What Is Net Of Tax What is Net of Tax Net of tax is the amount obtained after the applicable tax is deducted from the gross income that resulted from investments or transactions Net of tax is a term most commonly used for showing the results of businesses in terms of income profits or losses

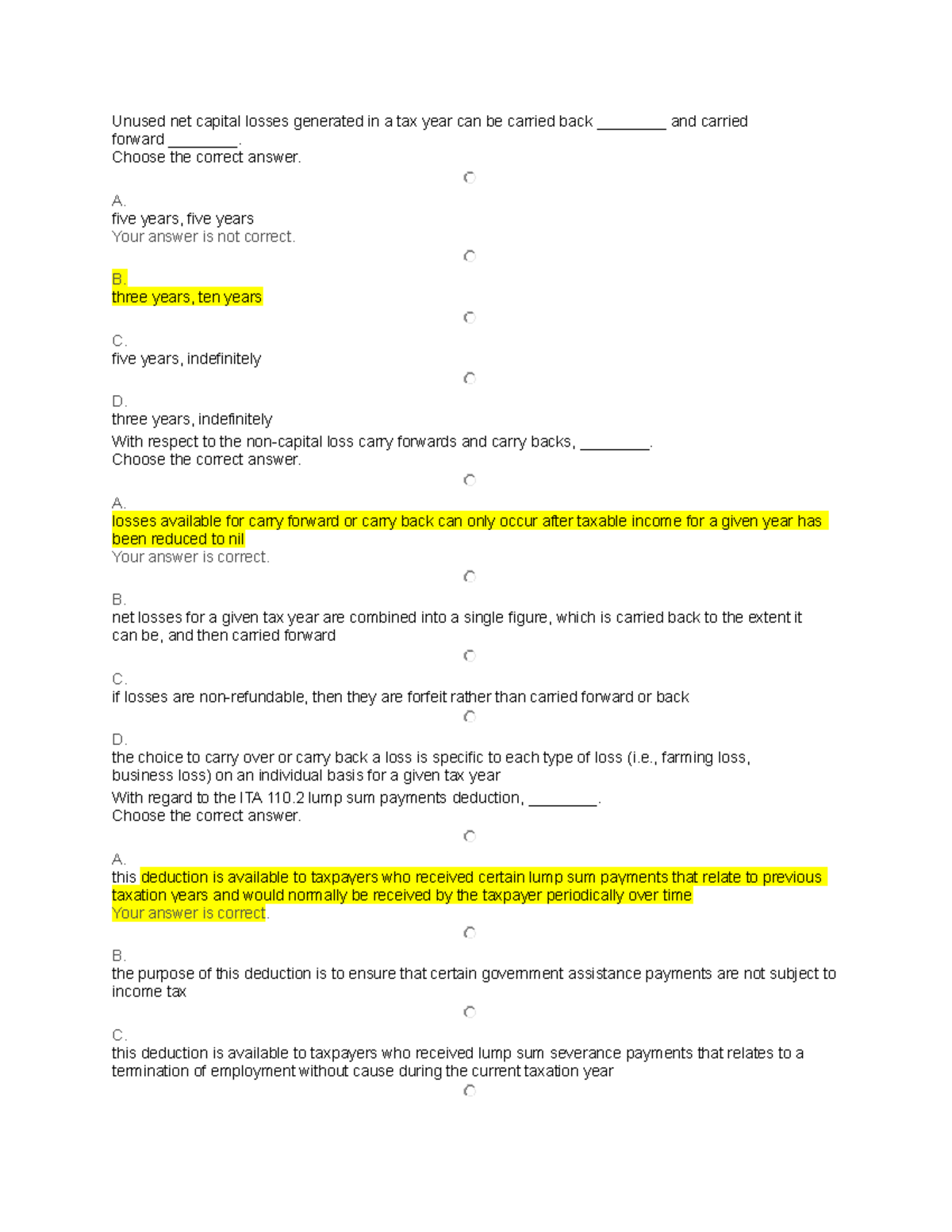

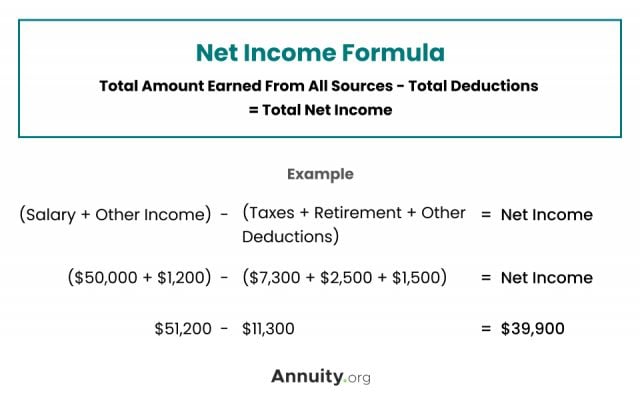

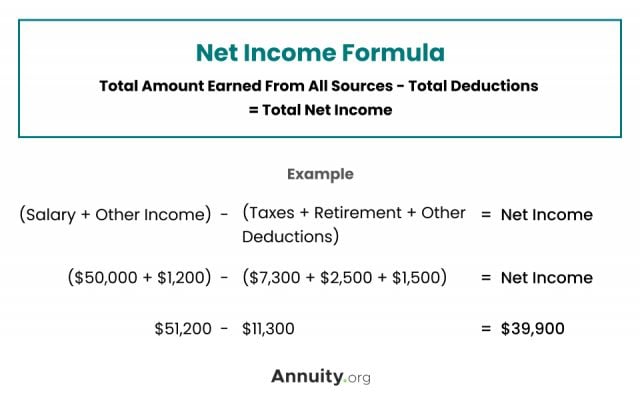

The expression net of represents the exclusion of something from a particular sum For example net of tax means the resultant amount which is exclusive of tax or in other words the amount we get after deducting tax is net of tax amount Net of Taxes Gross Amount Amount of Taxes The amount net of tax can be calculated by subtracting the amount of taxes from the gross value For Example the total Income of ABC Inc for the year ending 2019 was 1 000 00

What Is Net Of Tax

What Is Net Of Tax

https://www.superfastcpa.com/wp-content/uploads/2023/07/Net-of-Tax-1024x576.png

:max_bytes(150000):strip_icc()/GettyImages-184090029-5a2ea59c0c1a8200376615c2.jpg)

What Net Of Tax Means And How It Affects Business Taxes

https://www.thebalancemoney.com/thmb/gjtNSF-T4K-JeTrdM7kul54C1wE=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/GettyImages-184090029-5a2ea59c0c1a8200376615c2.jpg

Net Of Tax FundsNet

https://fundsnetservices.com/wp-content/uploads/net-of-tax.png

Net of tax refers to how much of your income is left over after you subtract taxes Learn about what it is how it works and how you can calculate your net of tax Net of tax is a business term that takes into account the estimated amount of tax on an investment or business transaction All you need in order to calculate the net of tax is to consider the gross income from a specific transaction and subtract the tax paid

Net of tax a crucial financial concept represents the amount of money you have left after accounting for taxes In various scenarios whether it s making investment decisions purchasing assets or analyzing annual tax filings understanding net of tax is essential Net of tax refers to the amount of money remaining after taxes have been deducted It s a term commonly used in both personal finance and business contexts to represent the actual value of income investment returns or profits after accounting for taxes

Download What Is Net Of Tax

More picture related to What Is Net Of Tax

Why It s Still Hard To File Your Taxes For Free 1A

https://the1a.org/wp-content/uploads/sites/4/2020/07/GettyImages-897291366.jpg

Net Of Tax

https://s3.studylib.net/store/data/009587147_1-53ac7ab300d6e00f15c7c9311e26d0c2-768x994.png

Net Of Tax AwesomeFinTech Blog

https://www.awesomefintech.com/term/cards/net-of-tax/card.png

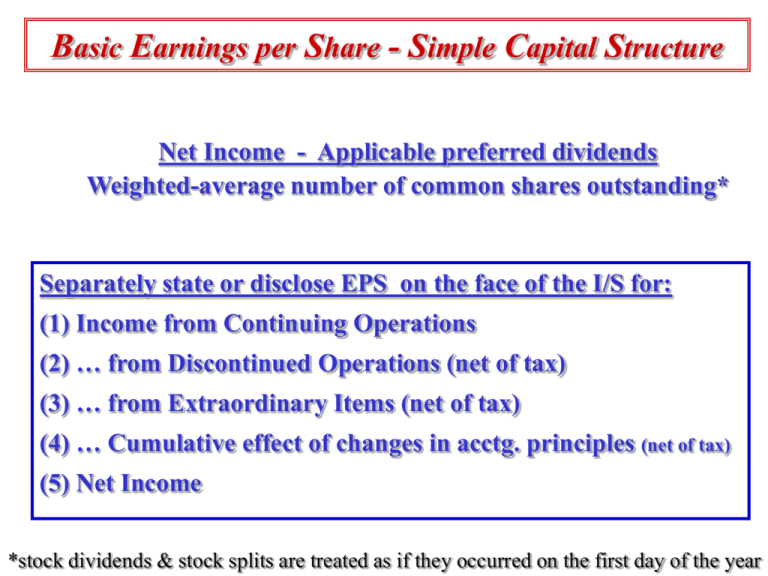

Definition Net of tax figures are commonly used in income statements and balance sheets Meaning It allows stakeholders to assess the true financial performance and position of a company Implications Investors can make more informed What is Net of Tax Net of tax is the initial or gross results of a transaction or group of transactions minus the related income taxes The term is most commonly associated with the results of an entire business such that its profits or losses are described as being net of tax if the effects of income taxes are calculated into the

[desc-10] [desc-11]

Preliminary Net Income Formula JunaidTasnim

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/16190411/Net-Income-Apple.jpg

What Is Net Income After Tax Earnings Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/09/17160238/Net-Income-Calculator-960x632.jpg

https://corporatefinanceinstitute.com › resources › accounting › net-of-tax

What is Net of Tax Net of tax is the amount obtained after the applicable tax is deducted from the gross income that resulted from investments or transactions Net of tax is a term most commonly used for showing the results of businesses in terms of income profits or losses

:max_bytes(150000):strip_icc()/GettyImages-184090029-5a2ea59c0c1a8200376615c2.jpg?w=186)

https://pakaccountants.com › what-is-meant-by-the-term-net-of

The expression net of represents the exclusion of something from a particular sum For example net of tax means the resultant amount which is exclusive of tax or in other words the amount we get after deducting tax is net of tax amount

Sample Question For Tax 2 Unused Net Capital Losses Generated In A

Preliminary Net Income Formula JunaidTasnim

Net Of Tax Overview Formula Types Importance

:max_bytes(150000):strip_icc()/single-word-taxes-on-wooden-block-1132754811-f3ef431cc47a4be3a49223b20774845f.jpg)

Net Of Tax Definition Benefits Of Analysis And How To Calculate

Net Of Taxes Meaning Formula Calculation With Example

Net Income What Is It How Is It Measured

Net Income What Is It How Is It Measured

Net Vs Gross Profit Explained How To Calculate Capalona

Tax Season Considerations 1099 And Tangible Property Epilawg

/GettyImages-184939771-10a77dd8e8b34ac7aaff499dfe09a657.jpg)

Form 1040 U S Individual Tax Return Definition

What Is Net Of Tax - [desc-14]