What Is Considered Medical Expenses For Taxes Canada What is the Medical Expense Tax Credit METC The deductible medical expenses are considered a non refundable tax credit meaning they can help lower how much taxes you d have to pay To

February 7 2022 Medical expenses are one of the most if not the most overlooked non refundable tax deductions Most Canadians know that they can claim some of their Eligible medical expenses can be claimed as a non refundable tax credit Medical Expense Tax Credit in Canada at the federal and provincial territorial levels

What Is Considered Medical Expenses For Taxes Canada

What Is Considered Medical Expenses For Taxes Canada

https://www.onlinegmptraining.com/wp-content/uploads/2022/04/what-is-considered-medical-device.jpg

Canada Revenue Agency Health Spending Accounts Lasemhuman

https://www.taxpolicycenter.org/sites/default/files/styles/original_optimized/public/book_images/2.7.4_tab1.png

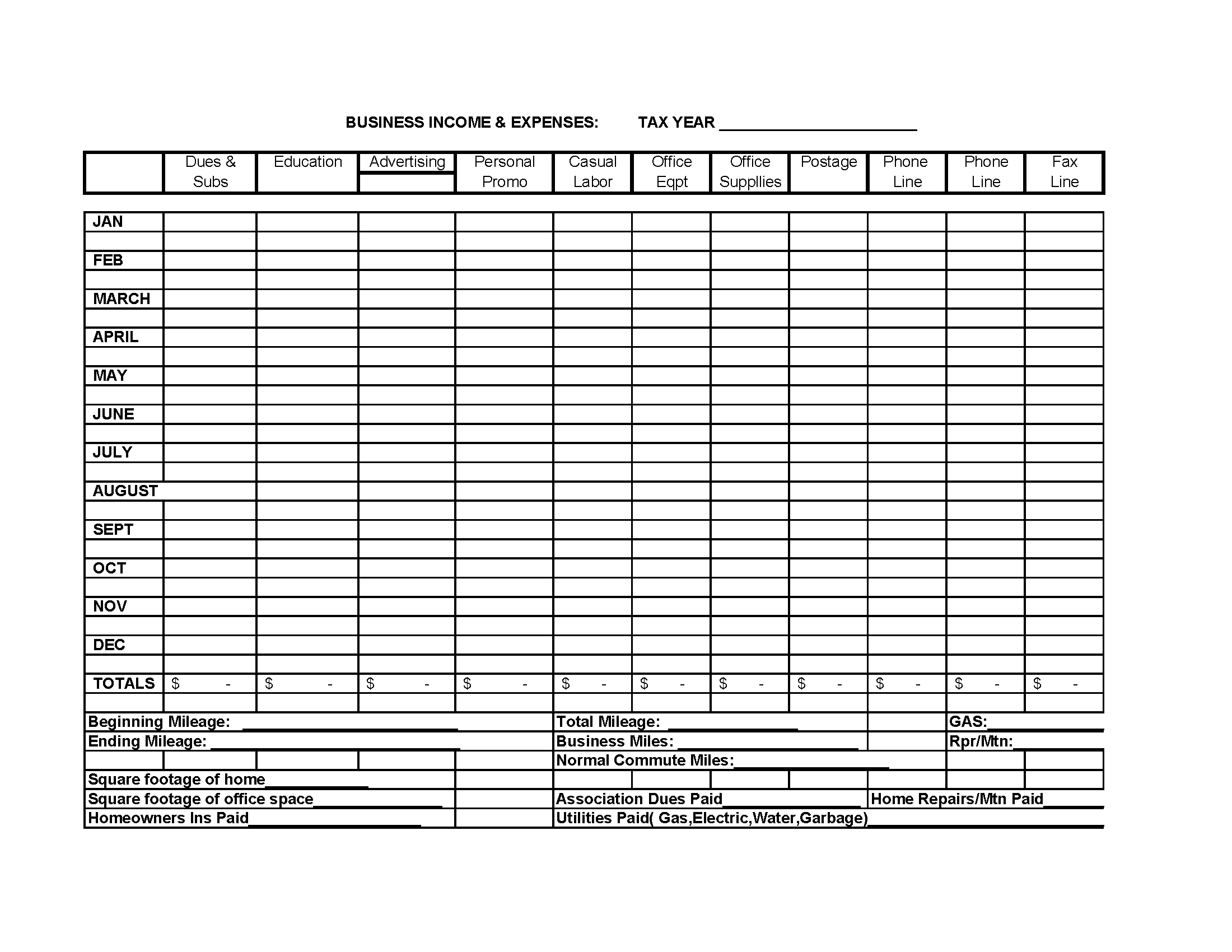

Deductible Business Expenses For Independent Contractors Financial

https://www.financialdesignsinc.com/wp-content/uploads/2020/11/Expenses-1.jpg

The maximum amount of medical expenses for tax deduction in Canada is either 3 of your net income or 2 479 whichever is lower For example if 3 of your net income is Medical expenses may be eligible for a federal non refundable tax credit on your tax return To be eligible expenses must exceed a limit of 3 of your net income subject to a maximum

An individual taxpayer can only claim medical expenses if the medical expenses exceed the lesser amount of 3 of the individual s net income reported on his The list of qualifying medical expenses is extensive and includes Payments for non insured health care services received from physicians dentists psychologists and many others Prescription drugs

Download What Is Considered Medical Expenses For Taxes Canada

More picture related to What Is Considered Medical Expenses For Taxes Canada

What Is An FSA Definition Eligible Expenses More Finansdirekt24 se

https://www.patriotsoftware.com/wp-content/uploads/2017/06/FSA-eligible-expenses-compressed.png

KadenceatWest

https://fundsnetservices.com/wp-content/uploads/cost-of-goods-sold.png

8 Tax Preparation Organizer Worksheet Worksheeto

https://www.worksheeto.com/postpic/2015/05/business-income-expense-spreadsheet-template_449267.png

An individual taxpayer can only claim medical expenses if the medical expenses exceed the lesser amount of 3 of the individual s net income reported on his Health care premiums paid to private health service plans are tax deductible medical expenses Taxpayers can claim health care premiums paid to plans

The Medical Expense Tax Credit METC is a non refundable tax credit that you can use to reduce the tax that you paid or may have to pay You can claim eligible Income Tax Act s 118 2 1 Who Can Claim Medical Expenses What Medical Expenses Can Be Claimed Medical Expenses for Former Spouse or Common Law Partner

What Is Counted As Income For Medicaid MedicAidTalk

https://www.medicaidtalk.net/wp-content/uploads/2022/01/income-limit-for-medicaid-ny-2020-oncomie.png

Quick Guide Who Should Claim Medical Expenses On Taxes Canada

https://www.olympiabenefits.com/hubfs/Who should claim medical expenses on taxes Canada-1.png

https://turbotax.intuit.ca/tips/everything-y…

What is the Medical Expense Tax Credit METC The deductible medical expenses are considered a non refundable tax credit meaning they can help lower how much taxes you d have to pay To

https://www.hrblock.ca/blog/medical-expenses-you...

February 7 2022 Medical expenses are one of the most if not the most overlooked non refundable tax deductions Most Canadians know that they can claim some of their

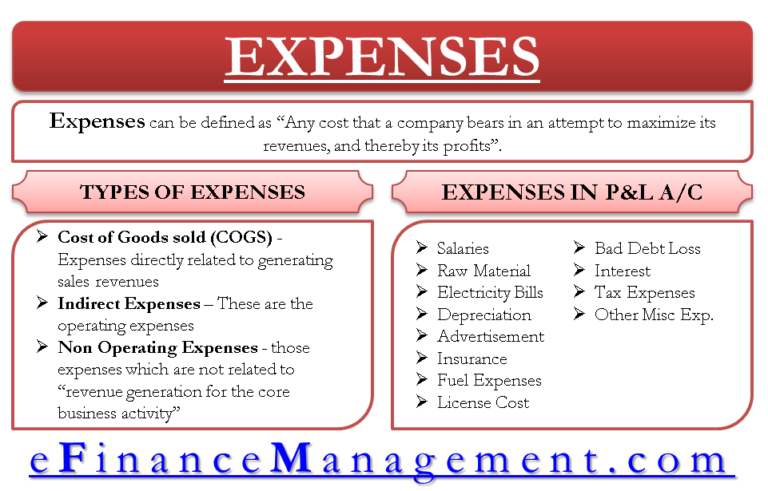

What Is Expense Definition And Meaning

What Is Counted As Income For Medicaid MedicAidTalk

What Are Expenses Its Types And Examples TutorsTips

How To Claim Medical Expenses On Your Tax Return

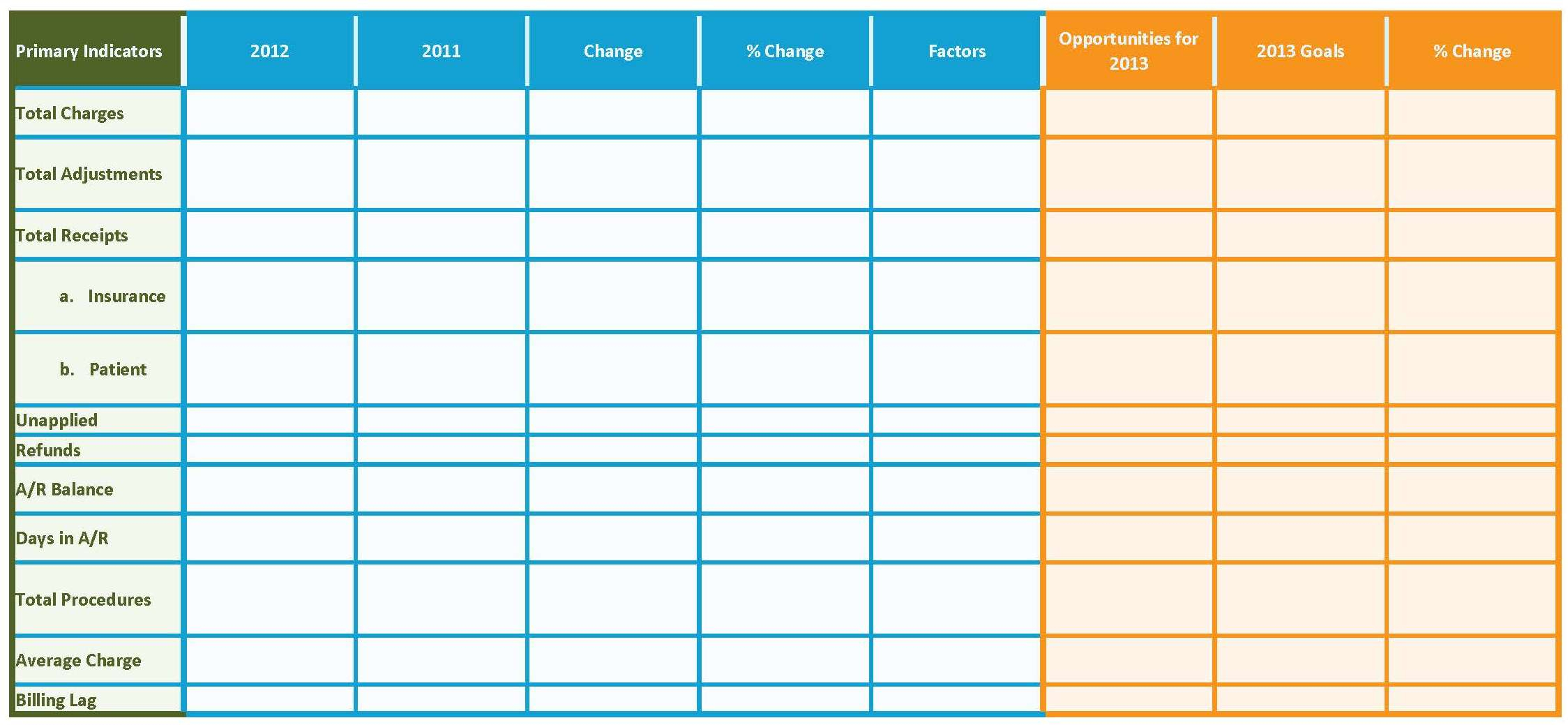

Medical Spreadsheet Templates

How Does The Medical Expense Tax Credit Work In Canada

How Does The Medical Expense Tax Credit Work In Canada

Business Expenses What Can You Claim

How To Keep A Spreadsheet Of Expenses With Regard To Track Expenses And

Are You Unsure What Expenses Are Deductible For You Business This

What Is Considered Medical Expenses For Taxes Canada - An individual taxpayer can only claim medical expenses if the medical expenses exceed the lesser amount of 3 of the individual s net income reported on his