What Is Medical Insurance Relief Tax Credit The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

You pay your employee s medical insurance policy of 800 1 000 less tax relief of 200 You must deduct Income Tax PRSI and USC on the gross amount 1 000 from your employee s pay This employee is entitled to a tax credit for the gross premium 1 000 20 in their Tax Credit Certificate The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC

What Is Medical Insurance Relief Tax Credit

What Is Medical Insurance Relief Tax Credit

https://i.ytimg.com/vi/9OKLo0o1sdA/maxresdefault.jpg

What Is Medical Payments Coverage Home Insurance Coverage F Clovered

https://i.ytimg.com/vi/VogtjLRHLnA/maxresdefault.jpg

Health Insurance Plans Too Complicated To Understand UConn Today

https://today.uconn.edu/wp-content/uploads/2017/04/shutterstock_373492012-health-insurance-1024x683.jpg

If you have health insurance you can get tax relief on the premium you pay to an approved insurer You do not need to claim the relief it is given as a reduction in the amount of the insurance premium you pay Who is Eligible for a Health Care Credit Before 2021 the PTC was available to people with household incomes from 100 to 400 of the poverty level who bought health coverage through an exchange

You are claiming the premium tax credit Advance credit payments were paid to your health insurer for you or someone else in your tax family For purposes of the premium tax credit your tax family is every individual you claim on your tax return yourself your spouse if filing jointly and your dependents The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums The advance PTC lowers the premiums themselves

Download What Is Medical Insurance Relief Tax Credit

More picture related to What Is Medical Insurance Relief Tax Credit

What Is A Medical Insurance Plan What Are The Benefits Of A Medical

https://ind-strapi-cms.s3.ap-south-1.amazonaws.com/xlarge_Slide_16_9_447_1_f447a8fd79.jpg

Medical Insurance Tax Relief Claim Tax Back On Your Health Insurance

https://www.mytaxrebate.ie/wp-content/uploads/2020/10/Medical-Insurance-Relief-Blog-Image-e1602499719822.png

What Is Medical Payments Coverage On My Auto Insurance YouTube

https://i.ytimg.com/vi/I7dDdonAa3g/maxresdefault.jpg

The Premium Tax Credit PTC makes health insurance more affordable by helping eligible individuals and their families pay premiums for coverage purchased through the Health Insurance Marketplace also referred to as the Marketplace or Exchange There are two ways to get the credit A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax credit is based on the income estimate and household information you put on your Marketplace application

The premium tax credit is a refundable credit that helps lower the cost of your monthly health insurance premium You must meet the requirements and file a specific form with your tax return to qualify for it One of these health insurance subsidies is the premium tax credit which helps pay your monthly health insurance premiums This article will explain how these subsidies work who is eligible and how they ll affect your tax return

What Is Medical Payments Coverage YouTube

https://i.ytimg.com/vi/xnqDss_3vtQ/maxresdefault.jpg

Medical Payments Insurance Coverage In Virginia What Is Medical

https://i.ytimg.com/vi/Qje9n79tHbs/maxresdefault.jpg

https://www.irs.gov/affordable-care-act/...

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

https://www.revenue.ie/en/employing-people/benefit...

You pay your employee s medical insurance policy of 800 1 000 less tax relief of 200 You must deduct Income Tax PRSI and USC on the gross amount 1 000 from your employee s pay This employee is entitled to a tax credit for the gross premium 1 000 20 in their Tax Credit Certificate

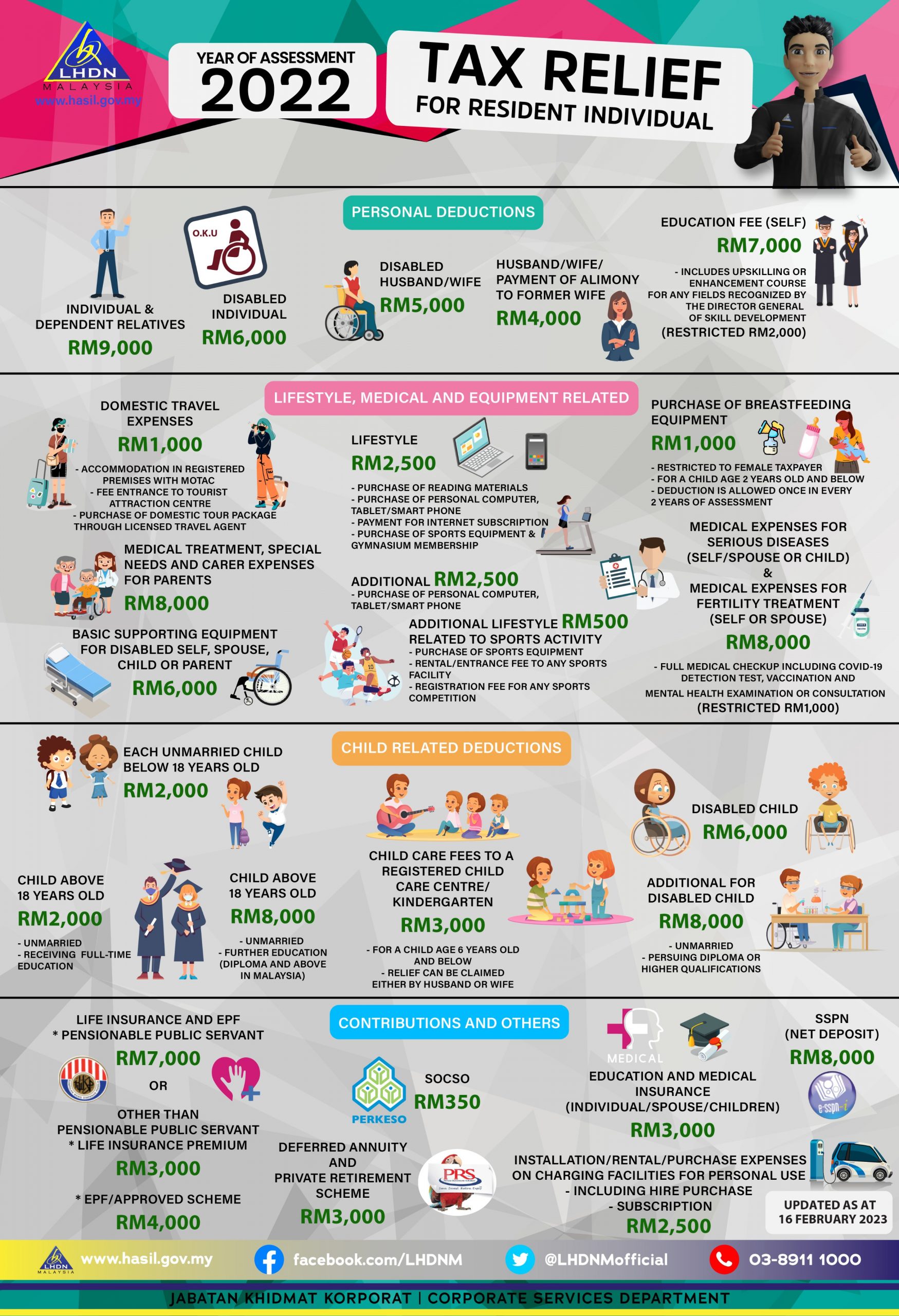

Company Tax Relief 2023 Malaysia Printable Forms Free Online

What Is Medical Payments Coverage YouTube

Benefits Human Resources

How To Find Policy Number On Health Insurance Card

American Medical ID Announces One Week Offer 50 Off Medical IDs

Understanding Medical Insurance In US A Beginner s Guide Pabeam

Understanding Medical Insurance In US A Beginner s Guide Pabeam

What Is Medical Billing Solutions Medical Billing Inc

Value based Market Access Symposium Summary Report APACMed

What Medical Insurance Companies Actually Do Theauldshillelagh

What Is Medical Insurance Relief Tax Credit - If you have health insurance you can get tax relief on the premium you pay to an approved insurer You do not need to claim the relief it is given as a reduction in the amount of the insurance premium you pay