What Is Foreign Tax Credit Foreign Tax Credit If you paid or accrued foreign taxes to a foreign country or U S possession and are subject to U S tax on the same income you may be able to take either a credit or an itemized deduction for those taxes

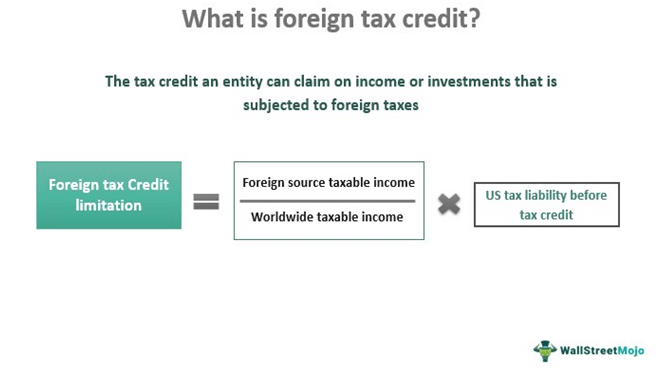

Your foreign tax credit is the amount of foreign tax you paid or accrued or if smaller the foreign tax credit limit You figure your foreign tax credit and the foreign tax credit limit on Form 1116 Foreign Tax Credit The foreign tax credit is a U S tax credit for income tax paid to other countries The general objective is to help taxpayers avoid double taxation on foreign income

What Is Foreign Tax Credit

What Is Foreign Tax Credit

https://i.ytimg.com/vi/HgM6nGiH9qc/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ab4EgAKACIoCDAgAEAEYZSBZKDswDw==&rs=AOn4CLBBeUSxqhbDJxO8e9rxQHNtVu9lEg

Foreign Tax Credit Meaning Example Limitation Carryover

https://www.wallstreetmojo.com/wp-content/uploads/2021/02/what-is-foreign-tax-credit.png.webp

What Is The Foreign Tax Credit Commons credit portal

https://i4.ytimg.com/vi/5VSmmake6x8/sddefault.jpg

A foreign tax credit FTC is generally offered by income tax systems that tax residents on worldwide income to mitigate the potential for double taxation The credit may also be granted in those systems taxing residents on income that may have been taxed in The Foreign Tax Credit FTC is a tax provision that allows U S taxpayers to reduce their U S income tax liability by the amount of foreign taxes paid or accrued on income earned outside the United States The main purpose of the FTC is to prevent double taxation of income by both the U S and the foreign country where the income is

Generally the following four tests must be met for any foreign tax to qualify for the credit The tax must be imposed on you You must have paid or accrued the tax The tax must be the legal and actual foreign tax liability The tax must be an income tax or a tax in lieu of an income tax Introduction This lesson will show you how to help taxpayers claim the foreign tax credit This credit applies to those who have paid or accrued taxes to a foreign country on foreign sourced income and who are subject to U S tax on the same income

Download What Is Foreign Tax Credit

More picture related to What Is Foreign Tax Credit

What Is The Foreign Tax Credit FTC FTC Rules Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/05/Foregn-Tax-Credit.png

The Concerns And Consequences Of Foreign Tax Credit

https://usaindiacfo.com/wp-content/uploads/2021/12/Downloader.la-61bd8e96be6bc.jpg

US Foreign Tax Credit FTC

https://cdn2.storyasset.link/b98fb9ca-aa81-404d-a063-f53cda74128b/ftc1-ms-lvtejdztqb.jpg

Definition You can claim income tax paid to a foreign country as a foreign tax credit but foreign property tax deductions were eliminated by 2018 tax reform The foreign tax credit is an IRS tax credit used to offset income tax paid abroad Generally speaking American citizens pay federal income tax on their worldwide income That income includes both incomes received within the US and outside the US

[desc-10] [desc-11]

The Foreign Tax Credit What You Need To Know For 2023

https://www.expatriatetaxreturns.com/wp-content/uploads/2023/01/Foreign-Earned-Income-2048x1365.jpeg

Demystifying The Form 1118 Foreign Tax Credit Corporations Part 2

https://sftaxcounsel.com/wp-content/uploads/2020/06/shutterstock_339923021.jpg

https://www.irs.gov/.../foreign-tax-credit

Foreign Tax Credit If you paid or accrued foreign taxes to a foreign country or U S possession and are subject to U S tax on the same income you may be able to take either a credit or an itemized deduction for those taxes

https://www.irs.gov/individuals/international...

Your foreign tax credit is the amount of foreign tax you paid or accrued or if smaller the foreign tax credit limit You figure your foreign tax credit and the foreign tax credit limit on Form 1116 Foreign Tax Credit

Foreign Tax Credit Form 1116 US Expat Guide For Beginners

The Foreign Tax Credit What You Need To Know For 2023

What Is Foreign Tax Credit FTC Company Registration In India

All About Foreign Tax Credit And Its Claim In India RAAAS

San Francisco Foreign Tax Credit Attorney SF Tax Counsel

What Are The Basics Of The Foreign Tax Credit

What Are The Basics Of The Foreign Tax Credit

How Do I Claim Foreign Tax Credit In USA Leia Aqui Can A US Citizen

Foreign Tax Credit Processing Of Tax Returns HLS 2234 Harvard

Is Foreign Tax Credit Allowed For Taxes That Are Paid Or Accrued

What Is Foreign Tax Credit - The Foreign Tax Credit FTC is a tax provision that allows U S taxpayers to reduce their U S income tax liability by the amount of foreign taxes paid or accrued on income earned outside the United States The main purpose of the FTC is to prevent double taxation of income by both the U S and the foreign country where the income is