What Is Investment Income Tax Updated December 29 2022 Reviewed by Gordon Scott Fact checked by Vikki Velasquez What Is Investment Income Investment income is money received in interest payments dividends

What is the Net Investment Income Tax NIIT The Net Investment Income Tax is imposed by section 1411 of the Internal Revenue Code The NIIT applies at a rate of 3 8 to certain net investment income of individuals estates and trusts that have income above the statutory threshold amounts 2 When did the Net Investment The net investment income tax NIIT is a 3 8 tax that kicks in if you have investment income and your income exceeds 200 000 for single filers 250 000 for those married filing jointly or

What Is Investment Income Tax

What Is Investment Income Tax

https://www.snideradvisors.com/uploads/investment-income-tax-rates.png

What Is Investment Income Frank Murillo CFP

https://franktheplanner.com/wp-content/uploads/2022/03/What-Is-Investment-Income-800x600.png

What Is Investment Income

https://cdn.wealthgang.com/wp-content/uploads/2019/02/what-is-investment-income.jpg

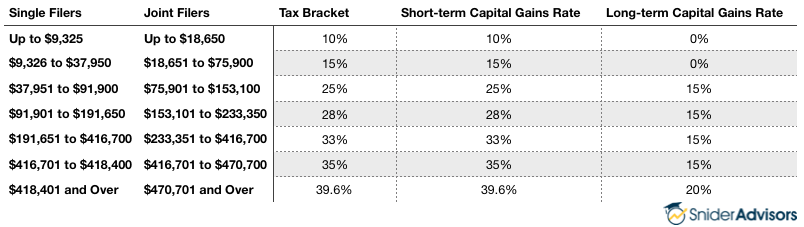

Net investment income NII for tax purposes is the total amount of money received from assets such as stocks bonds and mutual funds minus related expenses NII may Find out if Net Investment Income Tax applies to you If an individual has income from investments the individual may be subject to net investment income tax Effective Jan 1 2013 individual taxpayers are liable for a 3 8 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified

What is the net investment income tax NIIT is a tax on net investment income Those who are subject to the tax will pay 3 8 percent on the lesser of the following their net investment income What s net investment income and how is it taxed As an investor you may owe an additional 3 8 tax called net investment income tax NIIT But you ll only owe it if you have investment income and your modified adjusted gross income MAGI goes over a certain amount What counts as net investment income

Download What Is Investment Income Tax

More picture related to What Is Investment Income Tax

How Is Investment Income Taxed Tax Tip Weekly YouTube

https://i.ytimg.com/vi/iA1P2_bt7M8/maxresdefault.jpg

What Is Investment Income Helping You Understand Your Profit

https://www.dividendmantra.com/wp-content/uploads/2019/09/revenue-1704073_1280.png

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status based thresholds the IRS Net investment income NII is defined as the profit gained from investments after deducting certain related expenses This includes various forms of income such as interest dividends rental income and capital gains

It includes information on the tax treatment of investment income and expenses for individual shareholders of mutual funds or other regulated investment companies such as money market funds It explains what investment income is taxable and what investment expenses are deductible Updated on January 5 2023 Reviewed by Michelle P Scott Fact checked by Sarah Fisher Photo Korrawin Khanta EyeEm Getty Images The net investment tax is a tax on the lesser of your MAGI over a threshold amount or your net investment income for the year Find out if you have to pay

The 6 Investment Income Types That Need To Be Declared On Your Income

https://www.zmp.com.au/site/wp-content/uploads/2023/06/The-6-Investment-Income-Types-That-Need-To-Be-Declared-On-Your-Income-Tax-Return.jpg

What Are The 7 Types Of Income

https://educacion.cc/en/make-money-online/wp-content/uploads/2023/03/what-are-the-7-types-of-income.jpg

https://www.investopedia.com/terms/i/investmentincome.asp

Updated December 29 2022 Reviewed by Gordon Scott Fact checked by Vikki Velasquez What Is Investment Income Investment income is money received in interest payments dividends

https://www.irs.gov/newsroom/questions-and-answers...

What is the Net Investment Income Tax NIIT The Net Investment Income Tax is imposed by section 1411 of the Internal Revenue Code The NIIT applies at a rate of 3 8 to certain net investment income of individuals estates and trusts that have income above the statutory threshold amounts 2 When did the Net Investment

What Is Investment Income Retire Gen Z

The 6 Investment Income Types That Need To Be Declared On Your Income

Understanding What Is Investment Income Explained

Minimize Your Tax On Investment Income In Canadian controlled Private

Tax Payment Which States Have No Income Tax Marca

Unlocking Investment Income Simplifying Calculation Strategies Eva Cox

Unlocking Investment Income Simplifying Calculation Strategies Eva Cox

Investment Income Concept Types How To Get Investors Planet

What Is Investment Income Acorns

What Is Investment Income Marcus By Goldman Sachs

What Is Investment Income Tax - Find out if Net Investment Income Tax applies to you If an individual has income from investments the individual may be subject to net investment income tax Effective Jan 1 2013 individual taxpayers are liable for a 3 8 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified