy that reduces the amount individuals pay for their monthly health insurance premiums Advanced Premium Tax Credits are a provision in the A tax credit you can take in advance to lower your monthly health insurance payment or premium When you apply for coverage in the Health Insurance Marketplace you estimate your expected income for the year If you qualify for a premium tax credit based on your estimate you can use any amount of the credit in advance to lower your

For tax years other than 2020 if advance payments of the premium tax credit were paid for you or someone else in your tax family your tax family consists of every individual you claim on your tax return yourself your spouse if filing jointly and your dependents you must complete Form 8962 Premium Tax Credit PTC PDF and attach it to The advance premium tax credit APTC reduces health insurance payments of the premium for those with ACA marketplace plans When you buy health insurance on Healthcare gov or from the 14 states and the District of Columbia that run their own insurance marketplaces you can receive a subsidy to help reduce your premiums based on your income

Download What Is Advance Premium Tax Credit

More picture related to What Is Advance Premium Tax Credit

What Is An Advance Premium Tax Credit Nevada Insurance Enrollment

https://www.prlog.org/12828699-what-is-an-advance-premium-tax-credit.jpg

Insurance Questions What Is The Advance Premium Tax Credit APTC

https://i.ytimg.com/vi/mzDHpUybtIs/maxresdefault.jpg

What Is Advance Premium Tax Credit Insurance Noon

https://insurancenoon.com/wp-content/uploads/2020/08/What-Is-Advance-Premium-Tax-Credit.jpg

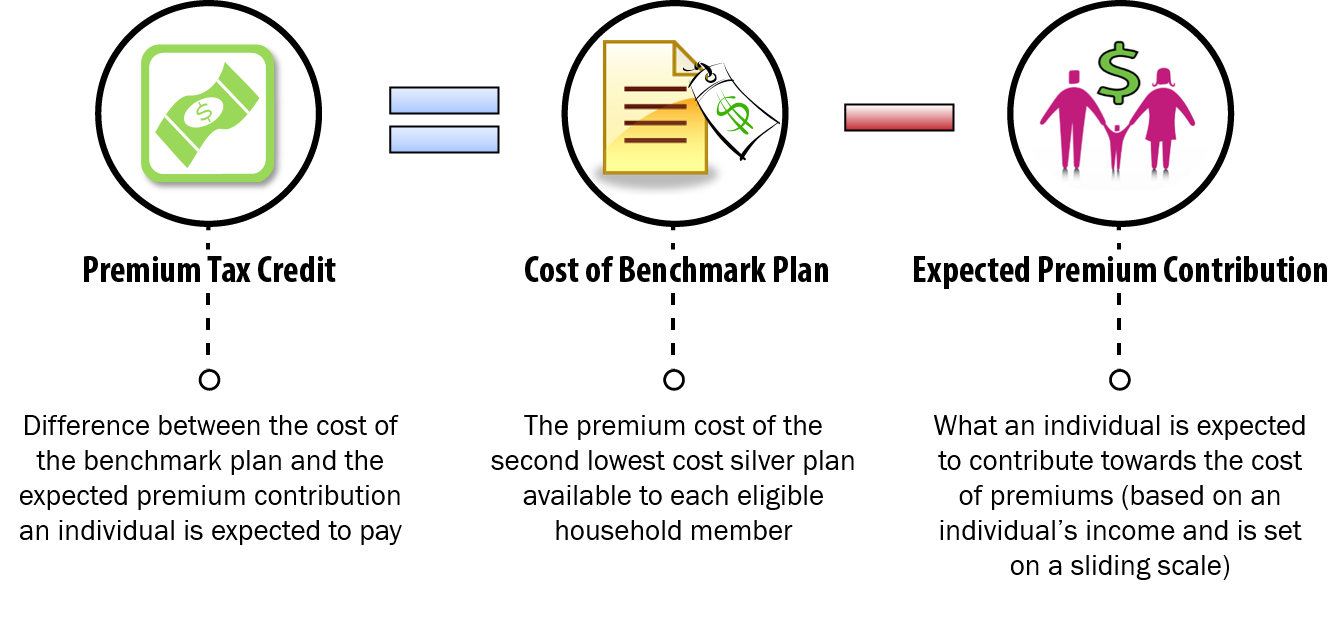

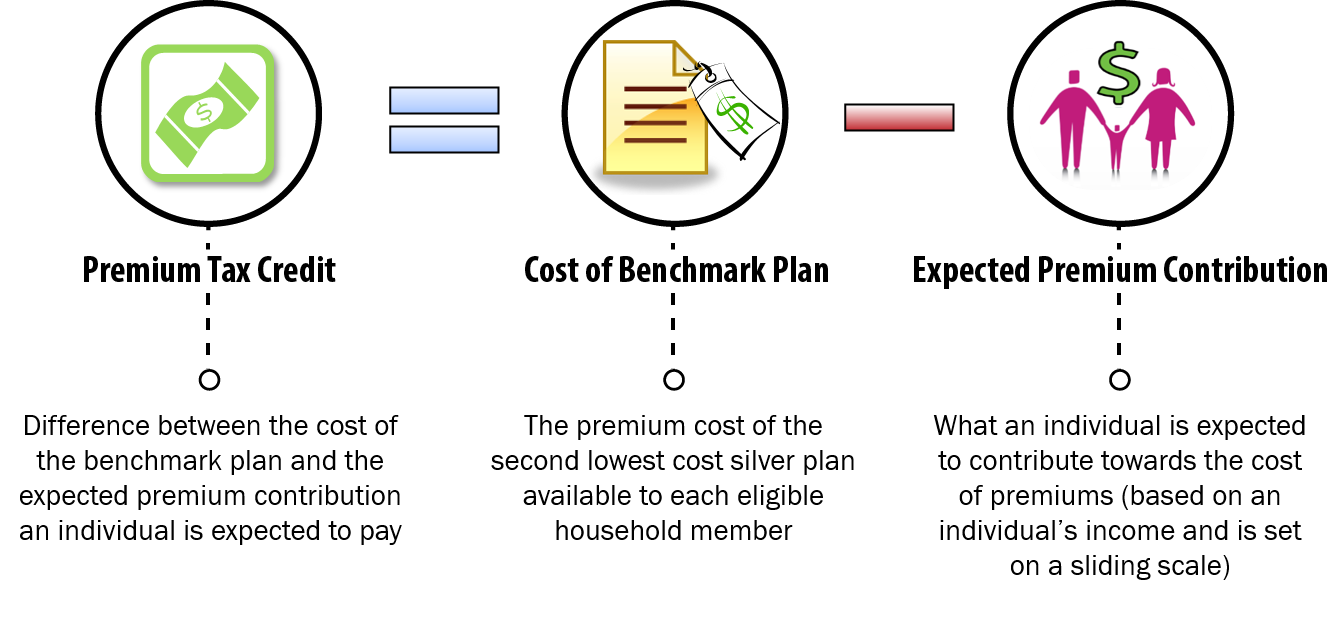

The value of your advance premium tax credit is calculated as the difference between the premium for the second lowest cost Silver plan SLCSP and your premium cap APTC amount premium of SLCSP premium cap The insurance premium cap is the amount your state thinks is the most you can reasonably afford to spend on a monthly health insurance An Advance Premium Tax Credit APTC is a federal tax credit that is calculated on a per tax household basis If you are eligible to receive APTC you may use it right away to lower what you pay for your monthly health plan premiums Households who qualify can take the tax credit as advance payments

[desc-10] [desc-11]

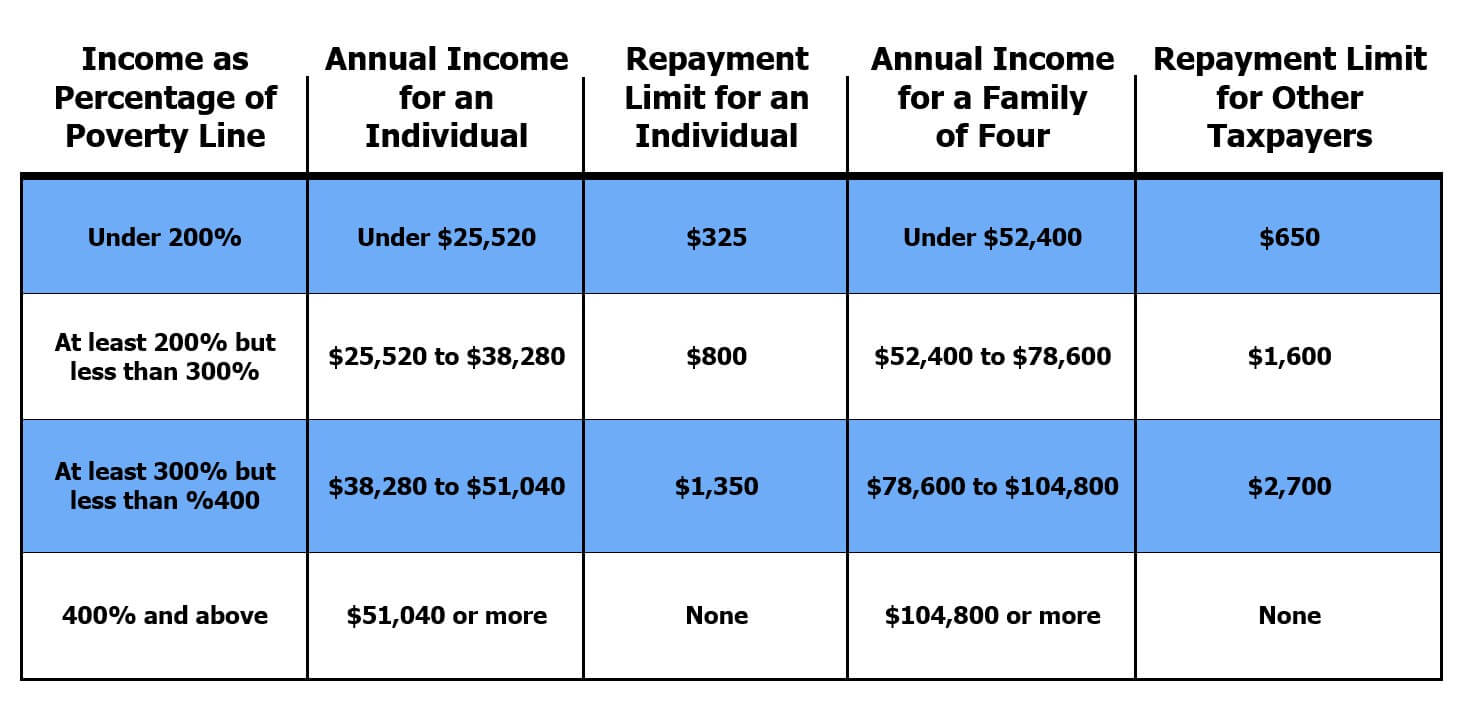

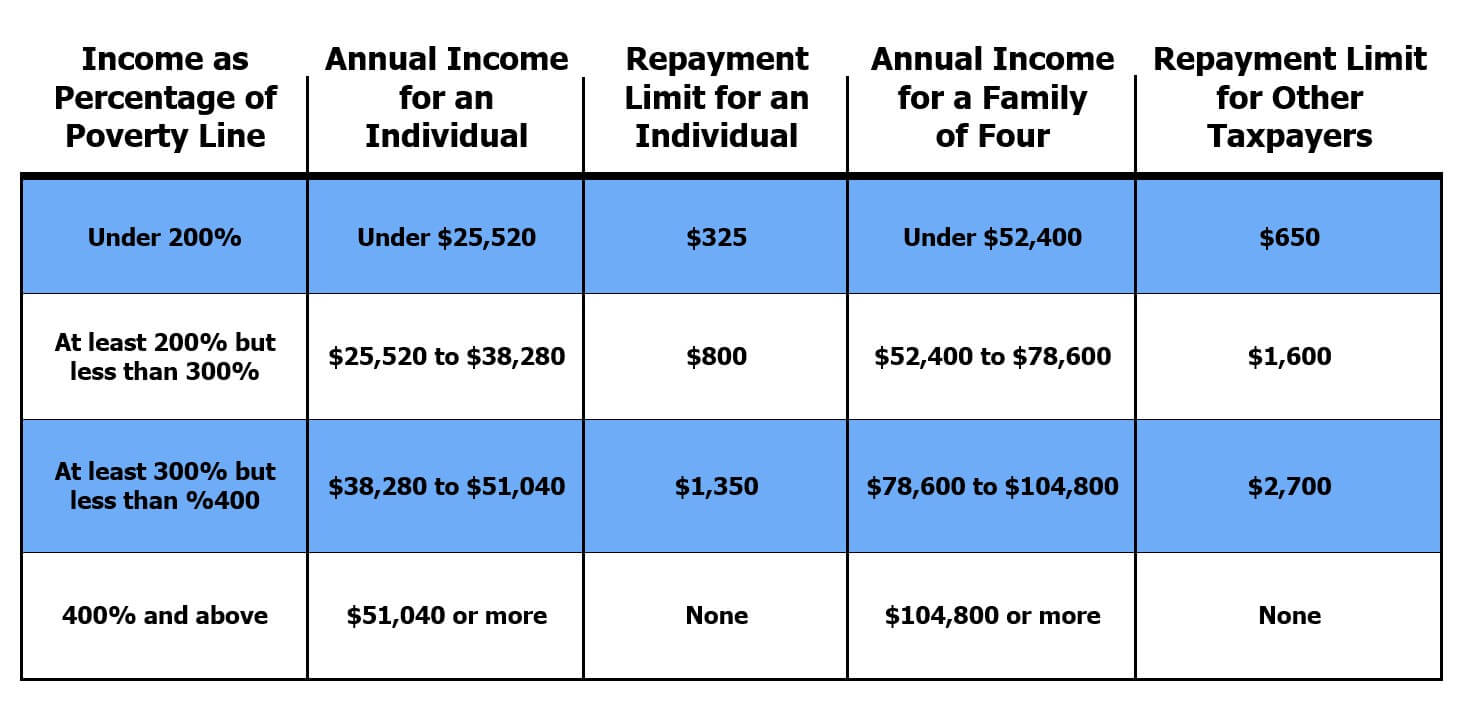

Repayment Limits For Advanced Premium Tax Credit

https://www.nevadainsuranceenrollment.com/wp-content/uploads/2022/09/Repayment-Limits-for-Advanced-Premium-Tax-Credit.jpg

What Is An Advance Premium Tax Credit Nevada Insurance Enrollment

https://www.prlog.org/12939924-what-is-an-advance-premium-tax-credit.jpg

https://www.irs.gov/affordable-care-act/individuals-and-families/...

If you choose to have advance payments of the Premium Tax Credit made on your behalf you will reconcile the amount paid in advance with the actual credit you compute when you file your tax return for the year Either way you will complete Form 8962 Premium Tax Credit PTC and attach it to your tax return for the year

https://www.nerdwallet.com/article/taxes/premium-tax-credit

Form 8962 Premium Tax Credit is the tax worksheet you use to settle up your PTC situation with the IRS APTC users must check their Form 1095 A Health Insurance Marketplace Statement which

Advance Premium Tax Credit

Repayment Limits For Advanced Premium Tax Credit

No Repayment Of Advance Premium Tax Credits YouTube

2021 Explanation Of Advanced Premium Tax Credits APTC YouTube

What Is The Advance Premium Tax Credit Correct Success

Health Insurance Marketplace Advance Premium Tax Credit YouTube

Health Insurance Marketplace Advance Premium Tax Credit YouTube

What You Need To Know About ACA s Advance Premium Tax Credit

How Does The Advanced Premium Tax Credit Work TaxAct

Advance Premium Tax Credit How The Federal Government Can Help

What Is Advance Premium Tax Credit - A tax credit you can take in advance to lower your monthly health insurance payment or premium When you apply for coverage in the Health Insurance Marketplace you estimate your expected income for the year If you qualify for a premium tax credit based on your estimate you can use any amount of the credit in advance to lower your