What Is Income Tax Wikipedia Tax A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to collectively fund government spending public expenditures or as a way to regulate and reduce negative externalities 1

A tax is imposed on net taxable income in the United States by the federal most state and some local governments 5 Income tax is imposed on individuals corporations estates and trusts 6 The definition of net taxable income for most sub federal jurisdictions mostly follows the federal definition Income tax is a type of tax governments impose on income generated by businesses and individuals within their jurisdiction Income tax is used to fund public services pay government

What Is Income Tax Wikipedia

What Is Income Tax Wikipedia

https://certicom.in/wp-content/uploads/2018/09/income-tax.png

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

How Are Income Taxes Calculated The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10-1.jpg

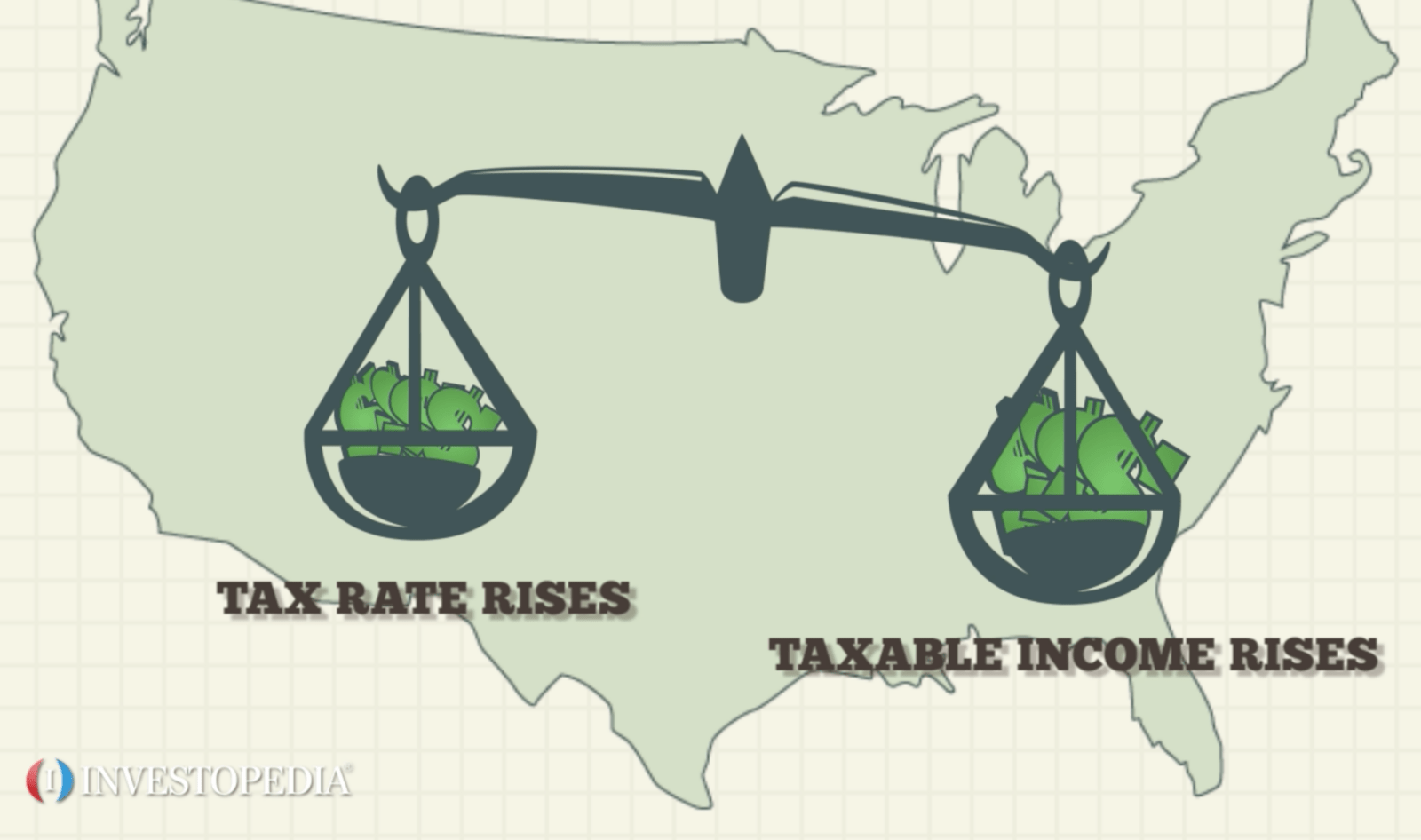

When it takes income taxes the government takes a percentage of a person s income This percentage is called an income tax rate In other words the income tax rate is the part or portion of a person s income that the government takes Jan 29 2024 1 06 PM ET AP Tax season is under way Here are some tips to navigate it income tax levy imposed on individuals or family units and corporations

Taxes that are based on how much money a person earns are called income taxes Taxes that are based on how much a person buys are called sales taxes Taxes that are based on how much a person owns are called property taxes Things like houses have a Tax return A tax return is the completion of documentation that calculates an entity or individual s income earned and the amount of taxes to be paid to the government or government organizations or potentially back to the taxpayer 1 Taxation is one of the biggest sources of income for the government There are two types of taxes

Download What Is Income Tax Wikipedia

More picture related to What Is Income Tax Wikipedia

What Is Income Tax FEATURES And OBJECTS Of INCOME TAX Law Of Taxation

https://legalhelpdesk.co.in/wp-content/uploads/2020/04/income-tax.jpg

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

https://4.bp.blogspot.com/-4cLQaqI0jYM/TkmIL611lAI/AAAAAAAAPlc/z5MYhmcnqd0/s1600/taxrate.jpg

/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

An Explanation Of 2016 Federal Income Tax Rates

https://fthmb.tqn.com/R6g3XDOAiKF0_9DlJIpGIkm4p-w=/864x576/filters:fill(auto,1)/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png

TurboTax is the most popular tax preparation software in the United States holding a 66 6 market share of self prepared returns in 2018 H R Block at Home formerly TaxCut is the second most popular with a 14 share Other popular tax software includes TaxACT at 7 Tax Hawk including FreeTaxUSA at 5 9 Credit Karma s free tax software now Taxes are generally an involuntary fee levied on individuals or corporations that is enforced by a government entity whether local regional or national in order to finance government activities

Taxation imposition of compulsory levies on individuals or entities by governments Taxes are levied in almost every country of the world primarily to raise revenue for government expenditures although they serve other purposes as well This article is concerned with taxation in general its principles its objectives and its effects The courts have held that an income tax is the most typical form of direct taxation Personal income taxes Canada levies personal income tax on the worldwide income of individual residents in Canada and on certain types of Canadian source income earned by non resident individuals

What Is Income Tax Describe The History Of Income Tax In India

https://okcredit-blog-images-prod.storage.googleapis.com/2020/12/shutterstock_84866158-1.jpg

How Federal Income Tax Rates Work Full Report Tax Policy Center

https://www.taxpolicycenter.org/sites/default/files/publication/137756/01_6.png

https://en.wikipedia.org/wiki/Tax

Tax A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to collectively fund government spending public expenditures or as a way to regulate and reduce negative externalities 1

https://en.wikipedia.org/wiki/Income_tax_in_the_United_States

A tax is imposed on net taxable income in the United States by the federal most state and some local governments 5 Income tax is imposed on individuals corporations estates and trusts 6 The definition of net taxable income for most sub federal jurisdictions mostly follows the federal definition

What Is Income Tax Times Money Mentor

What Is Income Tax Describe The History Of Income Tax In India

:max_bytes(150000):strip_icc()/tax-468440_19201-9a334c7fae6249b89a19b77ef7000d34.jpg)

Simplifying The Concept What Is Income Tax Payable Explained

A COMPREHENSIVE GUIDE FOR INCOME TAX RETURN FILLING

The Definition And Calculation Of Federal Income Tax Personal Accounting

How High Are Income Tax Rates In Your State

How High Are Income Tax Rates In Your State

Income After Taxes Calculator California

Government Announces New Tax Provision For NRIs The Indian Wire

Calculate My Income Tax SuellenGiorgio

What Is Income Tax Wikipedia - Tax return A tax return is the completion of documentation that calculates an entity or individual s income earned and the amount of taxes to be paid to the government or government organizations or potentially back to the taxpayer 1 Taxation is one of the biggest sources of income for the government There are two types of taxes