What Is Federal Taxable Income Find out what and when income is taxable and nontaxable including employee wages fringe benefits barter income and royalties

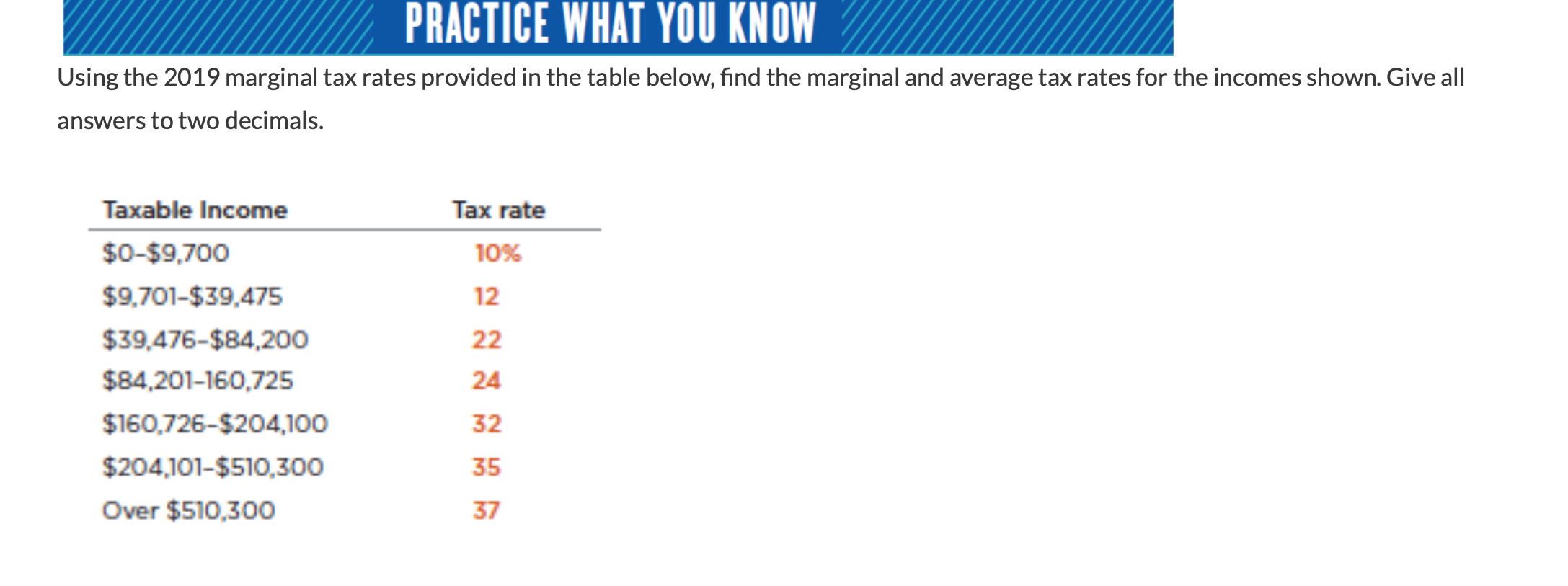

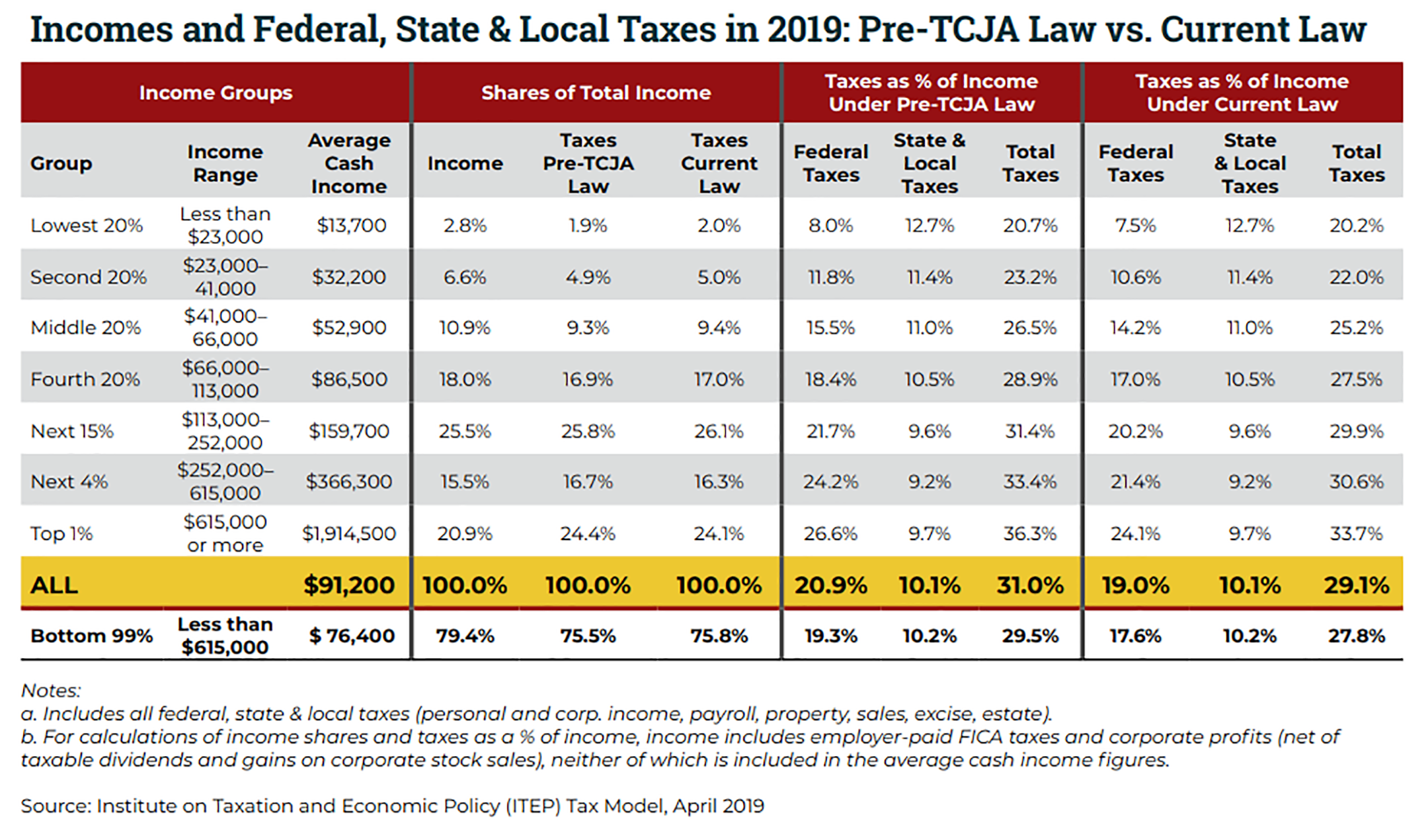

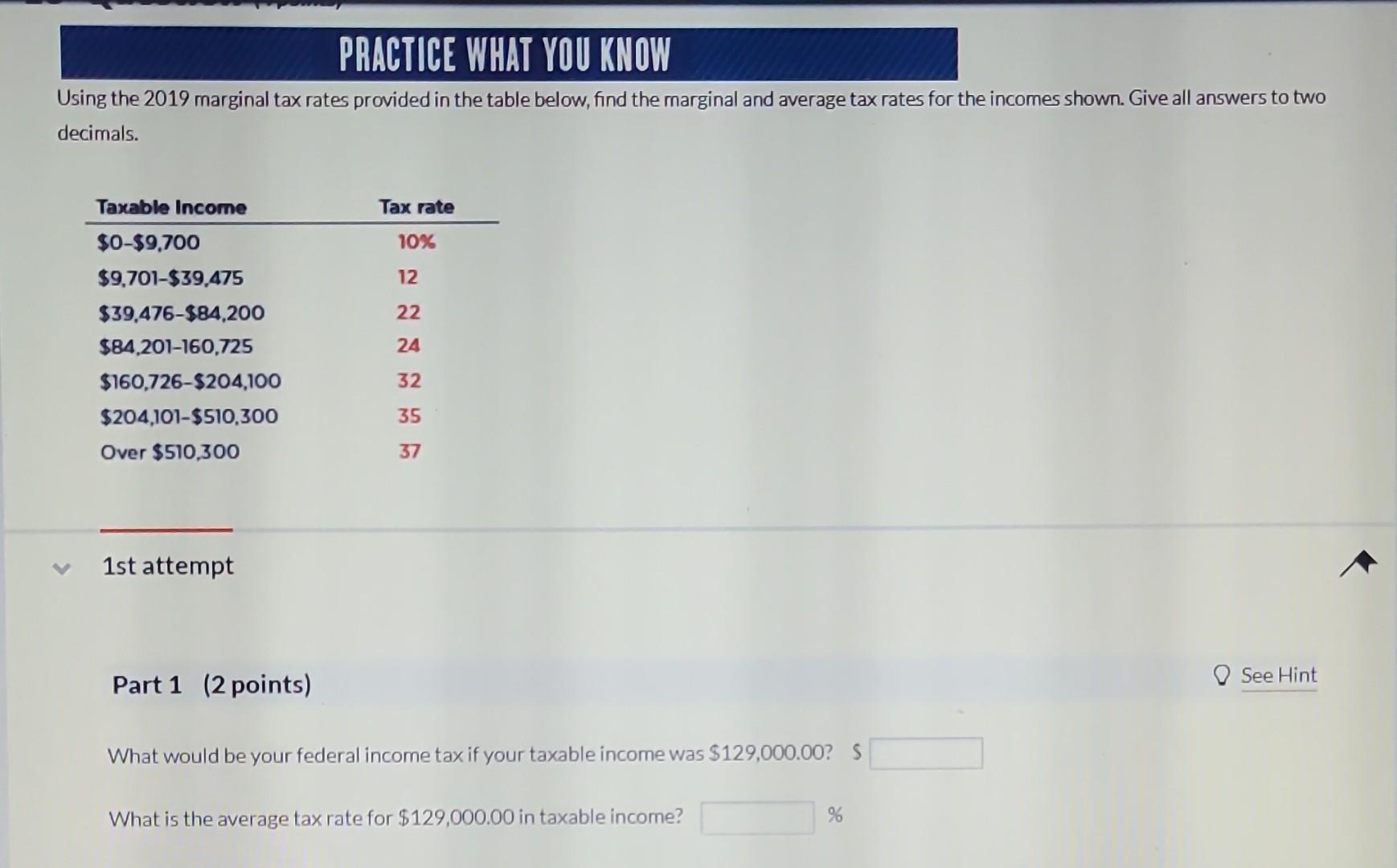

Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year It can be described broadly as adjusted gross income AGI minus Taxable income is the amount of income subject to tax after deductions and exemptions For both individuals and corporations taxable income differs from and is less than gross income Individuals and corporations begin with gross income the total amount earned in a given year

What Is Federal Taxable Income

What Is Federal Taxable Income

https://i1.wp.com/biznessprofessionals.com/wp-content/uploads/2020/02/Capture34.png?fit=2630%2C1497&ssl=1

Federal Income Tax FIT Payroll Tax Calculation YouTube

https://i.ytimg.com/vi/Bpta4olQddw/maxresdefault.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Taxable income is the portion of gross income used to calculate how much taxpayers owe in taxes in a given year In general it s their adjusted gross income AGI minus According to IRS rules all income is taxable unless it s specifically exempted by law That makes the definition of taxable income pretty broad but some common taxable sources of

What is taxable income Taxable income is the part of your gross income the total income you receive that is subject to federal tax Taxable income and gross income Federal income tax rates range from 10 to 37 for the 2024 and 2025 tax years There are seven tax brackets each kicking in at specific income thresholds The federal income tax is the

Download What Is Federal Taxable Income

More picture related to What Is Federal Taxable Income

How Federal Income Tax Rates Work Full Report Tax Policy Center

https://www.taxpolicycenter.org/sites/default/files/publication/137756/01_6.png

What is taxable income Financial Wellness Starts Here

https://blog.navitmoney.com/wp-content/uploads/2020/07/what-is-taxable-income.png

What Income Is Subject To The 3 8 Medicare Tax

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Share of income tax paid by level of income The top 2 7 of taxpayers those with income over 250 000 paid 51 6 of the federal income taxes in 2014 22 Taxable income is gross income 23 less adjustments and allowable tax deductions 24 Gross income for federal and most states is receipts and gains from all sources less cost of goods Unless it s specifically exempt from tax by law all income received during the year is taxable income for federal income tax purposes This includes wages and other compensation from employment self employment income investment income business income and more

[desc-10] [desc-11]

IRS Tax Charts 2021 Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/2021-tax-chart-cmh-3.jpg

Solved What Would Be Your Federal Income Tax If Your Taxable Chegg

https://media.cheggcdn.com/media/306/3064aa3f-45d1-4e88-91fc-d613aac9f0ab/phpjplfSo

https://www.irs.gov › ... › what-is-taxable-and-nontaxable-income

Find out what and when income is taxable and nontaxable including employee wages fringe benefits barter income and royalties

https://www.investopedia.com › terms › taxableincome.asp

Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year It can be described broadly as adjusted gross income AGI minus

Top 10 Federal Income Tax Prep Tips For The 2019 Filing Year The

IRS Tax Charts 2021 Federal Withholding Tables 2021

Solved Using The 2019 Marginal Tax Rates Provided In The Chegg

State Corporate Income Tax Rates And Brackets For 2020

Taxable Income What Is Taxable Income Tax Foundation

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

New Federal Tax Brackets For 2023

Maximize Your Paycheck Understanding FICA Tax In 2023

2022 Tax Brackets Lashell Ahern

What Is Federal Taxable Income - Federal income tax rates range from 10 to 37 for the 2024 and 2025 tax years There are seven tax brackets each kicking in at specific income thresholds The federal income tax is the