What Is Capital Allowance In Taxation A capital allowance is an expenditure a U K or Irish business may claim against its taxable profit Capital allowances may be claimed on most assets purchased for use

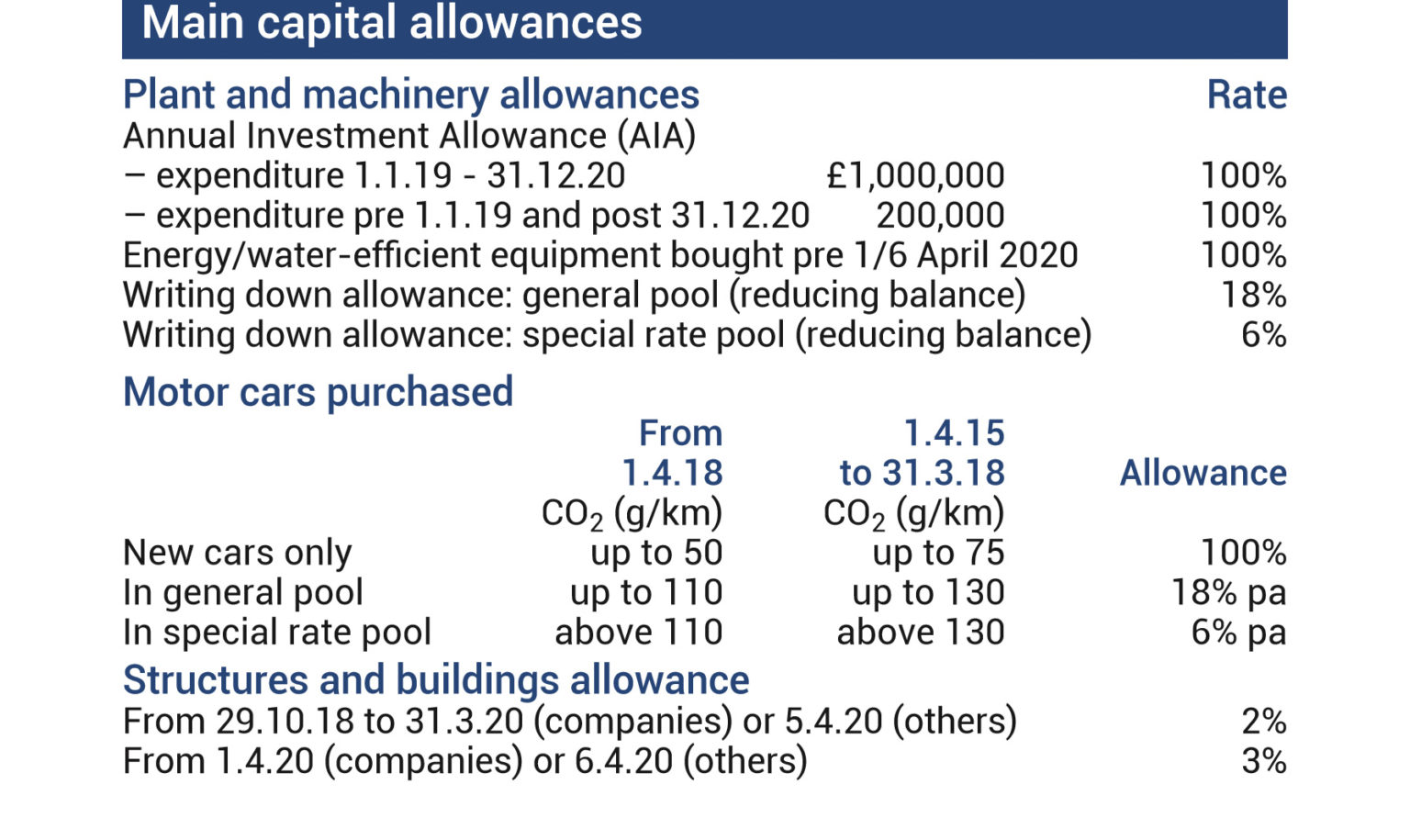

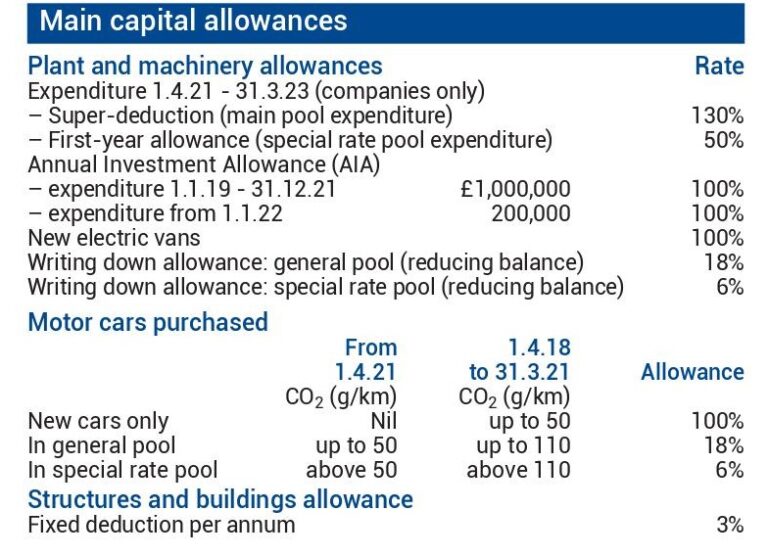

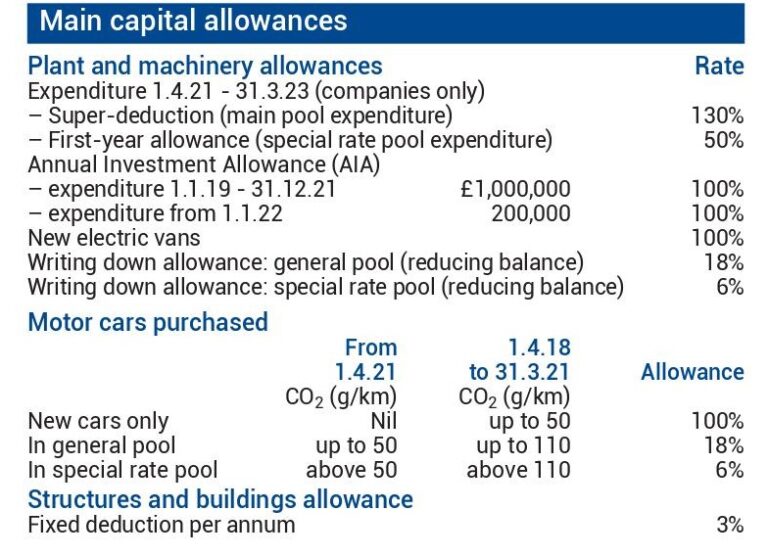

What Incentives do Investors get Capital allowances These are tax incentives offered for capital expenditures They include wear and tear allowances industrial building deduction investment deduction and farm works deductions Wear and tear allowances Capital Allowances Rates 2022 Notes 1 Capital allowance was calculated on Reducing balance basis in the year 2020 2 Investment deduction rate shall be 100 where Investment is made in special economic zones or Investment of at least Sh 250 Million is made outside Nairobi and Mombasa County in that year of income or

What Is Capital Allowance In Taxation

What Is Capital Allowance In Taxation

https://image.slidesharecdn.com/chapter7capitalallowancesstudents-141101025109-conversion-gate02/95/chapter-7-capital-allowances-students-24-638.jpg?cb=1414815446

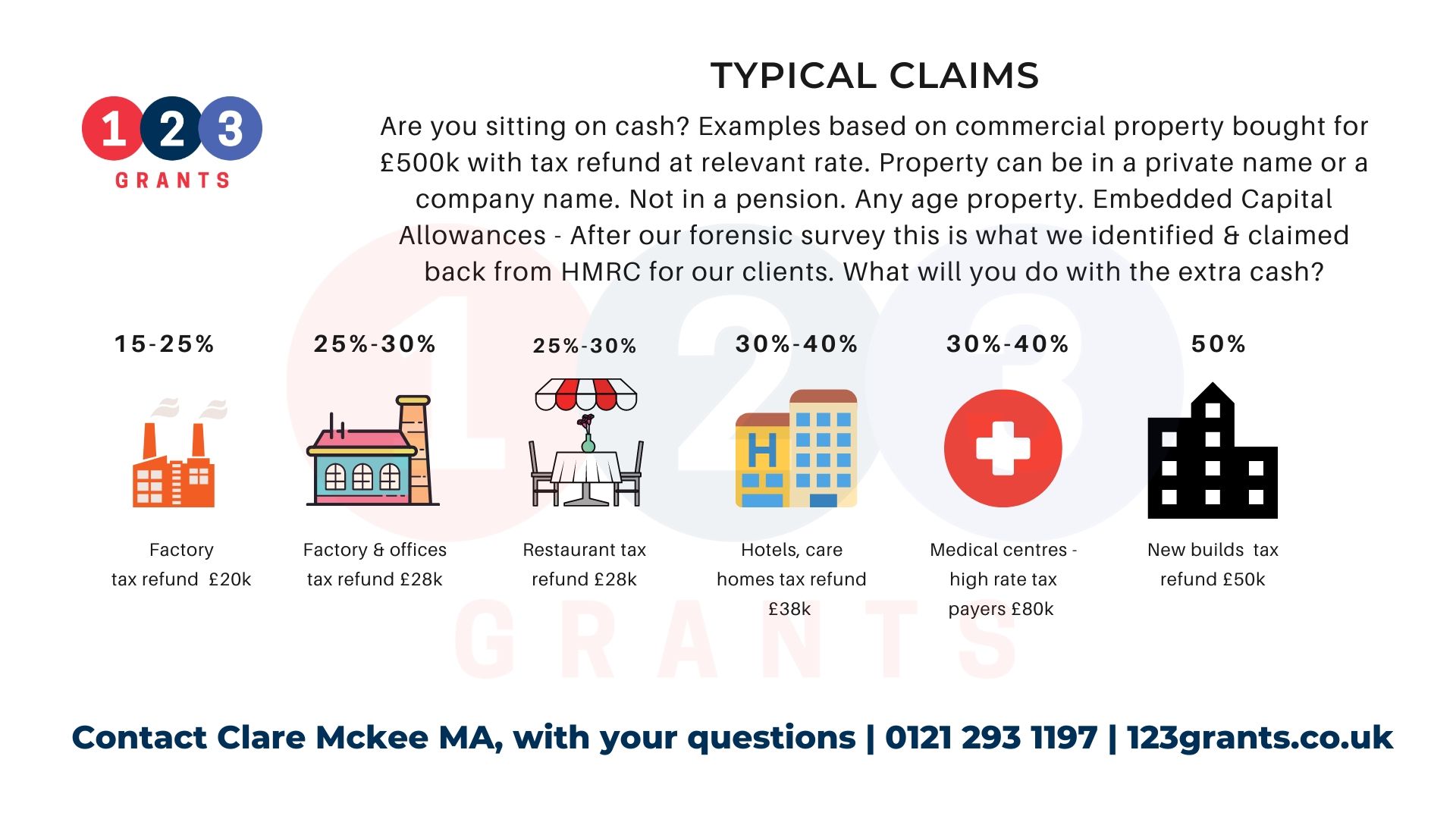

Capital Allowances Commercial Property Unlock 000 s 123 Grants

https://www.123grants.co.uk/wp-content/uploads/2020/07/Capital-allowances-example-claim.jpg

What Is Capital Gains Tax In Canada MoneyTalk

https://www.moneytalkgo.com/wp-content/uploads/2023/01/TAXES_TD_MT_DIY_SEO_MainArtThumbnail.png

Capital allowances these are tax incentives offered for capital expenditures They are tax allowable and this means that a company will not be taxed on them They include wear and tear allowances industrial building deduction investment deduction and farmworks deductions What are capital allowances In a nutshell capital allowances enable you to reduce your taxable income by accounting for the capital assets you use for your business Capital allowances can typically be claimed on capital expenditure for tangible and intangible assets including equipment vehicles property research and patents

Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for the purposes of a trade or rental business They effectively allow a taxpayer to write off the cost of an asset over a period of time A capital allowance is the amount of capital investment costs or money directed towards a company s long term growth a business can deduct each year from its revenue via depreciation These are also sometimes referred to as depreciation allowances

Download What Is Capital Allowance In Taxation

More picture related to What Is Capital Allowance In Taxation

What Are Capital Allowances UWM Accountants

https://uwm.co.uk/wp-content/uploads/2022/02/what-is-capital-allowance.jpg

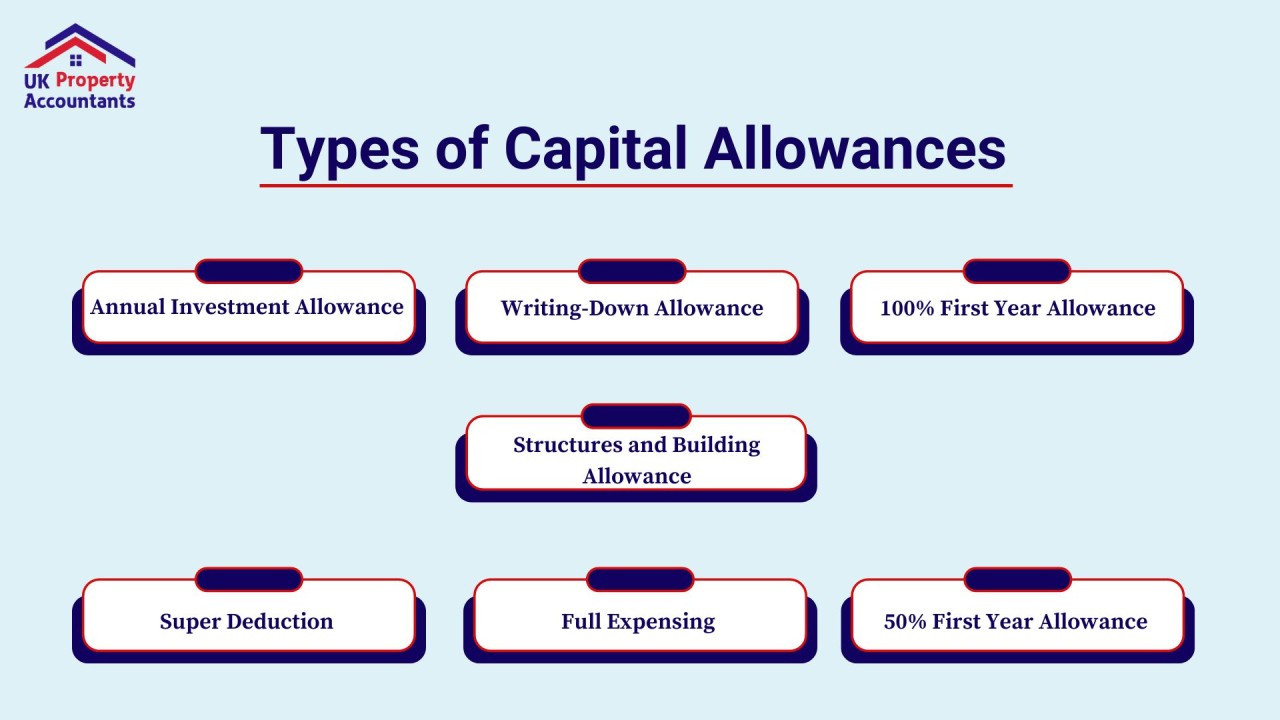

Types Of Capital Allowances Their Regulation

https://media.licdn.com/dms/image/D5612AQGxIS8bLBl8tw/article-cover_image-shrink_720_1280/0/1684151975428?e=2147483647&v=beta&t=EfOuem3iSEhXYJZIBaVxszzWmAYh9P_LN3ty4MX8Zw4

Capital Allowances

https://parkerhartley.co.uk/wp-content/uploads/2020/03/Capital-Allowances-Page-1536x915.jpg

Capital allowances reduce a business s taxable profits and enable it to retain more of its profits With depreciation not allowable for tax purposes a thorough understanding of capital allowances is critical in managing the tax liability for Capital allowances are a type of tax relief for businesses They let you deduct some or all of the value of an item from your profits before you pay tax You can claim capital

[desc-10] [desc-11]

Capital Allowances

https://parkerhartley.co.uk/wp-content/uploads/2021/03/Capital-Allowances-1-768x557.jpg

Chapter 7 Capital Allowances Students

https://image.slidesharecdn.com/chapter7capitalallowancesstudents-131206235250-phpapp02/95/chapter-7-capital-allowances-students-4-638.jpg?cb=1386374186

https://www.investopedia.com/terms/c/capital-allowance.asp

A capital allowance is an expenditure a U K or Irish business may claim against its taxable profit Capital allowances may be claimed on most assets purchased for use

https://www.kra.go.ke/ngos/incentives-investors...

What Incentives do Investors get Capital allowances These are tax incentives offered for capital expenditures They include wear and tear allowances industrial building deduction investment deduction and farm works deductions Wear and tear allowances

Advisorsavvy What Is Capital Cost Allowance

Capital Allowances

Guide About What Is Capital Allowance AccountingFirms

Taxation Lectures Capital Allowance Part 2 Taxation In Ghana

What Are Capital Allowances Understanding The Basics

Notes Capital Allowance CAPITAL ALLOWANCE Capital Allowance Is A

Notes Capital Allowance CAPITAL ALLOWANCE Capital Allowance Is A

Capital Allowances Performance Accountancy

/shutterstock_263186492-5bfc2b3346e0fb005144cde1.jpg)

Capital Allowance

Capital Allowance Explained Isuzu Truck

What Is Capital Allowance In Taxation - [desc-14]