What Is An Advance Payment Of Premium Tax Credit These payments which are called advance payments of the premium tax credit or advance credit payments lower what you pay out of pocket for your monthly

When you enroll the Marketplace will determine if you are eligible for advance payments of the premium tax credit also called advance credit payments or APTC Advance The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums The advance PTC lowers the premiums themselves

What Is An Advance Payment Of Premium Tax Credit

What Is An Advance Payment Of Premium Tax Credit

https://i.ytimg.com/vi/AqMnOg7WnvQ/maxresdefault.jpg

Premium Tax Credit PTC 965 Income Tax 2020 YouTube

https://i.ytimg.com/vi/vZ-LzT0wVuI/maxresdefault.jpg

What Is An Advance Premium Tax Credit Nevada Insurance Enrollment

https://www.prlog.org/12828699-what-is-an-advance-premium-tax-credit.jpg

The advance premium tax credit APTC lowers your monthly health insurance bill on plans you signed up for through the marketplace by paying part of your premium tax credit directly to A tax credit you can take in advance to lower your monthly health insurance payment or premium When you apply for coverage in the Health Insurance Marketplace

An advance premium tax credit often just called APTC refers to a premium tax credit premium subsidy that s paid throughout the year directly to the insurer on behalf of an The advanced premium tax credit is a federal tax credit for individuals that reduces the amount they pay for monthly health insurance premiums when they buy health insurance on the

Download What Is An Advance Payment Of Premium Tax Credit

More picture related to What Is An Advance Payment Of Premium Tax Credit

Who Gets The 1400 Tax Credit Leia Aqui Who Is Eligible For The 1400

https://uploads-ssl.webflow.com/5f8b3b580a028fb03a114a0c/635e8110482d4a62090ff7d0_premium tax credit repayment caps 2022.png

How Do I Calculate My Premium Tax Credit

https://s.yimg.com/ny/api/res/1.2/dH2V3YdQWB4mNrhDZQ6U7g--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTQxOA--/https://media.zenfs.com/en/smartasset_475/b15873c2a51e6da6c4d1c0fc48cbe377

No Repayment Of Advance Premium Tax Credits YouTube

https://i.ytimg.com/vi/ZPDE5vfHGJg/maxresdefault.jpg

What you take in advance is called the advance premium tax credit APTC You can only claim the APTC if you get a plan through a health insurance marketplace The premium tax credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the

The premium tax credit PTC is a refundable tax credit designed to help you pay for health plans purchased through the federal or state exchanges Eligibility for the PTC for an exchange A consumer can apply some or all of this tax credit to their monthly insurance premium payment The Marketplace will send the tax credit directly to their insurance company

Advance Payment Premium Tax Credit Blog hubcfo

https://blog.hubcfo.com/wp-content/uploads/2016/02/53022e6ddfc74.image_.jpg

Request Letter For Advance Salary Loan Company Salaries 2023

https://www.allbusinesstemplates.com/thumbs/5e76305c-c1b3-4398-93cb-91a53466e33c_1.png

https://www.irs.gov › affordable-care-act › ...

These payments which are called advance payments of the premium tax credit or advance credit payments lower what you pay out of pocket for your monthly

https://www.irs.gov › affordable-care-act › ...

When you enroll the Marketplace will determine if you are eligible for advance payments of the premium tax credit also called advance credit payments or APTC Advance

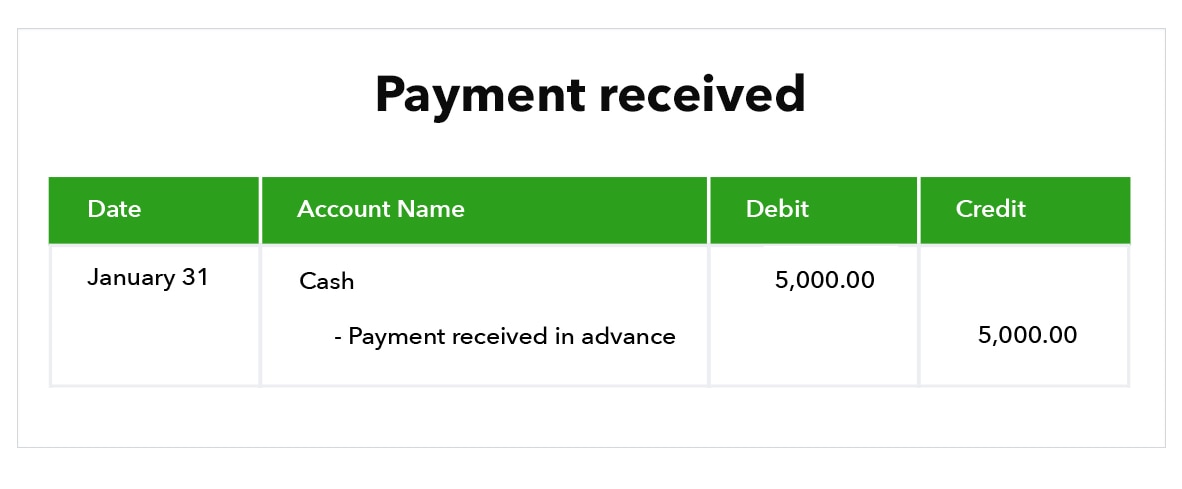

Credit Note To Customer And Then Payment Received Page 2 Manager Forum

Advance Payment Premium Tax Credit Blog hubcfo

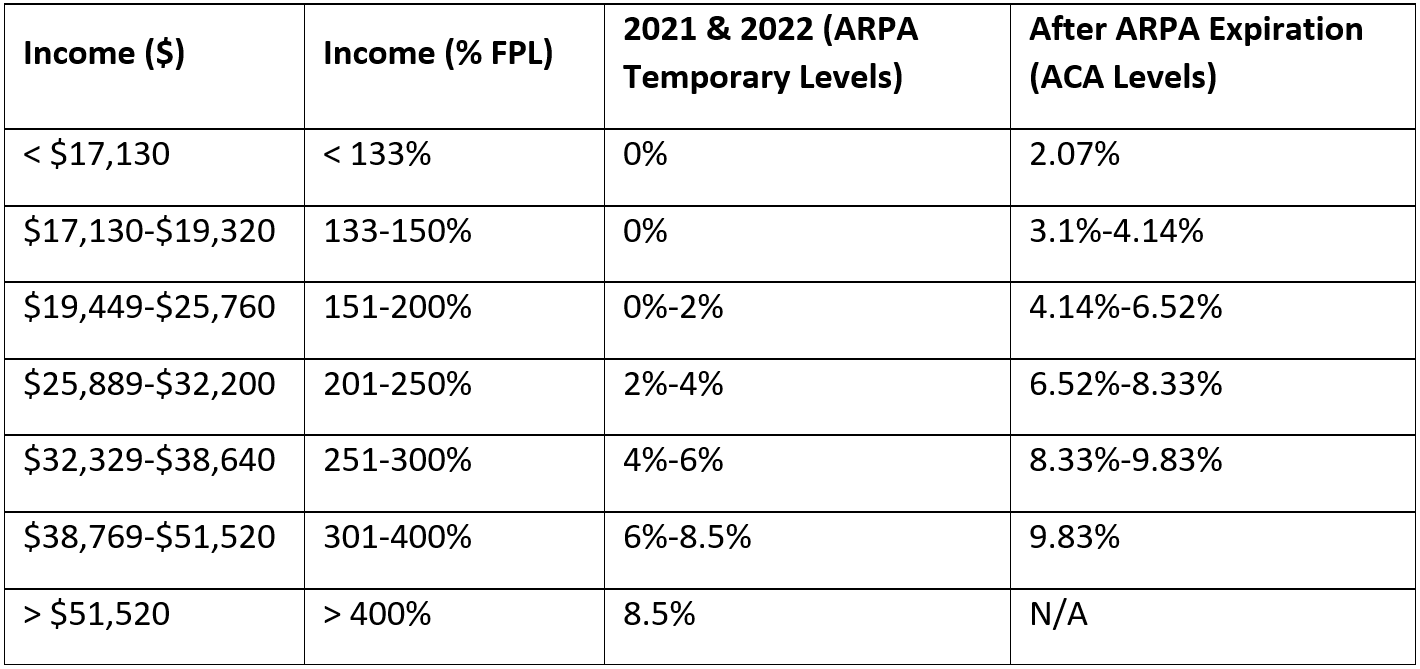

After The American Rescue Plan s Enhanced Premium Tax Credits End AAF

Search Safelocaltrades For Recommended Tradesmen Suppliers And

Accepting Advance Payments What Is Advance Billing QuickBooks

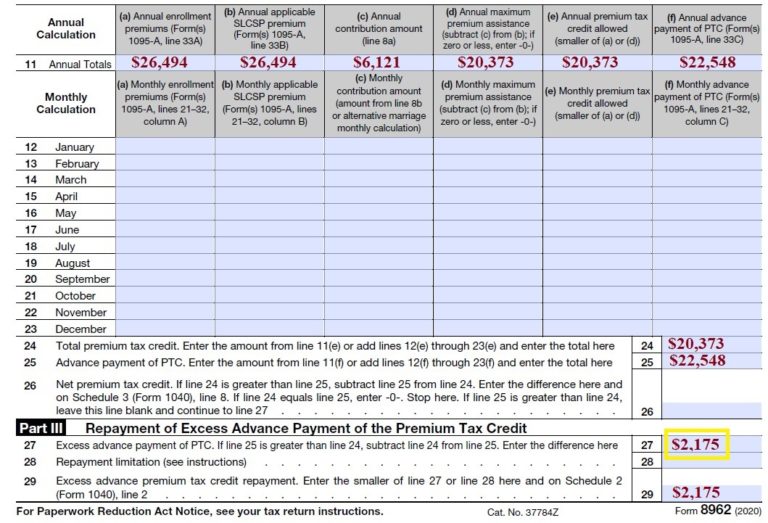

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

A State By State Look At Marketplace Tax Credit Eligibility

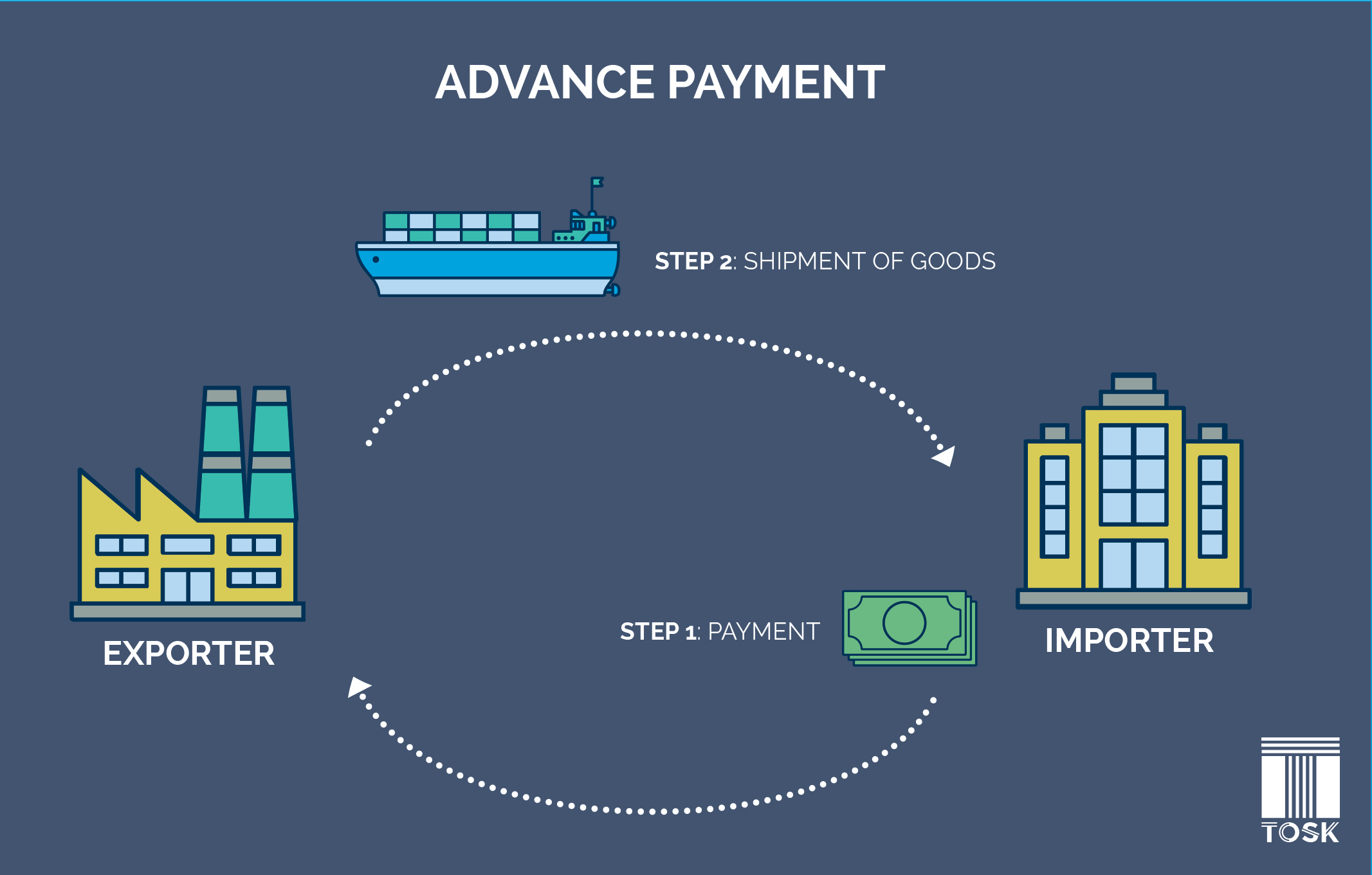

Advance Payment In International Trade Pros And Cons TOSK Global

Advance Payment Of Tax Advance Tax Services In New Delhi India

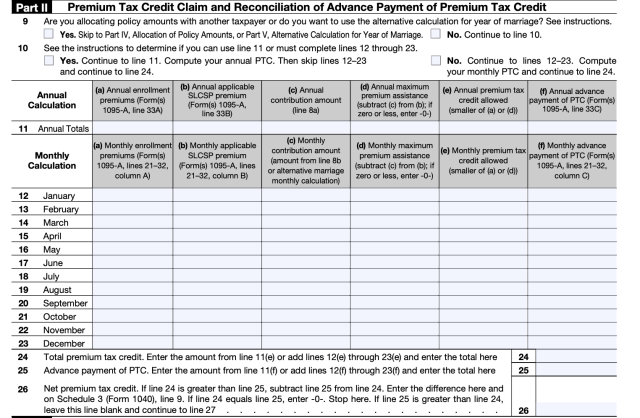

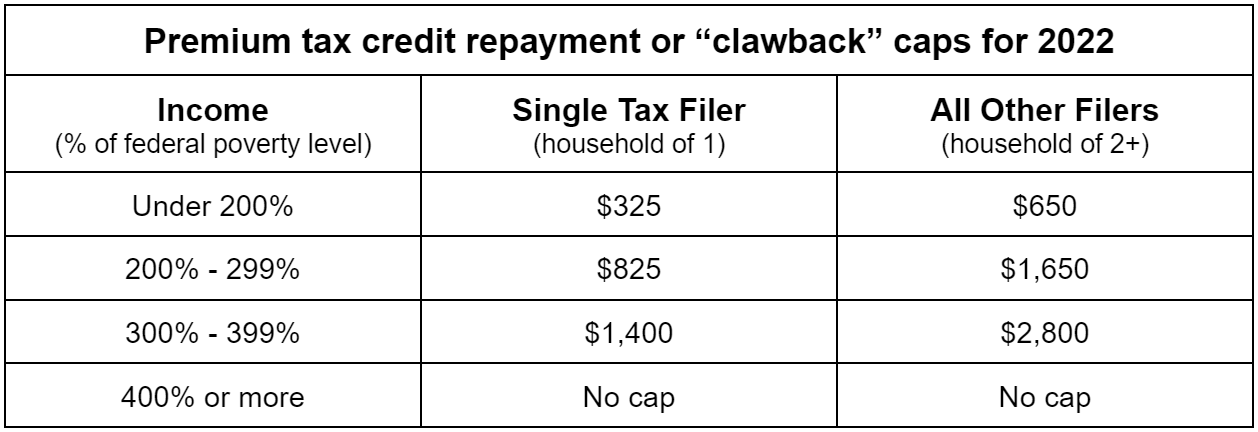

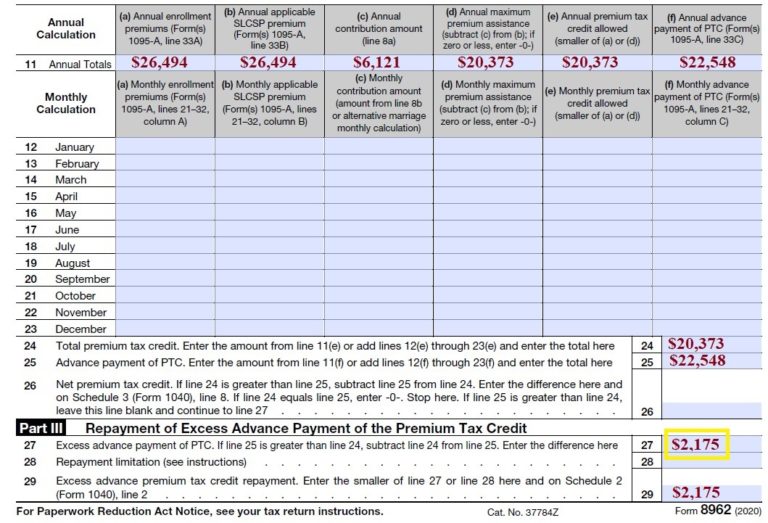

What Is An Advance Payment Of Premium Tax Credit - To reconcile you compare two amounts the premium tax credit you used in advance during the year and the amount of tax credit you qualify for based on your final income You ll