What Is Home Tax Credit A tax credit for first time homebuyers is a powerful way to save money on your first home but it s not the only way to reduce your expenses First time homebuyer loans down payment

The bill is designed to provide a tax credit for first time buyers worth up to 15 000 or 10 of a home s purchase price whichever is less The bill also known as the Biden first time Most home buyers take out a mortgage loan to buy their home and then make monthly payments to the mortgage holder This payment may include several costs of owning a home The only costs the homeowner can deduct are state and local real estate taxes subject to the 10 000 limit

What Is Home Tax Credit

What Is Home Tax Credit

https://info.courthousedirect.com/hs-fs/hubfs/Blog Image Fix/Depositphotos_45934253_original.jpg?width=2800&name=Depositphotos_45934253_original.jpg

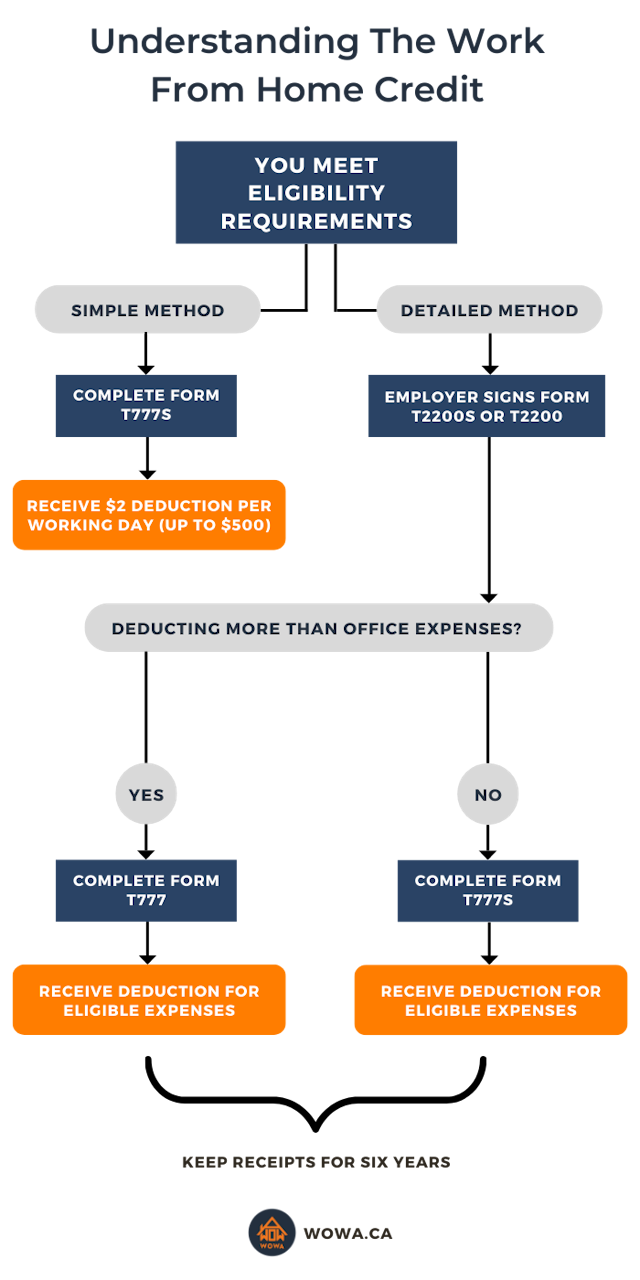

Here s How To Save Money On Your Taxes In Canada If You Work From Home

https://media.blogto.com/articles/2023228-work-from-home-tax-credit.jpg?w=2048&cmd=resize_then_crop&height=1365&quality=70

Should You Do Your Taxes Yourself Or Hire A Tax Preparer

https://www.gannett-cdn.com/-mm-/d8340c24781da72edad3ed5c705ee2a1eba422cf/c=0-22-2114-1217/local/-/media/2017/01/29/USATODAY/USATODAY/636213215291027598-GettyImages-518322266.jpg?width=3200&height=1680&fit=crop

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the total The one year tax credit for current homeowners would be available to people who own starter homes defined as homes below the median home price in their county The owners would have to sell to

Simply put it offered homebuyers a significant tax credit for the year in which they purchased their home Unfortunately this credit no longer exists However legislation to create a new refundable tax credit of up to 15 000 for first time homebuyers was introduced in April 2021 What is the energy efficient home improvement credit The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2023 to 2032

Download What Is Home Tax Credit

More picture related to What Is Home Tax Credit

Working From Home Tax Deductions Etax

https://www.etax.com.au/wp-content/uploads/2023/04/working-from-home-tax-deductions.jpg

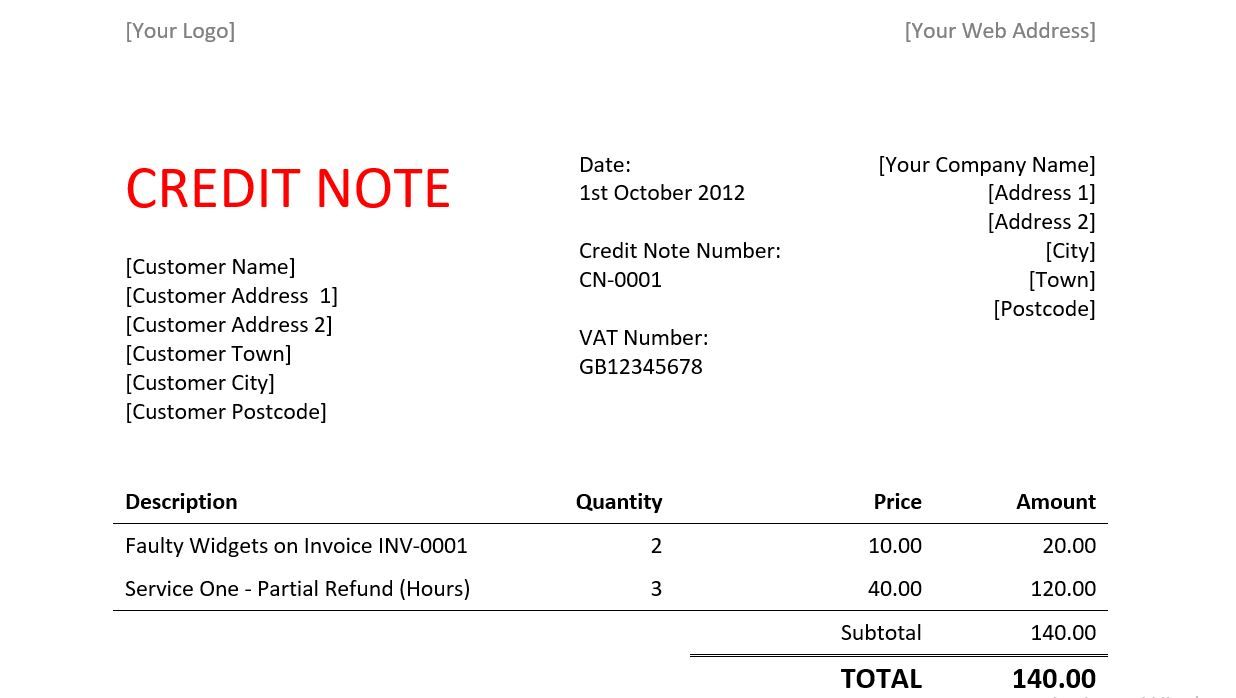

Tax Credit Note Under VAT In UAE Tax Credit Note Requirements

https://www.xactauditing.ae/wp-content/uploads/2021/11/Tax-credit-note-VAT-in-UAE.jpg

What Is Setc Tax Credit 1099 Expert

https://1099.expert/wp-content/uploads/2023/12/image-title-Generate-high-resolution-42512.png

Tax credits and rebates for home energy efficiency The credits in the IRA fall mainly into two categories the Residential Clean Energy Credit and the Energy Efficient Home Improvement IR 2024 202 Aug 7 2024 WASHINGTON The Department of the Treasury and the Internal Revenue Service today issued statistics on the Inflation Reduction Act clean energy tax credits for tax year 2023 The Inflation Reduction Act or IRA extended and expanded tax credits PDF that allow taxpayers to claim residential and energy efficient home

Home energy tax credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 August 7 2024 at 9 01 a m EDT American taxpayers claimed more than 8 billion in credits on their 2023 returns more than twice government projections for making climate friendly

What Is Home Insurance Do We Actually Need It

https://2.bp.blogspot.com/-bq9CVoL2MlU/W--byS8-Z7I/AAAAAAAAADM/4xQBlReUkLg05hFbITNmAXjbLy--2AooACLcBGAs/s1600/Home-Insurance.png

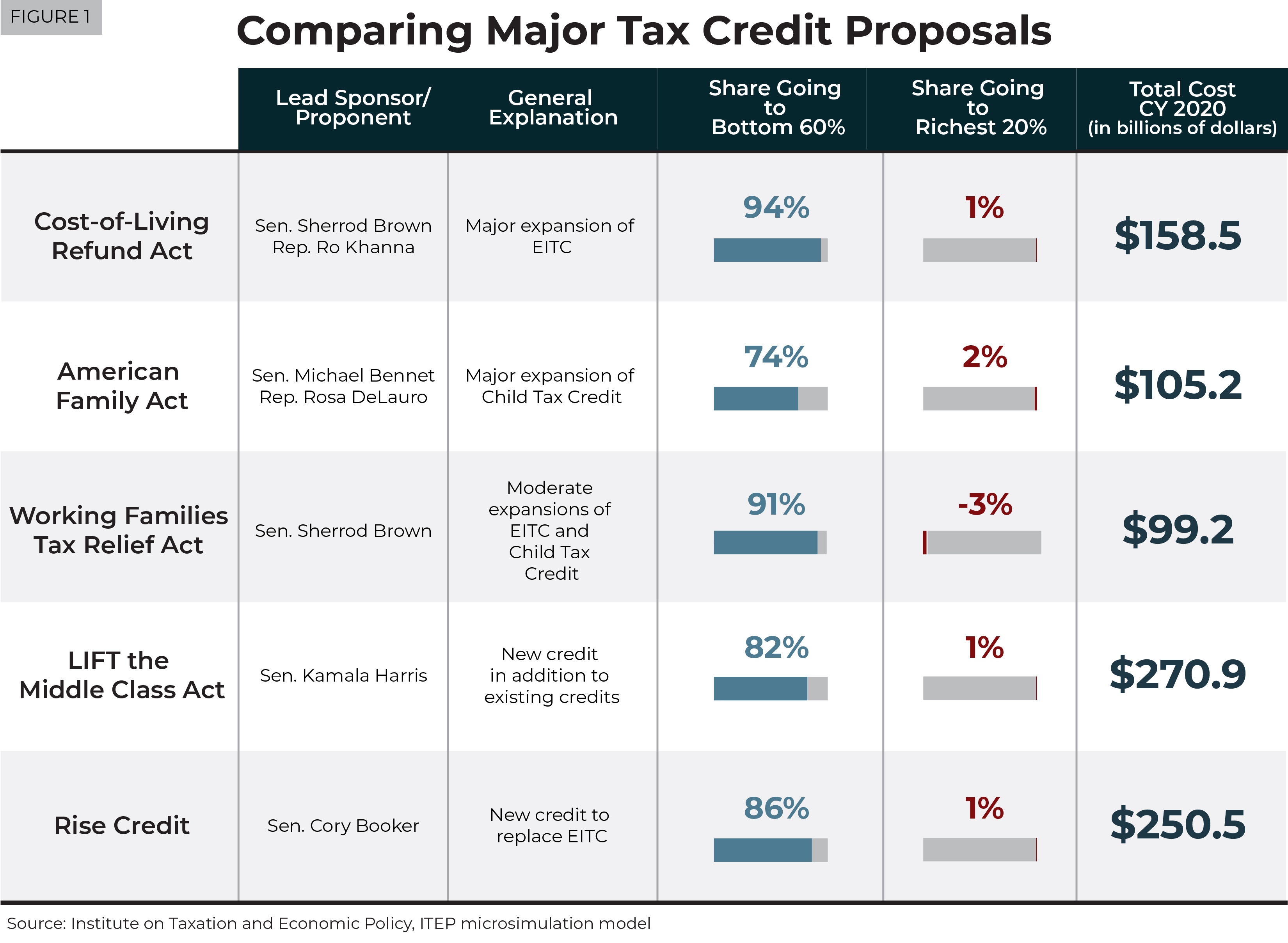

Understanding Five Major Federal Tax Credit Proposals Common Dreams

https://itep.org/wp-content/uploads/052219-Figure-1-taxcreditproposals.jpg

https://www.bankrate.com/mortgages/first-time...

A tax credit for first time homebuyers is a powerful way to save money on your first home but it s not the only way to reduce your expenses First time homebuyer loans down payment

https://www.cnn.com/cnn-underscored/money/first...

The bill is designed to provide a tax credit for first time buyers worth up to 15 000 or 10 of a home s purchase price whichever is less The bill also known as the Biden first time

What Happens To Tax Credits Now That Our Home Is In A Trust Nj

What Is Home Insurance Do We Actually Need It

Work From Home Tax Credit Guide WOWA ca

Home Insurance Igiritam

Working From Home Tax Deductions 2023

Corporation Prepaid Insurance Tax Deduction Financial Report

Corporation Prepaid Insurance Tax Deduction Financial Report

Does Canada Have A Work From Home Tax Credit In 2023 NerdWallet

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

What Is Home Office Tax Deduction How Does It Work

What Is Home Tax Credit - The one year tax credit for current homeowners would be available to people who own starter homes defined as homes below the median home price in their county The owners would have to sell to