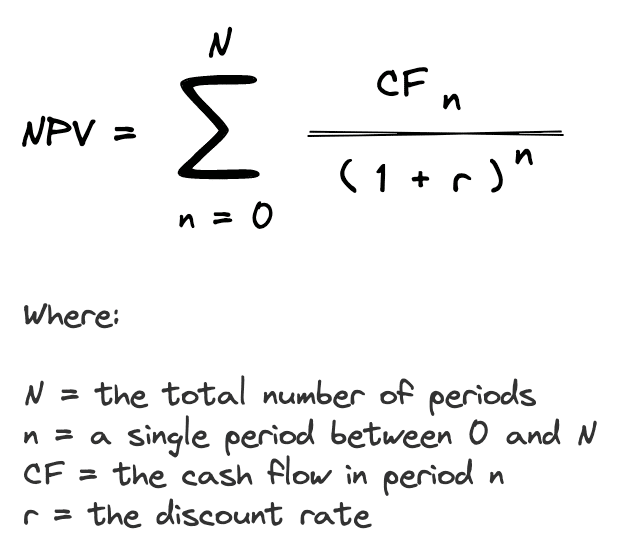

What Is Discount Rate In Npv Net Present Value NPV is the value of all future cash flows positive and negative over the entire life of an investment discounted to the present

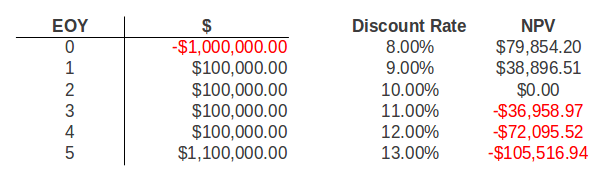

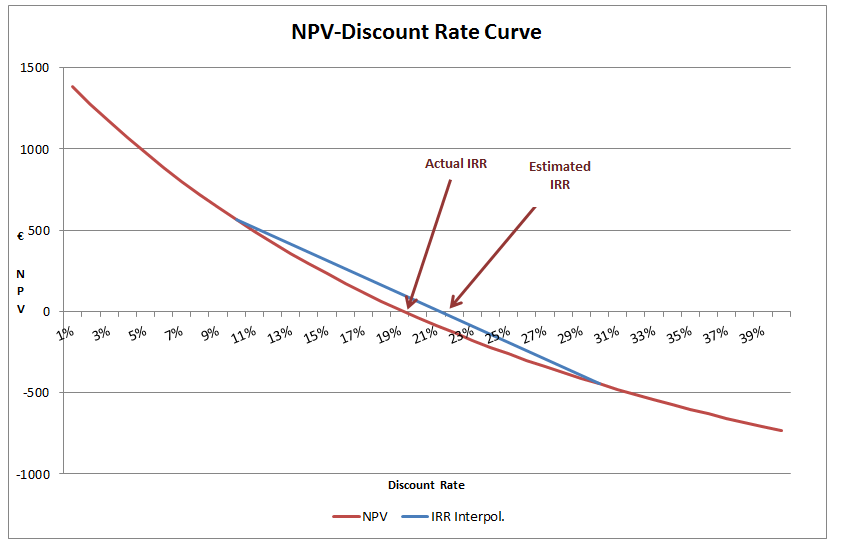

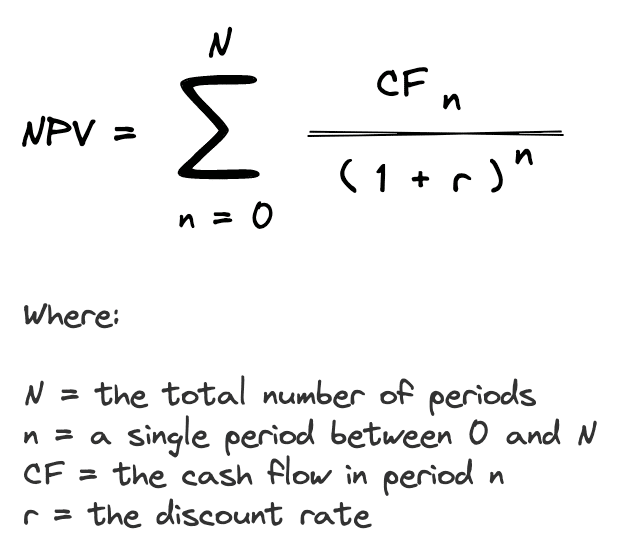

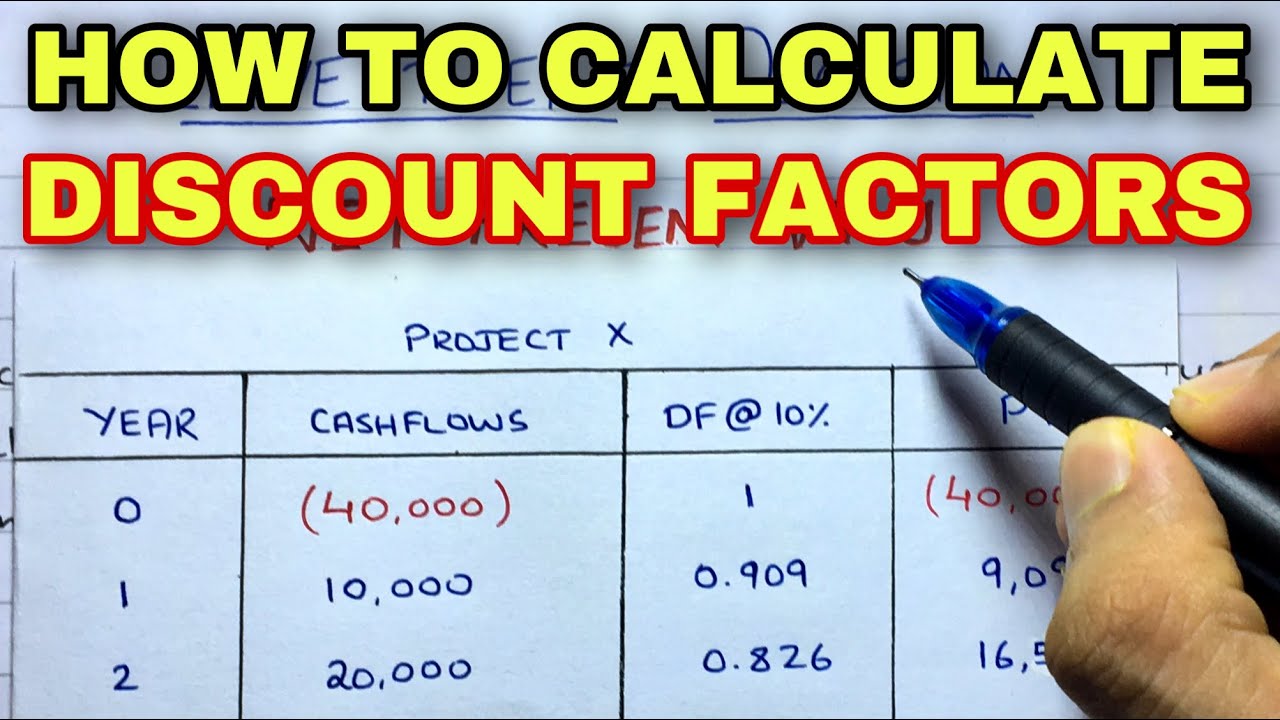

Discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its Net Present Value NPV NPV helps to determine an investment or project s feasibility If NPV is a positive value the investment is Discount Rate vs NPV What is the Difference The net present value NPV of a future cash flow equals the cash flow amount discounted to the present date With that said a higher discount rate reduces the present value PV of future cash flows and vice versa

What Is Discount Rate In Npv

What Is Discount Rate In Npv

https://www.researchgate.net/profile/Fabien_Roques/publication/4944561/figure/download/tbl3/AS:670047110443028@1536763088843/Single-plants-NPV-distribution-statistics-10-discount-rate-m.png

What You Should Know About The Discount Rate

http://www.propertymetrics.com/wp-content/uploads/2013/09/discount_rate_sensitivity.png

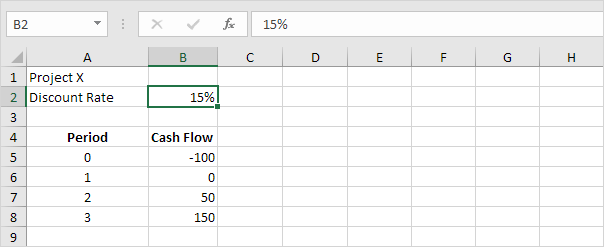

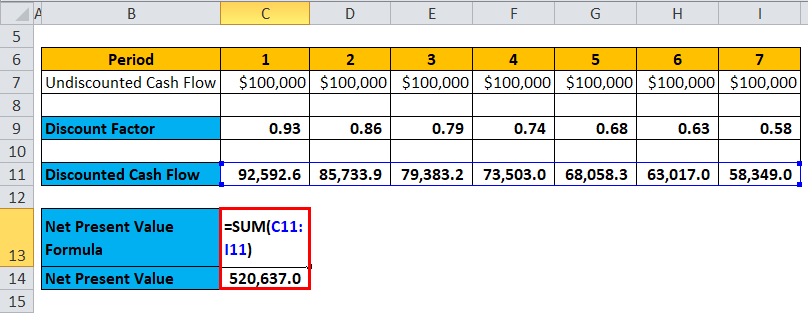

NPV Formula In Excel In Easy Steps

https://www.excel-easy.com/examples/images/npv/discount-rate.png

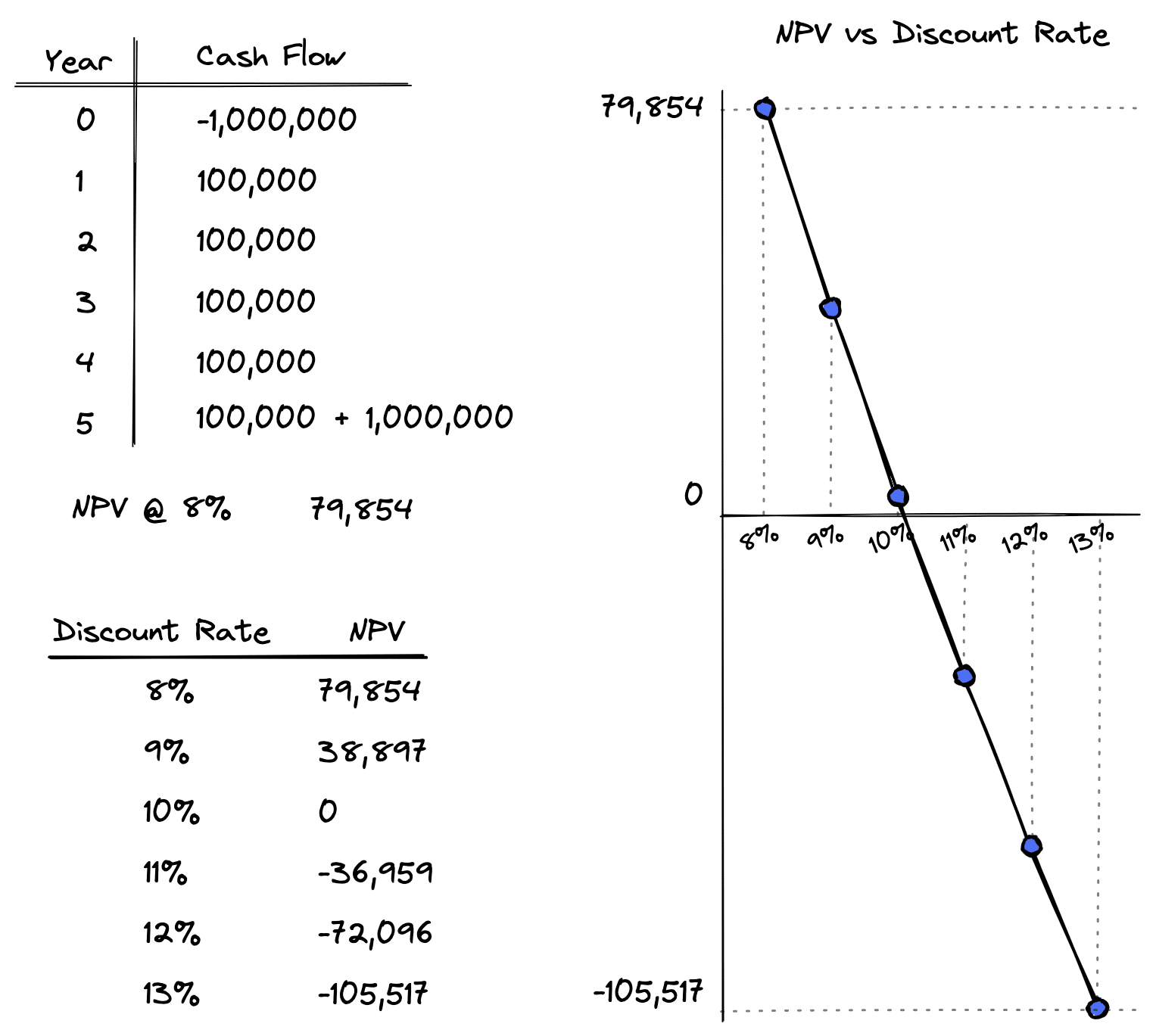

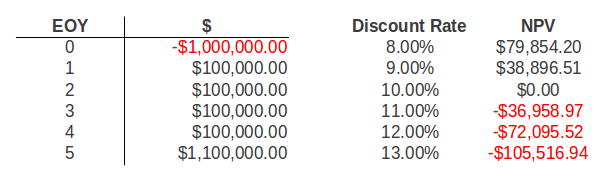

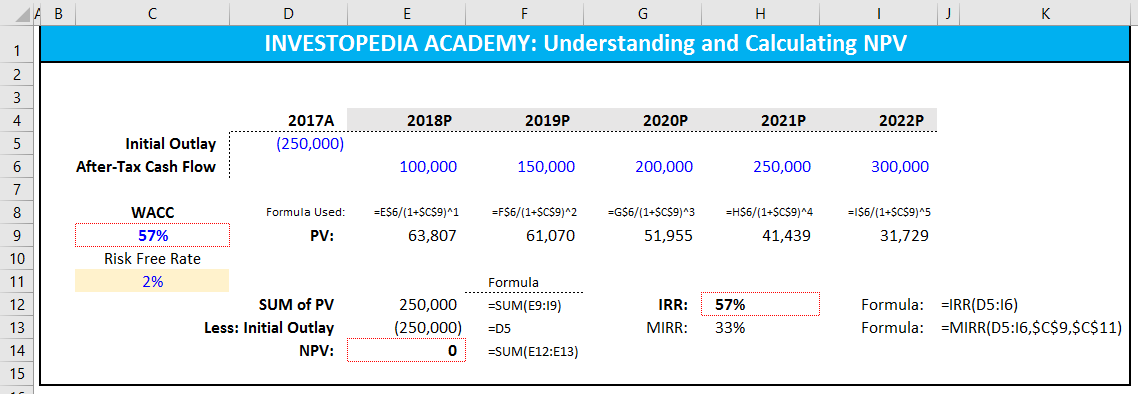

If a higher discount rate is used the present value of future cash flows falls and the NPV of the project falls Theoretically we should use the firm s cost to attract capital as the discount rate when calculating NPV NPV Formula In practice the XNPV Excel function is used to calculate the net present value NPV XNPV Rate Values Dates Where Rate The appropriate discount rate based on the riskiness and potential returns of the cash flows Values The array of cash flows with all cash outflows and inflows accounted for

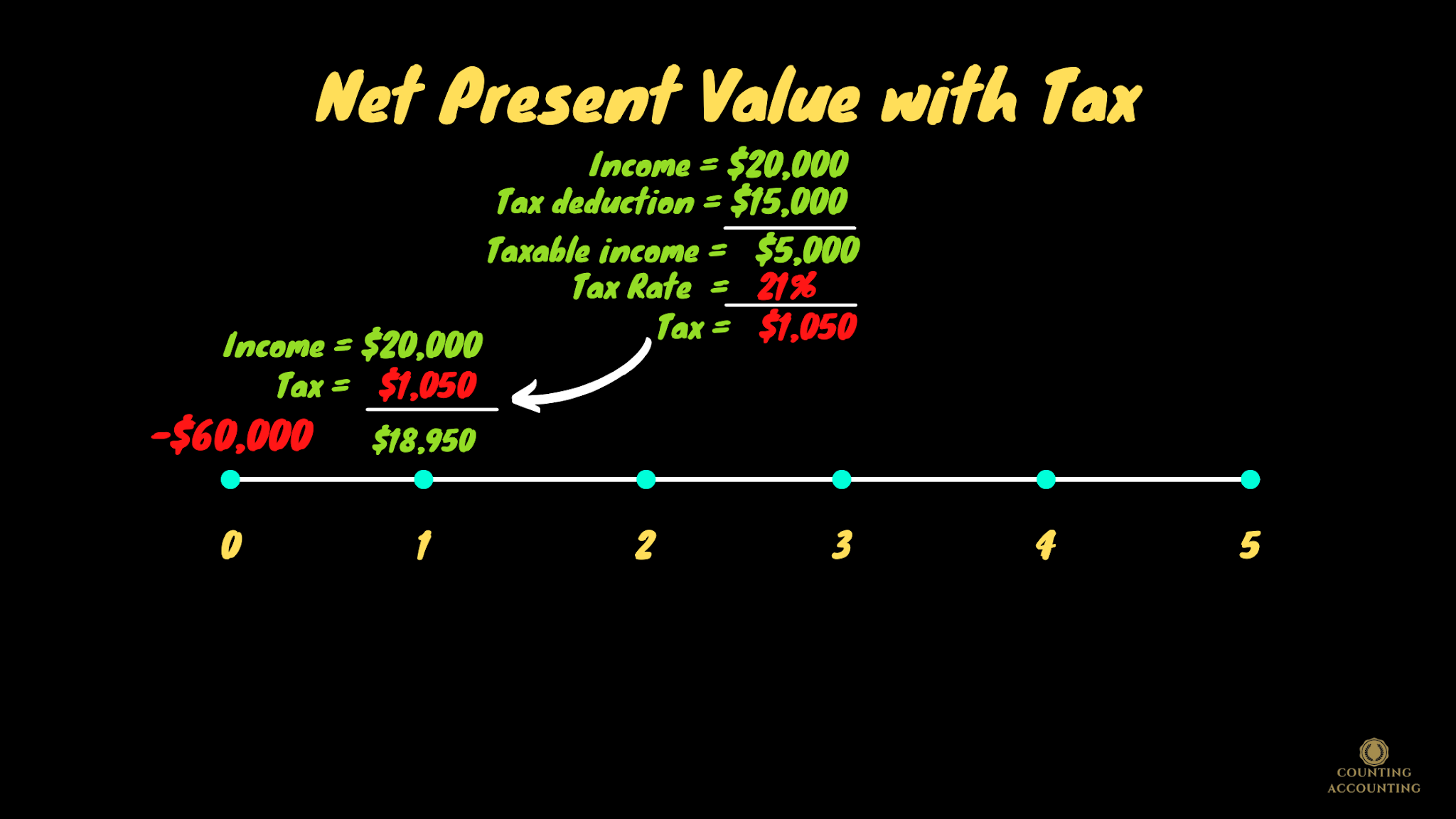

The NPV calculation uses a discount rate to bring future cash flows back to present day dollars The discount rate is commonly taken as the Weighted Average Cost of Capital WACC for the business i e what is the average cost of funding our business taking the cost of debt and the required return on equity into account Determine the discount rate This rate reflects the investment s risk and the cost of capital Calculate NPV Discount each cash flow to its present value using the formula PV Cash Flow 1 Discount Rate Year Sum the discounted cash flows Add all present values

Download What Is Discount Rate In Npv

More picture related to What Is Discount Rate In Npv

How To Create A NPV Profile Using Excel NPV Vs Discount Rate YouTube

https://i.ytimg.com/vi/ai4H5VLa7wM/maxresdefault.jpg

Double Exit NPV IRR Using MS Excel

http://doubleexit.ie/wp-content/uploads/2015/11/npv-irr.png

What Is The Discount Rate Definition And Meaning Market Business News

https://i2.wp.com/marketbusinessnews.com/wp-content/uploads/2016/08/Discount-rate-Federal-Reserve.jpg?fit=639,631&ssl=1

The discount rate in NPV calculates the present value of future cash flows relative to their future risk and time value Mastering it requires understanding the principles of time value of money and risk assessment The discount rate is a rate used to determine the current value of future cash flows AKA the NPV or net present value Sometimes you hear a discount rate referred to as a hurdle rate A discount rate could represent some sort of opportunity cost or risk rating

[desc-10] [desc-11]

What You Should Know About The Discount Rate PropertyMetrics

https://propertymetrics.com/wp-content/uploads/2022/12/image-119.png

What You Should Know About The Discount Rate PropertyMetrics

https://propertymetrics.com/wp-content/uploads/2022/12/image-113.png

https://corporatefinanceinstitute.com › resources › ...

Net Present Value NPV is the value of all future cash flows positive and negative over the entire life of an investment discounted to the present

https://www.wallstreetmojo.com › discount-rate

Discount rate refers to the rate of interest that is used to discount all future cash flows of an investment to derive its Net Present Value NPV NPV helps to determine an investment or project s feasibility If NPV is a positive value the investment is

How To Calculate Discount Factor In Excel Haiper

What You Should Know About The Discount Rate PropertyMetrics

What Is A Discount Rate And How To Calculate It Eqvista

How To Calculate Discount Factor Haiper

Calculate Net Present Value With Taxes How To Calculate NPV With Taxes

NPV PV Of 1080 12 Discounted Rate Download Table

NPV PV Of 1080 12 Discounted Rate Download Table

How To Calculate Your Discount Rate Haiper

How To Calculate Discounting Factors Financial Management YouTube

How To Calculate Current Discount Rate Haiper

What Is Discount Rate In Npv - [desc-13]