What Is Fbt Rebate If your not for profit organisation provides fringe benefits to its employees or their associates such as partners it may be eligible for a fringe benefits tax FBT exemption

An FBT rebate essentially a tax discount is available to organisations that are rebatable employers Rebatable employers include certain charities registered with the ACNC For rebatable employers you apply a rebate to the grossed up value of fringe benefits you provide to an employee up to a capping threshold Any fringe benefits in excess of the

What Is Fbt Rebate

What Is Fbt Rebate

https://i.ytimg.com/vi/6N1WZBWaTF4/maxresdefault.jpg

Family Rapt With Cloth Nappy Rebate Strathbogie Shire

https://www.strathbogie.vic.gov.au/wp-content/uploads/2022/08/20220729ClothNappyRebate2Crop.jpg

Fbt Seamless Tours

https://seamless-tours.com/wp-content/uploads/2020/02/IMG_20190216_070948-scaled.jpg

Fringe benefits tax FBT is a tax paid on benefits that an employer provides to their employees in addition to their salary such as the use of a work car or phone Charity tax Charities and not for profits in Australia are entitled to certain concessions and exemptions regarding fringe benefits tax FBT for their employees A new draft tax ruling has been

An employer s guide to Fringe Benefits Tax FBT When rewarding your team with perks beyond their salary it s important to consider the implications of Fringe Benefits Tax Depending on the type of organisation you run you could be eligible for an FBT Exemption or an FBT Rebate What s the difference The FBT Exemption is the most generous

Download What Is Fbt Rebate

More picture related to What Is Fbt Rebate

Fbt Bye Bye Maldad

https://chingatumadrechichicancer.files.wordpress.com/2018/08/img_20180712_063341.jpg

Entertainment FBT

https://bristax.com.au/wp-content/uploads/2023/09/entertainment-fbt-bristax-tax-accountants-4.webp

AGIKgqPZtKRnqk2fpOYBiUMRQ5GdMvaNzjjU79ZINEKM s900 c k c0x00ffffff no rj

https://yt3.googleusercontent.com/ytc/AGIKgqPZtKRnqk2fpOYBiUMRQ5GdMvaNzjjU79ZINEKM=s900-c-k-c0x00ffffff-no-rj

What is fringe benefits tax FBT Your employer is liable for any applicable FBT on fringe benefits they provide to you and or your family FBT is separate from income tax It s calculated on the taxable value of a fringe Payment of Fringe Benefits Tax FBT is the responsibility and obligation of the employer and paid by the employer FBT is paid by the employer irrespective of whether the employer is a sole trader partnership

FBT is a tax that employers pay on benefits paid to an employee or their associate such as a family member in addition to their salary or wages FBT is calculated on the taxable Not for profit capping thresholds and FBT rebate rate The not for profit capping thresholds and FBT rebate rate are in the table below They have not changed for the

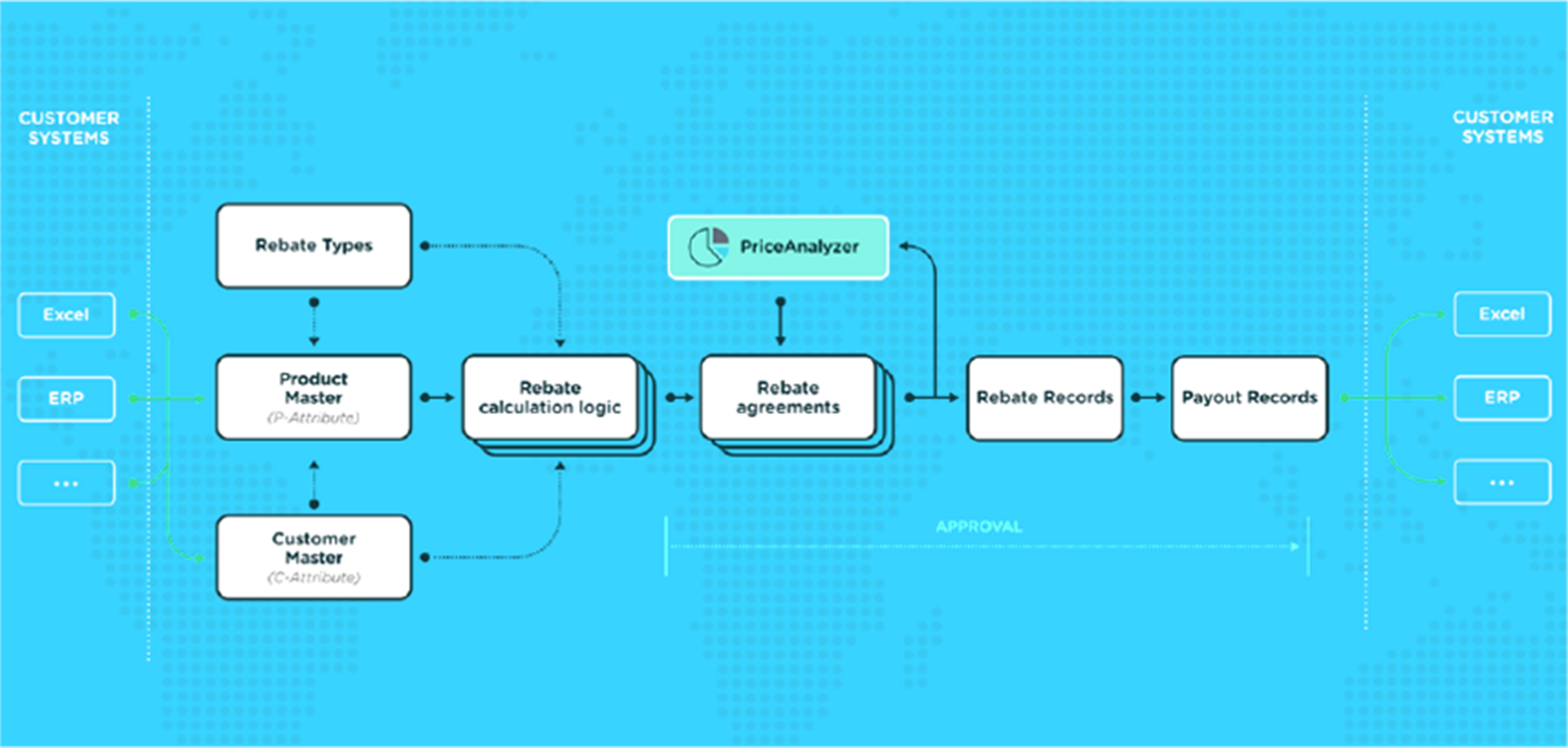

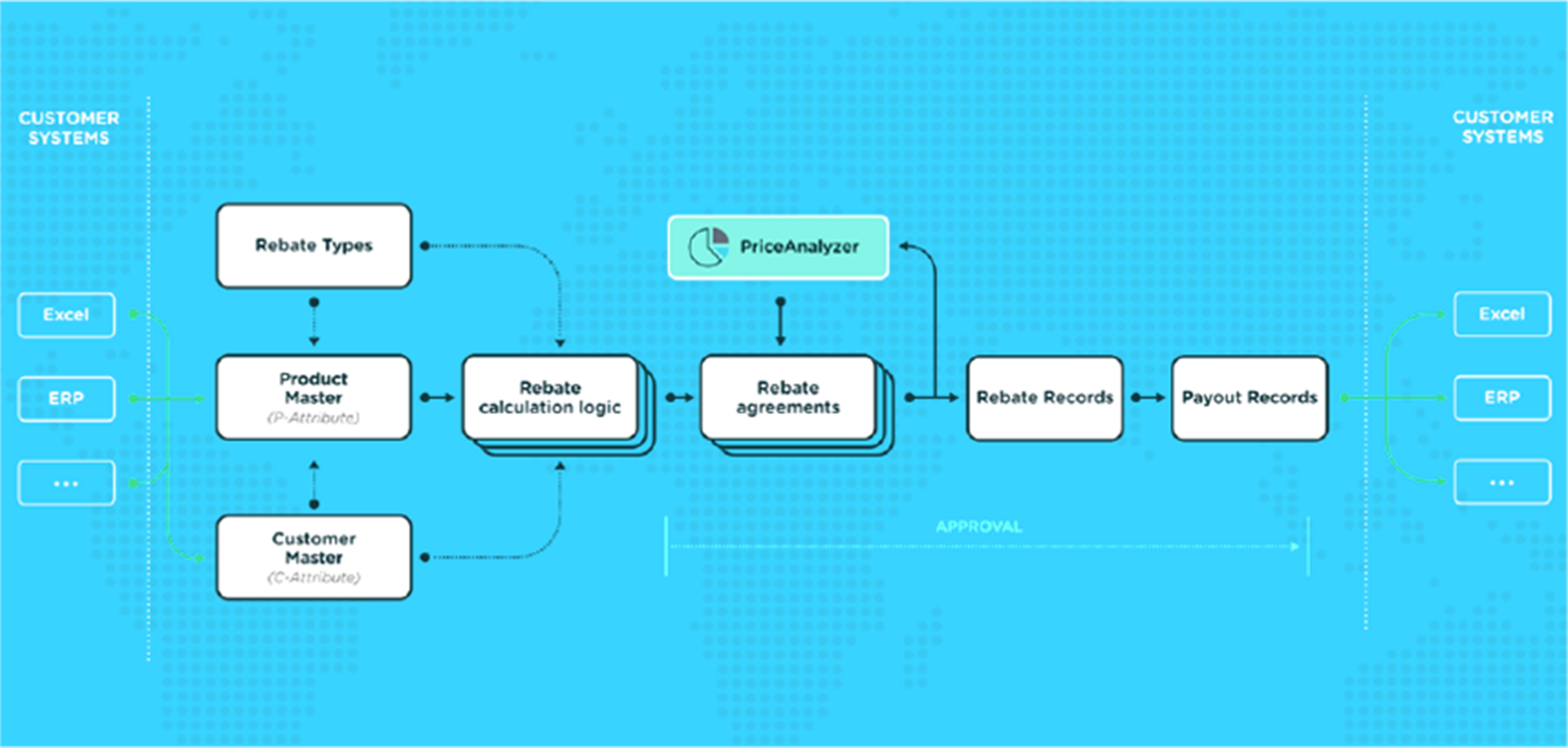

RebateManager Don t Get Stuck In Rebate Management Hell Pricefx

https://www.pricefx.com/wp-content/uploads/2019/04/[email protected]

Greek Rebate Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/270000/velka/greek-rebate.jpg

https://www.ato.gov.au/.../overview-fbt-concessions-for-not-for-profits

If your not for profit organisation provides fringe benefits to its employees or their associates such as partners it may be eligible for a fringe benefits tax FBT exemption

https://www.nfplaw.org.au/free-resources/tax...

An FBT rebate essentially a tax discount is available to organisations that are rebatable employers Rebatable employers include certain charities registered with the ACNC

FBT Training

RebateManager Don t Get Stuck In Rebate Management Hell Pricefx

Traderider Rebate Program Verify Trade ID

What Is FBT Good Kiwi Limited

Fbt Hosted At ImgBB ImgBB

NSW Treasurer Dominic Perrottet Wants FBT Rebate To Lure People Back To

NSW Treasurer Dominic Perrottet Wants FBT Rebate To Lure People Back To

fbt

Fbt Bikepacking cz

Get1000 Rebate

What Is Fbt Rebate - Fringe benefits tax rebates Fringe benefits tax FBT is a tax paid on any benefits that an employer provides to their employees outside of their salary or their superannuation for