What Is Meaning Of Rebate Under Section 87a Verkko 3 helmik 2023 nbsp 0183 32 If your net taxable income does not exceed Rs 7 lakh you are eligible for the tax rebate under Section 87A This rebate will be automatically taken into account at the time of filing the income tax return The tax payable will be shown as zero If you are opting for the old tax regime

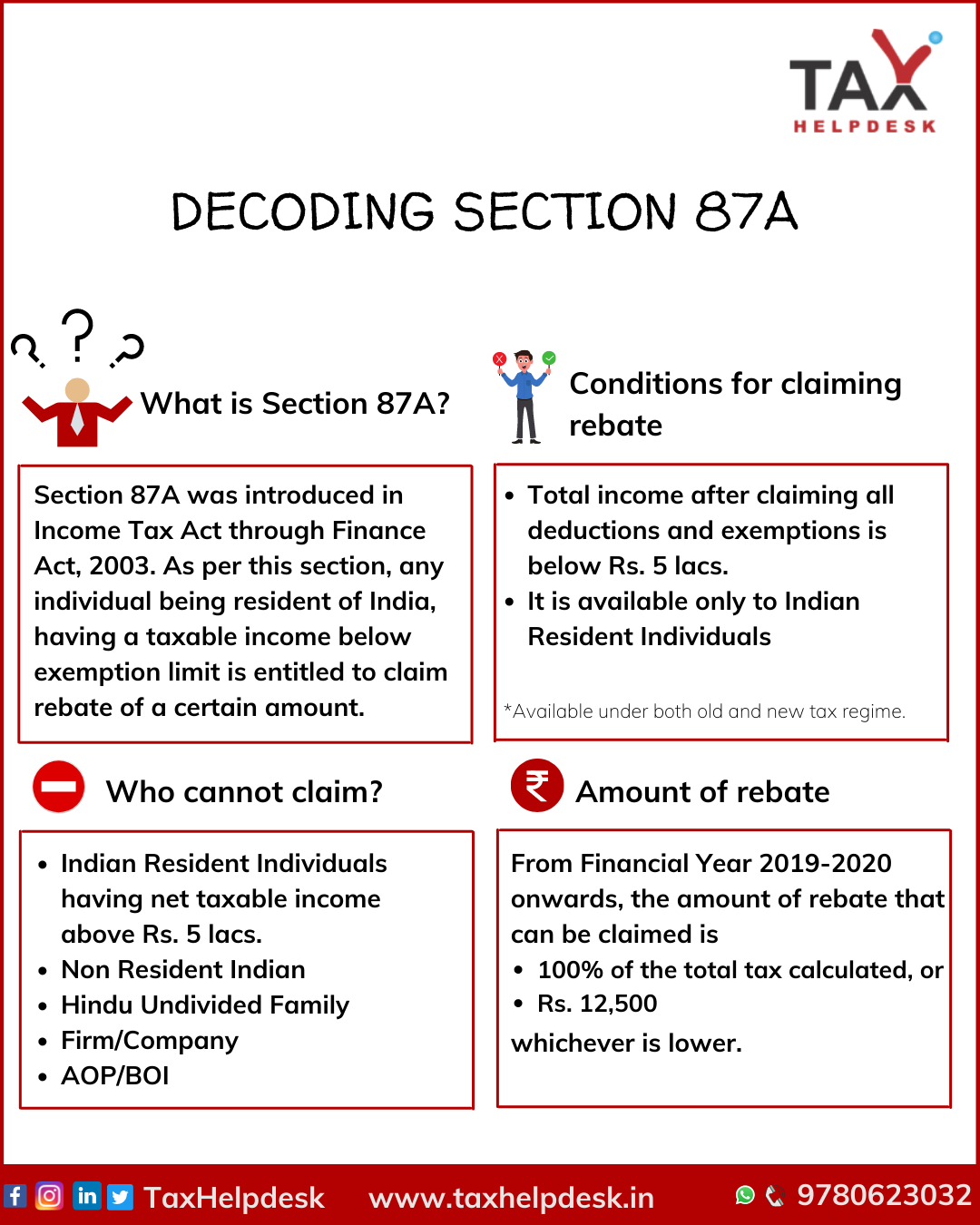

Verkko 28 jouluk 2023 nbsp 0183 32 This rebate helps reduce the income tax liability of taxpayers It is a benefit provided by the government to incentivize and provide relief to certain categories of taxpayers The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Verkko 1 What is Section 87A rebate limit The limit for Section 87A varies for the old and new tax regimes Under the old tax regime the limit is set to an income of INR 5 Lakh annum While for the new tax regime it is set at INR 7 Lakh annum 2 Who is

What Is Meaning Of Rebate Under Section 87a

What Is Meaning Of Rebate Under Section 87a

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/DECODING-SECTION-87A.png

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

https://financialcontrol.in/wp-content/uploads/2018/06/Rebate-87A.jpg

Verkko 25 elok 2020 nbsp 0183 32 Rebate under section 87A will be lower of 100 of income tax liability or Rs 2 500 In other words if the tax liability exceeds Rs 2 500 rebate will be available to the extent of Rs 2 500 only and no rebate will be available if the total income i e taxable income exceeds Rs 3 50 000 Verkko Rebate under section 87A can be claimed when your taxable income does not exceed the prespecified limit for the given financial year For example for FY 2021 22 AY 2022 23 if your taxable income is up to Rs 5 00 000 then you do not need to pay any taxes by claiming the benefit of rebate u s 87A You can claim a maximum rebate of up to

Verkko 26 huhtik 2022 nbsp 0183 32 Eligibility Criteria for Claiming Tax Rebate Under Section 87A Tax rebate under Section 87A is available for both old and new tax regimes for Financial Year 2021 2022 The assessment Year 2022 2023 The limit remains the same i e Rs 12 500 Individuals with net taxable income up to Rs 5 lakh Verkko 15 toukok 2023 nbsp 0183 32 A rebate is offered when the taxpayer s total taxable income falls above the basic exemption limit The government offers a reduction in tax if the taxpayers meet specific conditions The rebate as per Section 87A is offered based on the total taxable income of the eligible taxpayers

Download What Is Meaning Of Rebate Under Section 87a

More picture related to What Is Meaning Of Rebate Under Section 87a

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

https://stairfirst.com/blog/wp-content/uploads/2020/06/Adobe_Post_20200522_1633240.06060677195840691-1-2048x1536.png

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/image-91.png

Rebate Under Section 87A Of The Income Tax Act Fintrakk

https://blogassets.fintrakk.com/uploads/2016/05/Rebate-section-87A.jpg

Verkko 20 jouluk 2021 nbsp 0183 32 The income tax rebate available under Section 87A can be claimed against tax liability of any nature except for long term capital gains arising on equity shares sold on stock exchange and equity Verkko 14 marrask 2023 nbsp 0183 32 Under section 87A claimable rebate is up to Rs 12 500 The important thing here is that taxable income is calculated not just on tax slab Someone earning Rs 8 lakh can also claim a rebate There are two possibilities for taxpayers up to age 60 getting a rebate One where gross income is less than Rs 5 lakh Here just

Verkko 5 maalisk 2023 nbsp 0183 32 Calculation of Rebate Under Section 87A The rebate amount under Section 87A is calculated as follows If the total income is up to Rs 3 5 lakh the rebate amount is Rs 2 500 If the total income is between Rs 3 5 lakh and Rs 5 lacks the rebate amount is 5 of the total income or Rs 12 500 whichever is lower Verkko 5 lokak 2021 nbsp 0183 32 A tax rebate is a type of tax refund that a taxpayer is eligible to receive from the IT department when the tax paid or payable is higher than the actual tax liability So under Section 87A individuals with a taxable income of Rs 5 lakhs or less are eligible for a tax rebate of up to Rs 12 500

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

https://financialcontrol.in/wp-content/uploads/2018/06/How-to-calculate-rebate-us-87A.jpg

Tax Rebate Under Section 87A All You Need To Know YouTube

https://i.ytimg.com/vi/JM0j9VqDYfI/maxresdefault.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Verkko 3 helmik 2023 nbsp 0183 32 If your net taxable income does not exceed Rs 7 lakh you are eligible for the tax rebate under Section 87A This rebate will be automatically taken into account at the time of filing the income tax return The tax payable will be shown as zero If you are opting for the old tax regime

https://tax2win.in/guide/section-87a

Verkko 28 jouluk 2023 nbsp 0183 32 This rebate helps reduce the income tax liability of taxpayers It is a benefit provided by the government to incentivize and provide relief to certain categories of taxpayers The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A Legalraasta

Income Tax Rebate Under Section 87A Legalraasta

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

What Is Rebate Under Section 87A And Who Can Claim It

Rebate U s 87A Of I Tax Act Income Tax

What Is Meaning Of Rebate Under Section 87a - Verkko 15 toukok 2023 nbsp 0183 32 A rebate is offered when the taxpayer s total taxable income falls above the basic exemption limit The government offers a reduction in tax if the taxpayers meet specific conditions The rebate as per Section 87A is offered based on the total taxable income of the eligible taxpayers