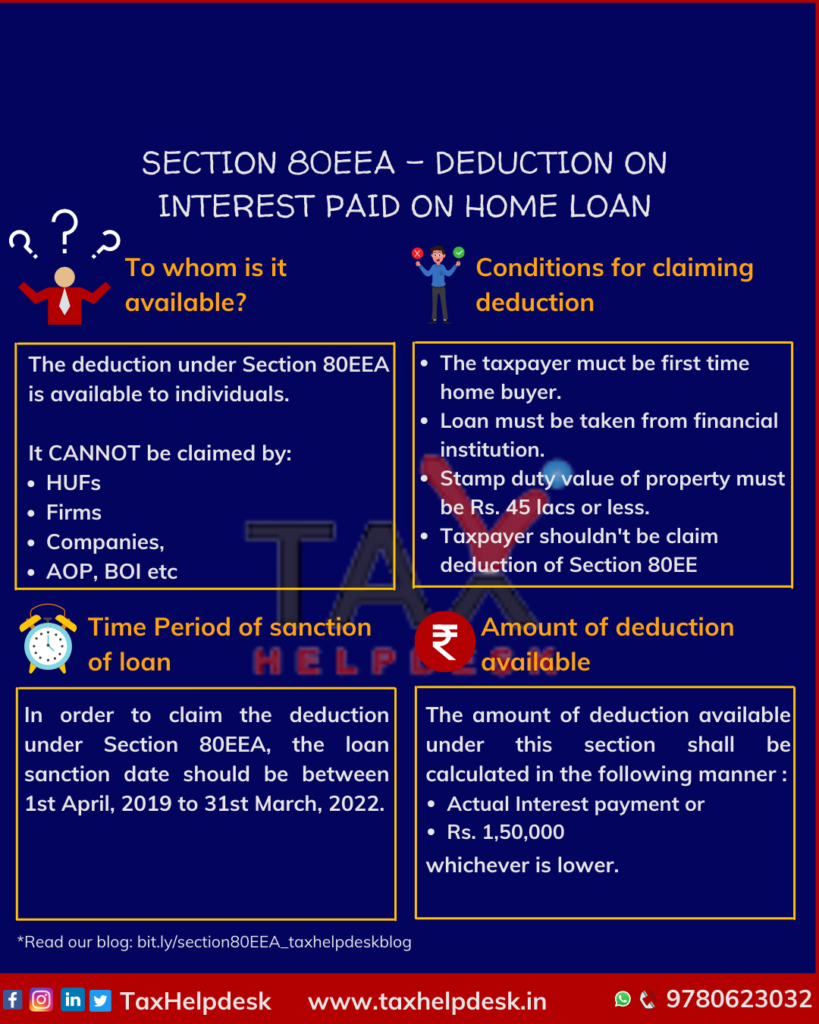

What Is Deduction Under 80eea Section 80EEA of the Income Tax Act 1961 provides an additional deduction on home loan interest for first time

Section 80EEA allows deductions only to first time homebuyers This implies that on the day the loan is sanctioned the assessee should not own any residential real Article explains Overview of Section 80EEA Eligibility conditions to be eligible for deduction under 80EEA Calculation of Deduction under Section 80EEA with Examples and Taxability of the

What Is Deduction Under 80eea

What Is Deduction Under 80eea

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Section-80EEA-Deduction-on-interest-paid-on-home-loan-819x1024.png

All About Section 80EEA For Deduction On Home Loan Interest

https://blog.saginfotech.com/wp-content/uploads/2023/01/tax-deduction-under-section-80eea.jpg

DEDUCTION UNDER CHAPTER VI A INCOME TAX SECTION 80EEA YouTube

https://i.ytimg.com/vi/BV6FTXQuELU/maxresdefault.jpg

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section The Indian Income Tax Act provides a tax deduction of up to Rs 1 5 lakhs per financial year for interest paid on home loans taken for purchasing or constructing an affordable

What is Section 80EEA deduction limit The deduction limit is Rs 1 50 lakh per year What is the period covered under Section 80EEA Borrowers whose home loans are sanctioned between 1 April 2019 and How is the Deduction Calculated Under Section 80EEA The total deduction that is available under section 80EEA is INR 1 50 000 or the interest payable amount

Download What Is Deduction Under 80eea

More picture related to What Is Deduction Under 80eea

Deduction Under Chapter 6A Of Income Tax Act Loan Deduction Under

https://i.ytimg.com/vi/4Xzz6JwI40c/maxresdefault.jpg

How To Claim Home Loan Deduction In Your ITR All About Section 80EEA Of

https://d136nkzuw2elkh.cloudfront.net/uploads/article/banner/477/carousel_Home_loan_articl.jpg

Tax Deduction Under Section 80EEA For Home Loan

https://cdn.navimumbaihouses.com/blog/wp-content/uploads/2022/11/Tax-deduction-under-Section-80EEA-for-home-loan.jpg

A can claim a total deduction of INR 3 2 lakhs in that financial year by claiming interest paid on the home loan under Section 80EEA The example clearly Tax deduction under section 80EEA is allowed for first time home buyers for the amount of interest paid towards the home loan under the affordable housing

Section 80EEA Income Tax Act enables any first time home buyer in India to earn an additional tax deduction of up to Rs 1 5 lakh Check out the conditions documents required and rules to get a claim Understand the difference between 80EE and 80EEA based on the deduction limit eligibility criteria applicability etc here in detail on Groww First time homebuyers can

REVISED HOME LOAN BENEFITS U S 80EEA Deduction On Interest For Housing

https://i.ytimg.com/vi/bftNK4L9-WU/maxresdefault.jpg

Section 80EEA Of Income Tax Act Deduction For Interest Paid On Home

https://emailer.tax2win.in/assets/guides/all_guides/80eea-claim-condition.jpg

https://tax2win.in/guide/section-80eea-d…

Section 80EEA of the Income Tax Act 1961 provides an additional deduction on home loan interest for first time

https://www.taxbuddy.com/blog/section-80ee-vs...

Section 80EEA allows deductions only to first time homebuyers This implies that on the day the loan is sanctioned the assessee should not own any residential real

Tax Deduction Under Section 80EEA For Home Loan pdf

REVISED HOME LOAN BENEFITS U S 80EEA Deduction On Interest For Housing

Tax Deduction Under Section 80EEA For Home Loan pdf

Who Is Eligible For 80EE And 80EEA The Deduction Under Th Flickr

How To Claim Rs 1 5 Lakhs Home Loan Interest Deduction U s 80EEA Under

Section 80EEA Claim Rs 1 50 Lakh IT Deduction Hurry Up Before 31 03 2022

Section 80EEA Claim Rs 1 50 Lakh IT Deduction Hurry Up Before 31 03 2022

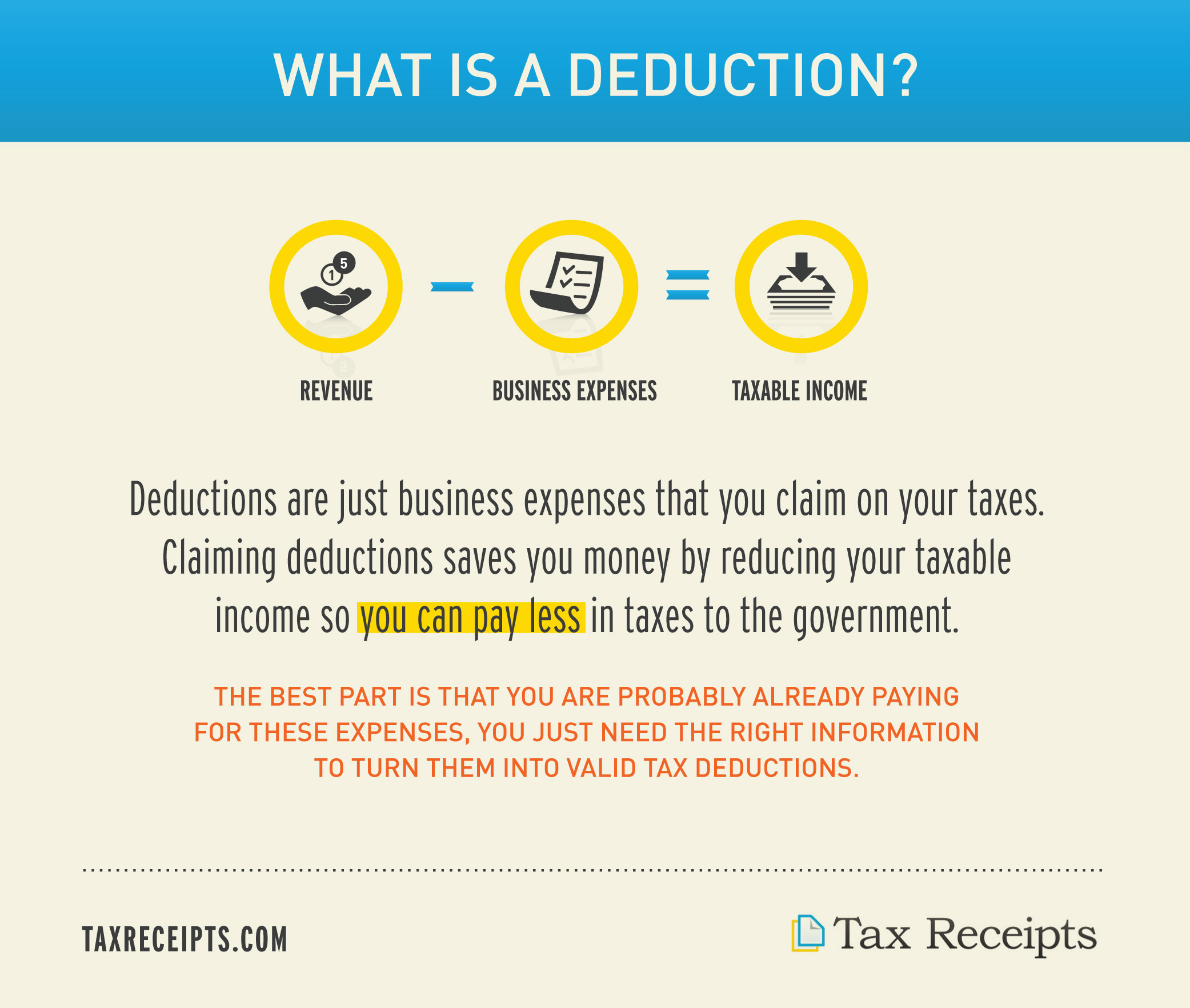

What Is A Tax Deduction

Sec 80E Sec 80EE Sec 80EEA Deductions Under Sec 80 Deductions

What Is Deduction Under Section 80TTA Chapter VIa How To Calculate

What Is Deduction Under 80eea - Deduction under section 80EEA has a provision that home buyers can save up to Rs 1 50 lakhs per year in favour of the interest paid on home loans This is in addition to the Rs