What Is Arn In 80g Deduction Without the certificate an individual cannot claim Section 80G deduction Till FY 2020 21 an individual can claim the donation on the basis of the donation receipts at the time of filing income tax return ITR

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax deductions in Section

What Is Arn In 80g Deduction

What Is Arn In 80g Deduction

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/SECTION-80G-Deduction-for-Donations-to-certain-Charitable-Institutions.png

80G Deduction

https://www.cabkgoyal.com/wp-content/uploads/2023/05/80g-deduction.png

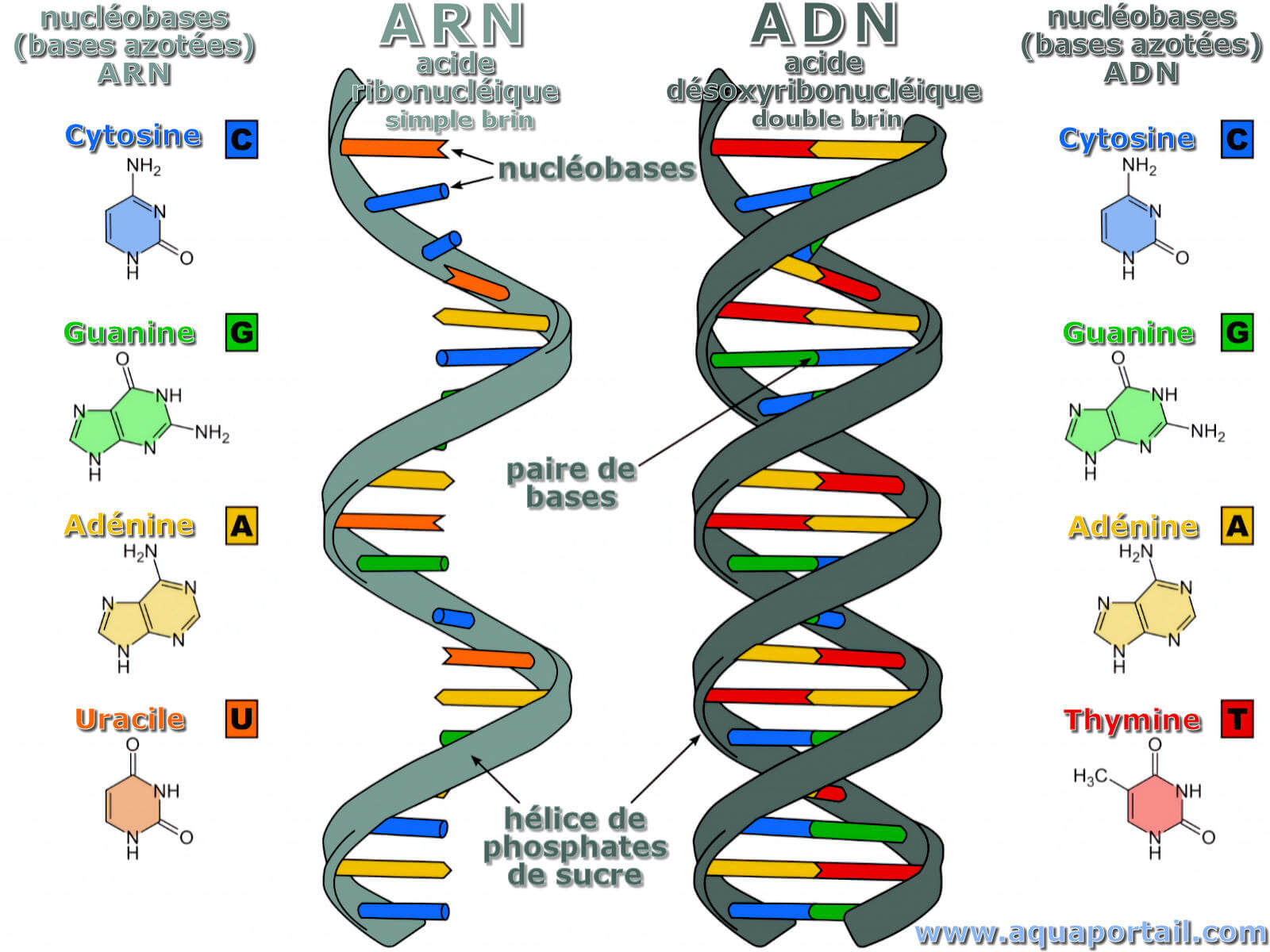

Tipos De ARN C mo Se Clasifican

https://www.clasificacionde.org/wp-content/uploads/2019/01/arn-1024x568.jpg

Section 80G of the Income tax Act 1961 allows taxpayers to claim deductions for their monetary donations to eligible charitable institutions However claiming this deduction while filing income tax return ITR can be What Type and How much is 80G Deduction Eligible To be eligible for an 80G deduction the donation must be in the form of money and not products or services to qualify for a deduction under Section 80G Only

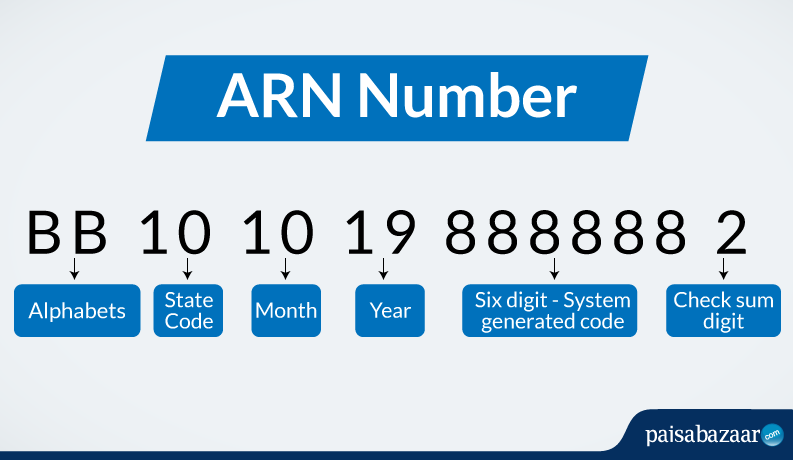

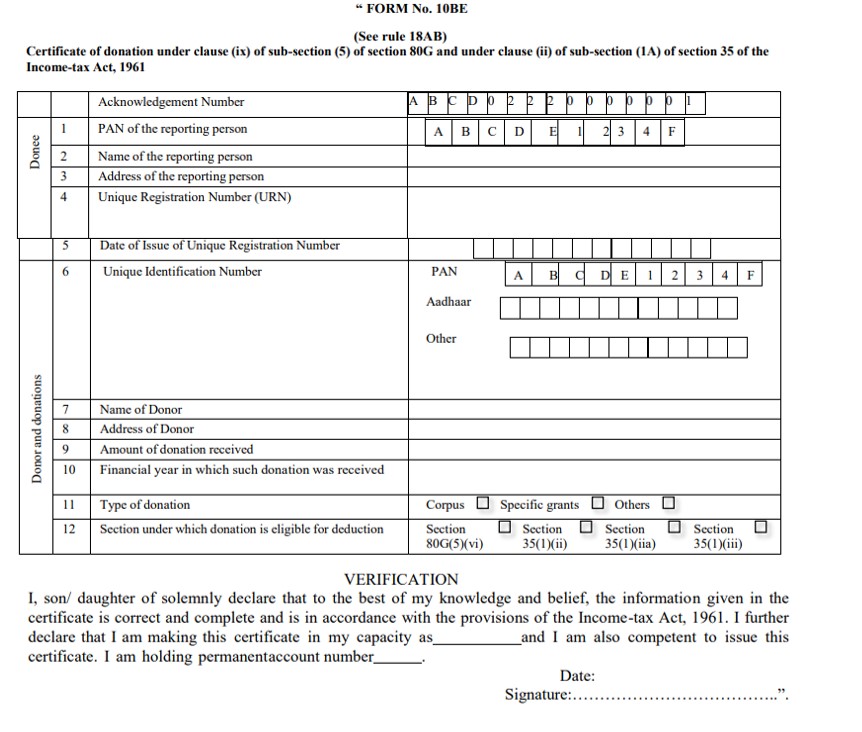

Details of ARN Donation Reference Number to claim Section 80G deduction Have you made a donation that qualifies for an 80G deduction during fiscal year 2022 23 To claim a deduction under Section 80G for eligible donations made during FY 2022 23 taxpayers must now mention the Donation Reference Number ARN on the ITR

Download What Is Arn In 80g Deduction

More picture related to What Is Arn In 80g Deduction

ARN Code Meaning Advantages How To Apply Registration Process Of

https://www.paisabazaar.com/wp-content/uploads/2019/10/ARN-Number.png

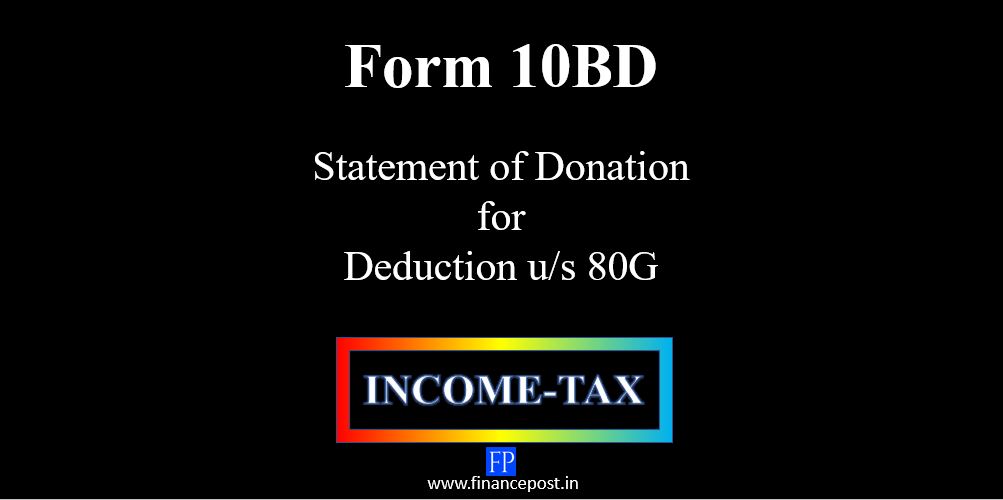

Form 10BD Statement Of Donation FinancePost

https://financepost.in/wp-content/uploads/2022/04/80G-form.jpg

How To Check GST ARN Status GST Registration Status

https://mybillbook.in/s/wp-content/uploads/2022/11/gst-arn-status.png

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals as well as The Users Reporting entity has the option of either directly filing Form 10BD and generate system generated Form 10BE certificates for the donors 24hrs from filing Form 10BD or generate Pre Acknowledgement Numbers Pre ARN s

Section 80G of the Income Tax Act provides tax incentives to individuals contributing to eligible charitable trusts or institutions This section allows for deductions on donations My question is regarding donation for claiming deduction u s 80G Once the certificate in Form 10BE is received from the donee organization will the same also reflect in

What Is Section 80G Tax Deductions On Your Donations Deduction U s

https://i.ytimg.com/vi/qbX0I6TKH9g/maxresdefault.jpg

80G Certificate

https://eadvisors.in/wp-content/uploads/2022/06/80g-certificate-1.jpg

https://economictimes.indiatimes.com › w…

Without the certificate an individual cannot claim Section 80G deduction Till FY 2020 21 an individual can claim the donation on the basis of the donation receipts at the time of filing income tax return ITR

https://tax2win.in › guide

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is

ARN D finition Et Explications

What Is Section 80G Tax Deductions On Your Donations Deduction U s

54F Requirements To Claim Exemptions Under Section 54F Of Income Tax Act

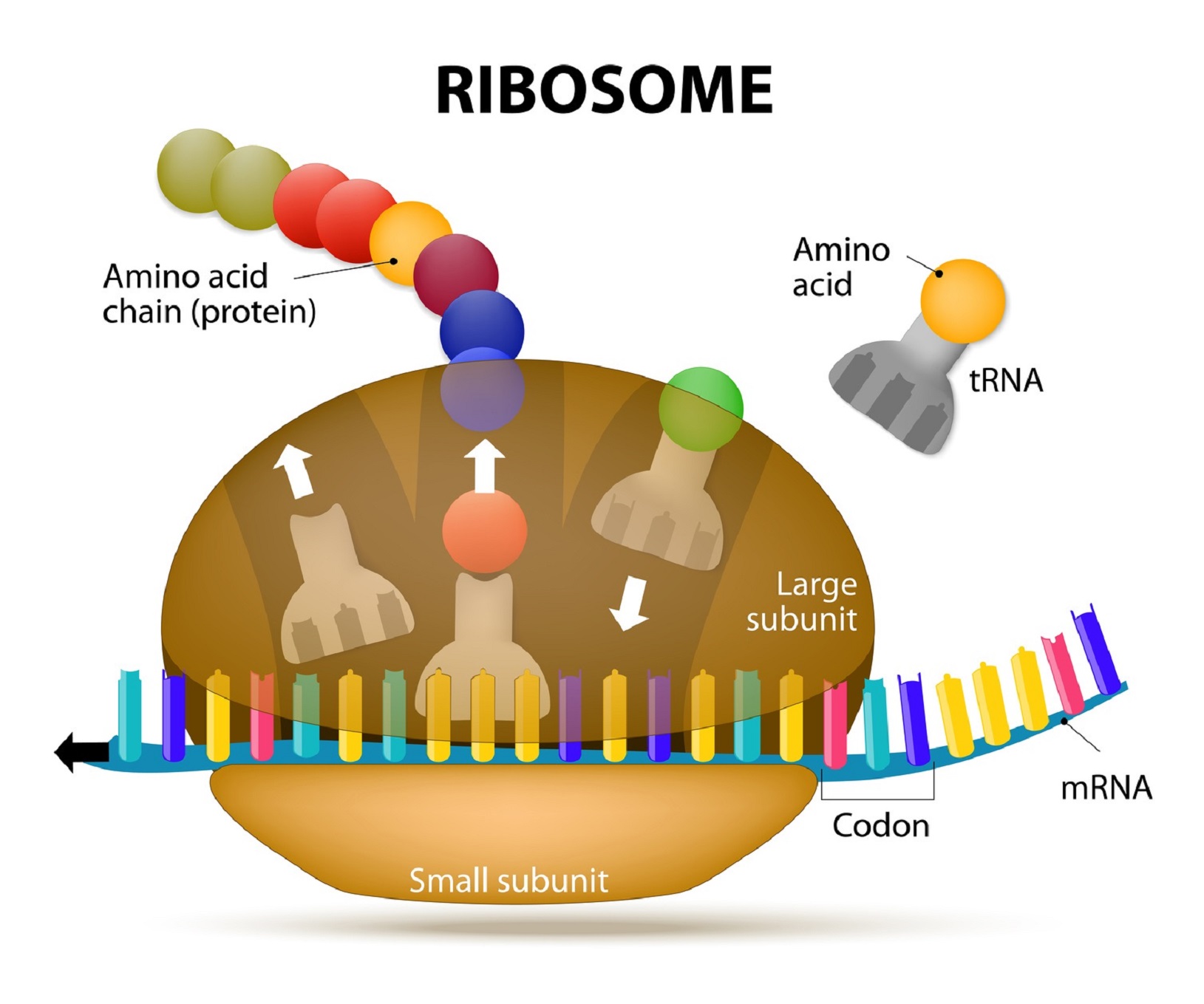

D finition ARNt Acide Ribonucl ique De Transfert ARN De Transfert

Information On Section 80G Of Income Tax Act Ebizfiling

ARN Number In Mutual Funds Meaning Benefits How To Apply

ARN Number In Mutual Funds Meaning Benefits How To Apply

Online Step To Download 80G Receipt For Donation Made To PM Cares Fund

Form 10BD Statement Of Donation FinancePost

What Is Section 80G Tax Deductions On Your Donations Deduction U s

What Is Arn In 80g Deduction - Details of ARN Donation Reference Number to claim Section 80G deduction Have you made a donation that qualifies for an 80G deduction during fiscal year 2022 23