What Is Payment Processing System Payment processing systems cater to various types of transactions including credit and debit cards electronic funds transfers EFTs automated clearing house ACH transfers mobile payments digital wallets and cryptocurrencies A diverse set of stakeholders including banks financial institutions payment processors technology

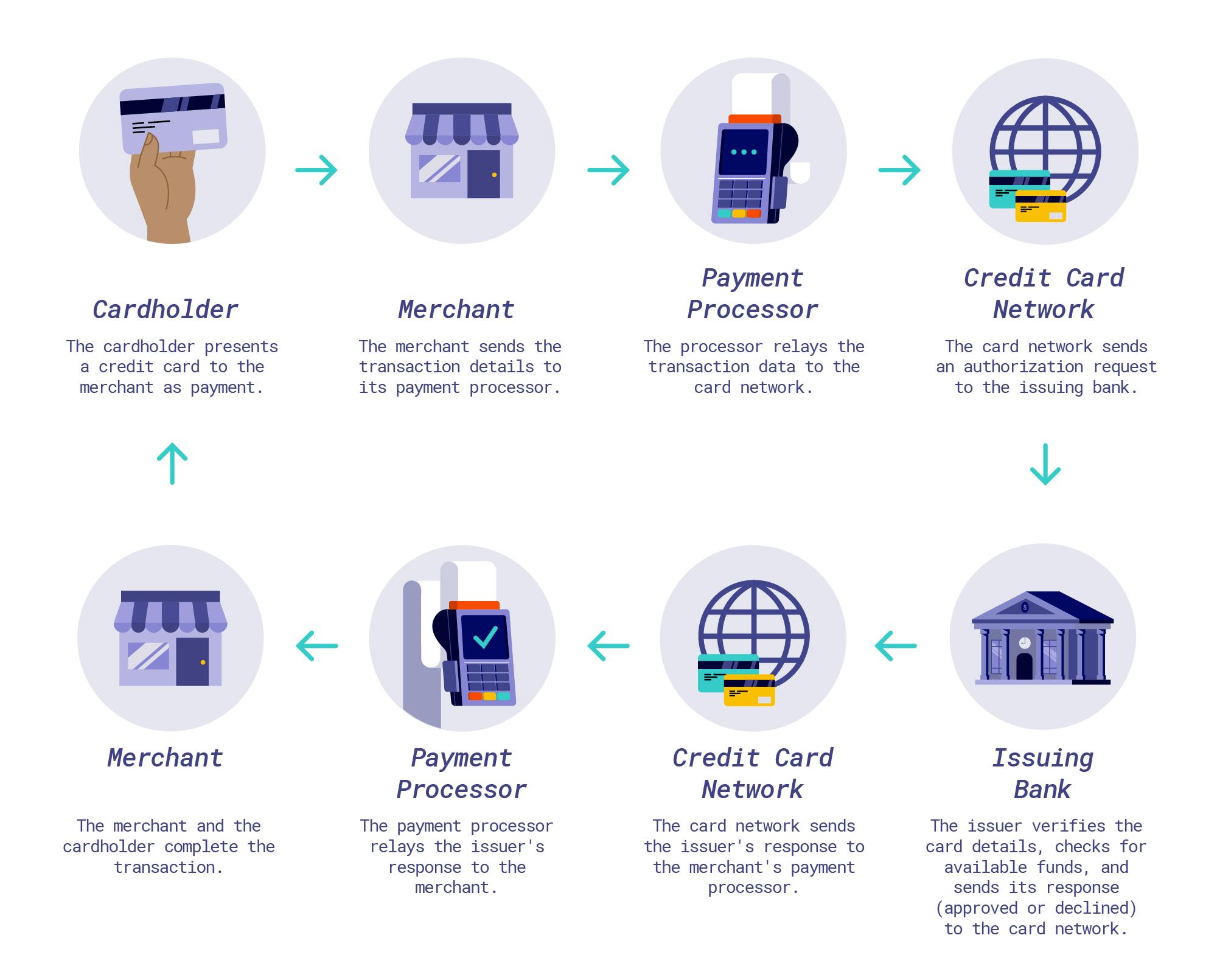

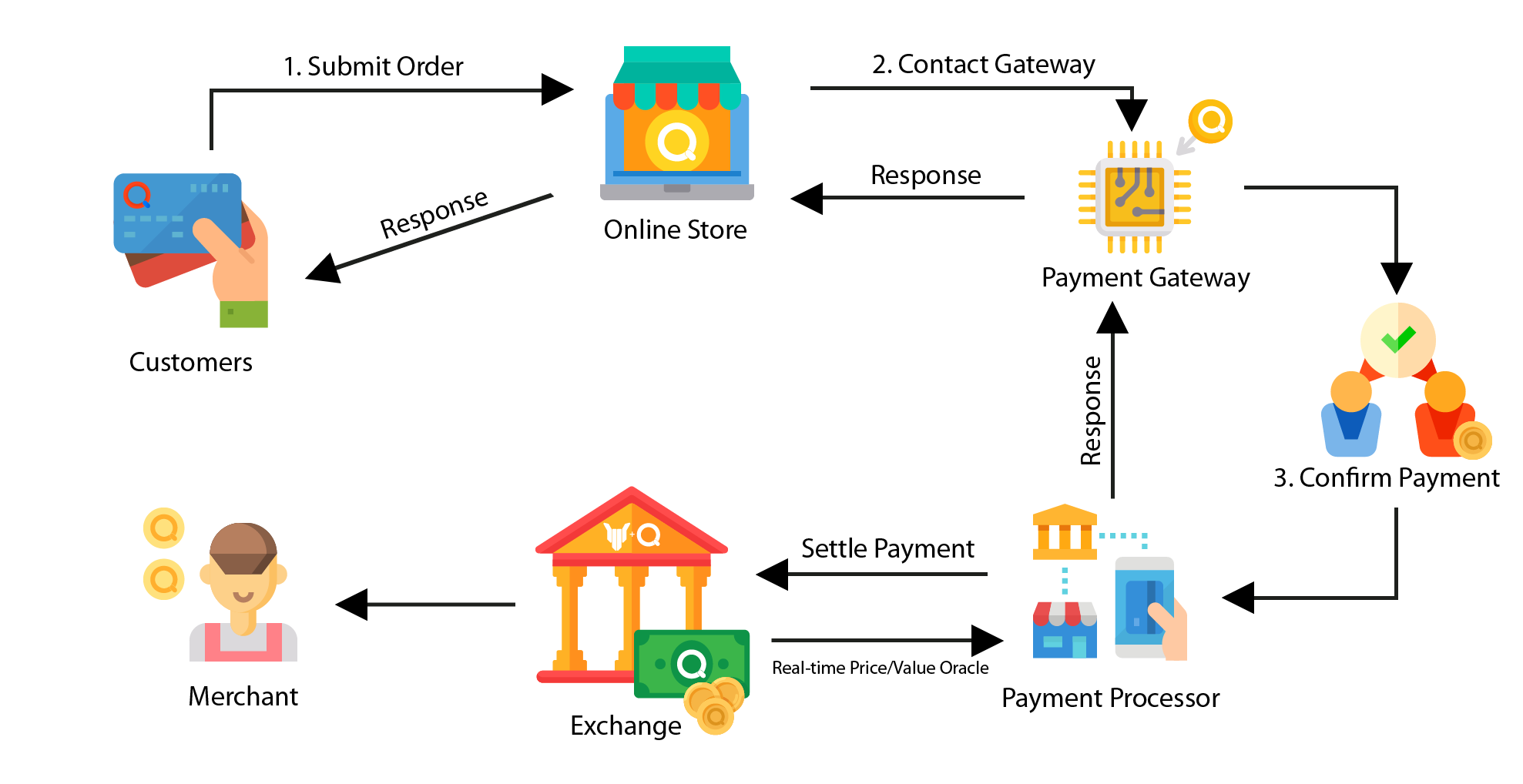

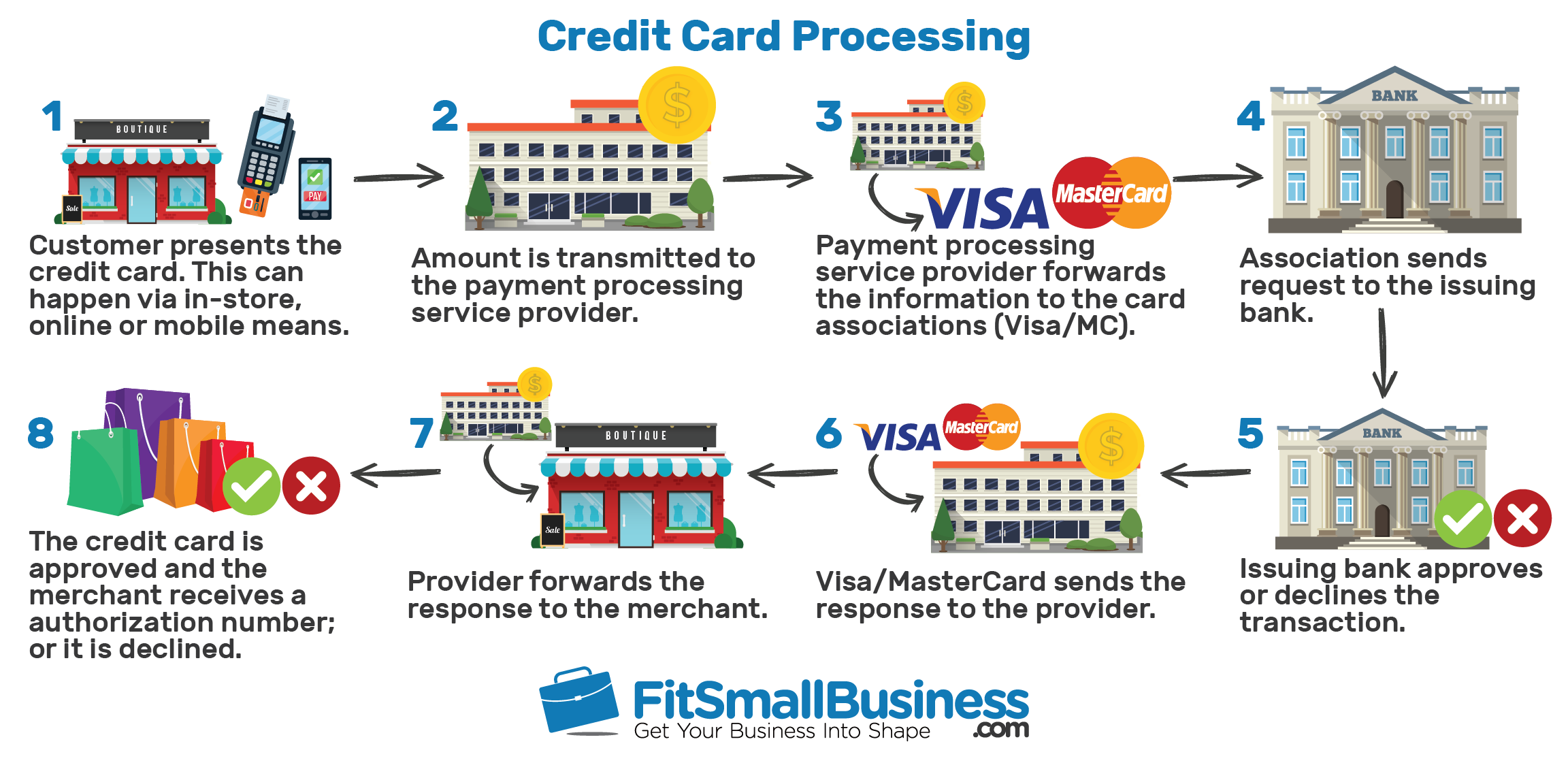

A payment system is any system used to settle financial transactions through the transfer of monetary value This includes the institutions payment instruments such as payment cards people rules procedures standards and What is a payment processor A payment processor is a system that allows financial transactions commonly employed by a merchant to manage transactions with customers from different channels like credit cards and debit cards or bank accounts They are usually broken down into two types front end and back end Qn4 How does a

What Is Payment Processing System

What Is Payment Processing System

https://www.card91.io/wp-content/uploads/2021/08/Card-Processing-1-2048x1143.png

Credit Card Fraud Detection With Machine Learning AltexSoft

https://www.altexsoft.com/media/2020/08/word-image.png

What Is Invoice Processing Invoice Processing Steps Explained

https://nanonets.com/blog/content/images/size/w1000/2021/04/invoice-infographics-FFFFFFFF-03.jpg

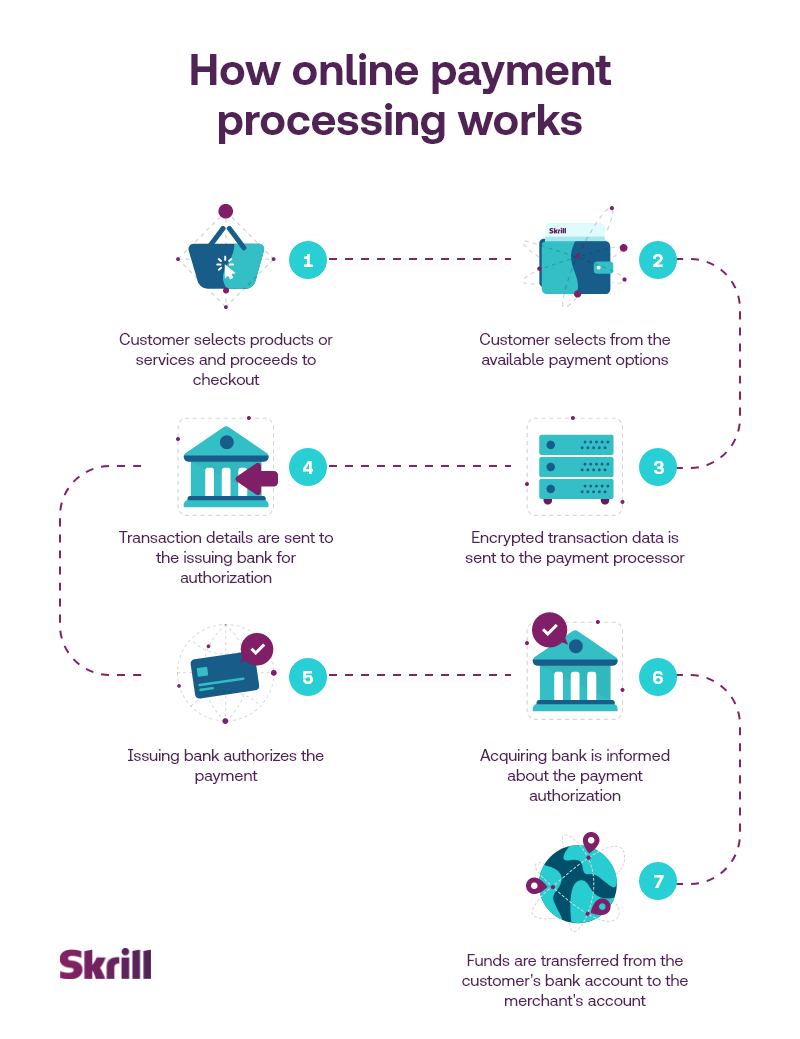

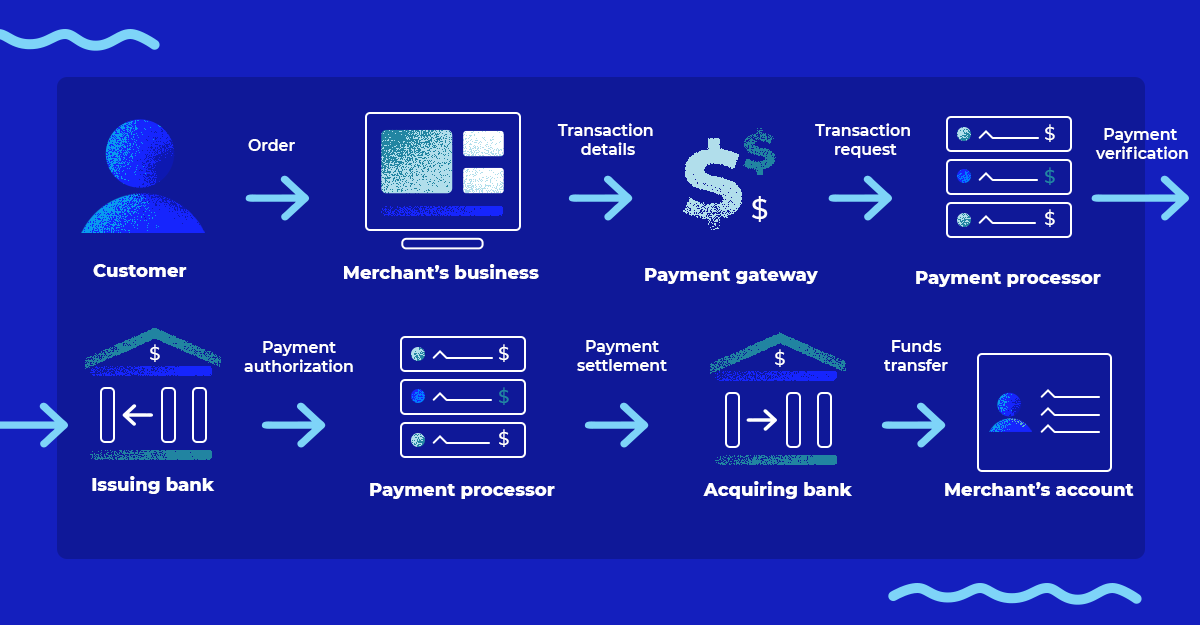

Payment processing is the series of digital communications between banks processing networks and POS systems that make it possible for your business to accept non cash payments In short if you want to accept payments via credit cards virtual wallets and more you ll need to implement payment processing Find the average number of transactions per month with 10 000 150 or about 67 monthly transactions Because the fee you pay for each transaction is 7 multiply 07 by 67 to find that you will pay about 5 in per transaction fees per month Then add up all the scheduled monthly fees and the annual fee of 170 12

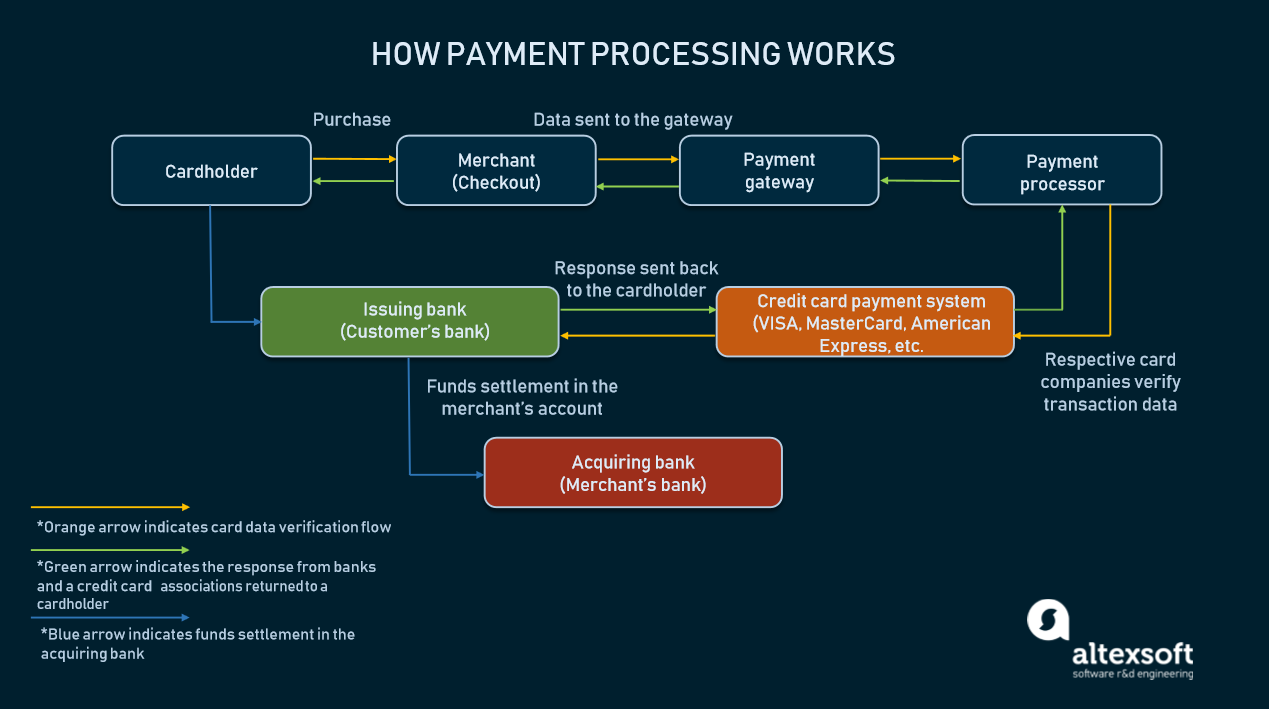

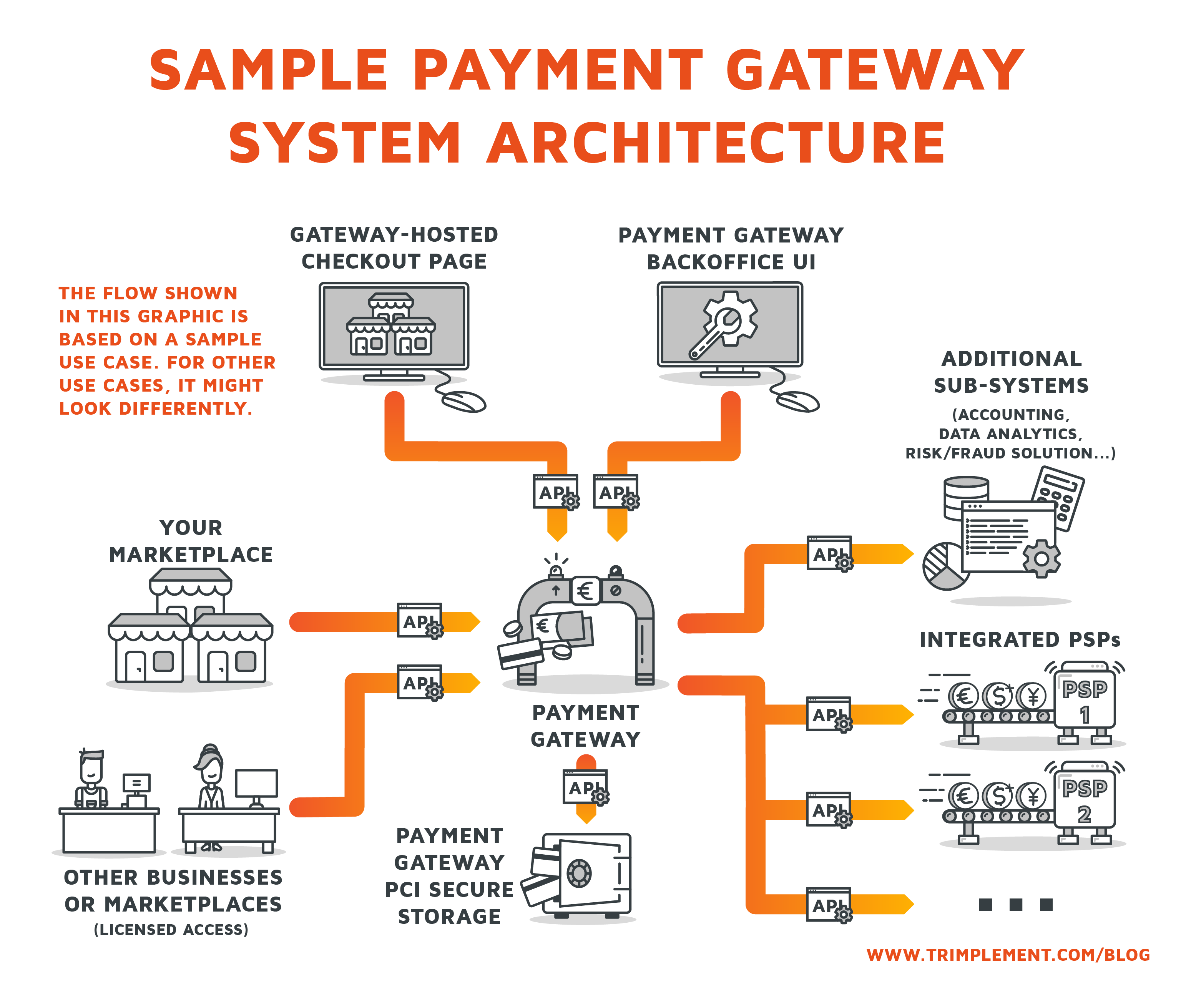

A payment processor or payment processing provider is a company that oversees the transaction process on behalf of the acquiring bank A payment processor s responsibilities include tasks such as communicating with payment networks obtaining authorization and managing the settlement process Payment processing is the orchestrated series of steps that occur behind the scenes when a customer initiates a transaction whether it s purchasing a product subscribing to a service or making a donation This multifaceted process involves collecting payment information securely transmitting it verifying the transaction s authenticity and

Download What Is Payment Processing System

More picture related to What Is Payment Processing System

How Online Credit Card Processing Works Online Payment Processing By

https://www.corporatetools.com/wp-content/uploads/2020/06/CT-credit-card-process.jpg

Payments SRK Residential Communities

https://srkresidentialcommunities.com/wp-content/uploads/2022/04/Understanding-The-Card-Payment-Processor.png

Who s Involved In Credit Card Processing DirectPayNet

https://directpaynet.com/wp-content/uploads/2020/11/Payment-cycle-scaled.jpg

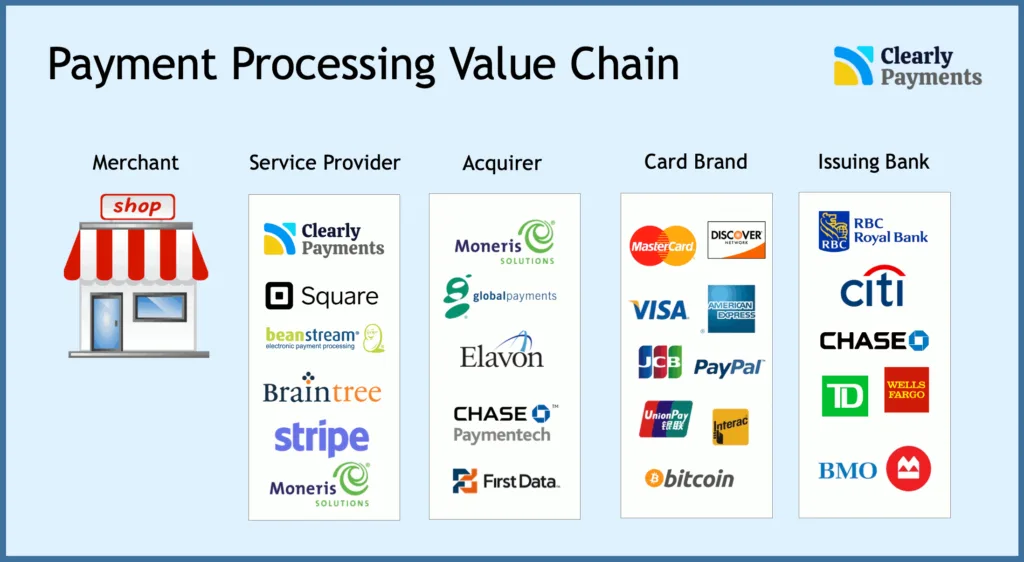

A payment processor or payment facilitator acts as a mediator between a merchant and a financial institution authorizing transactions and facilitating the transfer of funds Some options for providers include Shopify Square Paysafe In conclusion comprehensive payment processing is indispensable for businesses aiming to thrive in today s digital landscape By grasping the various transaction types steps involved and key players that makeup payment processing systems merchants can optimize operations Choosing a processor with solid customer service

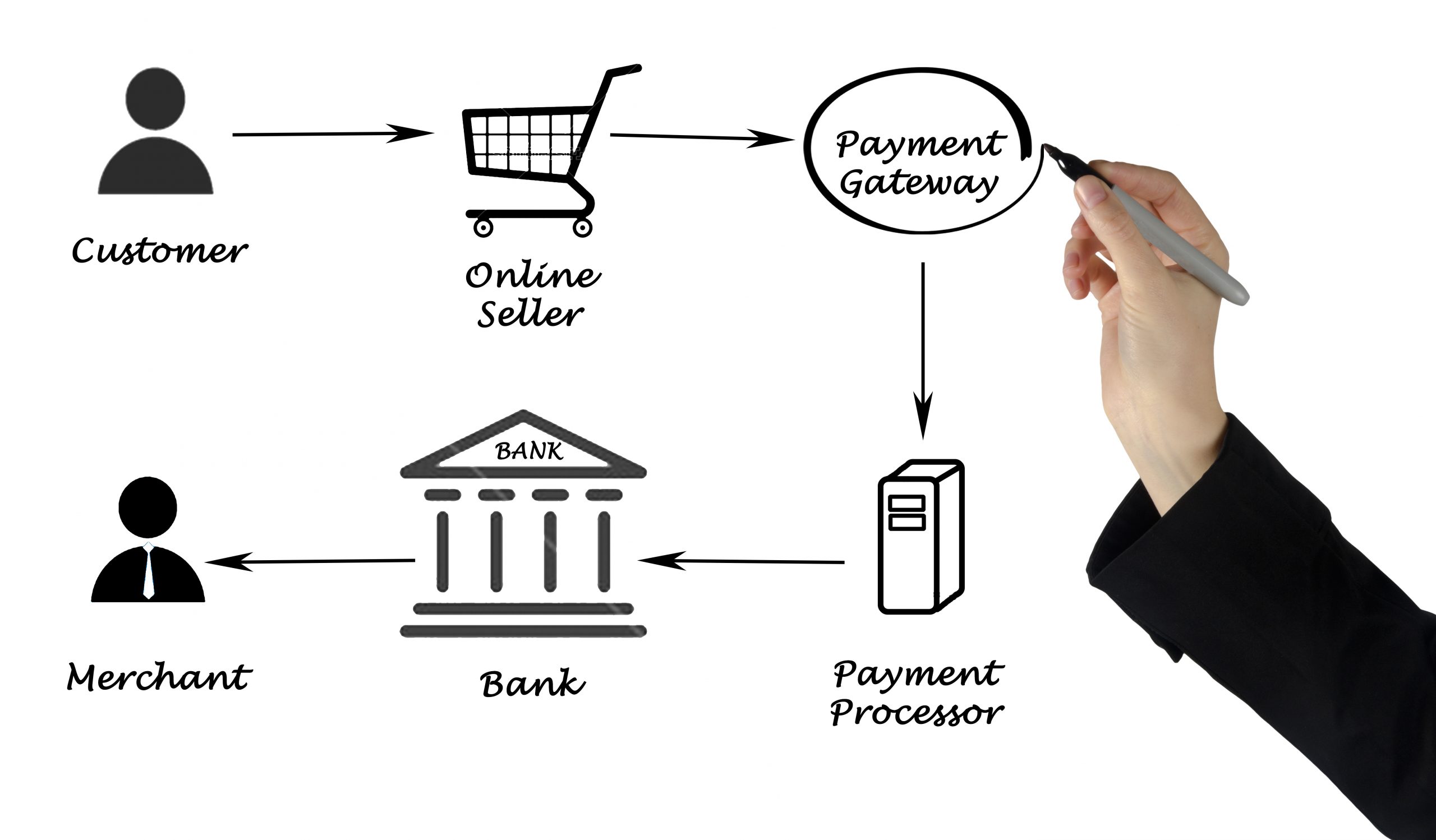

Payment processing is the system that allows businesses to accept electronic payments including debit and credit card transactions Payment processing consists of two parts A payment gateway that securely transmits a customer s payment information to financial institutions A payment processor or vendor that transfers A payment processor refers to the company or system that manages a transaction on a business s behalf It serves as the middleman between the parties involved in that transaction typically the merchant and customer When a customer wishes to make a card payment their financial details usually follow this process

Payments 101 How Online Payment Processing Works Rapyd

https://www.rapyd.net/wp-content/uploads/2021/04/Online-Payment-Process.png

E Commerce Payment Processing An Essential Guide For Online Sellers

https://uploads-ssl.webflow.com/60f7a163ec04fe91d0ed6051/627e785cd6ede8e9557ba731_D7HqNuhbzDe2PBzlQVKtpx3-g9DsJ_ppdiheLqrfuuRPiL3NjYW9CVFUmHyldo1413f7CZ9z_-gg_bWgR2Na52hXKGPIiYc6bMsR2qiZzFhbM2Flub7BdG3OTcFtwJma3ix5ppMu3b58NKE_xQ.png

https://stripe.com/resources/more/payment-processing-explained

Payment processing systems cater to various types of transactions including credit and debit cards electronic funds transfers EFTs automated clearing house ACH transfers mobile payments digital wallets and cryptocurrencies A diverse set of stakeholders including banks financial institutions payment processors technology

https://en.wikipedia.org/wiki/Payment_system

A payment system is any system used to settle financial transactions through the transfer of monetary value This includes the institutions payment instruments such as payment cards people rules procedures standards and

12 Hotel Credit Card Processors To Streamline Payments In 2024 The

Payments 101 How Online Payment Processing Works Rapyd

Payment Card Tokenization Payments Cards Mobile

Ecommerce Module 3 Mentoring With Voyagine

Demystifying Payment Processing Armstrong One Wire s Checking Account

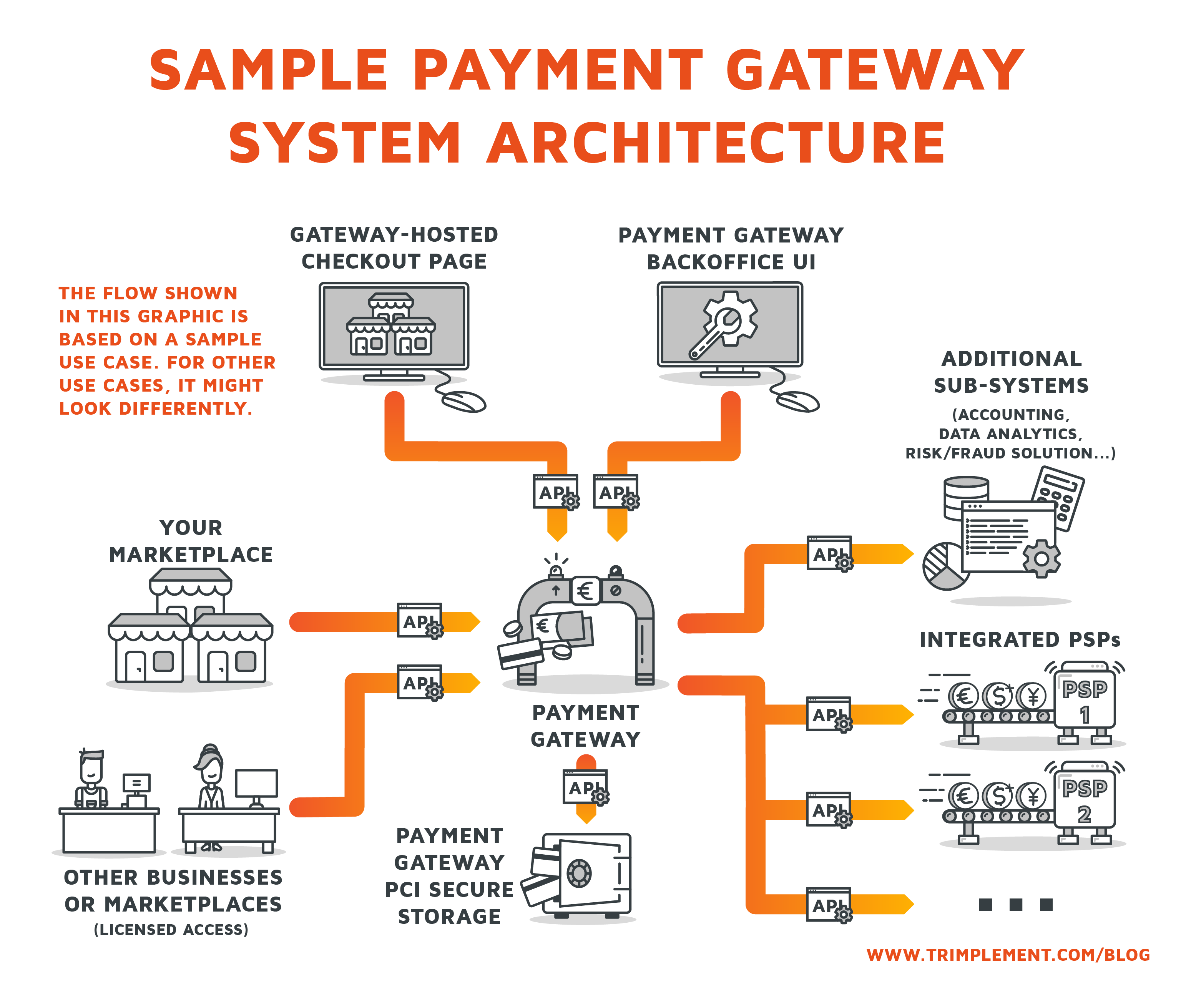

System Design Payment System Systemdesign

System Design Payment System Systemdesign

Payment System Design Architecture Captions Tempo

Payment Processing Companies For Startups Code Pepper

Credit Card Processing Fees And Rates Explained Riset

What Is Payment Processing System - A payment processing system is the technology and processes used to handle these transactions It includes everything from when customers input their payment details to when the funds are deposited into your account This system can vary depending on whether the transaction is made in person online or through other