What Is An Eligible Small Business For Tax Purposes Qualifying as a small business can make a company eligible for government contracts and other financial benefits Small businesses can structure themselves in a variety of ways for tax and

The qualified business income deduction QBI is a tax deduction that allows eligible self employed and small business owners to deduct up to 20 of their qualified business income on Find out about tax reliefs and allowances available from HMRC if you run a business employ people or are self employed

What Is An Eligible Small Business For Tax Purposes

What Is An Eligible Small Business For Tax Purposes

https://bbcincorp.com/wp-content/uploads/2022/11/S-corp-tax-benefits.jpg

The Commercial Accounting Group About

https://thecagroup.com.au/wp-content/uploads/2017/04/two.jpg

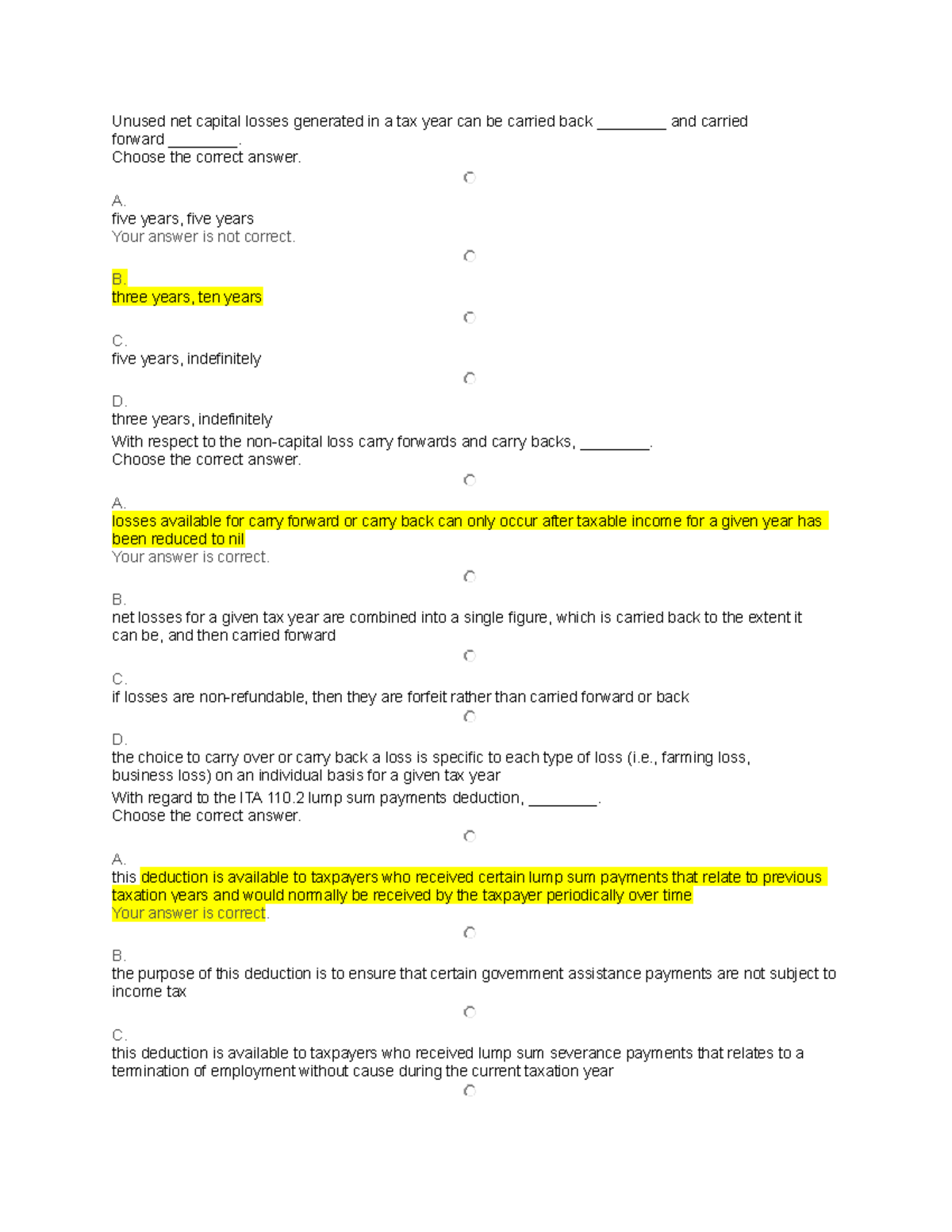

Sample Question For Tax 2 Unused Net Capital Losses Generated In A

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/74ba378144ce6f5321b7ff0772ffaa3a/thumb_1200_1553.png

Paying taxes and tax planning are key requirements of running a successful small business Learn about the taxes that businesses owe the strategies they can use the documents they need Learn how to save money on your taxes in 2024 with these 23 tax breaks for small businesses including how to deduct expenses and reduce your tax liability

Eligible Small Business For Purposes of Offsetting AMT Only An eligible small business is A corporation whose stock isn t publicly traded A partnership or A sole proprietorship The Qualified Business Income Deduction Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called the Section 199A

Download What Is An Eligible Small Business For Tax Purposes

More picture related to What Is An Eligible Small Business For Tax Purposes

FSA Eligible Expense List Flexbene

https://flexbene.com/wp-content/uploads/2022/12/Eligible-FSA-Expenses-2023-1-scaled.jpg

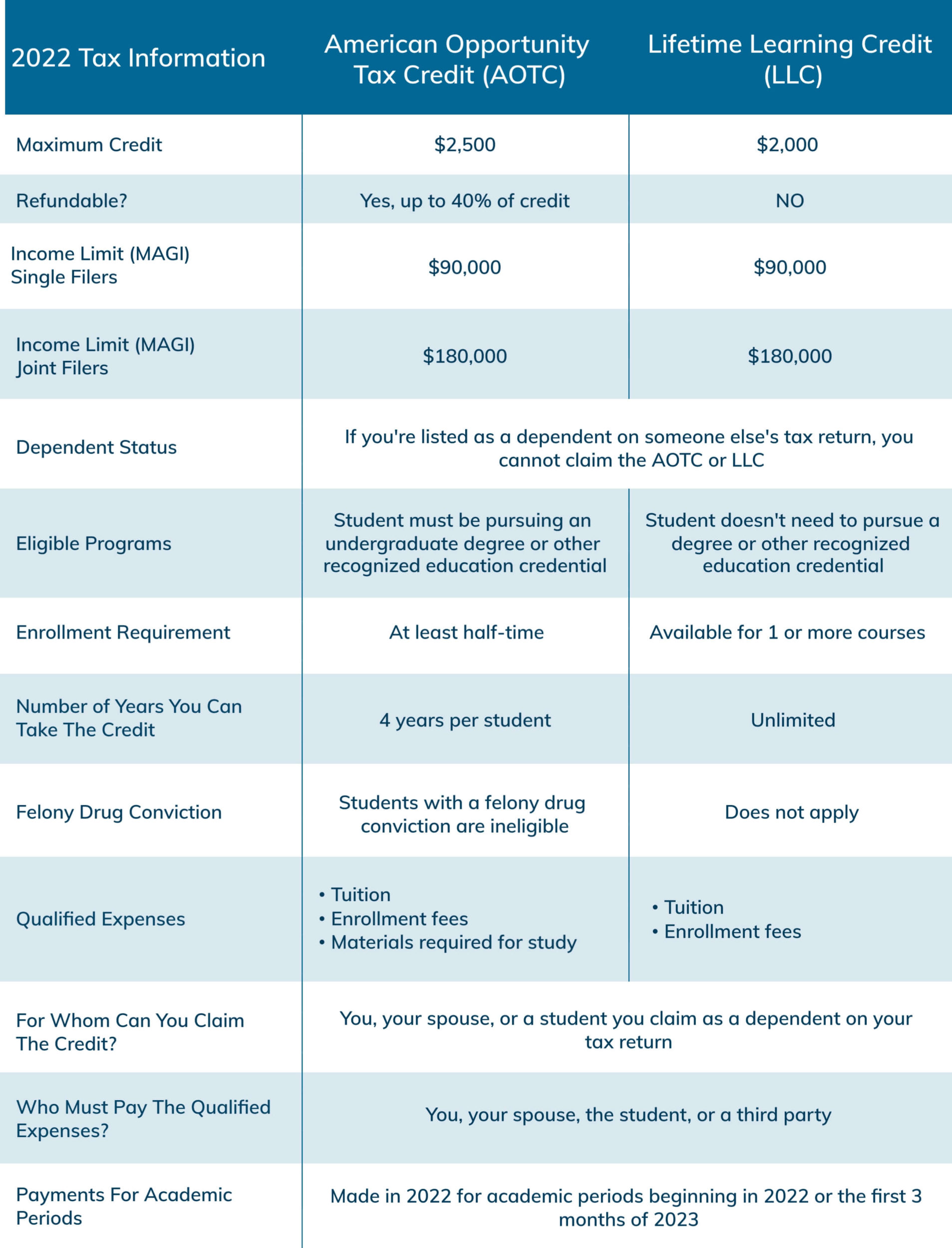

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-1907x2500.jpg

Restaurant Business Eligible To Declare Income Tax On Presumptive Basis

https://www.taxscan.in/wp-content/uploads/2023/01/Restaurant-Business-Eligible-Declare-Income-Tax-ITAT-TAXSCAN.jpg

A qualifying small business taxpayer is also exempt from Sec 163 j which limits the deductibility of business interest expense The following analyzes these changes and their The Budget also provides 1 9 billion of support to small businesses and the high street in 2025 26 by freezing the small business multiplier and providing 40 relief on bills

The top 25 tax deductions for a small business in the 2024 2025 tax year as outlined in this comprehensive tax deductions cheat sheet can help business owners lower their income tax How much your small business can make before paying taxes will depend on whether your business is structured as a pass through entity or a corporation How much your

How To File Taxes For Small Business How To Prepare For Tax Season

https://hbctaxacct.com/wp-content/uploads/2023/01/AdobeStock_83880309-scaled.jpeg

How To Prepare Your Small Business For Tax Season YouTube

https://i.ytimg.com/vi/YLLjGyjExJ0/maxresdefault.jpg

https://www.investopedia.com/small-b…

Qualifying as a small business can make a company eligible for government contracts and other financial benefits Small businesses can structure themselves in a variety of ways for tax and

https://www.nerdwallet.com/article/tax…

The qualified business income deduction QBI is a tax deduction that allows eligible self employed and small business owners to deduct up to 20 of their qualified business income on

Small Business Tax Preparation Checklist FloQast

How To File Taxes For Small Business How To Prepare For Tax Season

How To Prepare Your Small Business For Tax Season AfroTech

Prep Your Small Business For Tax Day With These 14 Smart Steps

Solved Lynn Purchased 100 Common Shares Of An Eligible Small Chegg

Small Business Tax Deduction Tips

Small Business Tax Deduction Tips

What Is Tax Status For Small Businesses Icsid

5 Tips To Prepare Your Small Business For Tax Season Progress Bank Blog

How To Prep Your Small Business For Tax Season Revenues Profits

What Is An Eligible Small Business For Tax Purposes - Paying taxes and tax planning are key requirements of running a successful small business Learn about the taxes that businesses owe the strategies they can use the documents they need