What Is Exempt From Gst In Nz If a registered New Zealand owned entity provides goods or services online to people in New Zealand they ll charge GST at 15 If a New Zealand owned entity sells goods or

Unlike taxable supplies including zero rated supplies exempt supplies are goods and services which are not subject to GST and not included in the GST return The following When determining the GST threshold of 60 000 a year zero rated transactions are included in the calculations while exempt transactions are not included for this purpose

What Is Exempt From Gst In Nz

What Is Exempt From Gst In Nz

https://learn.microsoft.com/en-us/dynamics365/finance/localizations/media/apac-nzl-gst-declaration.jpg

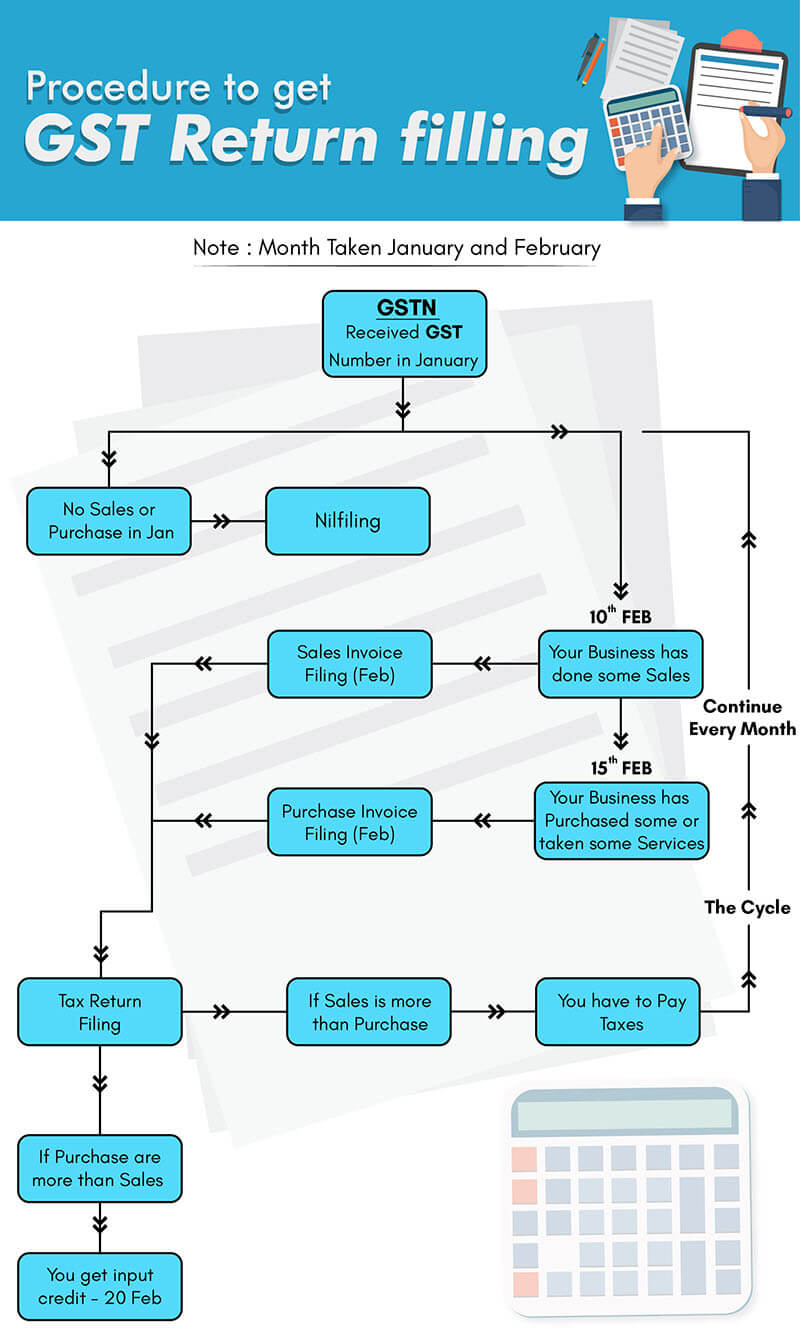

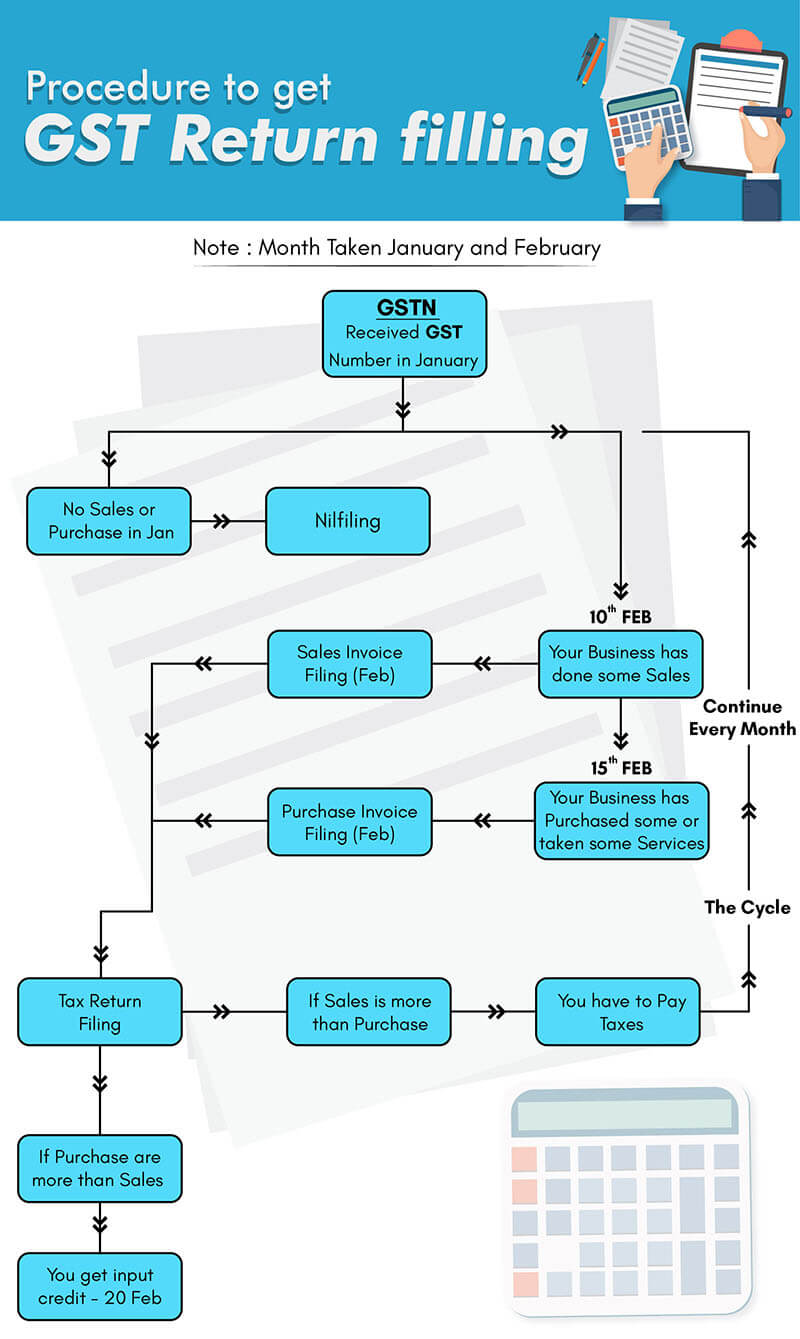

PROCESS FOR GST RETURN FILING SERVICES ONLINE CA CS ADV Service PUNE

https://legaldocs.co.in/img/gst-filling/gst-return-filling.jpg

GST Exempt Supply List Of Goods Exempted

https://www.saralgst.com/wp-content/uploads/2020/03/GST-exempt-supply-List-of-goods-exempted.jpg

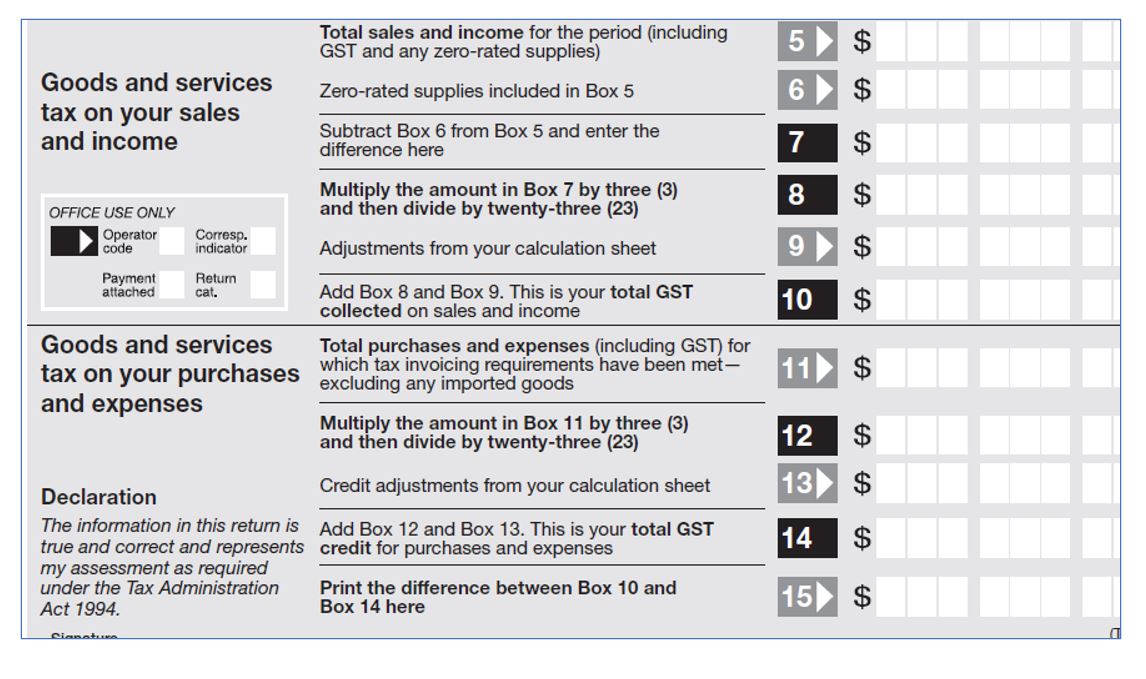

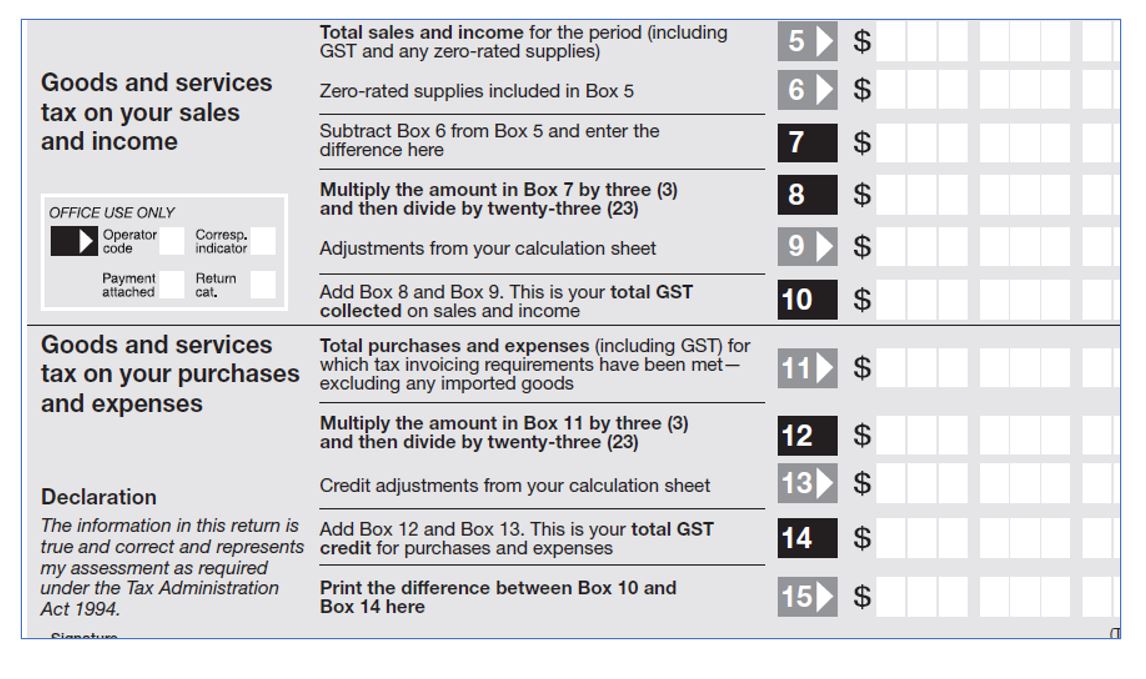

In New Zealand GST taxable supplies sold under taxable activity must attract a 15 GST payment to the IRD but there are some exemptions from GST under a small range of GST is a tax added to the price of most goods and services including imports It is a tax for people who buy and sell goods and services You might need to register for GST if you

Reduced rate GST 9 applies to hotel accommodation on a long term basis longer than 4 weeks Zero rate GST 0 applies to exports and related services financial services Key difference between zero rated exempt and non taxable activity Zero rated 0 GST is charged on the supply or sale of goods and services however GST can be claimed

Download What Is Exempt From Gst In Nz

More picture related to What Is Exempt From Gst In Nz

Quoting Without GST What Is Exempt From GST Legal Kitz

https://legalkitz.com.au/wp-content/uploads/2022/05/Screen-Shot-2022-05-04-at-1.11.03-pm.png

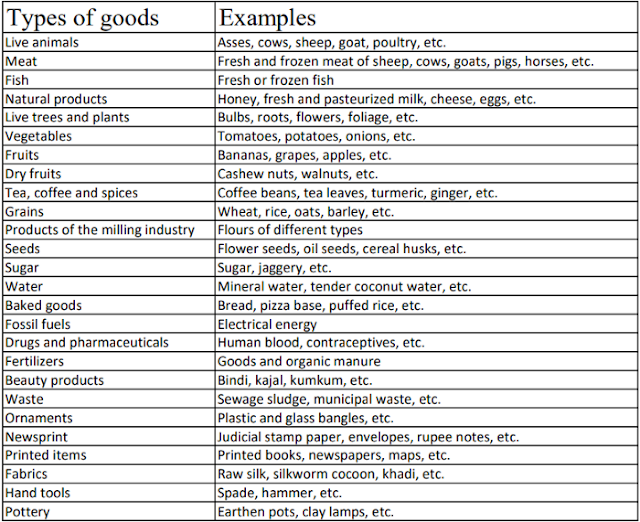

List Of Goods And Services Exemptions Under GST Act

https://lh3.googleusercontent.com/-b6cv2iuOGCY/YTIaBmVtikI/AAAAAAAAAEw/MroHIswv0dUo-aBys916KrCzHCWg78pKACLcBGAsYHQ/w640-h522/image.png

Overtime Rules To Change In 2020 Fingercheck

https://fingercheck.com/wp-content/uploads/2019/12/exemptvs2.jpg

There are 3 GST rates in New Zealand the standard reduced and nil rates New Zealand GST compliance In providing taxable supplies and once GST registered businesses The rate for GST is 15 although goods and services can be zero rated or exempt Zero rated Certain taxable supplies are taxed at the rate of 0 rather than at the

GST exemptions Some goods and services are exempt from GST Financial services residential rent and donated goods sold by non profits fall into this category You should Who is exempt from GST You are not required to register for GST if your business turnover is less than 60 000 per year Further even if you exceed this

You See It And You Don t GST IN MALAYSIA EXPLAINED FROM LOANSTREET

http://static.loanstreet.com.my/rich/rich_files/rich_files/000/000/021/original/exempt-20rated-20gst-20-en-.png

Exemptions In GST YouTube

https://i.ytimg.com/vi/0X8Yc9Bkxv0/maxresdefault.jpg

https://www.ird.govt.nz/gst/charging-gst/zero-rated-supplies

If a registered New Zealand owned entity provides goods or services online to people in New Zealand they ll charge GST at 15 If a New Zealand owned entity sells goods or

https://taxaccountant.kiwi.nz/goods-and-services...

Unlike taxable supplies including zero rated supplies exempt supplies are goods and services which are not subject to GST and not included in the GST return The following

Goods Exempted Under GST

You See It And You Don t GST IN MALAYSIA EXPLAINED FROM LOANSTREET

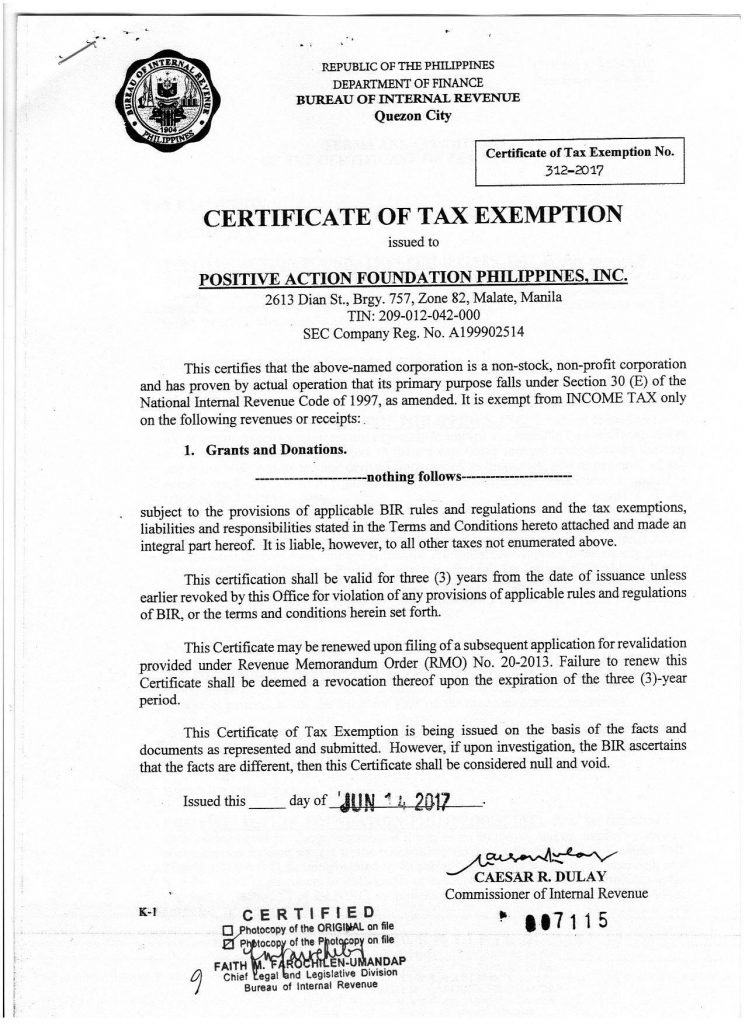

Tax Exemption Certificate Sachet Riset

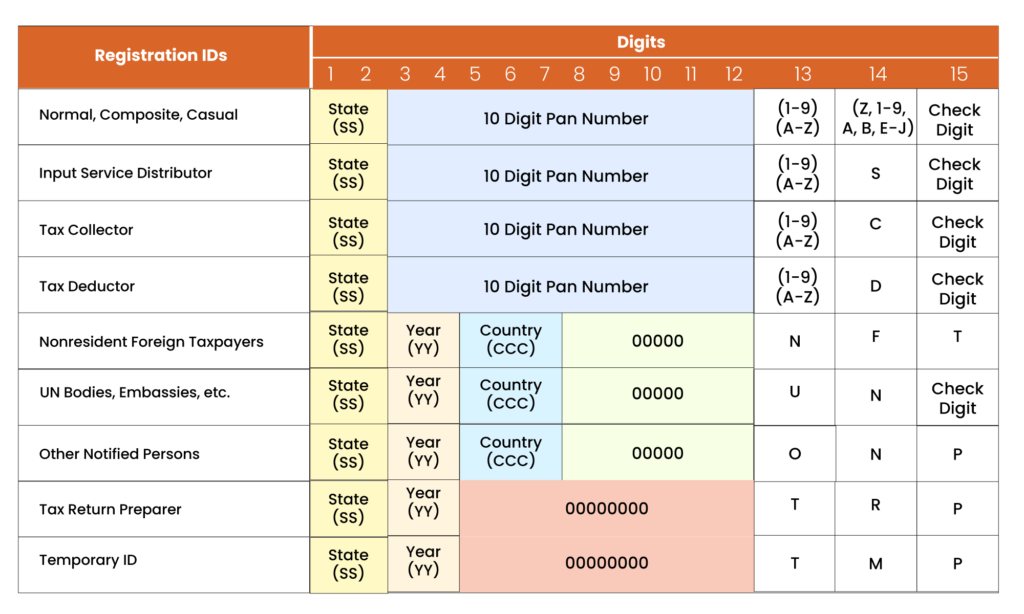

What Is GSTIN GST Number Format GSTIN Verification Process

GST In India Current State And Future Expectations Infographic

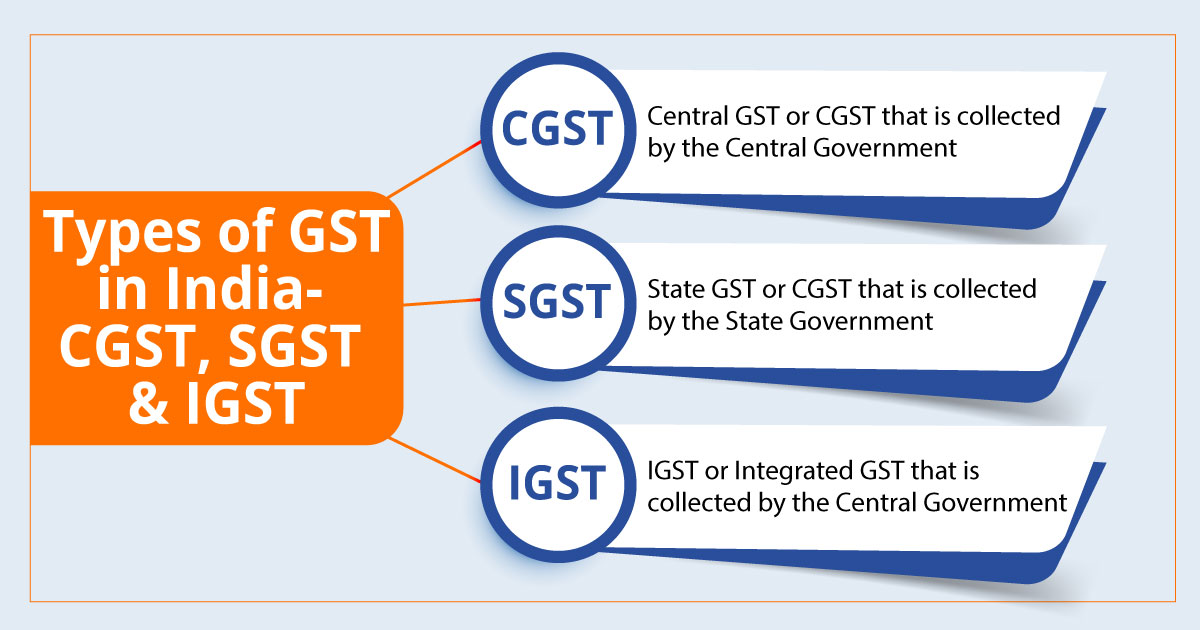

Types Of GST In India All About CGST SGST IGST UTGST

Types Of GST In India All About CGST SGST IGST UTGST

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

How To Register For GST In NZ How To Start A Business In New Zealand

Types Of GST In India What Is CGST SGST And IGST

What Is Exempt From Gst In Nz - Duty and GST may apply when importing items into New Zealand Customs does not collect duty fees or GST unless the value of your item shipment is over NZ 1000 This exemption does not apply to alcohol or tobacco