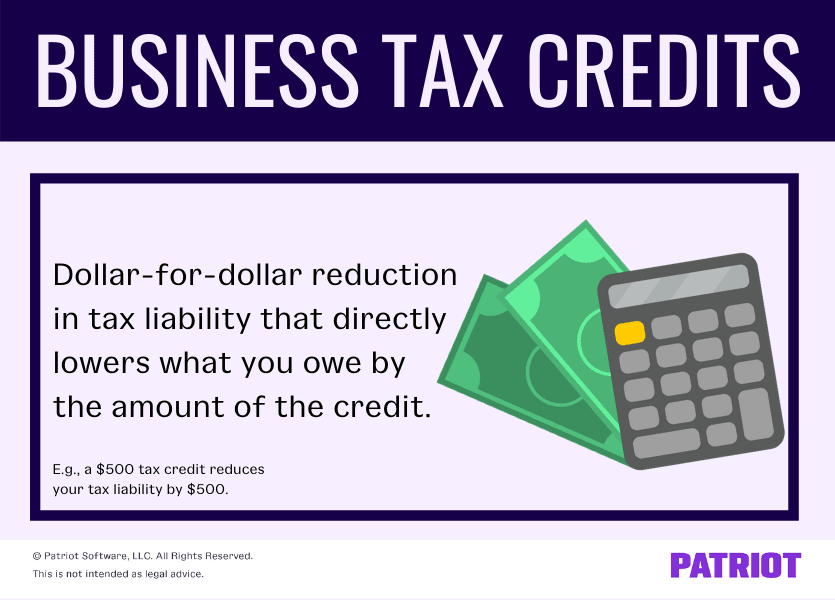

What Is Federal Credits On Taxes Claim credits A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund Some credits are refundable they can give you money back even if you don t owe any tax To claim credits answer questions in your tax filing software

What is a federal tax credit Broadly speaking a tax credit is the dollar for dollar amount of money that taxpayers subtract directly from the income taxes they owe There are A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

What Is Federal Credits On Taxes

What Is Federal Credits On Taxes

https://www.wealthmanagement.com/sites/wealthmanagement.com/files/uploads/2015/12/taxratechart.png

Freelance Taxes 3 50 Deductions You ll Want To Take To Save Money

https://www.theblackandblue.com/wp-content/uploads/2013/04/freelance_filmmaker_taxes_deductions.jpg

Business Tax Credits Types Of Credits Available How To Claim

https://www.patriotsoftware.com/wp-content/uploads/2019/03/Tax-Credit-1.png

A tax credit is a benefit that lowers your taxes owed by the amount of the credit Tax credits can be nonrefundable refundable or partially refundable Some of the most popular tax The term tax credit refers to an amount of money that taxpayers can subtract directly from the taxes they owe This is different from tax deductions which lower the amount of an

Credits and Deductions You can use credits and deductions to help lower your tax bill or increase your refund Credits can reduce the amount of tax due Deductions can reduce the amount of taxable income Credits and deductions are Some tax credits however are fully or partially refundable if their value exceeds income tax liability the tax filer is paid the excess The earned income tax credit EITC is fully refundable the child tax credit CTC is refundable only if the filer s earnings exceed a 2 500 threshold

Download What Is Federal Credits On Taxes

More picture related to What Is Federal Credits On Taxes

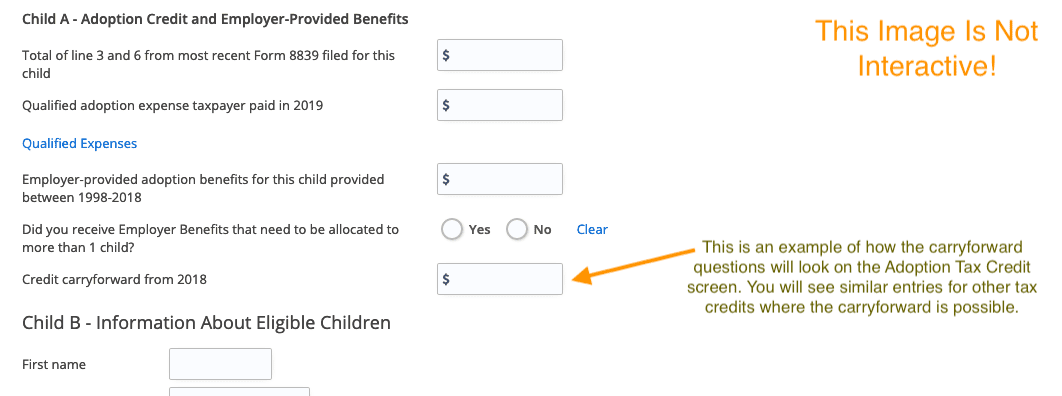

What Is A Provisional Tax Credit Award Chrystal Weathers

https://www.efile.com/image/efile-software-carryforward-example.png

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

https://cdn.mos.cms.futurecdn.net/atBAeA95EXm3hifrNbAKPV.jpg

What Is a Tax Credit A tax credit lowers the amount of money you must pay the IRS Not to be confused with deductions tax credits reduce your final tax bill dollar for dollar That means that if you owe Uncle Sam 5 000 a 2 000 credit would shave 2 000 off your total tax bill and you would only owe 3 000 Overall the most common credits fall into the following categories tax credits for college tax credits for families tax credits for income eligible households and tax credits for

Tax credits directly reduce the amount of tax you owe giving you a dollar for dollar reduction of your tax liability A tax credit valued at 1 000 for instance lowers your tax In short a credit gives you a dollar for dollar reduction in the amount of tax you owe A tax deduction also sometimes called a tax write off provides a smaller benefit by allowing you

Ca Tax Brackets Chart Jokeragri

https://workingholidayincanada.com/wp-content/uploads/2020/02/Federal-rates-min-1309x1536.jpg

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

https://www.irs.gov/credits

Claim credits A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund Some credits are refundable they can give you money back even if you don t owe any tax To claim credits answer questions in your tax filing software

https://www.usatoday.com/story/money/taxes/2023/02/...

What is a federal tax credit Broadly speaking a tax credit is the dollar for dollar amount of money that taxpayers subtract directly from the income taxes they owe There are

Tax Withholding Estimator 2022 ConaireRainn

Ca Tax Brackets Chart Jokeragri

2022 Education Tax Credits Are You Eligible

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

What Is The Difference Between A Tax Credit And Tax Deduction

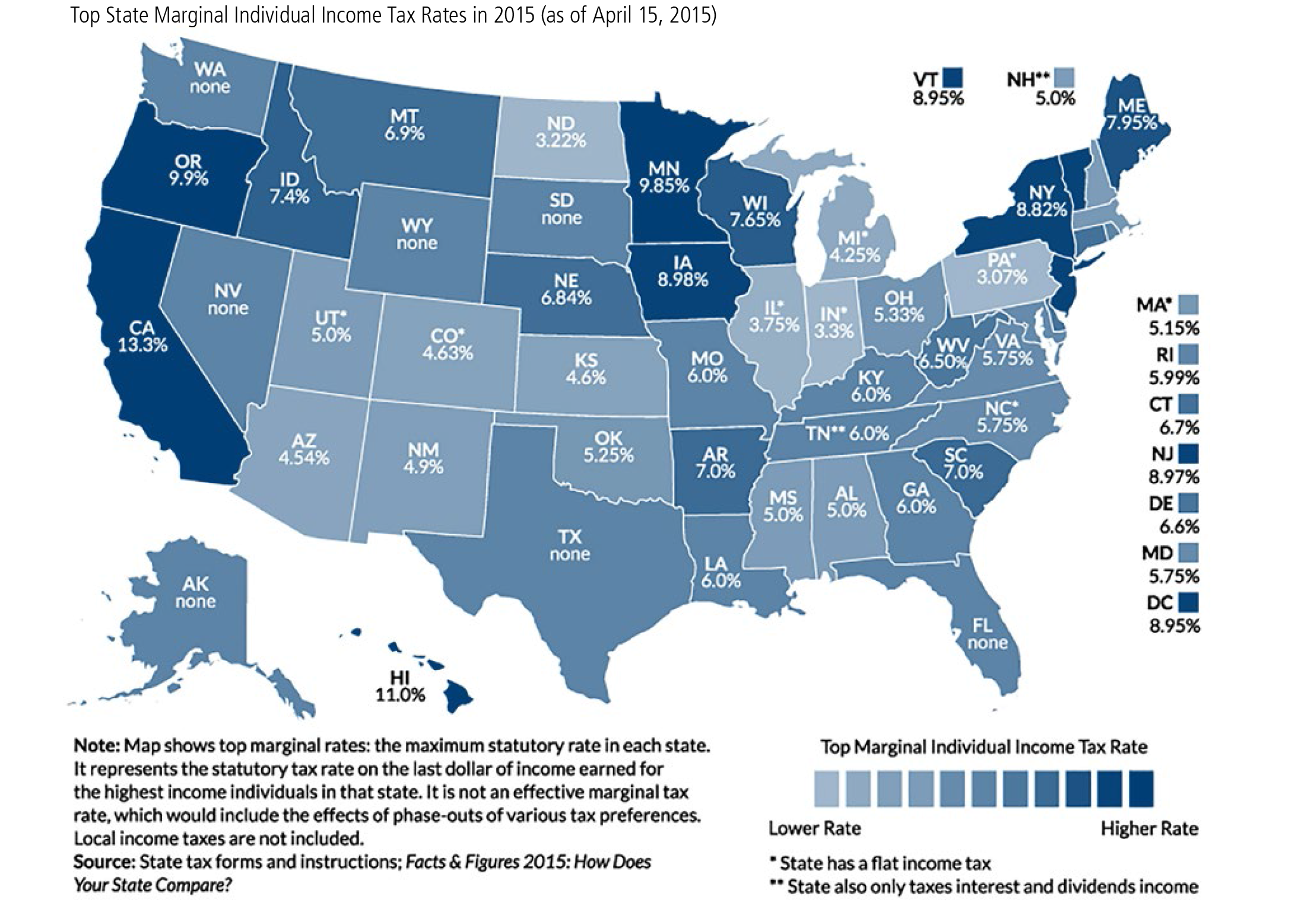

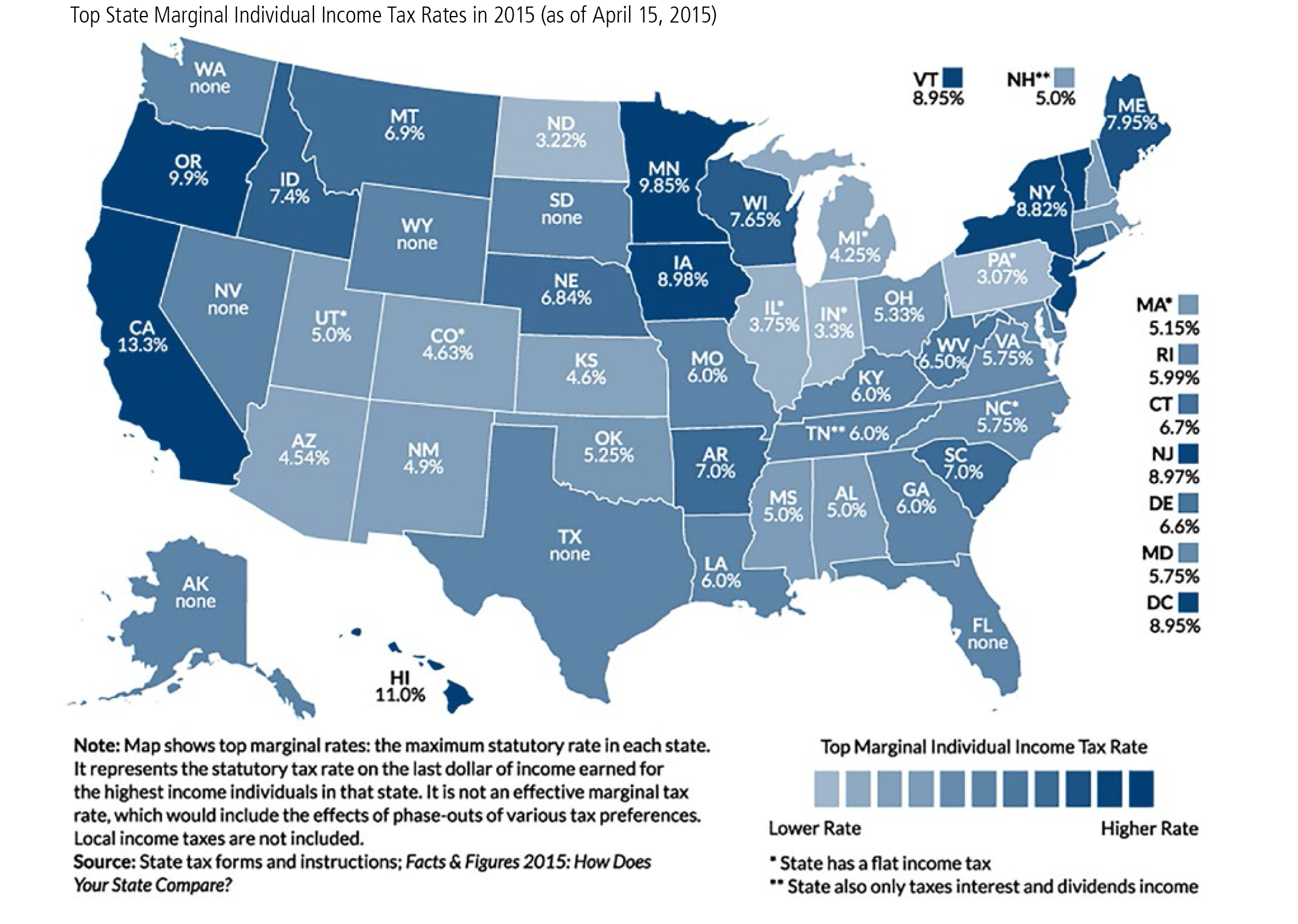

State Individual Income Tax Rates And Brackets Tax Foundation

State Individual Income Tax Rates And Brackets Tax Foundation

Tax Deductions Vs Tax Credits YouTube

The Importance Of Paying Your Taxes University Herald

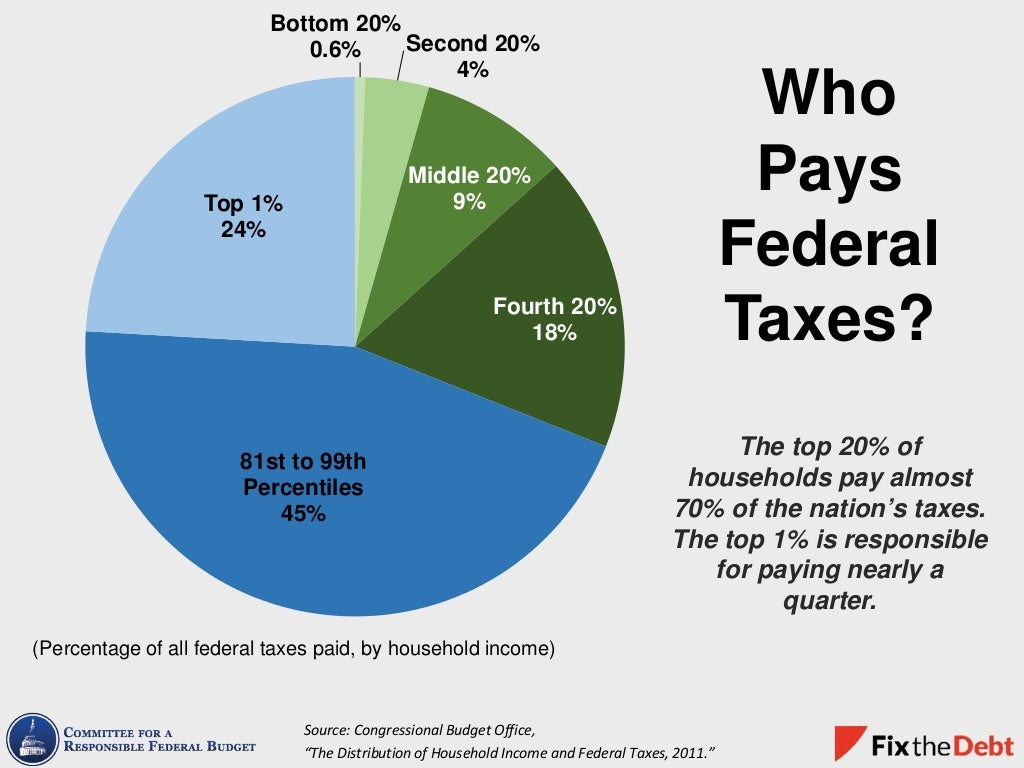

Who Pays Federal Taxes Source

What Is Federal Credits On Taxes - Credits and Deductions You can use credits and deductions to help lower your tax bill or increase your refund Credits can reduce the amount of tax due Deductions can reduce the amount of taxable income Credits and deductions are