What Is Investment Tax Credit An investment tax credit ITC is a tax incentive that allows taxpayers to reduce their tax liability by a certain percentage of the cost of an investment ITCs are available for a variety of investments including renewable energy

A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe Tax credits are more favorable than tax deductions Investment tax credits are basically a federal tax incentive for business investment They let individuals or businesses deduct a certain percentage of investment costs from their taxes These credits are in addition to normal allowances for depreciation

What Is Investment Tax Credit

What Is Investment Tax Credit

https://energytheory.com/wp-content/uploads/2023/05/JAN23-What-is-Investment-Tax-Credit-ITC.jpg

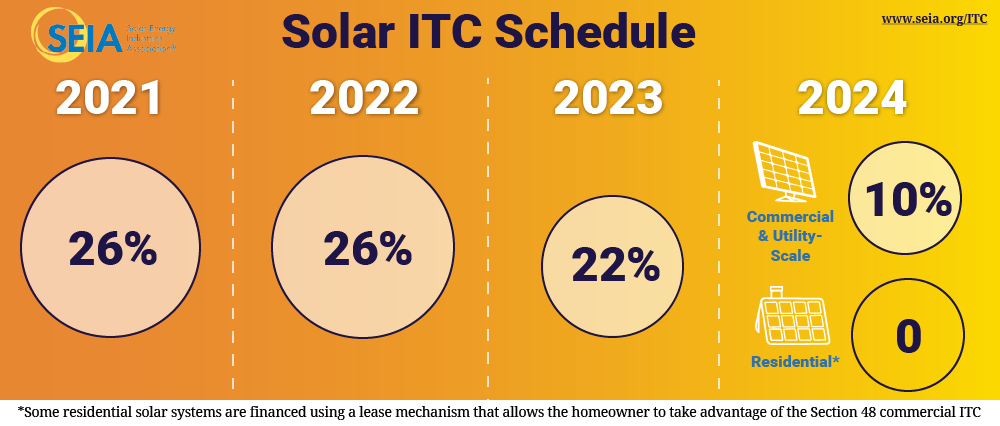

Solar Investment Tax Credit Extension ITC 2022 Update Solargraf

https://www.solargraf.com/wp-content/uploads/2022/08/Investment-Tax-Credit.jpg

Investment Tax Credit ITC How It Works Qualifications Benefits

https://www.carboncollective.co/hubfs/Investment_Tax_Credit.png#keepProtocol

The Investment Tax Credit commonly known as the ITC is a federal tax credit designed to encourage the installation and use of renewable energy systems This includes solar wind geothermal and other forms of renewable energy You may be eligible to claim an investment tax credit ITC if any of the following applies You bought certain new buildings machinery or equipment and they were used in certain areas of Canada in qualifying activities such as farming fishing logging manufacturing or processing see Atlantic investment tax credit

Investment credit tax incentive that permits businesses to deduct a specified percentage of certain investment costs from their tax liability in addition to the normal allowances for depreciation q v Learn how to get an SR ED investment tax credit ITC to reduce your income tax payable using Form T2SCH31 or Form T2038 IND Review ITC rates how to carry forward or back refundable ITC and ITC recaptures

Download What Is Investment Tax Credit

More picture related to What Is Investment Tax Credit

Investment Tax Credit Arcadia Energy

https://arcadiaenergy.green/wp-content/uploads/2019/01/investment-tax-credit.jpg

How To Acquire Federal Tax Credit Investments

https://mossadamsproduction.blob.core.windows.net/cmsstorage/mossadams/media/images/insights/2021/11/21-tci-0554_fedtax_credits-smsi.jpeg

Production Tax Credit Vs Investment Tax Credit Which Is Better For

https://i.ytimg.com/vi/6w-j8oaXbTw/maxresdefault.jpg

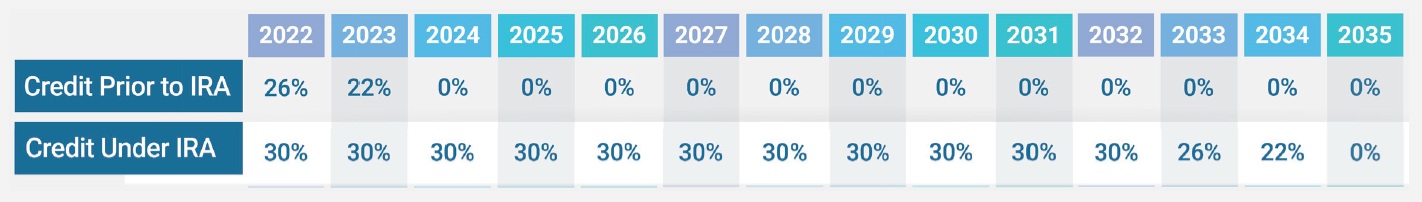

The ITC is a 30 percent tax credit for individuals installing solar systems on residential property under Section 25D of the tax code The Section 48 commercial credit can be applied to both customer sited commercial solar systems and large scale utility solar farms Use this form to claim the investment credit The investment credit consists of the following credits rehabilitation energy qualifying advanced coal project qualifying gasification project and qualifying advanced energy project

[desc-10] [desc-11]

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

https://impactcp.org/insights/what-are-investment-tax-credits

An investment tax credit ITC is a tax incentive that allows taxpayers to reduce their tax liability by a certain percentage of the cost of an investment ITCs are available for a variety of investments including renewable energy

https://www.investopedia.com/terms/t/taxcredit.asp

A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe Tax credits are more favorable than tax deductions

/investment-banker-1287141-b1875040b108412eb9e97dbb7df6ce7b.png)

What Is Investment Banking

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Default Green Investments

What Is Investment Income Marcus By Goldman Sachs

Federal Solar Tax Credit 2023 How Does It Work ADT Solar

Financial Markets Chapter 1 Investment Basics FINANCIAL MARKETS

Financial Markets Chapter 1 Investment Basics FINANCIAL MARKETS

Let Them Eat ITCs Buttondown

Tax Credit

Federal Investment Tax Credit ITC Extension Solar Project Zapotec

What Is Investment Tax Credit - Investment credit tax incentive that permits businesses to deduct a specified percentage of certain investment costs from their tax liability in addition to the normal allowances for depreciation q v