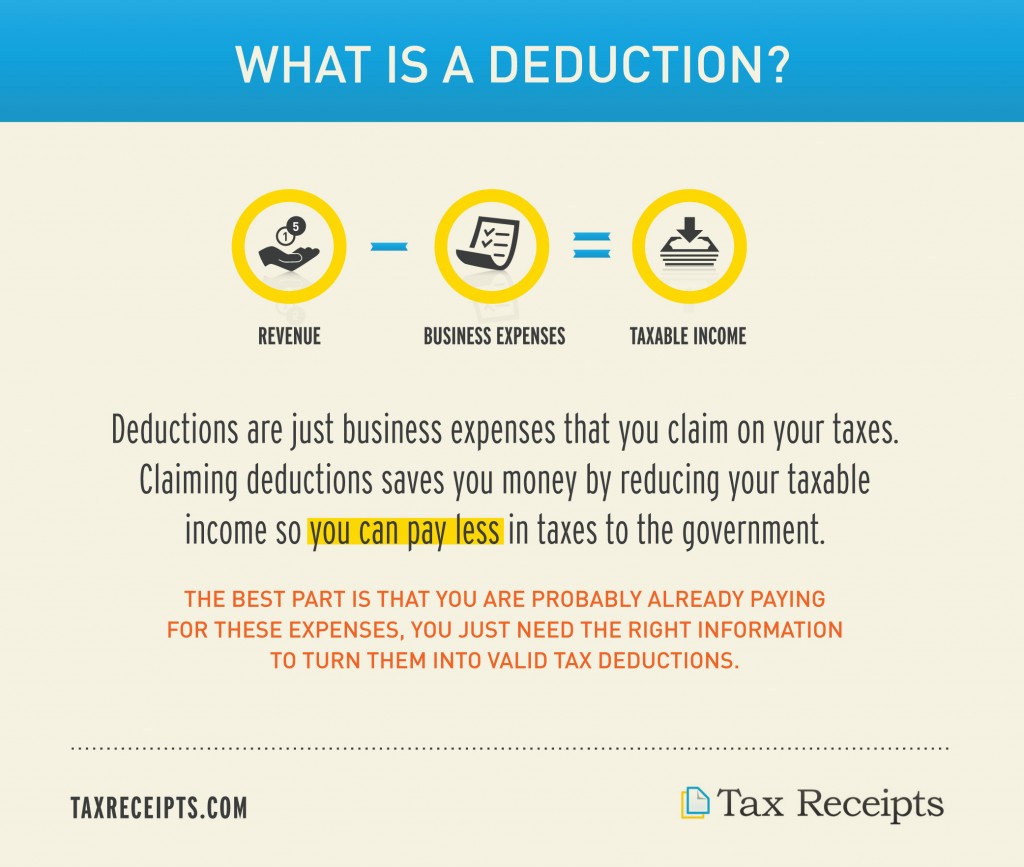

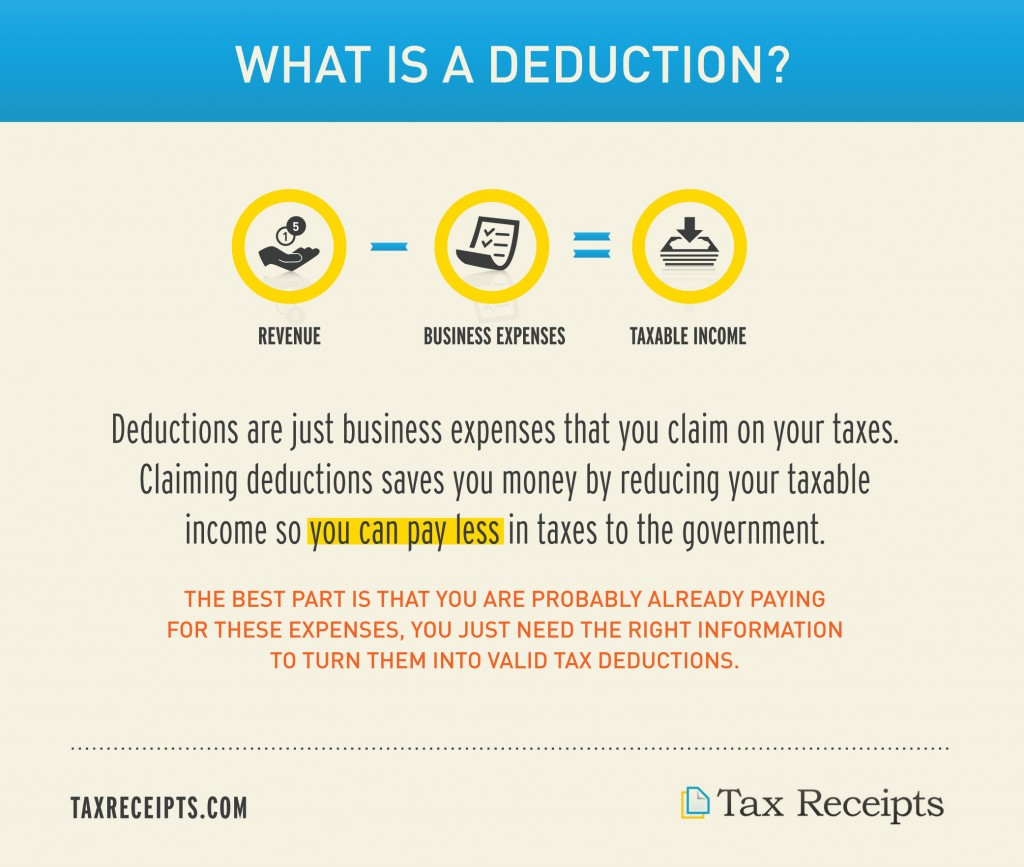

What Is Deductible On Taxes What is a Tax Deductible A tax deductible expense is any expense that is considered ordinary necessary and reasonable and that helps a business to generate income It is usually deducted from the company s income before taxation

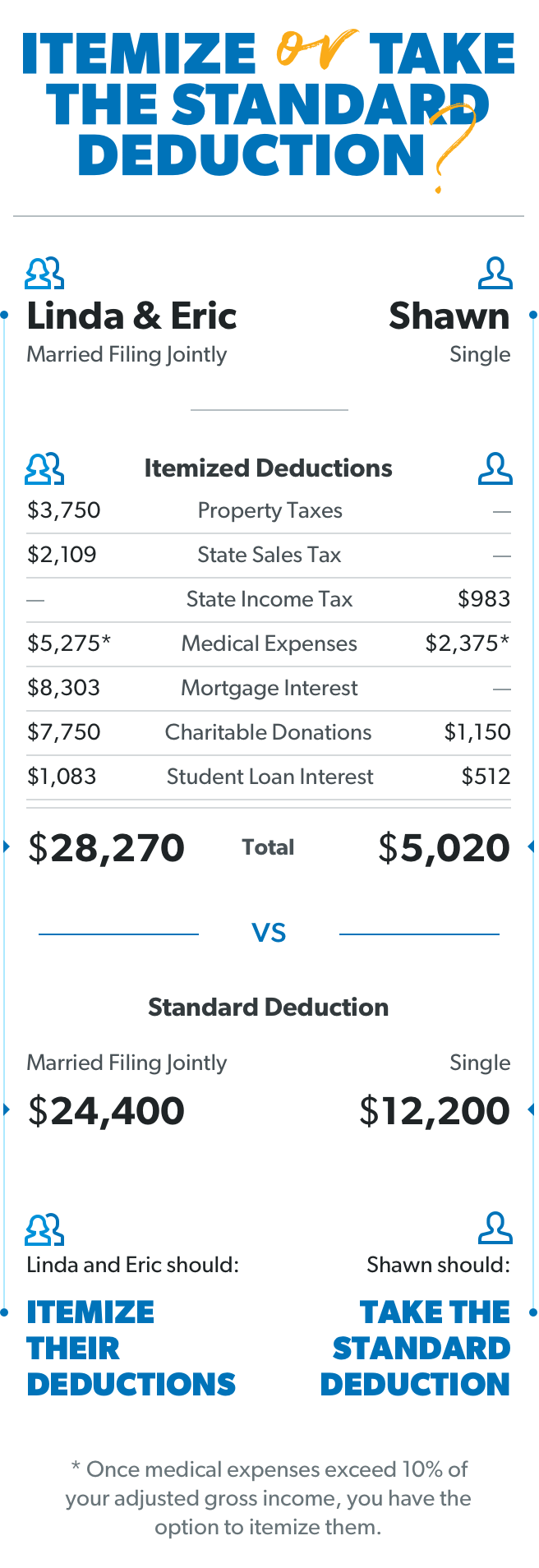

For tax purposes a deductible is an expense that an individual taxpayer or a business can subtract from adjusted gross income AGI while completing a tax form A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe You can choose the standard deduction a single deduction of a fixed

What Is Deductible On Taxes

What Is Deductible On Taxes

https://taxreceipts.com/wp-content/uploads/2012/03/what-is-a-deduction-1024x867.jpg

What Is A Tax Deduction Definition Examples Calculation

https://i0.wp.com/biznessprofessionals.com/wp-content/uploads/2020/04/Capture351.png?fit=693%2C345&ssl=1

What Is The Medicare Deductible For 2023 SingleCare

https://www.singlecare.com/blog/wp-content/uploads/2022/08/medicare-deductible.png

Credits and Deductions for Individuals It s important to determine your eligibility for tax deductions and tax credits before you file Deductions can reduce the amount of your income before you calculate the tax you owe Credits can reduce the amount of tax you owe or increase your tax refund Simply put a tax deduction is an expense that can be subtracted from your income to reduce how much you pay in taxes Tax deductions are a good thing because they lower your taxable income which also reduces your tax bill in the process

What Does Tax Deductible Mean Definition Examples What Does Tax Deductible Mean Definition Examples Last Updated February 2 2023 WHAT WE HAVE ON THIS PAGE What Is an Itemized Deduction Tax Deductions List Key Takeaways Overlooked Tax Deductions in 2022 Non Deductible Expenses You deduct the tax in the taxable year you pay them The categories of deductible taxes are State local and foreign income taxes or state and local general sales taxes in lieu of state and local income taxes State and local real property taxes and State and local personal property taxes

Download What Is Deductible On Taxes

More picture related to What Is Deductible On Taxes

What Is Deductible On Taxes For Real Estate Agents

https://activerain.com/image_store/uploads/1/4/6/9/7/ar120106323979641.jpg

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Canonprintermx410 25 New What Is A Good Deductible

https://s-media-cache-ak0.pinimg.com/originals/d4/a6/23/d4a623c037d4d16f30632f813df11eb9.png

Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of interest are tax deductible A tax deduction is an amount you can subtract from your gross income before calculating your tax liability For example if a single taxpayer with 75 000 in 2022 gross income decides to take

For the 2023 tax year meaning the taxes you ll file in 2024 the standard deduction amounts are 13 850 for single and married filing separate taxpayers 20 800 for head of household 4 State and local taxes deduction When you make state and local tax payments including sales tax real estate tax property tax and local and state income tax these are generally deductible from your federal income You can only deduct state and local income tax or state and local sales tax You can t deduct both

Investment Expenses What s Tax Deductible Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/Example-2.png

Deductibles Co Pay And Out Of Pocket Maximums

https://www.internationalinsurance.com/wp-content/uploads/2015/01/insurance-deductibles-infographic.png

https://corporatefinanceinstitute.com/resources/accounting/tax-deductible

What is a Tax Deductible A tax deductible expense is any expense that is considered ordinary necessary and reasonable and that helps a business to generate income It is usually deducted from the company s income before taxation

https://www.investopedia.com/terms/d/deductible.asp

For tax purposes a deductible is an expense that an individual taxpayer or a business can subtract from adjusted gross income AGI while completing a tax form

Can I Claim My Health Insurance Deductible On My Taxes Tax Walls

Investment Expenses What s Tax Deductible Charles Schwab

Standard Deduction 2020 Self Employed Standard Deduction 2021

Canonprintermx410 25 Unique How Is The Deductible Paid In Health Insurance

Tax Credit Vs Tax Deduction Difference And Comparison Diffen

Everything You Need To Know About Your Tax Deductible Donation Learn

Everything You Need To Know About Your Tax Deductible Donation Learn

School Supplies Are Tax Deductible Wfmynews2

How Do Tax Write Offs Work For Small Businesses Tax Walls

Can You Deduct Car Insurance From Your Taxes Tax Walls

What Is Deductible On Taxes - Credits and Deductions for Individuals It s important to determine your eligibility for tax deductions and tax credits before you file Deductions can reduce the amount of your income before you calculate the tax you owe Credits can reduce the amount of tax you owe or increase your tax refund