What Is Group Deductions Allowance The deductions allowance is what prevents smaller companies and groups from having their use of losses affected by the restriction

A group for the purposes of the deductions allowance CTM05120 means two or more companies where one company is the ultimate parent of each of the other companies 10 8 1 Overview Groups with at least two companies that are within the charge to corporation tax are only entitled to one group DA GDA and can choose how they

What Is Group Deductions Allowance

What Is Group Deductions Allowance

https://img.hechtgroup.com/1666443510162.jpg

Tax Deductions For Businesses BUCHBINDER TUNICK CO

http://www.buchbinder.com/wp-content/uploads/2016/02/deduction.jpg

Hecht Group Deductions For Commercial Property Owners

https://img.hechtgroup.com/1666443513106.jpg

Sage Corporation Tax Loss relief deductions allowance Where the company has set brought forward losses including those in respect of group relief claims against profits Details of group deductions allowance allocation The accounting periods for all group companies listed overleaf are concurrent The accounting periods for all group

The amendment in relation to group relief for carried forward losses the amendment to correct a group relief circularity issue the amendments to the time limits and The company has a deductions allowance of 5 million CTA 2010 s 269ZW This is the amount of profit that against which carried forward losses can be set

Download What Is Group Deductions Allowance

More picture related to What Is Group Deductions Allowance

Payroll Deduction Form Check More At Https nationalgriefawarenessday

https://i.pinimg.com/736x/34/54/a0/3454a0ad82975ea2e3e3ff5cfc579488.jpg

Nc Tax Allowance Worksheet Triply

https://i2.wp.com/briefencounters.ca/wp-content/uploads/2018/11/deductions-and-adjustments-worksheet-along-with-free-worksheets-library-download-and-print-worksheets-of-deductions-and-adjustments-worksheet.png

Calculate Salary Allowances And Tax Deduction In Excel By Learning

https://i.pinimg.com/736x/44/ae/9c/44ae9ce35dc58909cb61b8d410ca02dd.jpg

The group relief for carried forward losses rules were introduced as Part 5A CTA 2010 and provide that certain losses carried forward by a company may be The group deductions allowance for the group is 5 000 000 for each accounting period of the nominated company throughout which the group allowance nomination has

This will allow the group to have a deductions allowance for the period Allowing carried forward losses to be surrendered via group relief by a company that has Deductions allowance A company that is not in a group CTM05130 has a deductions allowance of 5 million per 12 month accounting period from 1 April 2017 A company

Corporation Tax Loss Relief Accountingcpd

https://www.accountingcpd.net/lbr/G20051010163243-949240147/images/courses/C20210426154054-668615428-img2.jpg

What Are Itemized Deductions And Who Claims Them 2023

https://www.taxpolicycenter.org/sites/default/files/styles/original_optimized/public/book_images/3.1.2.1.png?itok=7EubUVji

https://www.gov.uk/hmrc-internal-manuals/company...

The deductions allowance is what prevents smaller companies and groups from having their use of losses affected by the restriction

https://www.gov.uk/hmrc-internal-manuals/company...

A group for the purposes of the deductions allowance CTM05120 means two or more companies where one company is the ultimate parent of each of the other companies

Deductions Under The Head Salaries Section 16 Deep Gyan

Corporation Tax Loss Relief Accountingcpd

How Is Tax Deducted From Salary In Ghana TAX

2 Fill Out The Deductions Allowance Claim Section Of The Worksheet To

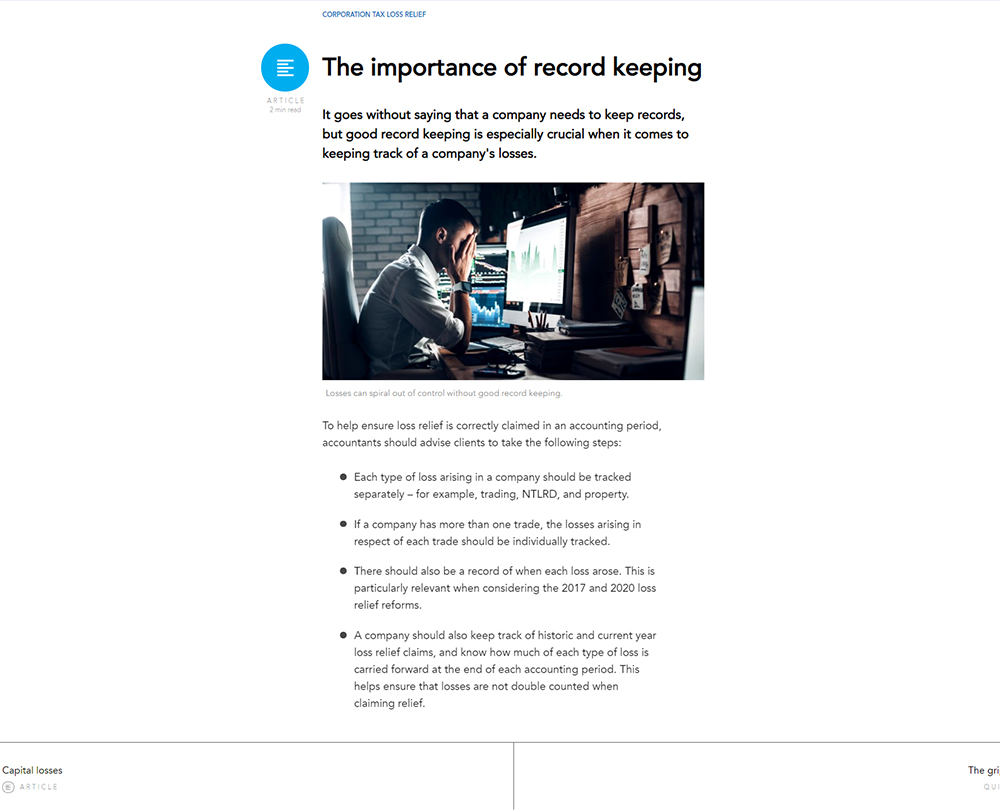

Understanding Bend Deductions MetaFab Inc

Section Wise Income Tax Deductions For AY 2022 23 FY 2021 22

Section Wise Income Tax Deductions For AY 2022 23 FY 2021 22

Travel Allowance Deductions Aspire Consulting

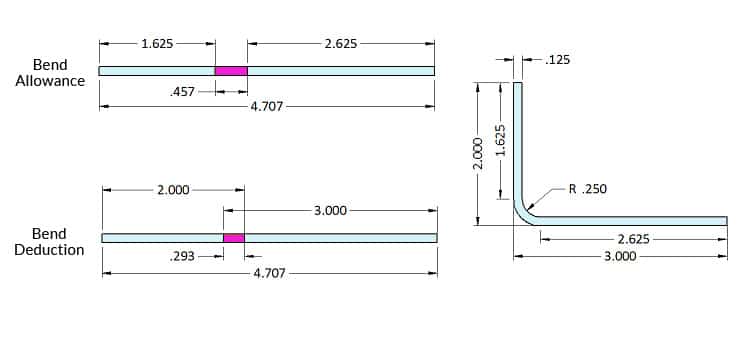

What Is A Tax Deduction

Traveling Conveyance Meaning Travel Info

What Is Group Deductions Allowance - The deduction allowance for an accounting period is up to 5m reduced proportionally where that accounting period is less than 12 months Groups are only entitled to one