What Is Journal Entry To Post Sales Tax Payment The journal entry is debiting cash and credit sale tax payable Sale tax payable is the current liability on the balance sheet which the company has to pay to the government

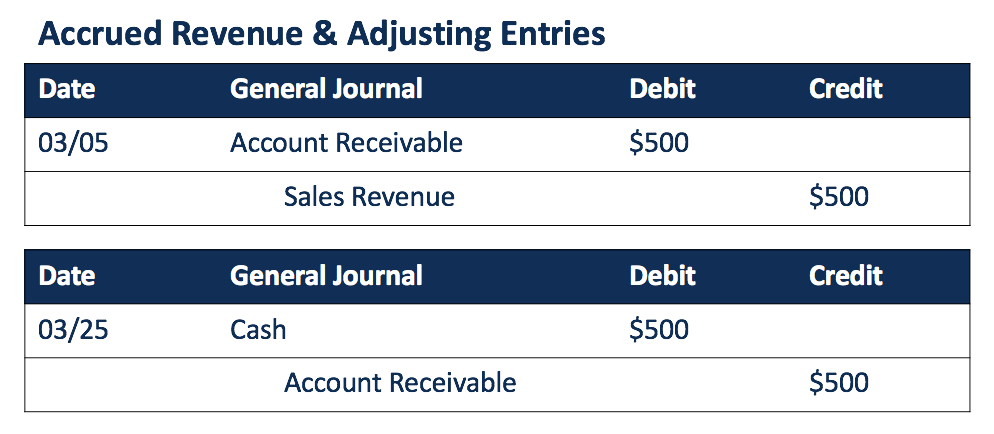

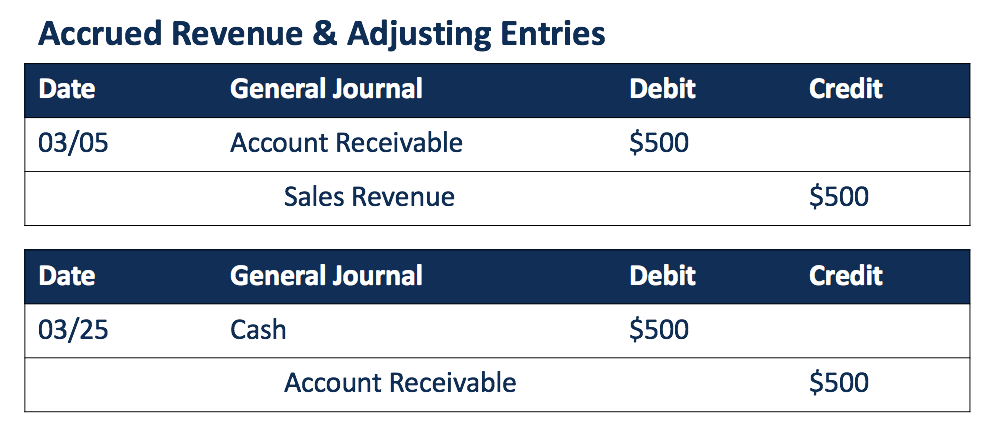

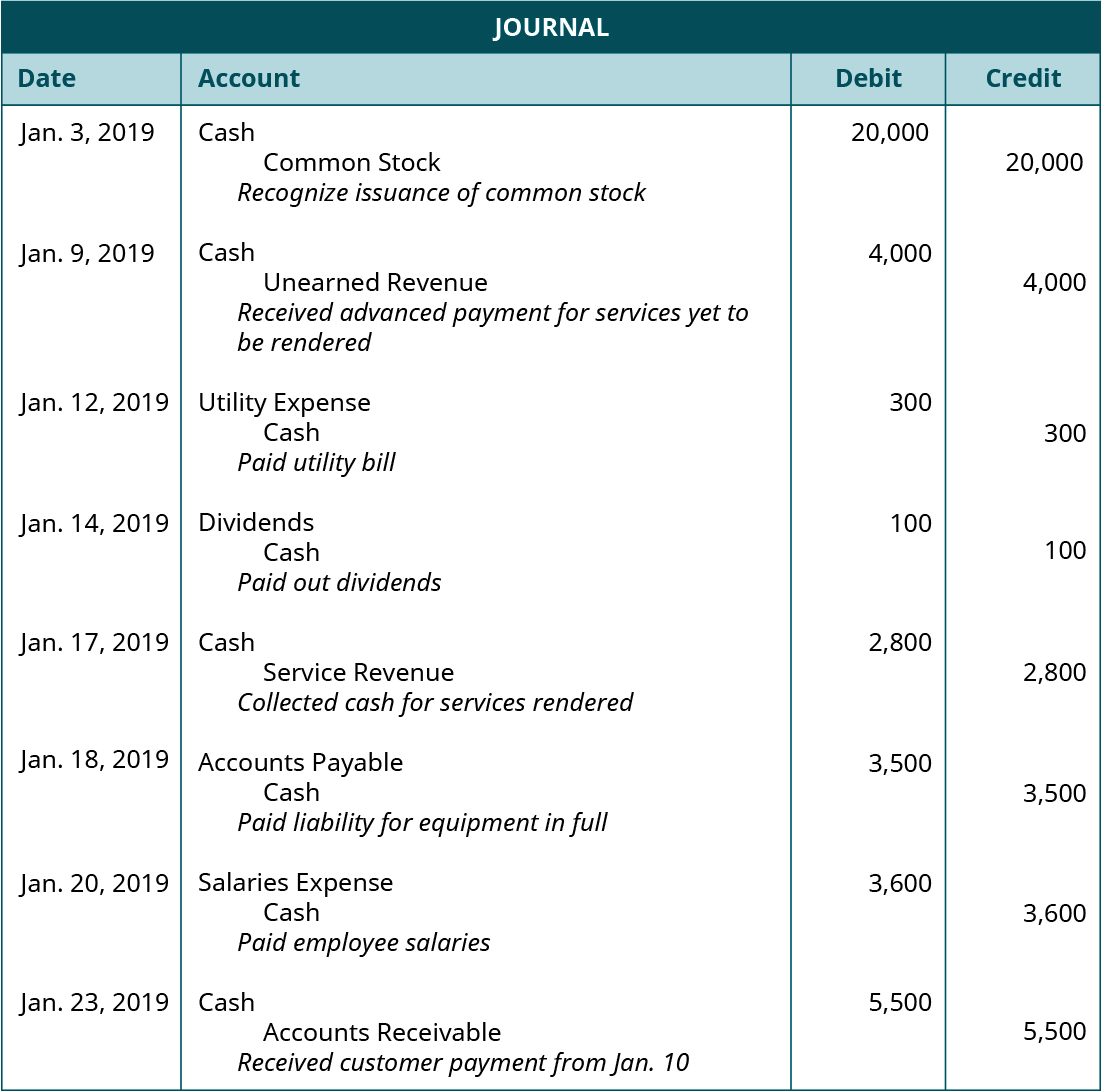

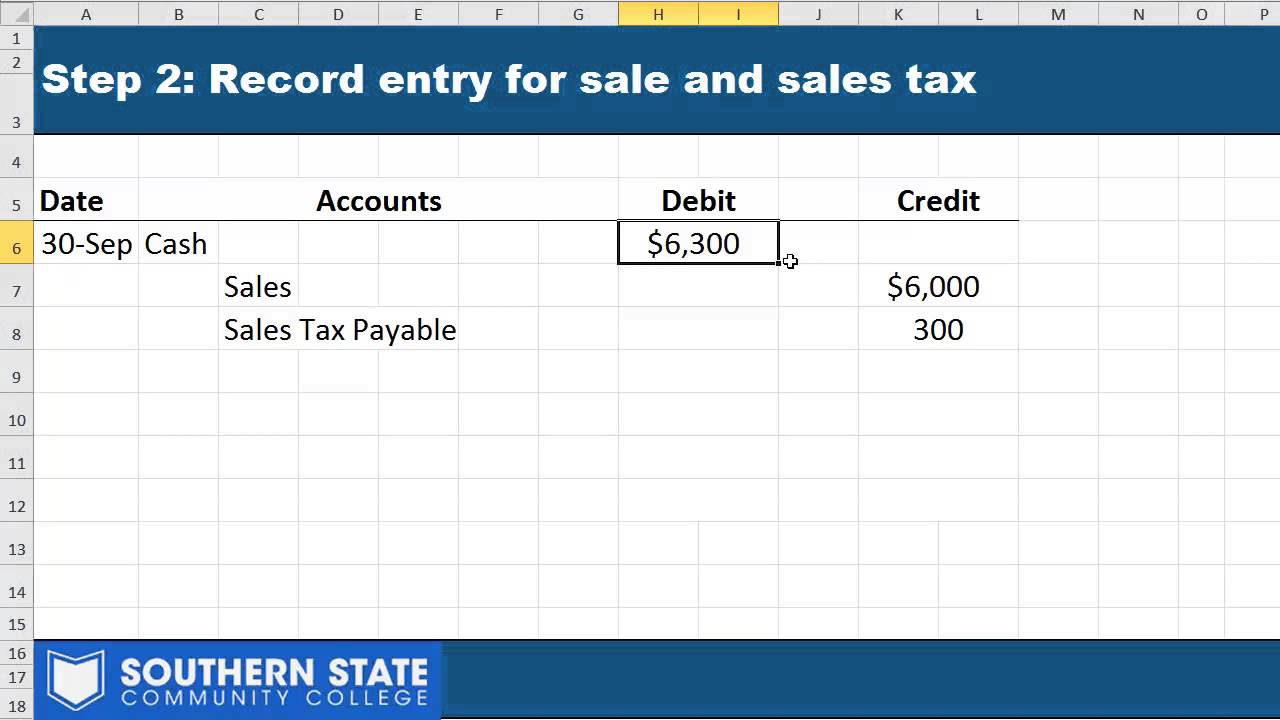

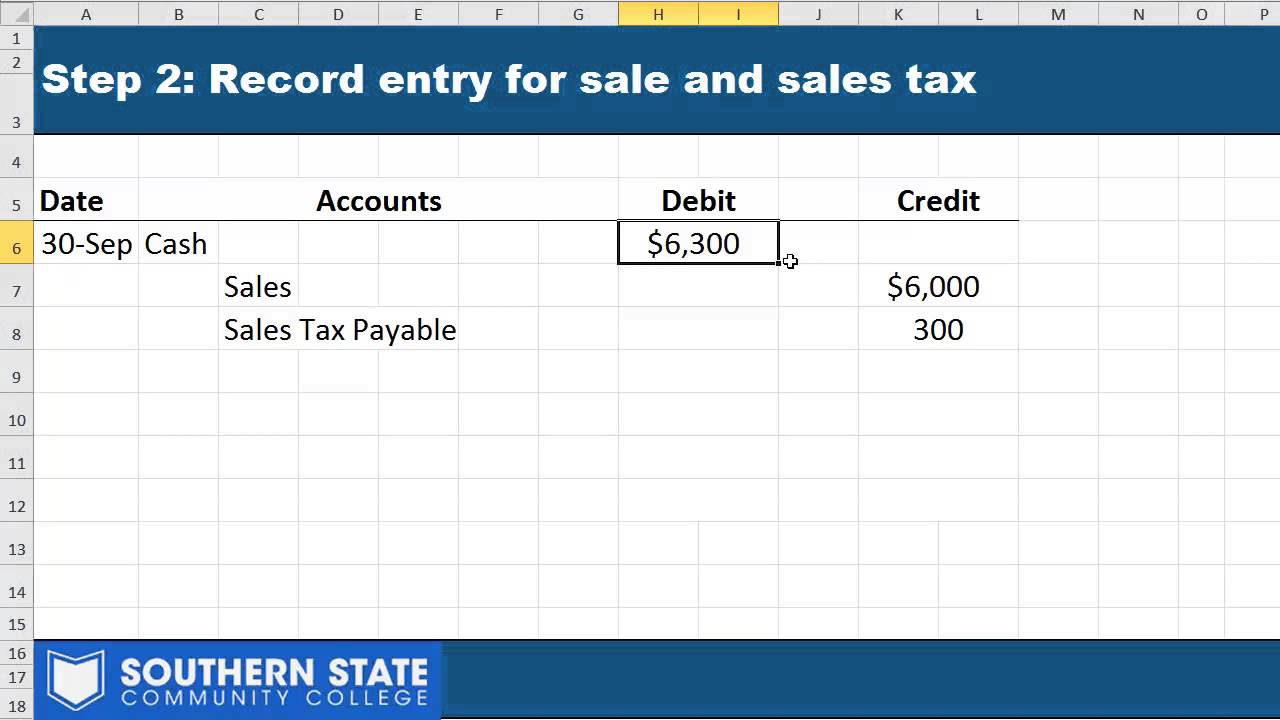

Sales tax journal entry The company can make the sales tax journal entry by debiting the cash account and crediting the sales revenue account and sales tax account Sales tax To record received sales tax from customers debit your Cash account and credit your Sales Revenue and Sales Tax Payable accounts Your sales tax payable

What Is Journal Entry To Post Sales Tax Payment

What Is Journal Entry To Post Sales Tax Payment

https://cdn.corporatefinanceinstitute.com/assets/adjusting-jounral-entry1.png

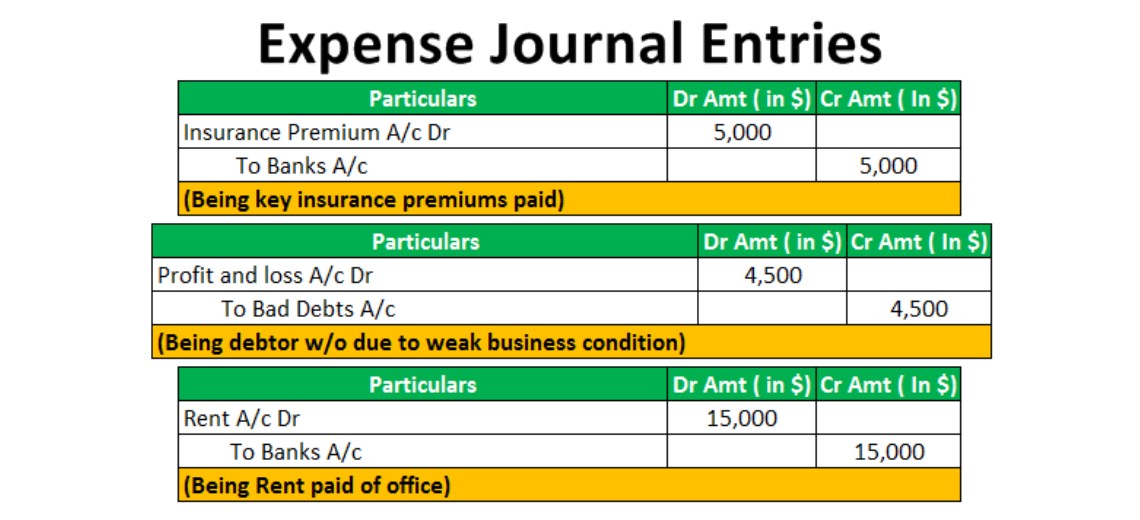

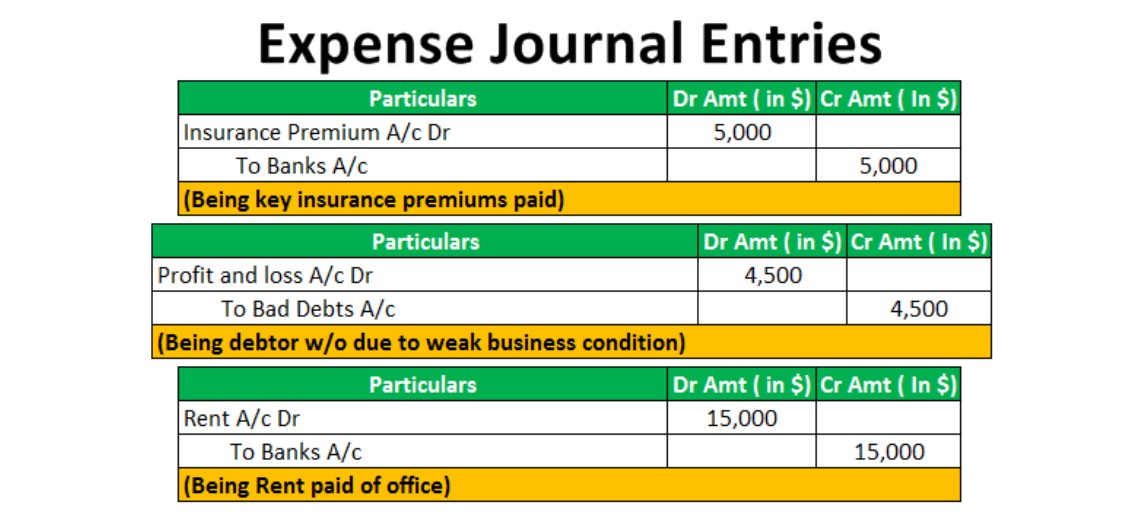

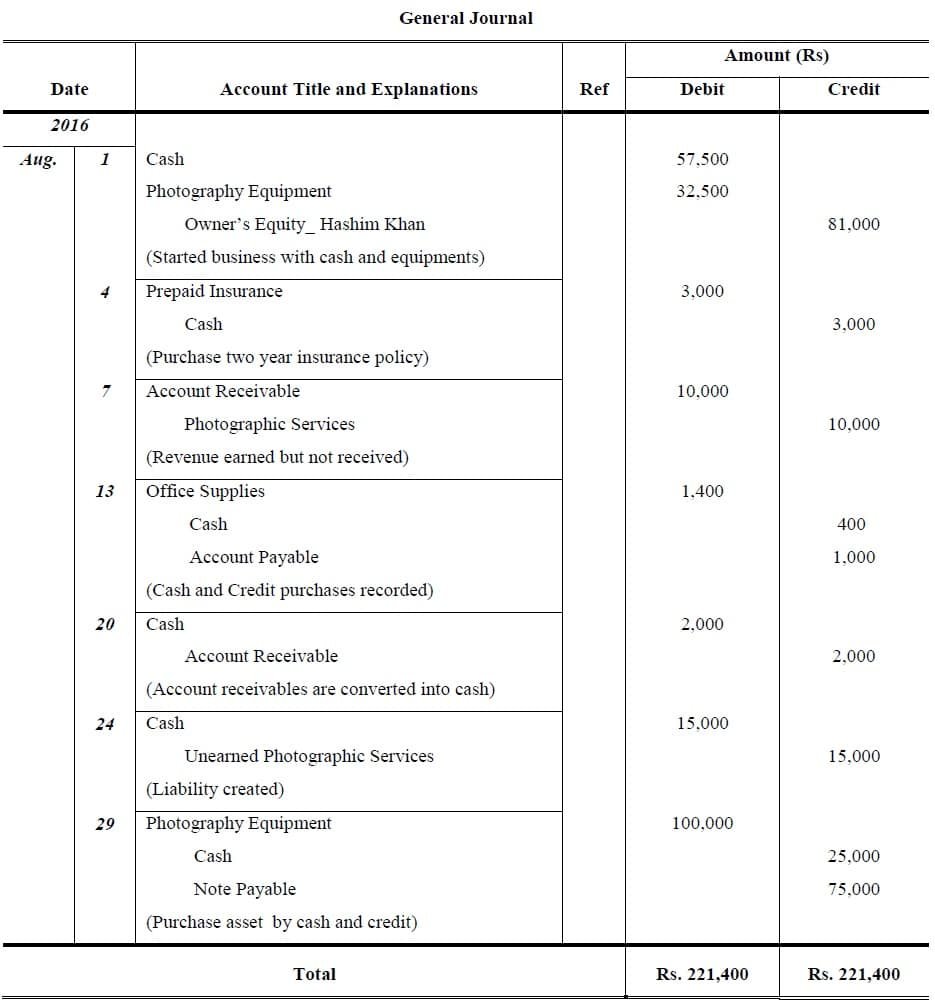

Journal Entry For Outstanding Expenses J Ethinomics

https://www.j-ethinomics.org/wp-content/uploads/2020/10/Outstanding-Expenses.jpg

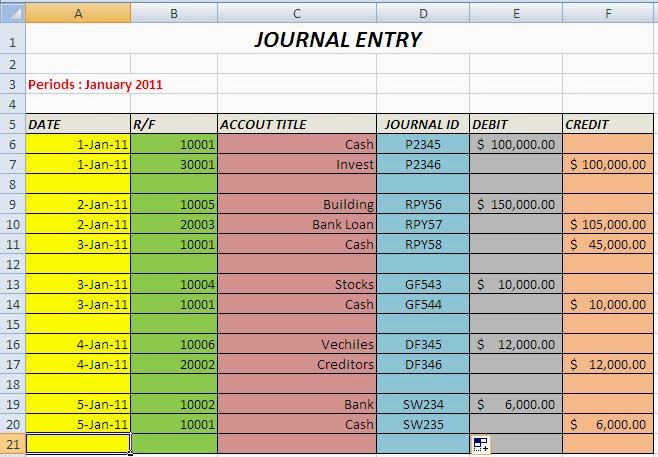

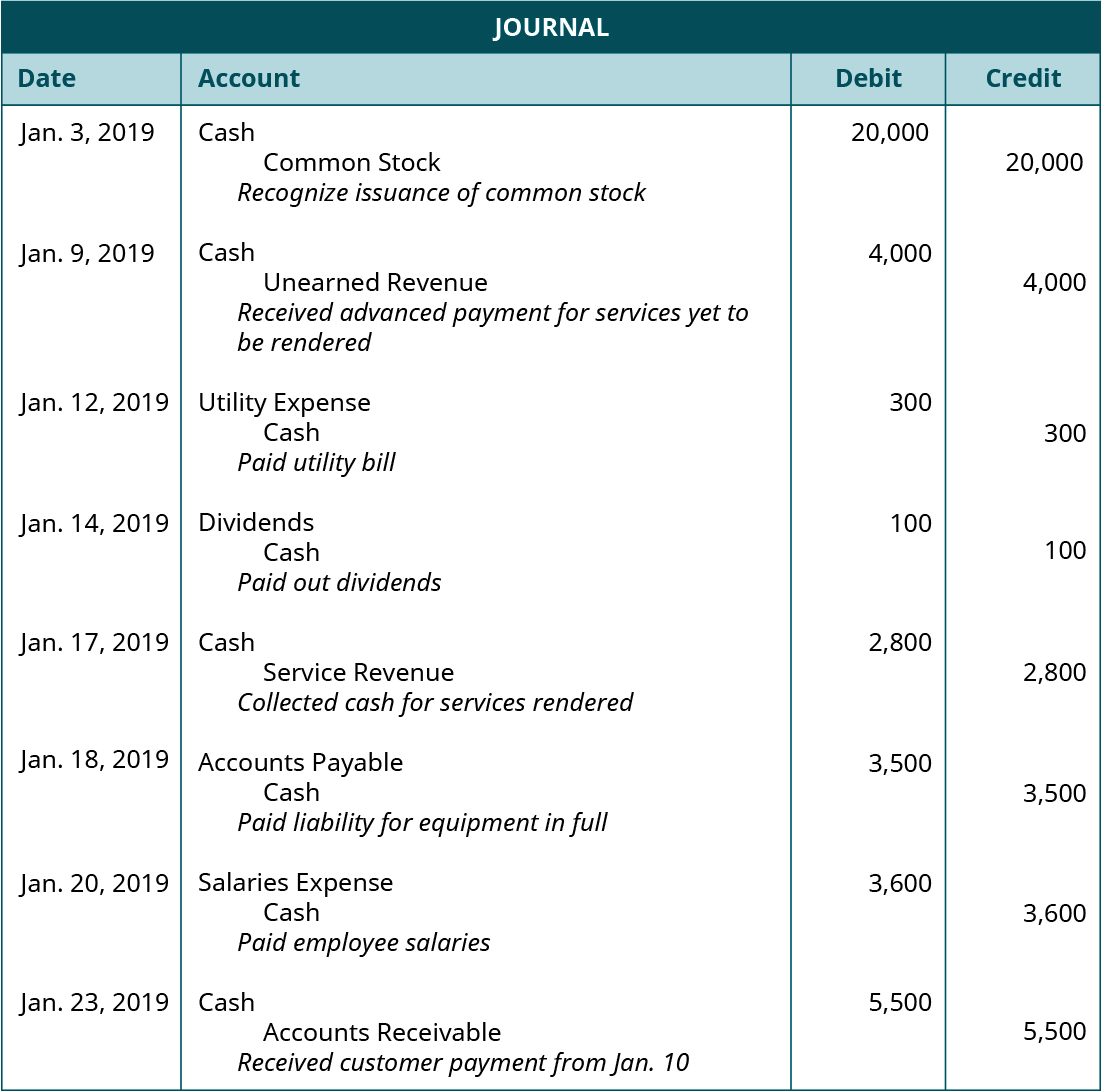

Online Account Reading What Is A Journal Entry Accounting Meaning

http://4.bp.blogspot.com/-yrcklDg8RII/U7UudG7lTsI/AAAAAAAAEDs/TxANN-kq3-U/s1600/b.jpg

The journal entry for sales taxes involves recognizing a liability for the amount collected from customers and payable to the taxing authority Key What Is the Journal Entry for Sales Tax The journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or

Journal Entry for Sales Tax Payable Following the posting of the purchase and sales transactions the sales tax account now has a net credit balance of 42 92 Trying to figure out how to record sales taxes for a business We break down how sales tax accounting works provide show how to record sales tax journal

Download What Is Journal Entry To Post Sales Tax Payment

More picture related to What Is Journal Entry To Post Sales Tax Payment

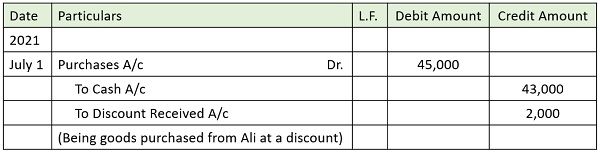

Cash Discount CA Ambition

https://keydifferences.com/wp-content/uploads/2014/12/journal-entry1.jpg

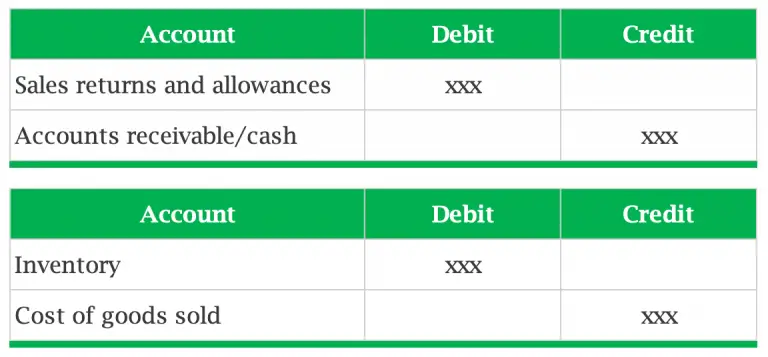

Accounting For Sales Return Journal Entry Example Accountinguide

https://accountinguide.com/wp-content/uploads/2020/01/Sales-return-journal-entry-768x357.png

Accounting Journal Entries

https://www.double-entry-bookkeeping.com/wp-content/uploads/general-journal.png

Collecting and paying sales tax takes two separate entries in your records one when you receive the tax and one when you pay it The amount of sales tax you When a customer is billed for sales taxes the journal entry is a debit to the accounts receivable asset asset for the entire amount of the invoice a credit to the sales

A journal uses a double entry system meaning that you must explain where the money was paid and where it came from in every transaction To enter your sales tax payment For sales tax payable specifically your journal entry will show the amount of sales tax you collect as a credit You ll also enter the product or service revenue

Accounting Journal Entries

https://spscc.pressbooks.pub/app/uploads/sites/64/2021/07/OSX_Acct_F03_05_CashLedg01_img.jpg

Journal Entry For Prepaid Insurance Better This World

https://betterthisworld.com/wp-content/uploads/2021/07/Journal-Entry-for-Prepaid-Insurance.jpeg

https://accountinguide.com/sales-tax-accounting

The journal entry is debiting cash and credit sale tax payable Sale tax payable is the current liability on the balance sheet which the company has to pay to the government

https://accountinginside.com/sale-tax-journal-entry

Sales tax journal entry The company can make the sales tax journal entry by debiting the cash account and crediting the sales revenue account and sales tax account Sales tax

dulting 101 Taxes nin Staffing

Accounting Journal Entries

Impressive Provision For Bad Debts In Balance Sheet Company Final

Journal Entry Problems And Solutions Format Examples MCQs

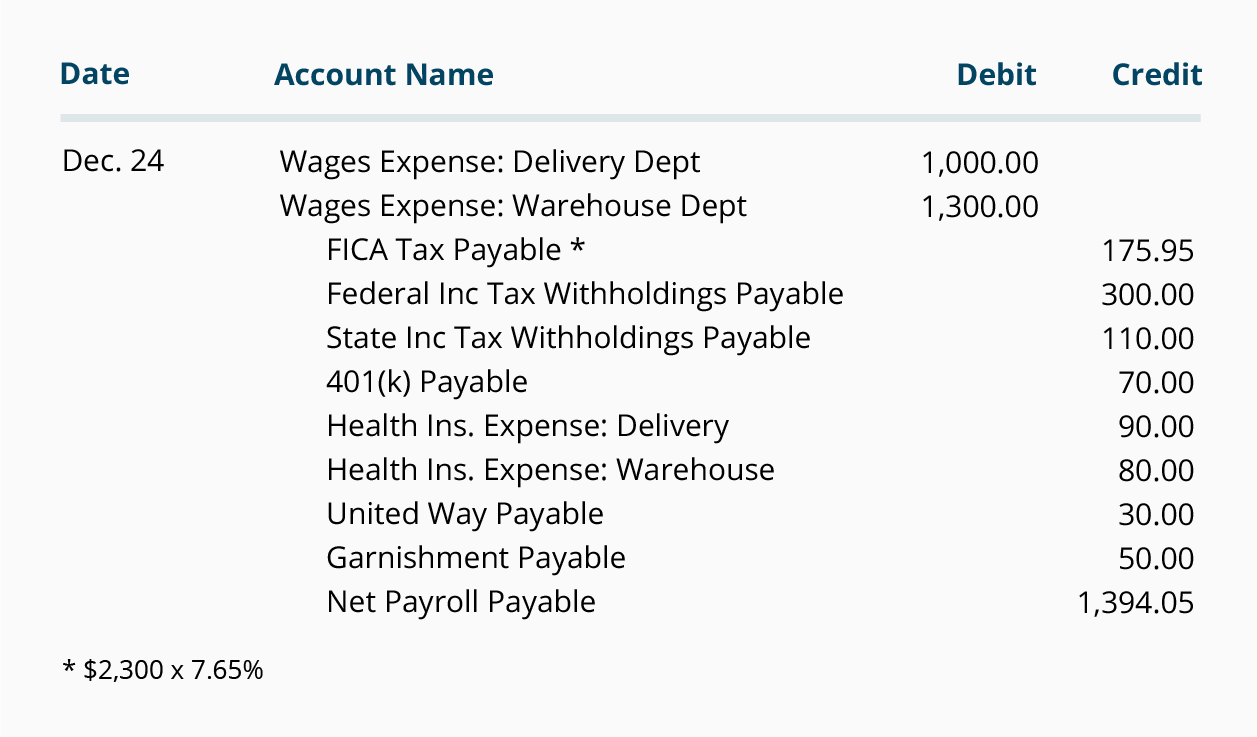

Non Profit And Payroll Accounting Examples Of Payroll Journal Entries

Sales Tax Payable Journal Entries YouTube

Sales Tax Payable Journal Entries YouTube

3 5 Use Journal Entries To Record Transactions And Post To T Accounts

Accounting Journal Entries For Dummies

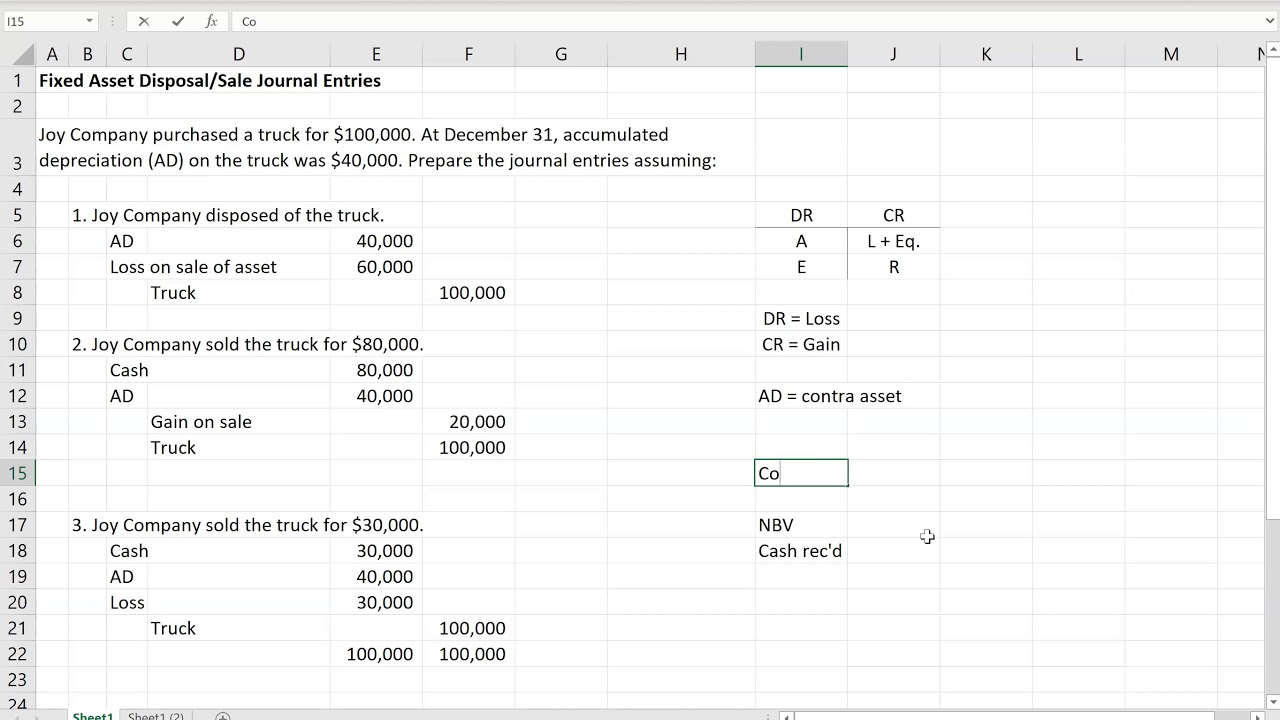

Fixed Asset Disposal And Sale Journal Entries YouTube

What Is Journal Entry To Post Sales Tax Payment - Once you pay the sales tax to the state government the Sales Tax account will be debited and the Cash Bank account will be credited This is how you make a