What Is Double Taxation Relief In Uk How to claim tax relief Check HMRC s Double taxation digest for countries that have an agreement with the UK and how income like pensions and interest is taxed

To begin the process an individual who believes they may be tax resident in two jurisdictions including the UK must make a claim for treaty residence via a self assessment tax return and a through a specific tax What types of double tax relief are available in the UK The UK provides three options for providing relief from double taxation two via a form of tax credit and one by way of deduction

What Is Double Taxation Relief In Uk

What Is Double Taxation Relief In Uk

https://www.patriotsoftware.com/wp-content/uploads/2019/09/double-taxation-compressed.png

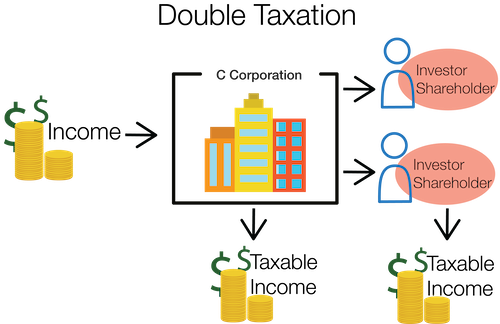

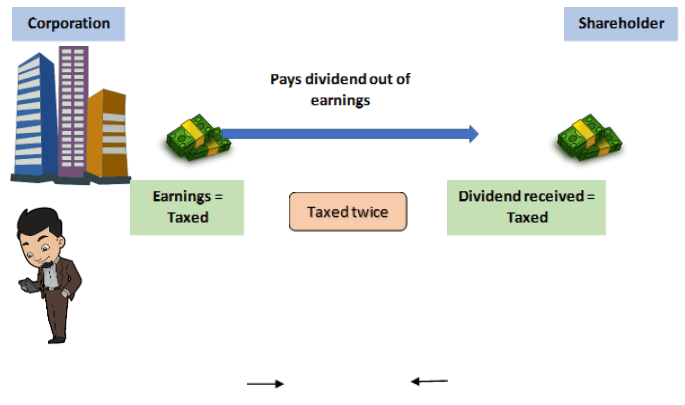

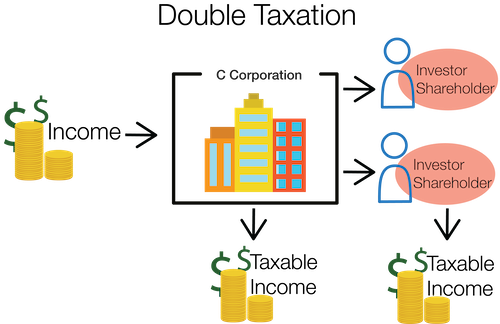

What Is Double Taxation How It Works Examples More

https://www.patriotsoftware.com/wp-content/uploads/2019/09/accounting-double-taxation.jpg

Complete Breakdown Of What Is Double Taxation From A C Corp Paying

https://i.ytimg.com/vi/n9Rd7ssjDXQ/maxresdefault.jpg

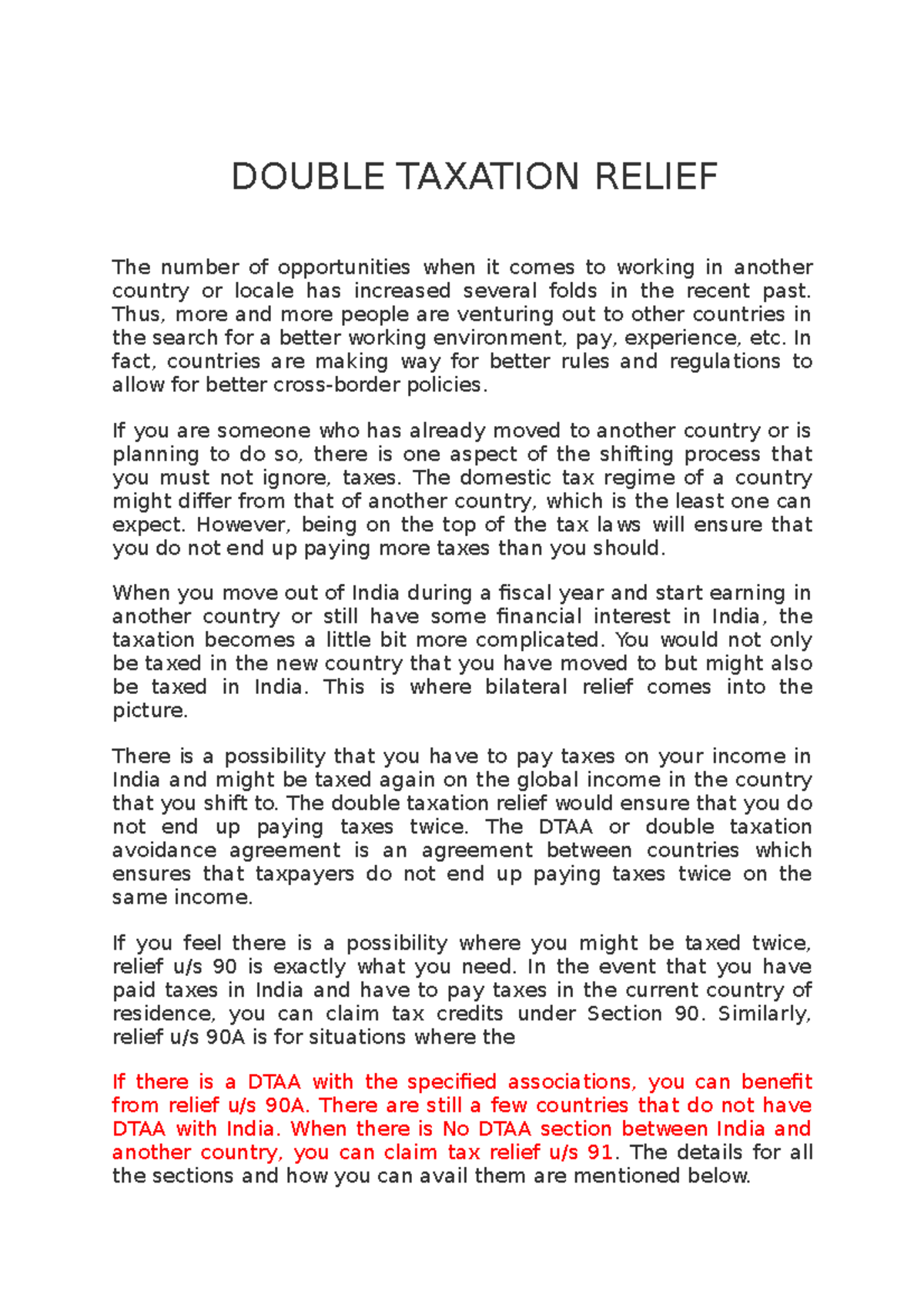

Double tax relief may be either be under the terms of a double tax agreement or unilateral relief where there is no agreement in place The basic rules are outlined below Learn how UK Double Taxation Agreements provide tax relief for dual residents Essential reading for anyone navigating UK and overseas tax obligations

The Form DT Individual is a key document used by individuals who are residents in countries that have a double taxation treaty with the UK enabling them to apply for relief or a refund of UK Income Tax on various The UK provides relief from double taxation to prevent international businesses from being taxed twice on the same income Treaty agreements exist with many countries to

Download What Is Double Taxation Relief In Uk

More picture related to What Is Double Taxation Relief In Uk

What Are Double Taxation Agreements Adam Fayed

https://adamfayed.com/wp-content/uploads/2022/06/3-12.jpg

Double Taxation Relief DOUBLE TAXATION RELIEF The Number Of

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/3dd5b0cd6b947dd2c5de837c1ee71b38/thumb_1200_1698.png

Double Taxation Relief Section 90 Of Income Tax Act What You Need To Know

https://res.cloudinary.com/jerrick/image/upload/fl_progressive,q_auto,w_1024/5fa0d7311774a8001d3aeec1.png

Double tax relief is available to all UK resident companies However it is only beneficial to companies who have suffered overseas foreign tax on some or all of their income A UK Your home country should give you double tax relief by giving a credit for UK taxes paid However if you are resident in a country with which the UK has a double taxation agreement you may be eligible for relief from UK

As a rule you will claim Foreign Tax Credit Relief by reporting overseas income in your tax return The amount of relief you get depends on the UK double taxation agreement with the country There are two types of double taxation Double taxation can be eliminated or reduced by the domestic law of the UK and of other countries see below Unilateral

How To Avoid Double Taxation In Your Small Business

https://m.foolcdn.com/media/affiliates/images/Double_Taxation-02-Double_Taxation_Flowchart.d.width-750.png

Double Taxation How Does Double Taxation Works With Example

https://cdn.educba.com/academy/wp-content/uploads/2021/01/Double-Taxation-1.1.png

https://www.gov.uk › tax-uk-income-live-abroad › taxed-twice

How to claim tax relief Check HMRC s Double taxation digest for countries that have an agreement with the UK and how income like pensions and interest is taxed

https://www.expertsforexpats.com › country …

To begin the process an individual who believes they may be tax resident in two jurisdictions including the UK must make a claim for treaty residence via a self assessment tax return and a through a specific tax

What Is Double Taxation

How To Avoid Double Taxation In Your Small Business

Read Download Double Taxation Relief By Rodney Taylor Ebook EPUB PD

What Is Double Taxation And How Can I Prevent It

Income Taxation Module 1 INCOME TAXATION Module 1 Principles Of

Double Taxation Relief Explained Tax Benefits

Double Taxation Relief Explained Tax Benefits

Double Taxation Relief M Meilak Associates Tax Advisors Malta

Principles Of Taxation 28 Principles Of Taxation Page 1 Of 32

Taxes Chart Graph Shows Increasing Tax Or Taxation Stock Image

What Is Double Taxation Relief In Uk - Double tax relief may be either be under the terms of a double tax agreement or unilateral relief where there is no agreement in place The basic rules are outlined below