What Is Hra Exemption In Income Tax Contents What is HRA House Rent Allowance Eligibility Criteria to Claim Tax Deductions On HRA How much HRA

HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting House Rent Allowance is an allowance given by an employer to an employee to cover the cost of living in rented housing HRA is not entirely taxable even though it is a part of

What Is Hra Exemption In Income Tax

What Is Hra Exemption In Income Tax

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

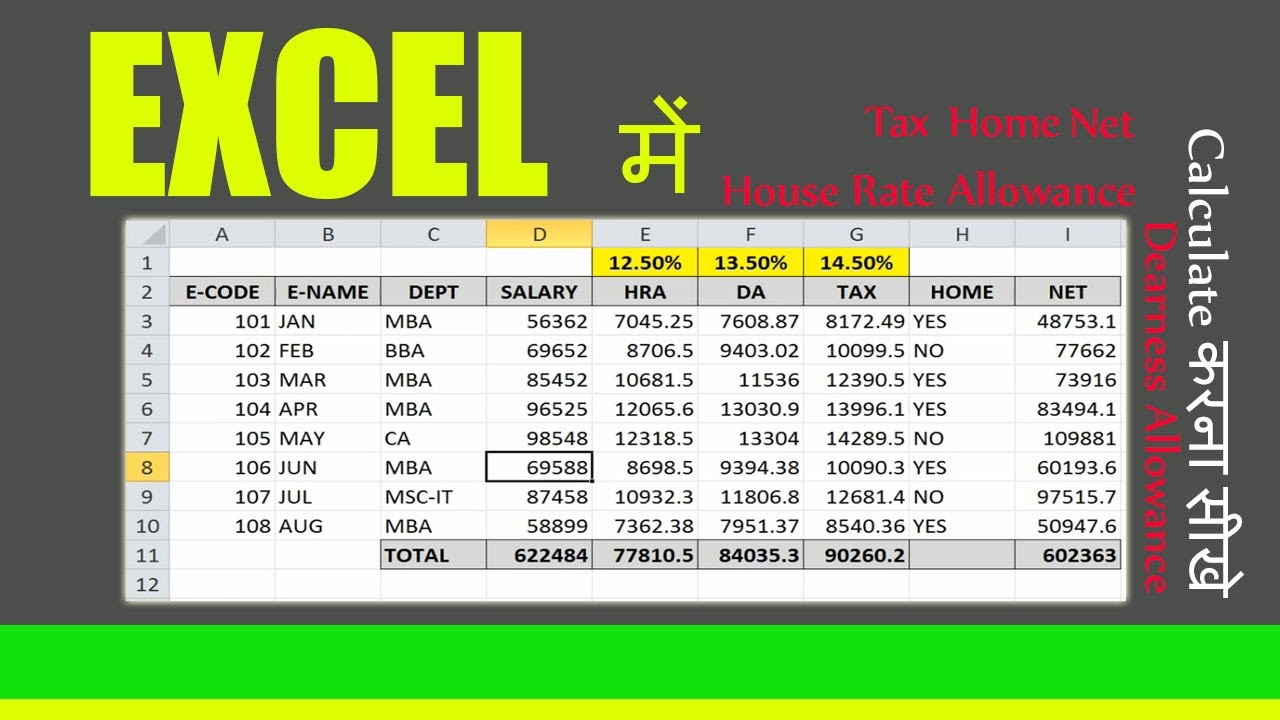

HRA Exemption Calculator EXCEL House Rent Allowance Calculation To

https://i.ytimg.com/vi/J04no0lpYJA/maxresdefault.jpg

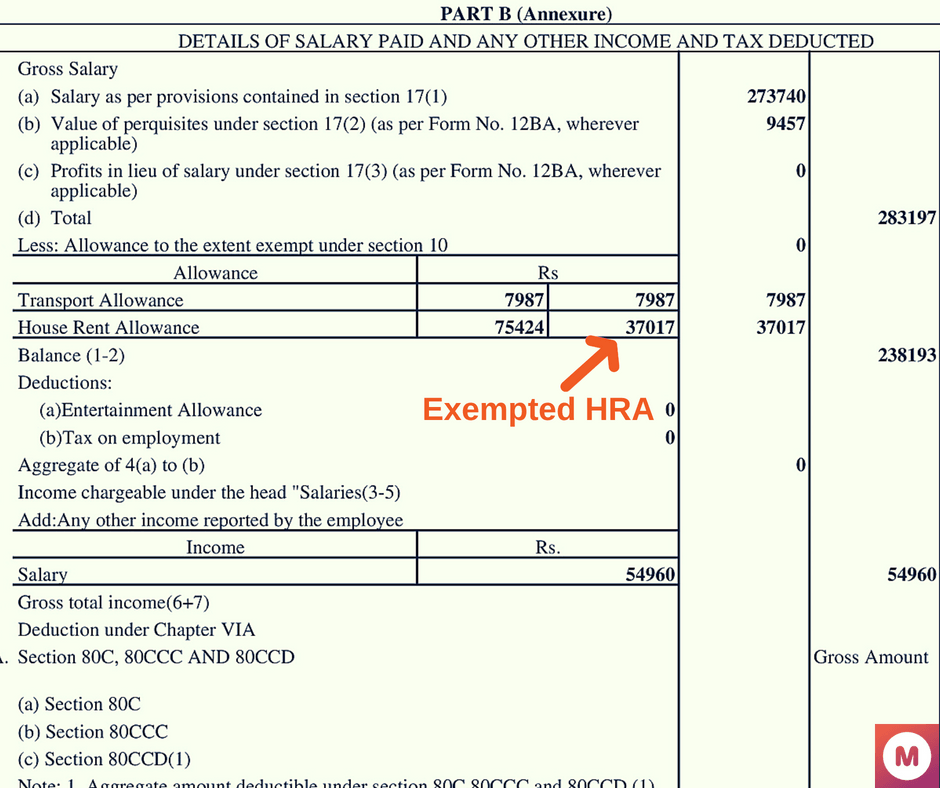

How To Show HRA Not Accounted By The Employer In ITR

http://bemoneyaware.com/wp-content/uploads/2016/07/hra-in-form-16-section-10.jpg

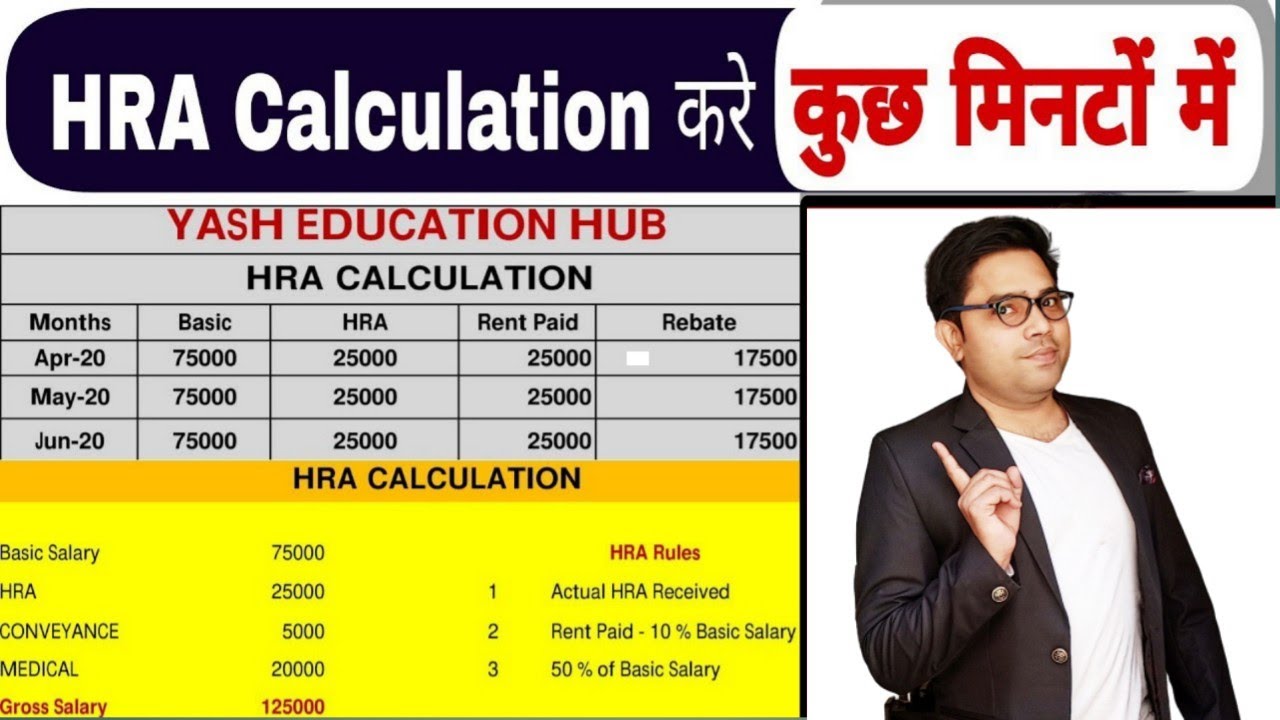

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the

Salaried individuals who live in a rented house can claim House Rent Allowance or HRA to lower taxes This can be partially or completely exempt from taxes The allowance is for Know the HRA Exemption Rules how to calculate HRA on your salary Check out the eligibility criteria understand how HRA helps you to utilise Section 80C

Download What Is Hra Exemption In Income Tax

More picture related to What Is Hra Exemption In Income Tax

Pin Auf NEWS You Can USE

https://i.pinimg.com/originals/4b/35/2c/4b352c55ac0959e4b980ff968f94f4f0.jpg

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

https://img.staticmb.com/mbcontent/images/uploads/2023/1/HRA-exemption.jpg

What Is House Rent Allowance HRA Exemptions Calculation Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

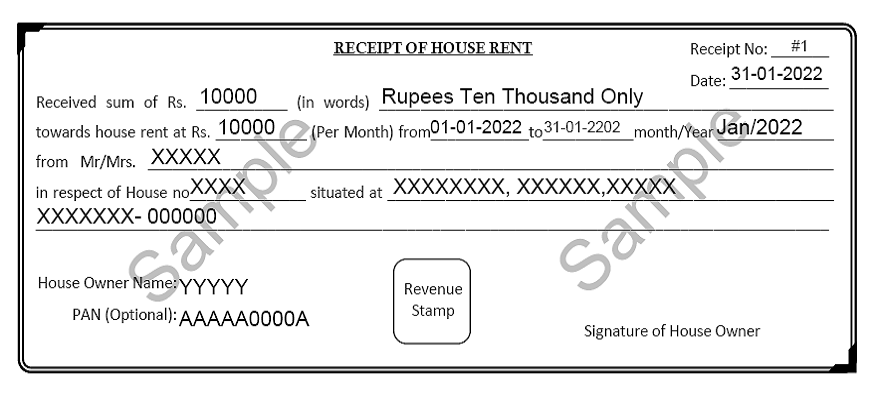

No HRA is an allowance and is exempt from Salary Income u s 10 13A of the Income Tax Act Can HRA exemption be claimed if living parents A taxpayer can HRA tax exemption will be available to you if you opt for the old income tax regime for purpose of TDS on salary Once the proof is submitted the employer will

Step 1 Enter your basic salary and HRA you get as per your salary slip Step 2 Enter the actual rent paid and specify whether you live in a metro city or not from the drop down The HRA exemption in income tax caters to both self employed and salaried individuals who stay in rented accommodations How is HRA calculated

HRA Exemption In Income Tax 2023 Guide InstaFiling

https://instafiling.com/wp-content/uploads/2023/01/HRA-Exemption-In-Income-Tax-1080x675.png

How To Calculate Hra da And Tax From Basic Salary In Excel How To Make

https://i.ytimg.com/vi/8fV8wuPmnvg/maxresdefault.jpg

https://tax2win.in/guide/hra-house-rent-allo…

Contents What is HRA House Rent Allowance Eligibility Criteria to Claim Tax Deductions On HRA How much HRA

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

HRA Exemption In Income Tax 2023 Guide InstaFiling

HRA Exemption Calculator In Excel House Rent Allowance Calculation

HRA Calculation Formula On Salary Change How HRA Exemption Is

HRA Exemption Calculator For Income Tax Benefits Calculation And

How To Calculate HRA Exemption For Income Tax Step by Step

How To Calculate HRA Exemption For Income Tax Step by Step

HRA Calculation In Salary HRA Calculation In Excel HRA Calculation

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech

Rent Receipt Generator Online Download Rent Receipt For HRA

What Is Hra Exemption In Income Tax - Know the HRA Exemption Rules how to calculate HRA on your salary Check out the eligibility criteria understand how HRA helps you to utilise Section 80C