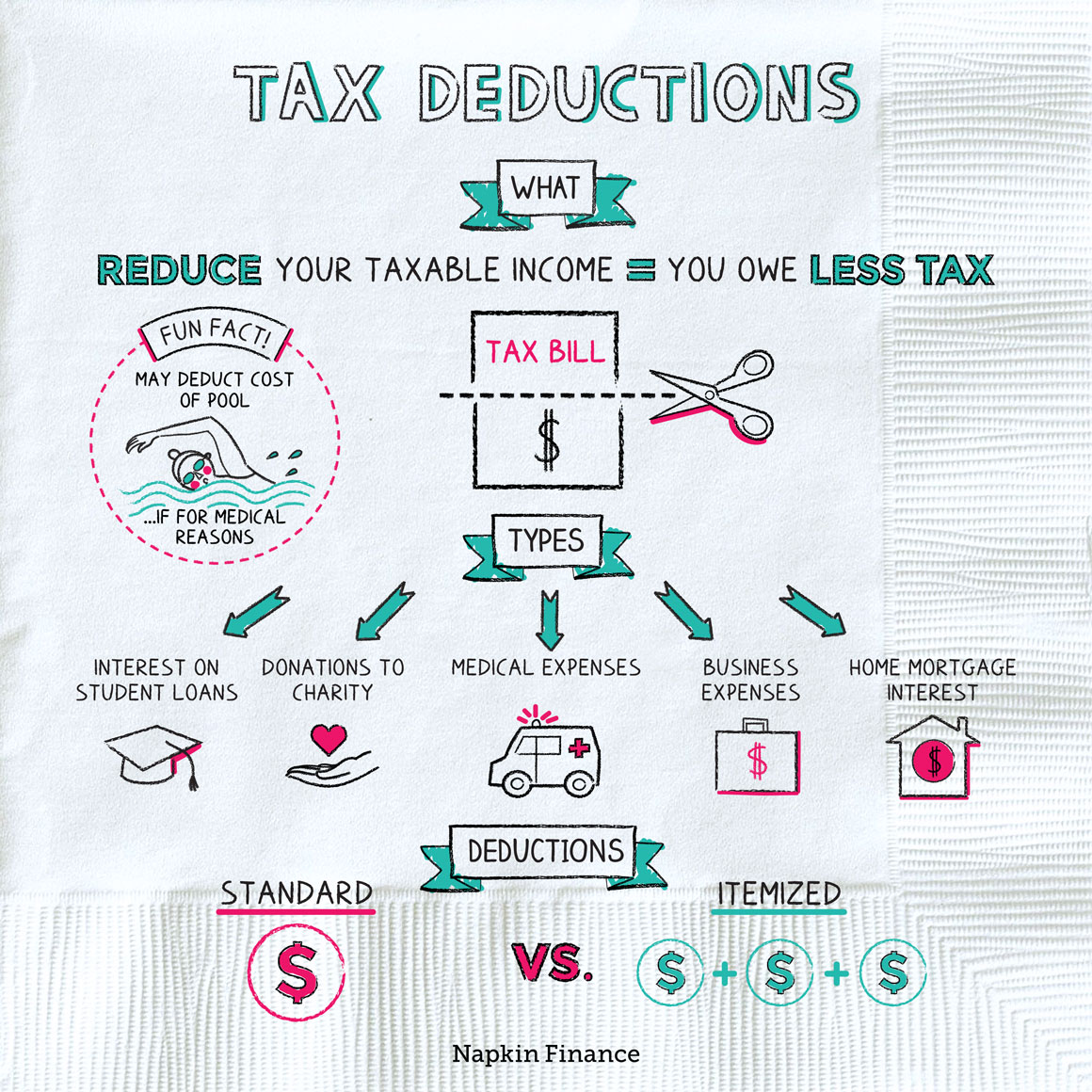

What Is Business Tax Deductible What is a Tax Deductible A tax deductible expense is any expense that is considered ordinary necessary and reasonable and that helps a business to generate income It

Many taxes that businesses pay are deductible although a few are not Learn the important details about deductible and non deductible business tax payments The IRS says a business expense must be ordinary necessary and directly related to running a company to be deductible Most small business expenses fall into

What Is Business Tax Deductible

What Is Business Tax Deductible

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

7 Most Overlooked Tax Deductions Small Business CPA Tax Accountants

https://lausconsult.com/wp-content/uploads/tax_deductions-810x573.png

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

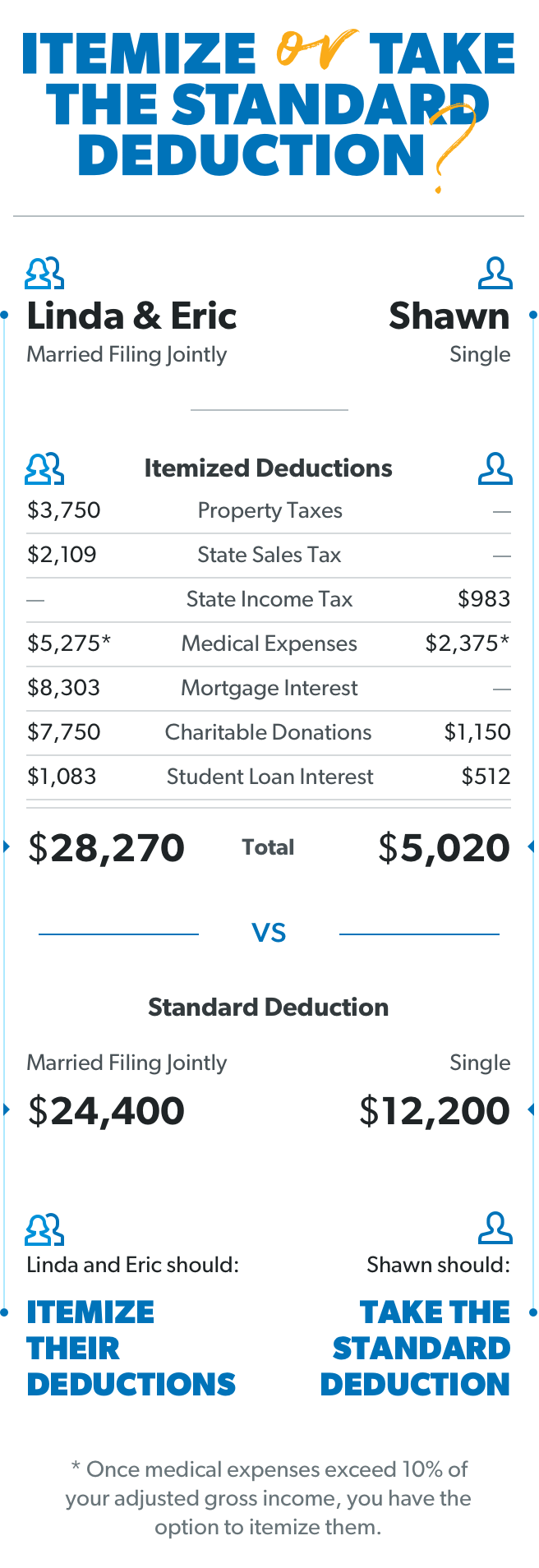

What is a small business tax deduction A small business tax deduction is an IRS qualifying expense that you can subtract from your taxable income These What Is a Tax Deductible A tax deductible is an expense that an individual taxpayer or a business can subtract from adjusted gross income AGI

All of the basic expenses necessary to run a business are generally tax deductible including office rent salaries equipment and supplies telephone and utility You can deduct expenses for employees including salaries bonuses payroll taxes fringe benefits such as health insurance sick pay and vacation pay What kind of deductions

Download What Is Business Tax Deductible

More picture related to What Is Business Tax Deductible

Investment Expenses What s Tax Deductible Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/Example-2.png

Small Business Tax Deductions Deductible Expenses

https://www.communitytax.com/wp-content/uploads/2019/04/Small-Business-Tax-Deductions-1-1024x846.png

What Does It Mean When Something Is Tax Deductible Business Partner

https://businesspartnermagazine.com/wp-content/uploads/2020/10/What-Does-It-Mean-When-Something-Is-Tax-Deductible.jpg

Here s a up to date list of small business tax deductions commonly available to entrepreneurs Check it twice and make sure you re claiming everything you can Deductible business expenses are those that can be deducted from your business income when you file your taxes This reduces your taxable income and

Under the tax law most small businesses sole proprietorships LLCs S corporations and partnerships can deduct 20 of their income on their taxes Woo hoo Business owners deduct expenses to bring down their total amount of taxable income Key Takeaways Publication 535 Business Expenses is an Internal

Sars 2022 Weekly Tax Tables Brokeasshome

https://cdn.ymaws.com/www.thesait.org.za/resource/resmgr/docs/01.jpg

Tax Deductions Write Offs To Save You Money Financial Gym

https://images.squarespace-cdn.com/content/v1/5a1efe26914e6b83e9456629/1582581779280-IL3MNWGKUNKHXL5A4790/TFG_IG-post_7-Tax-Deductions-You-Shouldn't-Miss.jpg

https://corporatefinanceinstitute.com/resources/...

What is a Tax Deductible A tax deductible expense is any expense that is considered ordinary necessary and reasonable and that helps a business to generate income It

https://www.thebalancemoney.com/what-business-tax...

Many taxes that businesses pay are deductible although a few are not Learn the important details about deductible and non deductible business tax payments

Are You Unsure What Expenses Are Deductible For You Business This

Sars 2022 Weekly Tax Tables Brokeasshome

How Do Tax Write Offs Work For Small Businesses Tax Walls

Travel Expense Tax Deduction Guide How To Maximize Write offs QuickBooks

Property Expenses What s Tax Deductible In The Year Of Occurrence

Best Tax Deductions For Small Business Owners Tax Walls

Best Tax Deductions For Small Business Owners Tax Walls

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Small

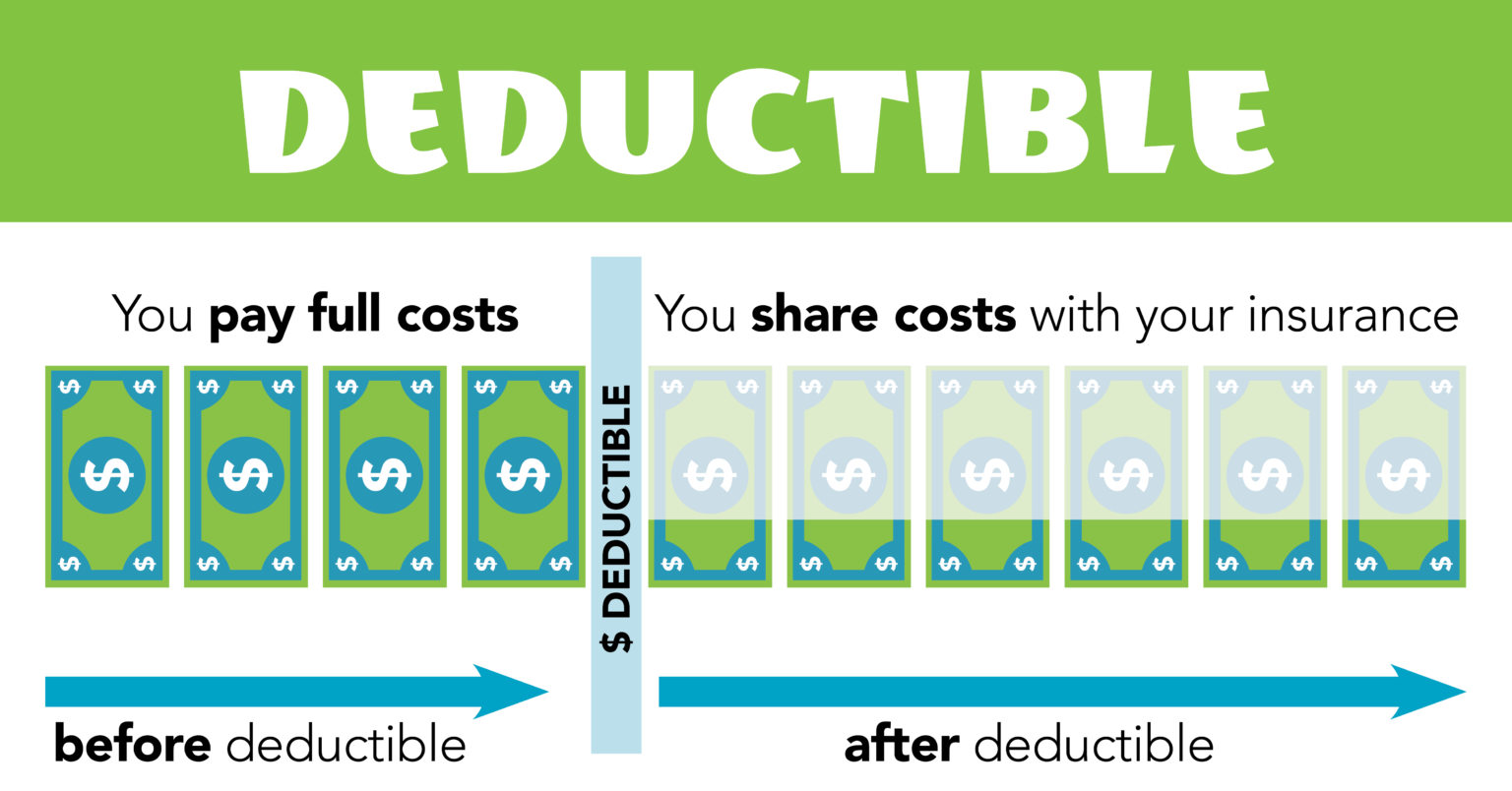

Deductibles Explained ETrustedAdvisor

How To Find Average Income Tax Rate Parks Anderem66

What Is Business Tax Deductible - You can deduct expenses for employees including salaries bonuses payroll taxes fringe benefits such as health insurance sick pay and vacation pay What kind of deductions