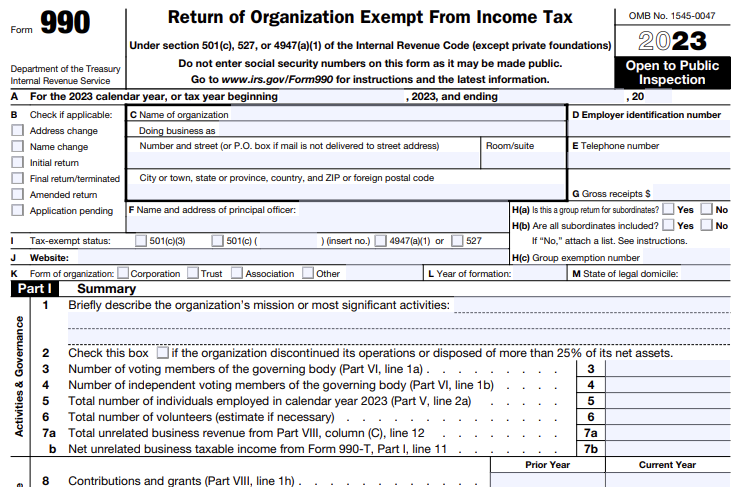

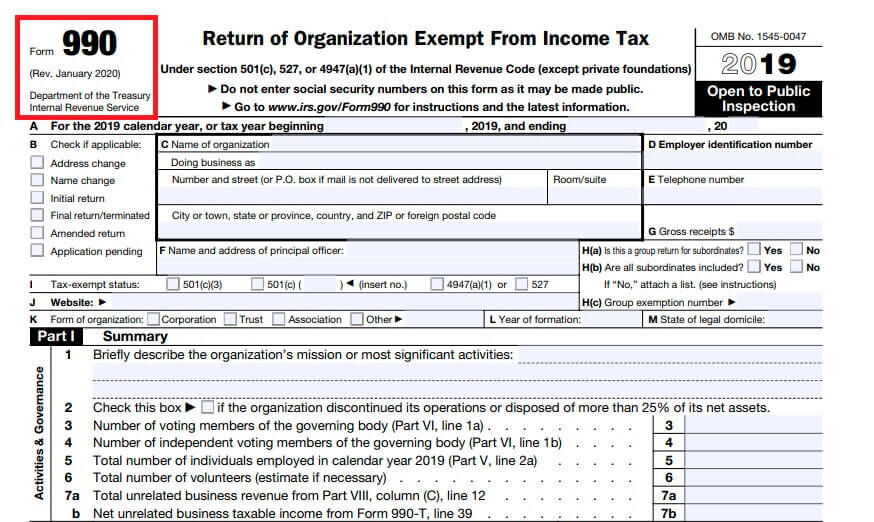

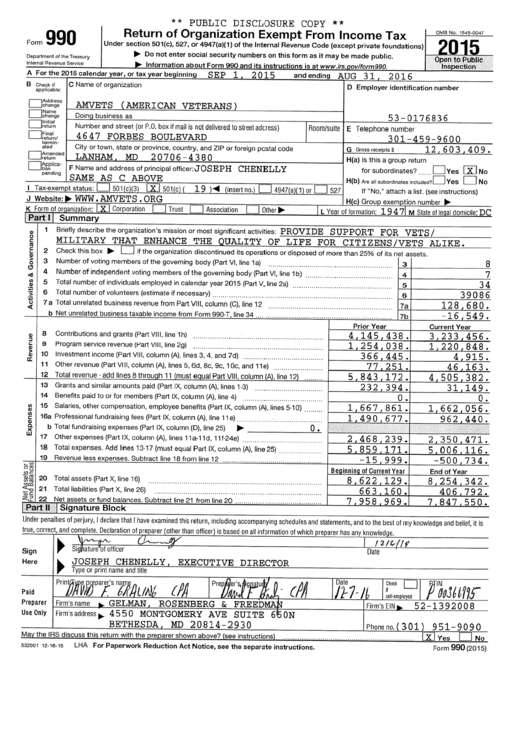

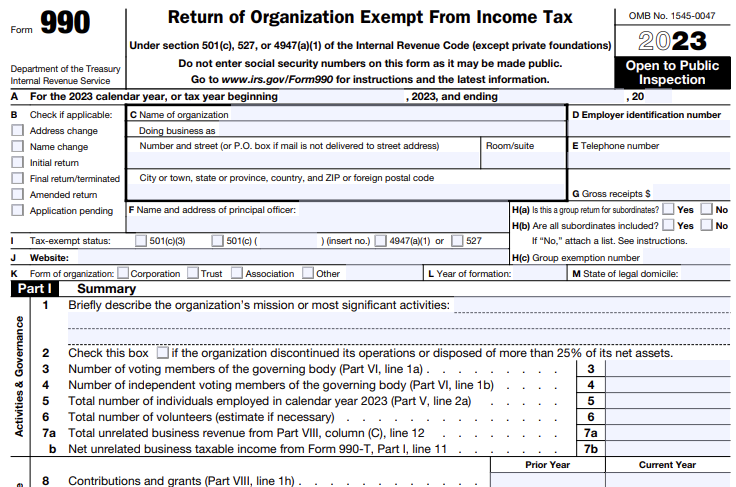

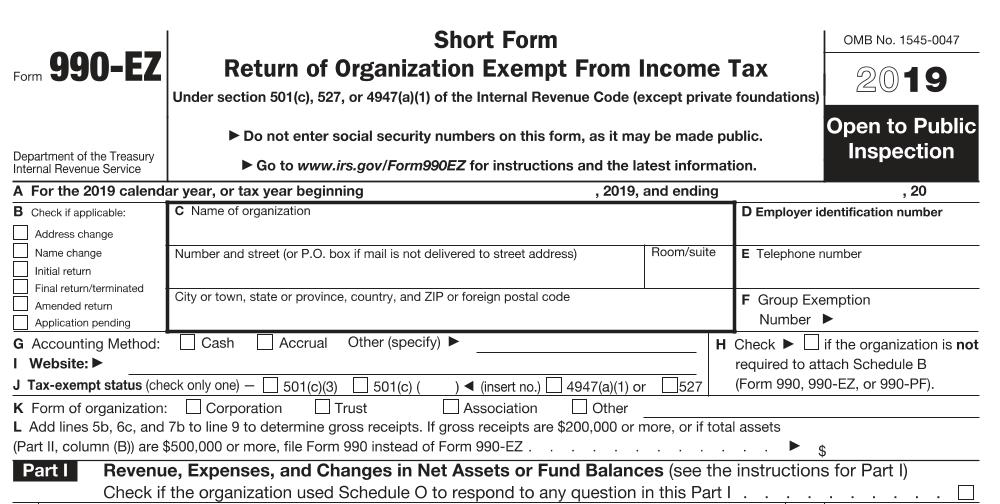

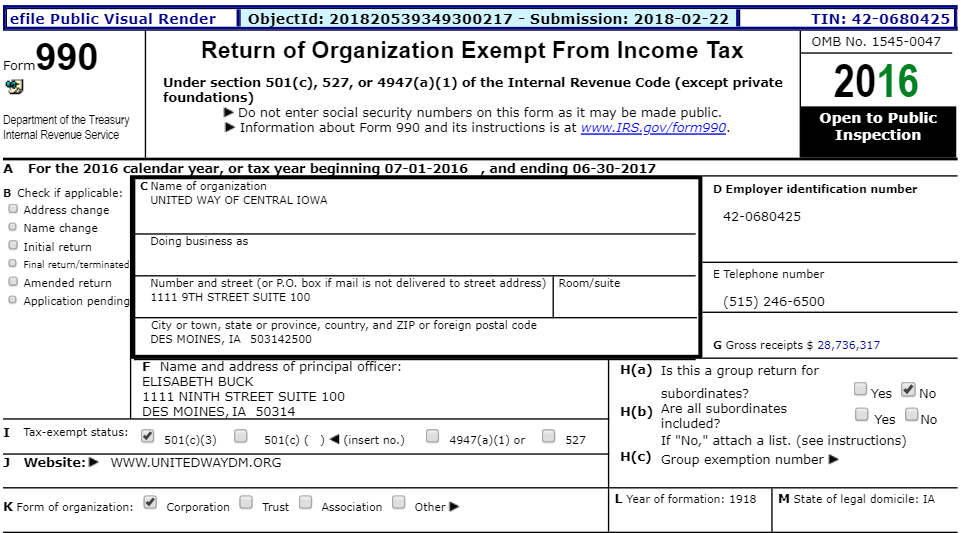

What Is Form 990 Form 990 officially the Return of Organization Exempt From Income Tax 1 is a United States Internal Revenue Service IRS form that provides the public with information about a nonprofit organization 2

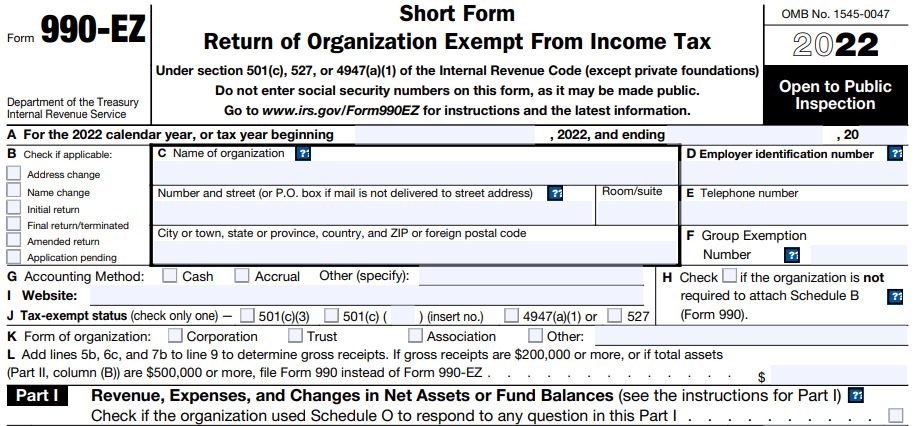

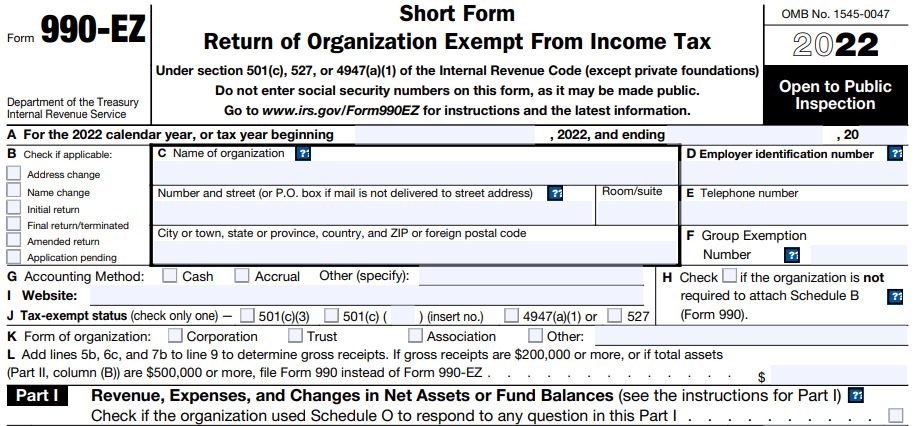

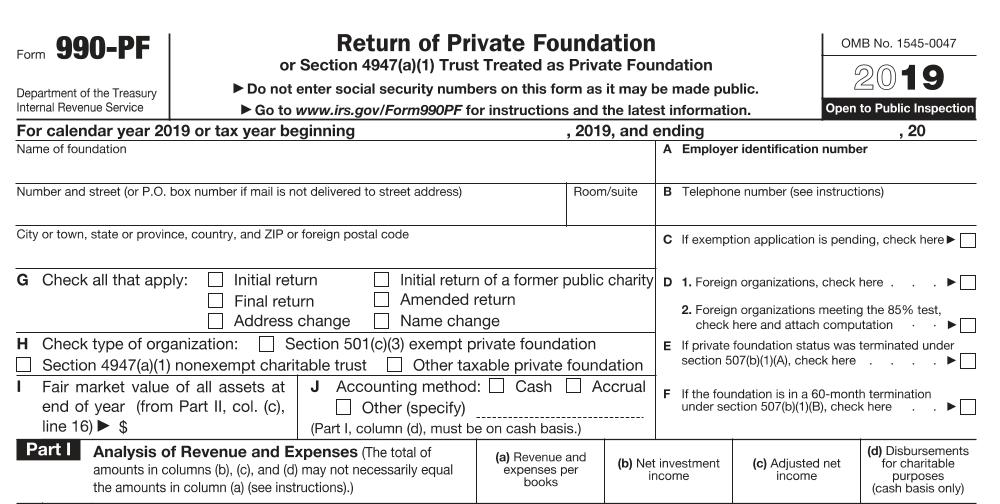

Form 990 is an annual information return required to be filed with the IRS by most organizations exempt from income tax under section 501 a and certain political organizations and nonexempt charitable trusts Form 990 is a form that some tax exempt organizations are required to submit to the Internal Revenue Service IRS as a part of their annual reporting

What Is Form 990

What Is Form 990

https://www.expresstaxexempt.com/Content/Images/newImages/form-990-2020-resource.png

What Is Form 990 EZ And Who Qualifies For It Foundation Group Inc

https://www.501c3.org/wp-content/uploads/2017/02/Form_990EZ.5891f5924cb32.jpg

What Is IRS Form 990

https://www.501c3.org/wp-content/uploads/2015/04/form990.jpg

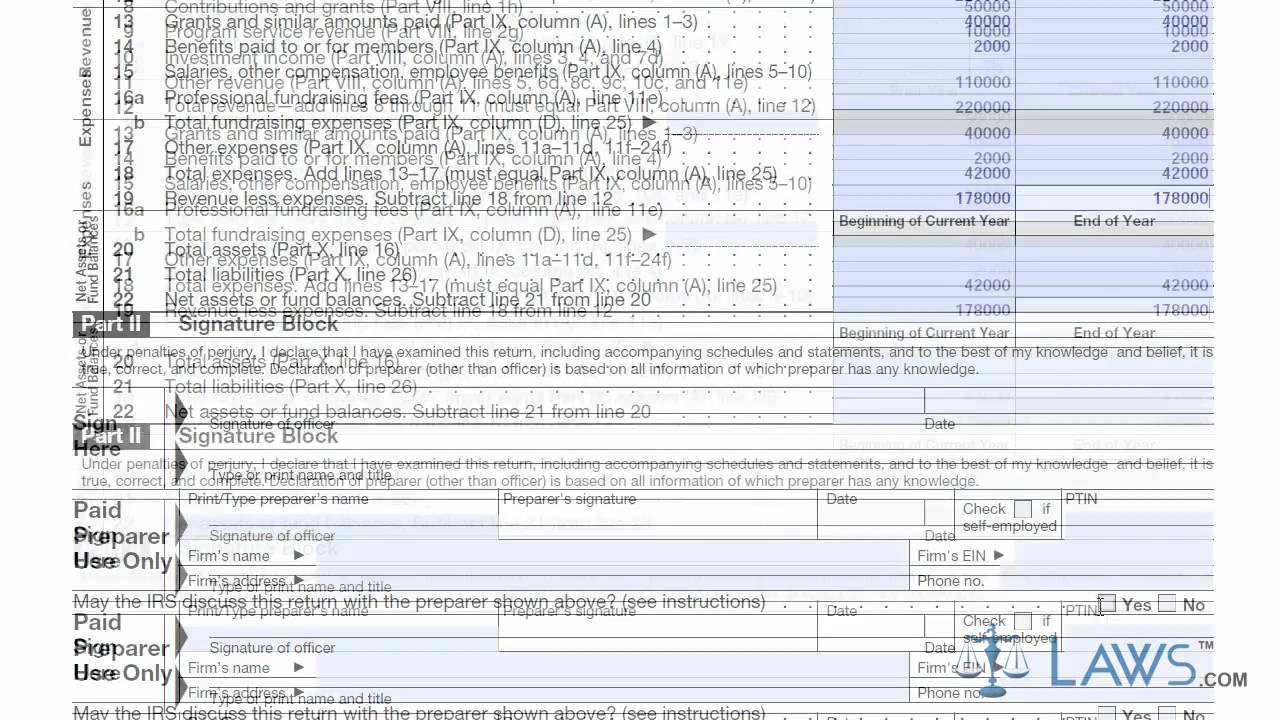

See the Form 990 filing thresholds page to determine which forms an organization must file The Form 990 allows the IRS to check up on a nonprofit in two capacities first verifying that a nonprofit isn t taking advantage of its tax exempt status and second ensuring that the nonprofit is fulfilling its responsibilities and requirements

The Form 990 is designed to increase financial transparency and includes revenue expenditure and income data in addition to information used to assess whether a nonprofit aligns with federal requirements for tax exempt status Form 990 is the tax return form that tax exempt organizations must submit annually to the IRS This document serves as a system for checking the legitimacy of your nonprofit s financial activity so you can maintain your tax exempt status What Are The Different Types of Form 990

Download What Is Form 990

More picture related to What Is Form 990

StartCHURCH Form 990 Service

https://assets-startchurch-stage.s3.amazonaws.com/REB+assets/images/keepright/Images/Form+990-N+2015.jpg

What Is IRS Form 990 990 N 990 EZ Accounts Confidant

https://accountsconfidant.com/wp-content/uploads/2020/02/IRS-form-990.jpg

What Is Form 990 Requirements And Types Of Forms Unemployment Gov

https://unemployment-gov.us/wp-content/uploads/2022/02/990_form-1.jpg

In short a Form 990 is an informational document highlighting your nonprofit s mission programs finances and accomplishments from the past year It s a publicly available filing that the IRS uses to ensure you comply with the laws regulating your tax exempt status Nonprofit organizations are required to file Form 990 with the IRS to report donations expenses and income earned from for profit businesses

[desc-10] [desc-11]

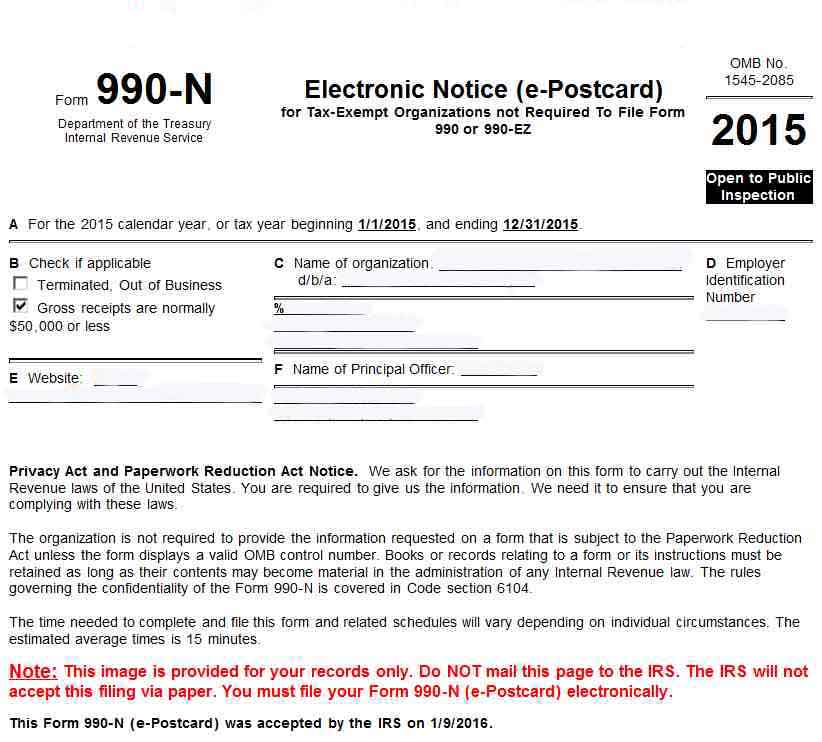

What Is Form 990 N YouTube

https://i.ytimg.com/vi/Yzr3A7sa5QI/maxresdefault.jpg

Top 19 Form 990 Templates Free To Download In PDF Format

https://data.formsbank.com/pdf_docs_html/304/3049/304942/page_1_thumb_big.png

https://en.wikipedia.org/wiki/Form_990

Form 990 officially the Return of Organization Exempt From Income Tax 1 is a United States Internal Revenue Service IRS form that provides the public with information about a nonprofit organization 2

https://www.irs.gov/instructions/i990

Form 990 is an annual information return required to be filed with the IRS by most organizations exempt from income tax under section 501 a and certain political organizations and nonexempt charitable trusts

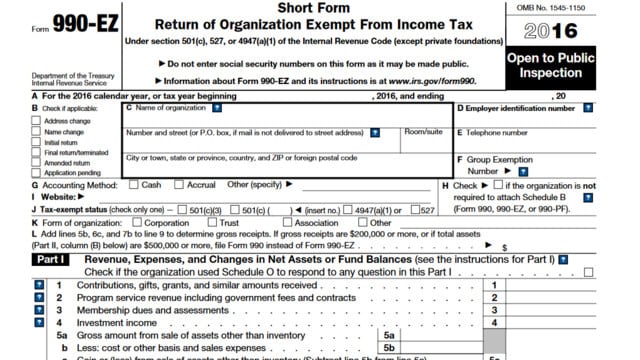

What Is The Form 990 EZ And Who Must File It

What Is Form 990 N YouTube

Blog 1 Tips On How To Read Form 990

Learn How To Fill The Form 990 Return Of Organization Exempt From

What Is Form 990 EZ And Who Qualifies For It Foundation Group Inc

Form 990 990 EZ 990 PF Schedule B IRS Form 990 Schedule B Instructions

Form 990 990 EZ 990 PF Schedule B IRS Form 990 Schedule B Instructions

Part 0 Form 990 Dustin K MacDonald

990 Pf Fillable Form Printable Forms Free Online

Understanding Form 990 For Nonprofits Nonprofit Megaphone

What Is Form 990 - See the Form 990 filing thresholds page to determine which forms an organization must file