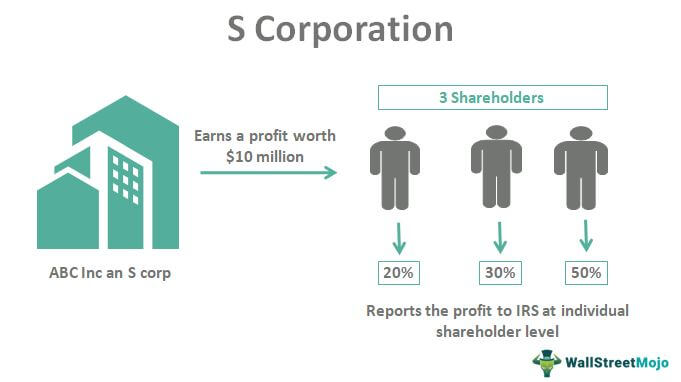

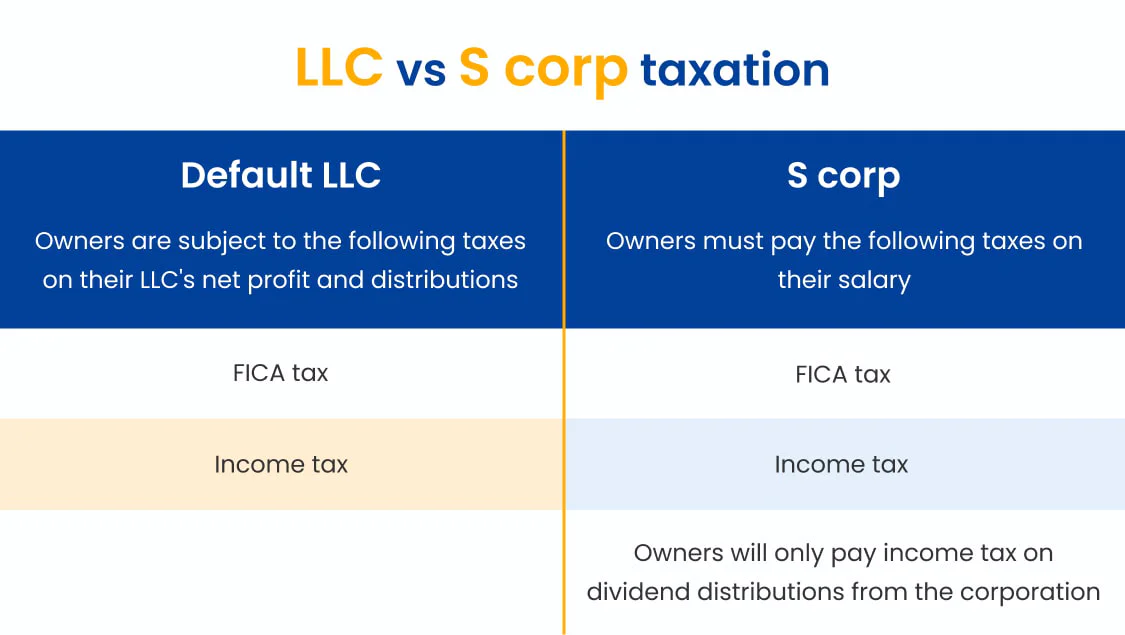

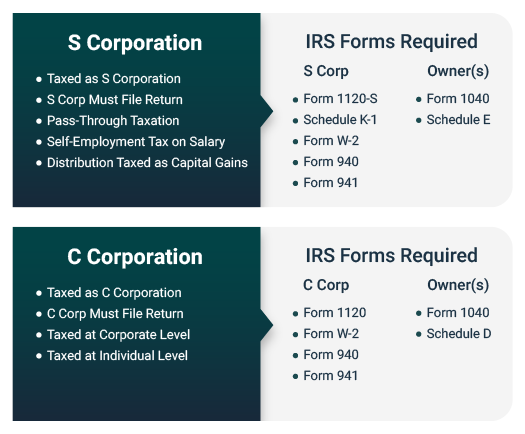

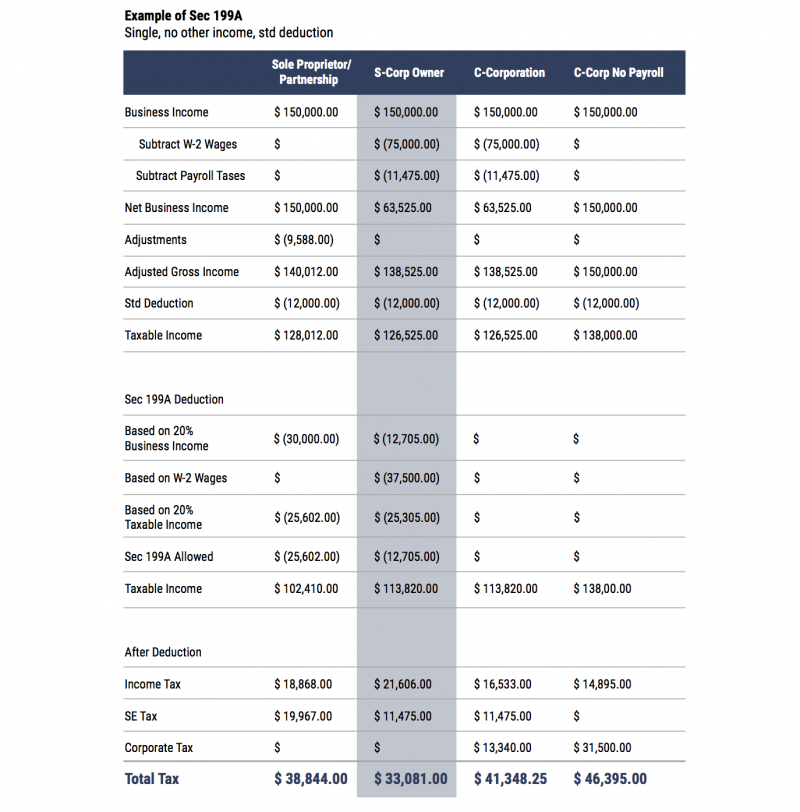

What Is An S Corp Tax Return S Corporations S corporations are corporations that elect to pass corporate income losses deductions and credits through to their shareholders for federal tax purposes Shareholders of S corporations report the flow through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates

S corporations are pass through entities with special tax advantages File your S corporation taxes by following The Ascent s five steps Choosing a business structure requires a calculus S corp tax returns are different from the returns of other business entities in that an S corporation does not pay any tax to the Internal Revenue Service IRS Instead of filing as a corporation the income and deductions are passed through to the corporation s shareholders to be reported on individual personal tax returns

What Is An S Corp Tax Return

What Is An S Corp Tax Return

https://www.wallstreetmojo.com/wp-content/uploads/2018/08/S-Corporation-2.jpg

What Is An S Corp

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/2147486381/images/eo83Z5NdTBmo3m2lobQi_Screen_Shot_2022-02-04_at_4.03.50_PM.png

Should Your LLC Be Taxed As A Partnership Or An S Corp Smith

https://smithpartnerswealth.com/wp-content/uploads/2021/10/LLC_vs._S_Corporation.png

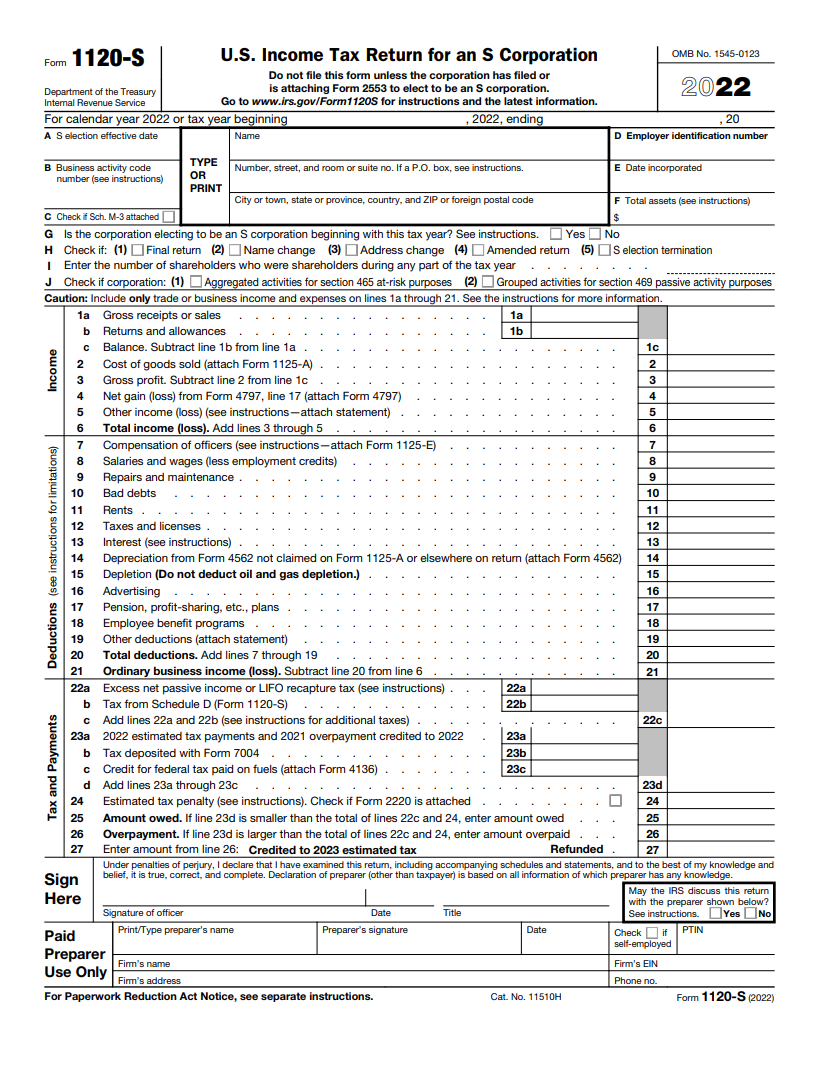

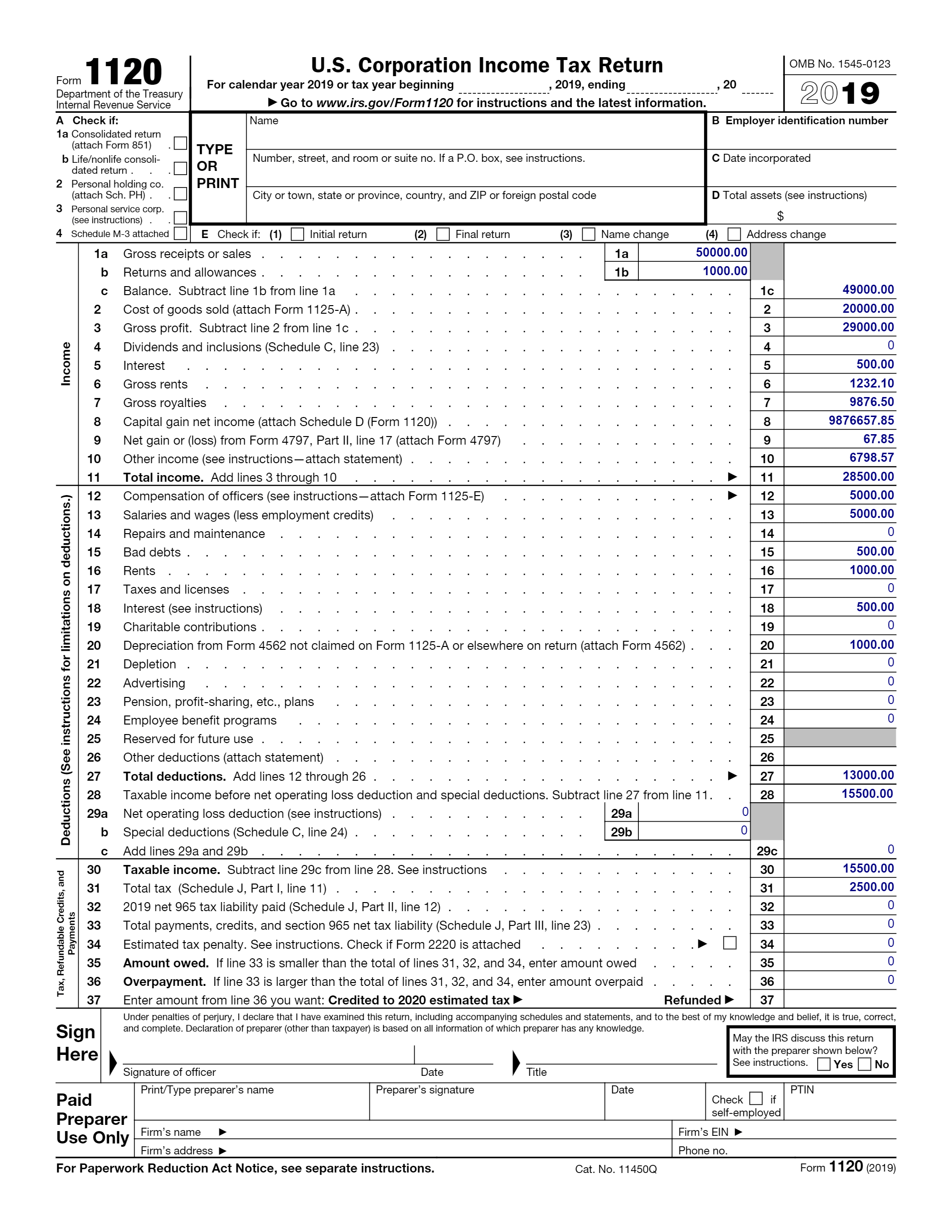

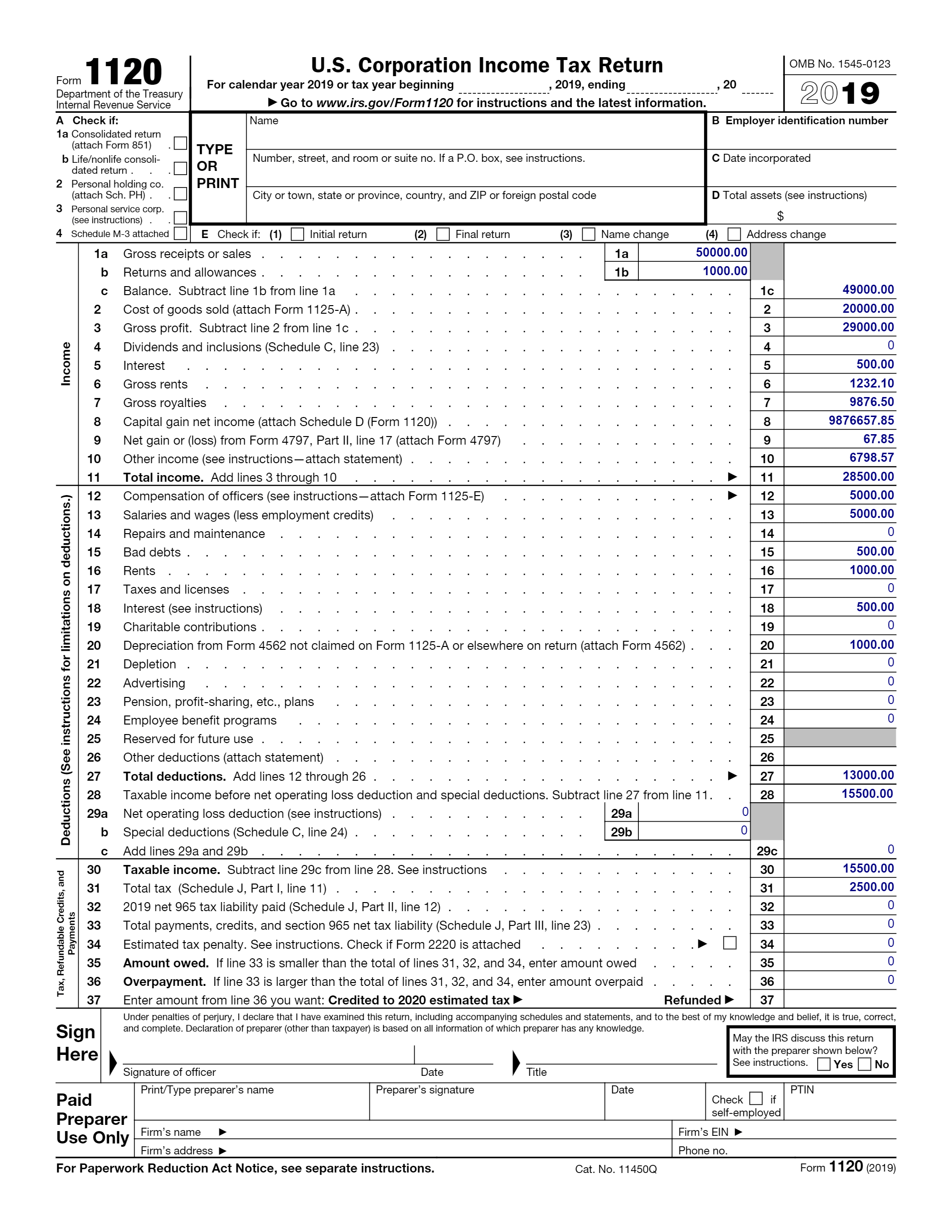

Form 1120 S U S Income Tax Return for an S Corporation is a tax document that is used to report income gains losses credits deductions and other information pertaining to Use Form 1120 S to report the income gains losses deductions credits etc of a domestic corporation or other entity for any tax year covered by an election to be an S corporation About Form 1120 S U S Income Tax Return for

If you have an S corporation S corp you ll need to file Form 1120 S a five page form that details your company s income deductions tax and payments and other important information Our S Corp Tax Return guide will introduce you to the process of filing Form 1120 S for your S corp An S corporation S corp is a special kind of corporation which operates as a corporation but is taxed on the individual shareholders tax forms for federal income tax purposes In order to become an S corporation a business must be a domestic corporation must meet some specific requirements and then must file an election form with the IRS

Download What Is An S Corp Tax Return

More picture related to What Is An S Corp Tax Return

S Corp What Is An S Corporation Best LLC Filing Services

https://i0.wp.com/bestllcfilingservices.com/wp-content/uploads/2020/07/S-Corp.png?resize=984%2C487&ssl=1

Form 1120s Due Date 2023 Printable Forms Free Online

https://images.ctfassets.net/ifu905unnj2g/4FLzdMpcEuGe2ymQGDQctA/93f56fdd486e39037f08c84294d711c7/2022_Form_1120-S.png

A Beginner s Guide To S Corporation Taxes

https://m.foolcdn.com/media/affiliates/images/S_corp_taxes_-_01_-_Form_1120-S_SLI0Nvc.width-750.png

The IRS describes S corps as corporations that pass corporate income losses deductions and credits through to shareholders for federal tax purposes In other words S corps are exempt Form 1120S U S Income Tax Return for an S Corporation is the tax form S corporations and LLCs filing as S corps use to file their federal income tax return 1120S is a five page form from the IRS which looks like this You ll need the following information on hand before filling out 1120S

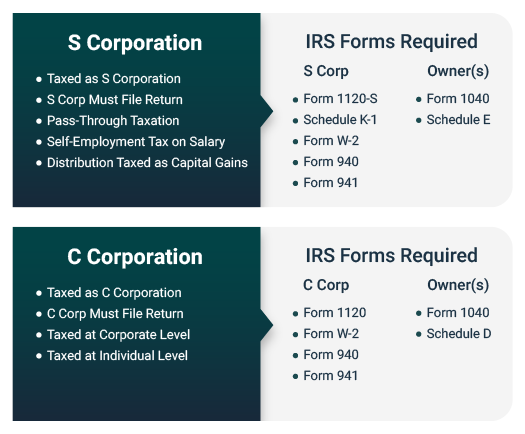

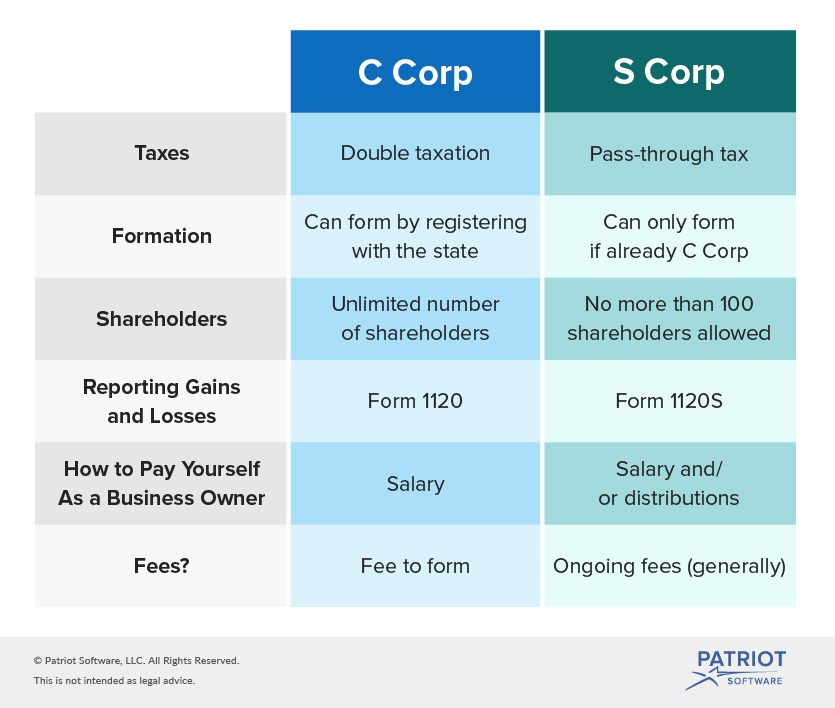

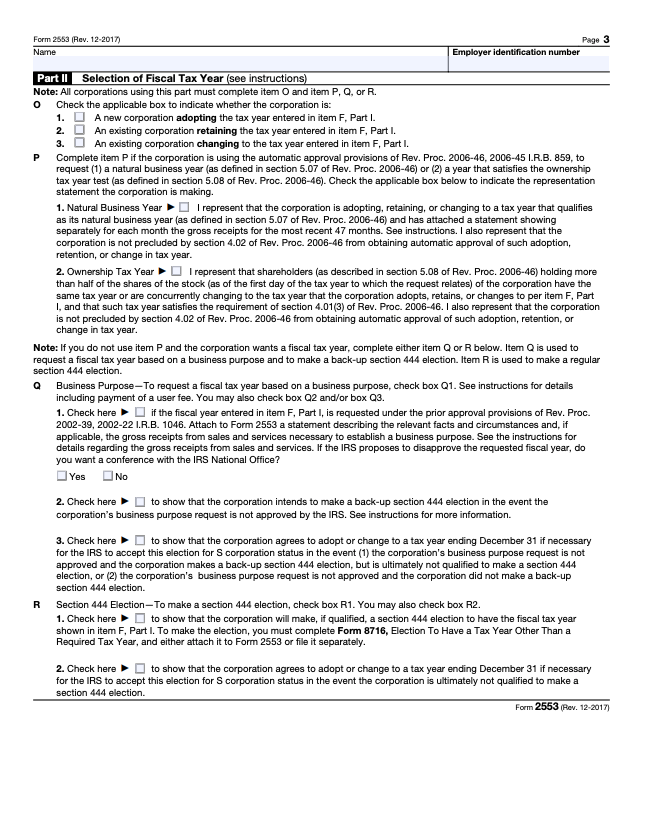

The income each shareholder reports on their individual return is taxed at their individual tax rate This is in contrast to a C Corporation which pays a flat tax rate of 21 Cash distributions to an S Corporation shareholder are generally tax free since shareholders pay tax on their share of the business income An S corporation is a tax status of the Internal Revenue Code IRS Subchapter S elected by LLC or corporation business owners by filing Form 2553 Electing S corp status allows a business to have pass through taxation as in a sole proprietorship partnership and LLC An S corp also has some benefits offered to corporations without

S Corp Vs C Corp What s The Difference TRUiC

https://cdn.startupsavant.com/images/how-to-guides/s-corp/scorp-v-ccorp.png

LLC Vs S Corporation Which One Can Save You More On Your Taxes RBA

https://images.squarespace-cdn.com/content/v1/57a4b7ec15d5db04f2470371/1518372319375-0E9ZOUL6050B3ZJEFN3N/new.jpg

https://www.irs.gov/.../s-corporations

S Corporations S corporations are corporations that elect to pass corporate income losses deductions and credits through to their shareholders for federal tax purposes Shareholders of S corporations report the flow through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates

https://www.fool.com/.../articles/s-corporation-taxes

S corporations are pass through entities with special tax advantages File your S corporation taxes by following The Ascent s five steps Choosing a business structure requires a calculus

Detailed Explanation For Difference Between LLC And S Corp

S Corp Vs C Corp What s The Difference TRUiC

I Own An S Corp How Do I Get Paid ClearPath Advisors

S Corp Vs LLC

Save Thousands On Taxes With An S Corp Election Singletrack Accounting

Hocr For Table Recognition Pdf Hocr table recognition pdf Visual

Hocr For Table Recognition Pdf Hocr table recognition pdf Visual

An S Corporation Is Taxed Just Like Any Other Corporation

C Corp Vs S Corp Business Basics Business Tax Business Structure

What Is IRS Form 2553 Bench Accounting

What Is An S Corp Tax Return - An S corporation is a corporation with a valid S election in effect The impact of the election is that the S corporation s items of income loss deductions and credits flow to the shareholder and are taxed on the shareholder s personal return The two main reasons for electing S corporation status are Avoid double taxation on distributions