What Is Oasdi Withholding OASDI also known as Social Security is the federal tax that funds retirement disability and survivor benefits Learn how much you and your employer pay what is the taxable maximum and how

OASDI tax stands for old age survivors and disability insurance tax which funds the Social Security program Learn how much OASDI tax you pay how it affects your benefits and OASDI also known as the Social Security tax is an acronym for the Old Age Survivors and Disability Insurance program which provides monthly benefits to qualified retired and disabled workers

What Is Oasdi Withholding

What Is Oasdi Withholding

https://img.saplingcdn.com/640/photos.demandstudios.com/getty/article/88/179/78479922.jpg

What OASDI Tax Is And Why You Should Care The Motley Fool

https://g.foolcdn.com/editorial/images/439678/tax-gettyimages-507839992.jpg

What Is Fed OASDI EE On A Paycheck Sapling

https://img.saplingcdn.com/640/photos.demandstudios.com/getty/article/225/131/509663685.jpg

Learn how the Old Age Survivors and Disability Insurance OASDI tax also known as the Social Security tax is deducted from employee paychecks and self employed income Find out the How Does the OASDI Tax Work By law the OASDI tax must be automatically withheld from employee paychecks at a rate of 6 2 and employers are required to pay a matching 6 2 for a total tax of 12 4 The accumulated funds are used to fund monthly benefits payments to Social Security program recipients

OASDI stands for Old Age Survivors and Disability Insurance the official name of the U S Social Security program Learn how OASDI taxes fund the program how benefits are calculated OASDI tax is a payroll tax that funds Social Security benefits for retired disabled and surviving workers Learn how to withhold and contribute OASDI tax how much it is and how it differs from Medicare tax

Download What Is Oasdi Withholding

More picture related to What Is Oasdi Withholding

What Does Fed OASDI EE Mean On A Paycheck

https://thelawdictionary.org/wp-content/uploads/2018/12/social-security-Oasdi-EE-683x1024.jpg

What Does Fed OASDI EE Mean On A Paycheck

https://thelawdictionary.org/wp-content/uploads/2018/12/Oasdi-EE-federal-tax-payments-1536x1024.jpg

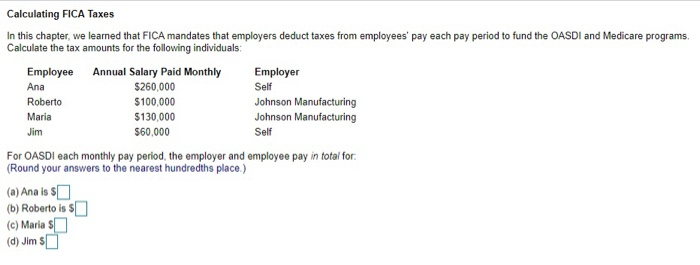

PPT Chapter 11 PowerPoint Presentation ID 468444

http://image.slideserve.com/468444/calculating-fica-taxes-oasdi22-l.jpg

As the name implies OASDI payments go to those who are retired disabled or have a spouse who earned Social Security benefits pass away The OASDI tax rate has been 12 4 since 1990 Tax law divides the responsibility What is the OASDI limit Known as the taxable limit the OASDI limit places a cap on how much of your employees wages can be subject to OASDI taxes In 2024 the maximum amount is 168 600 meaning that the most a worker can pay toward Social Security is 10 453 20 or 6 of 168 600 Note that the OASDI limit changes annually

[desc-10] [desc-11]

What Is Oasdi Deduction On My Paycheck YouTube

https://i.ytimg.com/vi/mXZXfJUcNNo/maxresdefault.jpg

OASDI Tax What Is It And Is It Mandatory To Pay The Tax Marca

https://phantom-marca.unidadeditorial.es/57bb8dad8636f7e2415710200cae7a14/resize/1320/f/jpg/assets/multimedia/imagenes/2023/01/26/16747454507416.jpg

https://www.usatoday.com/story/money/2023/01/25/...

OASDI also known as Social Security is the federal tax that funds retirement disability and survivor benefits Learn how much you and your employer pay what is the taxable maximum and how

https://www.fool.com/taxes/what-oasdi-tax-is-and...

OASDI tax stands for old age survivors and disability insurance tax which funds the Social Security program Learn how much OASDI tax you pay how it affects your benefits and

What Is OASDI Tax Definition And Types Of Social Security Tax

What Is Oasdi Deduction On My Paycheck YouTube

What Is OASDI On Paystub Uncover The Hidden Truth

What Is OASDI Tax

What Is Fed OASDI EE Tax On My Paycheck Old Blog Posts

What s OASDI On My Paycheck Social Security Tax Explained

What s OASDI On My Paycheck Social Security Tax Explained

What s OASDI On My Paycheck Social Security Tax Explained

How To Calculate Oasdi And Medicare Taxes

ZIP Maker Pro How To Quickly Understand OASDI Tax

What Is Oasdi Withholding - How Does the OASDI Tax Work By law the OASDI tax must be automatically withheld from employee paychecks at a rate of 6 2 and employers are required to pay a matching 6 2 for a total tax of 12 4 The accumulated funds are used to fund monthly benefits payments to Social Security program recipients