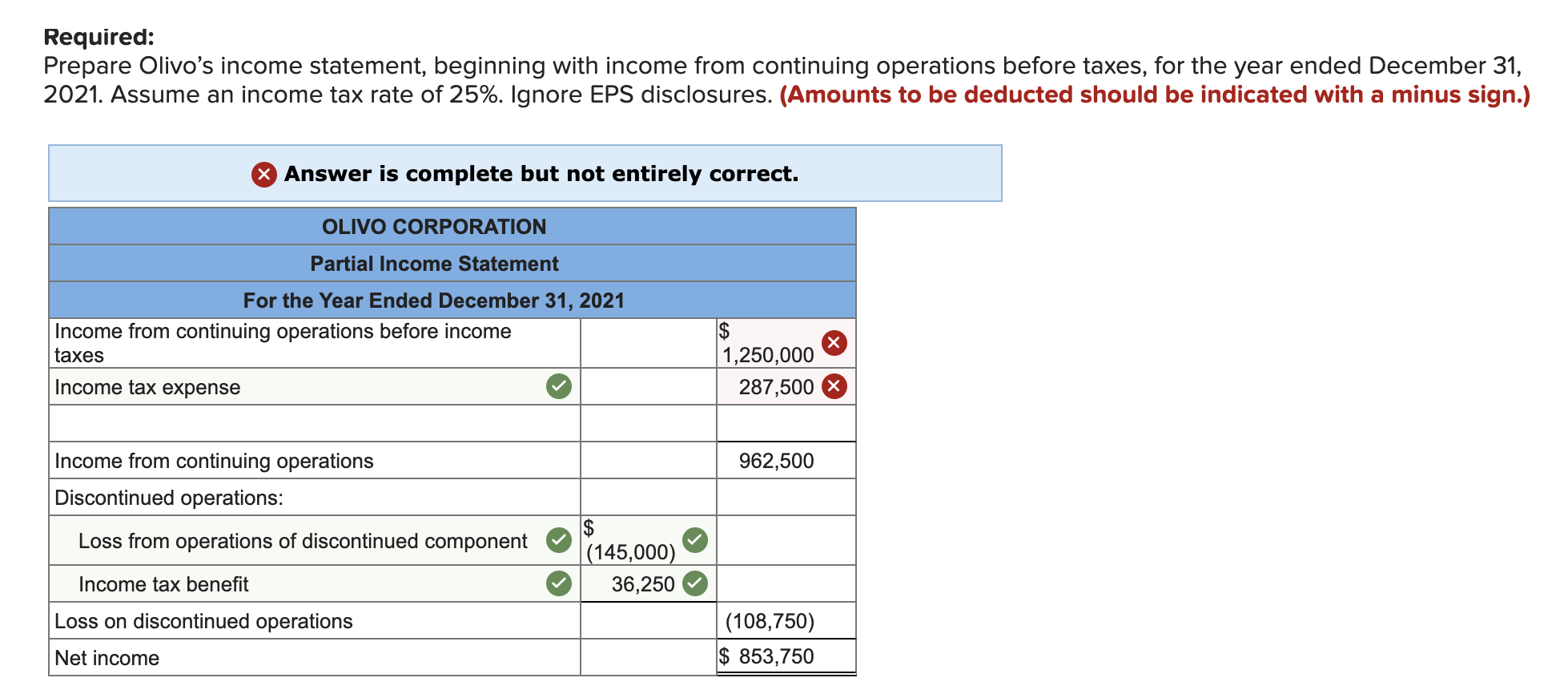

What Is Considered A Qualified Education Expense A qualified higher education expense is any money paid by an individual for expenses required to attend a college university or other post secondary institution

Qualified education expenses include tuition and other expenses that are necessary for you to pay in order to enroll in a course or program Nonessential fees Before you or your parents pursue an education related tax break it s important to know what the IRS considers a qualified education expense and what it doesn t And keep in mind that

What Is Considered A Qualified Education Expense

What Is Considered A Qualified Education Expense

https://technize.b-cdn.net/wp-content/uploads/Is-A-Laptop-A-Qualified-Education-Expense.jpg

Should You Apply To Positions You Are Under Qualified For Center For

https://www.hospitalrecruiting.com/wp/wp-content/uploads/2022/06/unqualified-blog-image-1.jpg

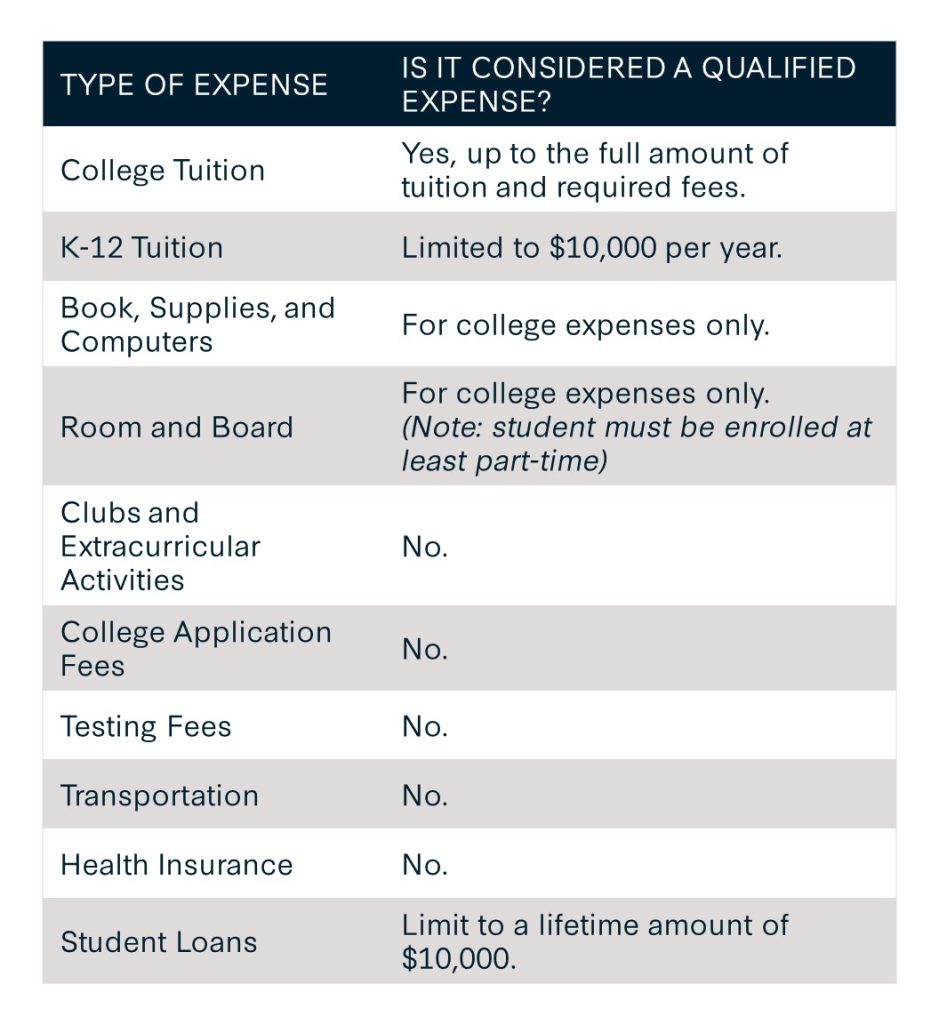

Solved For The Year Ending December 31 2021 Olivo Chegg

https://media.cheggcdn.com/media/ed2/ed21eb87-6154-4d25-b186-c81041f58e83/phpPre585

A qualified education expense is any expense you re required to pay to enroll in a program at an eligible educational institution These expenses can From line 1 you get qualified education expenses of 4 500 If the resulting qualified expenses are less than 4 000 the student may choose to treat some of the grant as

Most tax preferential savings accounts and tax breaks will define educational expenses for the purposes of tax free withdrawals or claiming deductions If you re an eligible educator you can deduct up to 300 600 if married filing jointly and both spouses are eligible educators but not more than 300 each of

Download What Is Considered A Qualified Education Expense

More picture related to What Is Considered A Qualified Education Expense

Is Food A Qualified Disability Expense ABLEnow

https://www.able-now.com/uploads/social/Is-Food-a-Qualified-Disability-Expense_1200x628-min.jpg

What Is Considered Healthy By An Insurance Company Meyer And Associates

https://meyerandassoc.com/wp-content/uploads/2019/12/What-is-Considered-Healthy-by-an-Insurance-Company-for-web.png

What Are Qualified Expenses Virginia529

https://www.virginia529.com/uploads/news/_rect_lg/Qualified-Expenses_1200x800-min.jpeg

Qualified higher education expenses include costs required for the enrollment or attendance at a college university or other eligible post secondary Qualified Education Expenses For purposes of the student loan interest deduction these expenses are the total costs of attending an eligible educational institution including

For purposes of the tuition and fees deduction qualified education expenses are tuition and certain related expenses required for enrollment or attendance at an eligible Qualifying education expenses are amounts paid for tuition fees and other related expenses for an eligible student That sounds like it covers a lot but there are

What s A Qualified Higher Education Expense Higher Education

https://i.pinimg.com/originals/39/a6/a8/39a6a87ef576b6a54402e05cd3f27908.jpg

Ready To Use Your 529 Plan Coldstream Wealth Management

https://www.coldstream.com/wp-content/uploads/2022/09/Ready-to-Use-Your-529-Account-Graphic-939x1024.jpg

https://www.investopedia.com/terms/q/qhee.asp

A qualified higher education expense is any money paid by an individual for expenses required to attend a college university or other post secondary institution

https://www.policygenius.com/taxes/qualified-education-expenses

Qualified education expenses include tuition and other expenses that are necessary for you to pay in order to enroll in a course or program Nonessential fees

Understanding Qualified Vs Non Qualified Annuities Simplified Seinor

What s A Qualified Higher Education Expense Higher Education

What Is Considered A Qualified Education Expense And What Can I Claim

What Counts As Qualified Education Expenses Credit Karma

Which Expenses Are Qualified Under College 529 Funds WTOP News

Georgia Qualified Education Expense Tax Credit Program YouTube

Georgia Qualified Education Expense Tax Credit Program YouTube

Higher Education Budgeting Operating Expense Budget Request By Fund

Adjusted Qualified Education Expenses Worksheet

Is Room And Board A Qualified Education Expense Fox Business

What Is Considered A Qualified Education Expense - From line 1 you get qualified education expenses of 4 500 If the resulting qualified expenses are less than 4 000 the student may choose to treat some of the grant as