What Is Personal Property Tax In Georgia This report examines the personal property tax system in Georgia The purpose of the report is to provide information on the structure of the current personal property tax system

Taxpayer return value Georgia Law O C G A 48 5 6 requires the taxpayer to return property at its fair market value If the values indicated from Schedules A B or C do not in your opinion Property taxes are normally due December 20 in most counties but some counties may have a different due date Taxpayers have 60 days from the date of billing to pay their property taxes

What Is Personal Property Tax In Georgia

What Is Personal Property Tax In Georgia

https://img.hechtgroup.com/is_a_warehouse_tangible_personal_property.png

0 Property Tax In Georgia YouTube

https://i.ytimg.com/vi/1_zXBiO8mb4/maxresdefault.jpg

What Is Personal Property Tax And Why Do Businesses Need To Pay It

https://legalinquirer.com/wp-content/uploads/2023/01/What-Is-Personal-Property-Tax.jpg

Everything that is moveable inside or outside of the Short Term Rental Property is considered personal property This includes All appliances Any and all kitchen wares used to provide the What Is Personal Property Personal Property consists of Any furniture fixtures machinery equipment inventory etc used in a business Any other personal property used in business

This guide provides a comprehensive overview of personal property taxes in Georgia equipping property owners with essential knowledge to navigate this crucial aspect of real estate Does everyone have to pay tax on business personal property No If the Fair Market Value of ALL business assets and any boats motors and aircraft of a tax payer does not exceed

Download What Is Personal Property Tax In Georgia

More picture related to What Is Personal Property Tax In Georgia

Property Tax Receipt November 30 1896 UNT Digital Library

https://digital.library.unt.edu/ark:/67531/metapth198866/m1/1/high_res/

Perdue Proposes Eliminating Georgia State Income Tax 11alive

https://media.11alive.com/assets/WXIA/images/ad192733-1f1d-4626-ae4d-c09db200a37e/ad192733-1f1d-4626-ae4d-c09db200a37e_1920x1080.jpg

Hecht Group The Process Of Appealing Your Property Taxes In California

https://img.hechtgroup.com/how_to_request_a_lower_commercial_property_tax_in_california.png

Individuals renting out residential property shall file a personal income tax return by March 31st of the year following the accounting year Legal entities must file property taxes by March 31st of the year following the reporting period Taxes on Personal Property Personal property in the State of Georgia is generally defined as any movable property that is property that is not permanently affixed to and part of real estate

Georgia Tax Law O C G A 48 5 specifies that the owner of the personal property i e business assets inventory planes boats and watercraft on January 1 of the tax year is responsible for Property taxes are paid annually in the county where the property is located A homestead exemption can give you tax breaks on what you pay in property taxes While the state sets a

Should You Pay Your Commercial Property Taxes Early Hegwood Group

https://www.hegwoodgroup.com/wp-content/uploads/2022/11/pay-commercial-property-taxes-in-the-fall.jpg

How High Are Property Taxes In Your State Tax Foundation

https://files.taxfoundation.org/20200813112019/property-taxes-by-state-2020-FV-01-1024x868.png

https://cslf.gsu.edu › files › taxation_of...

This report examines the personal property tax system in Georgia The purpose of the report is to provide information on the structure of the current personal property tax system

https://dor.georgia.gov › document › form

Taxpayer return value Georgia Law O C G A 48 5 6 requires the taxpayer to return property at its fair market value If the values indicated from Schedules A B or C do not in your opinion

Hecht Group Georgia State University s Exemption From Property Taxes

Should You Pay Your Commercial Property Taxes Early Hegwood Group

Property Tax Willowick Ohio

Hecht Group Paying Real Property Taxes In Bulacan A Step By Step Guide

The Rise Of Residential Property Tax In Arizona Klauer Law

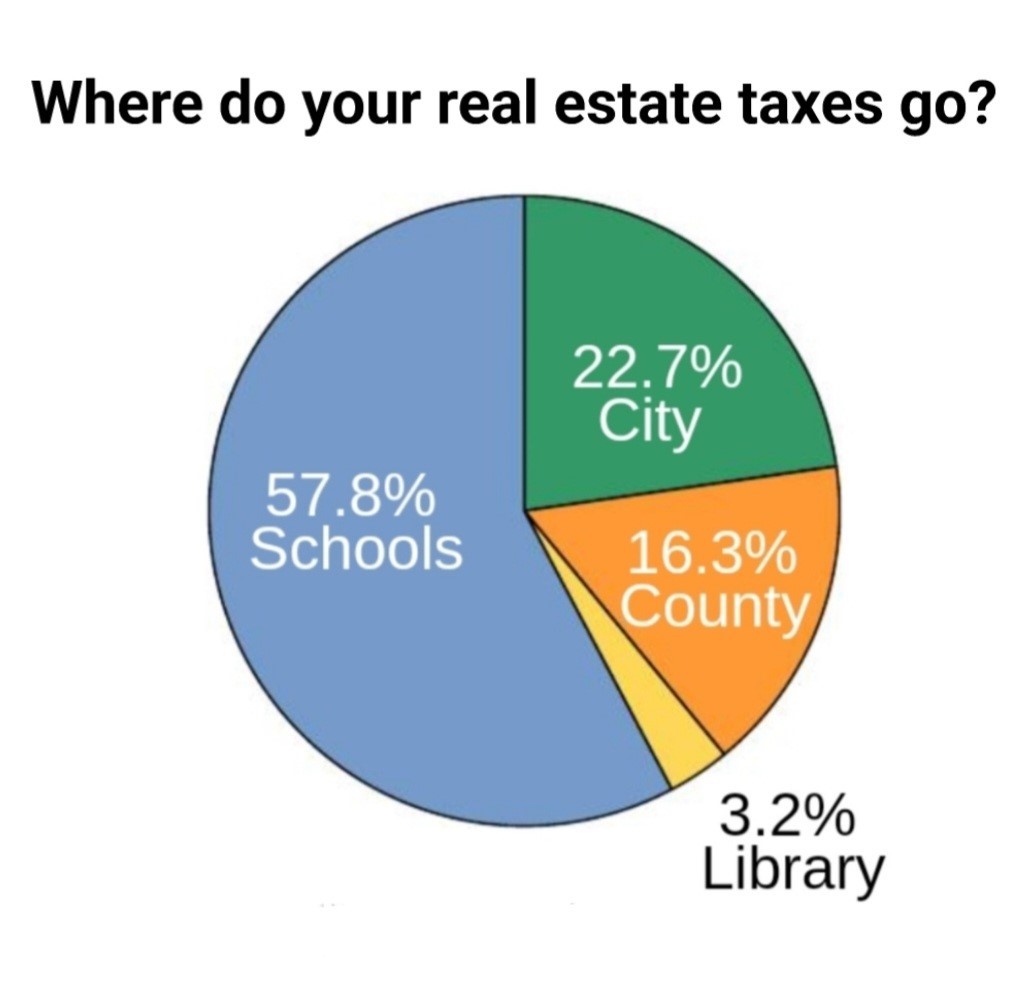

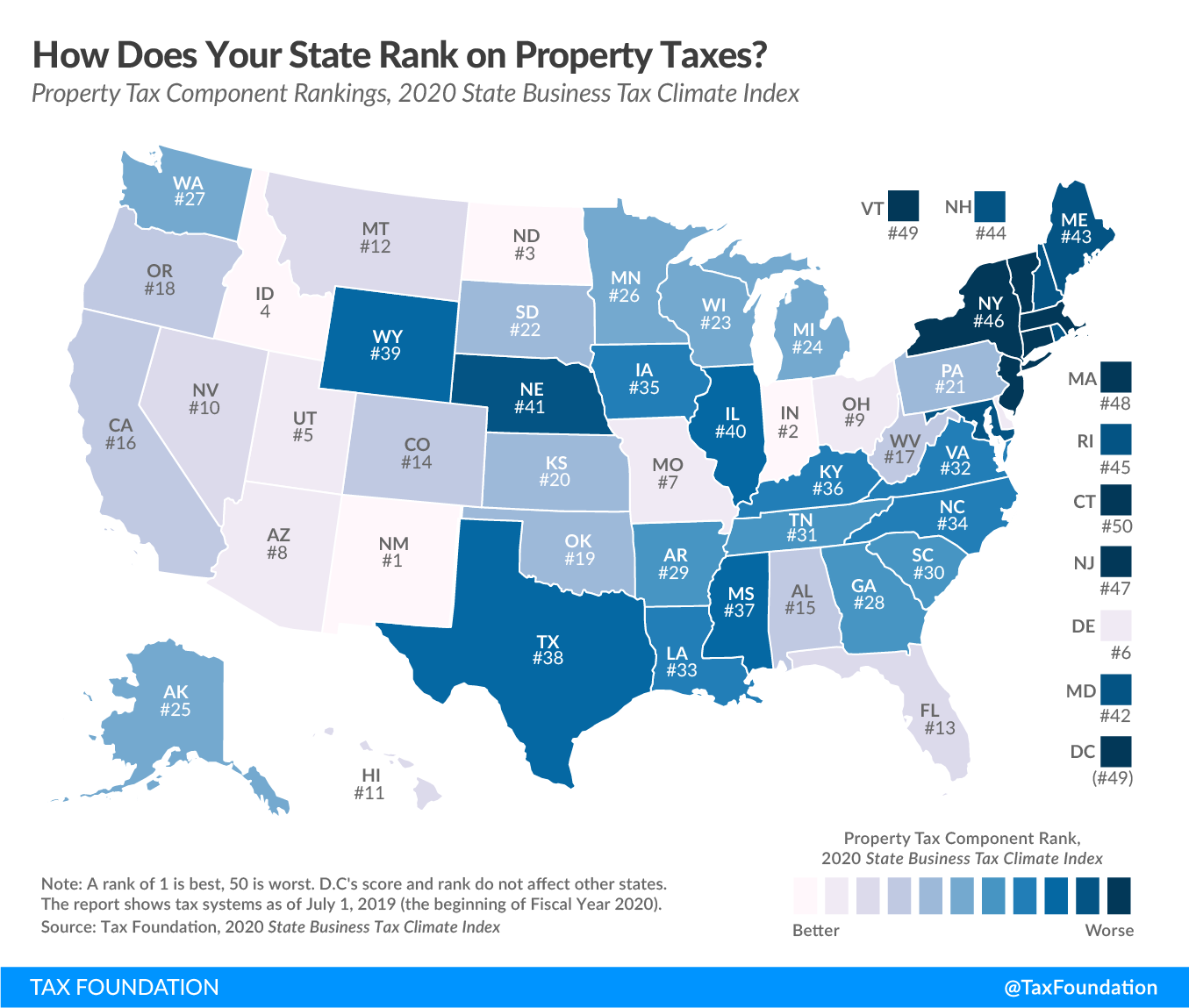

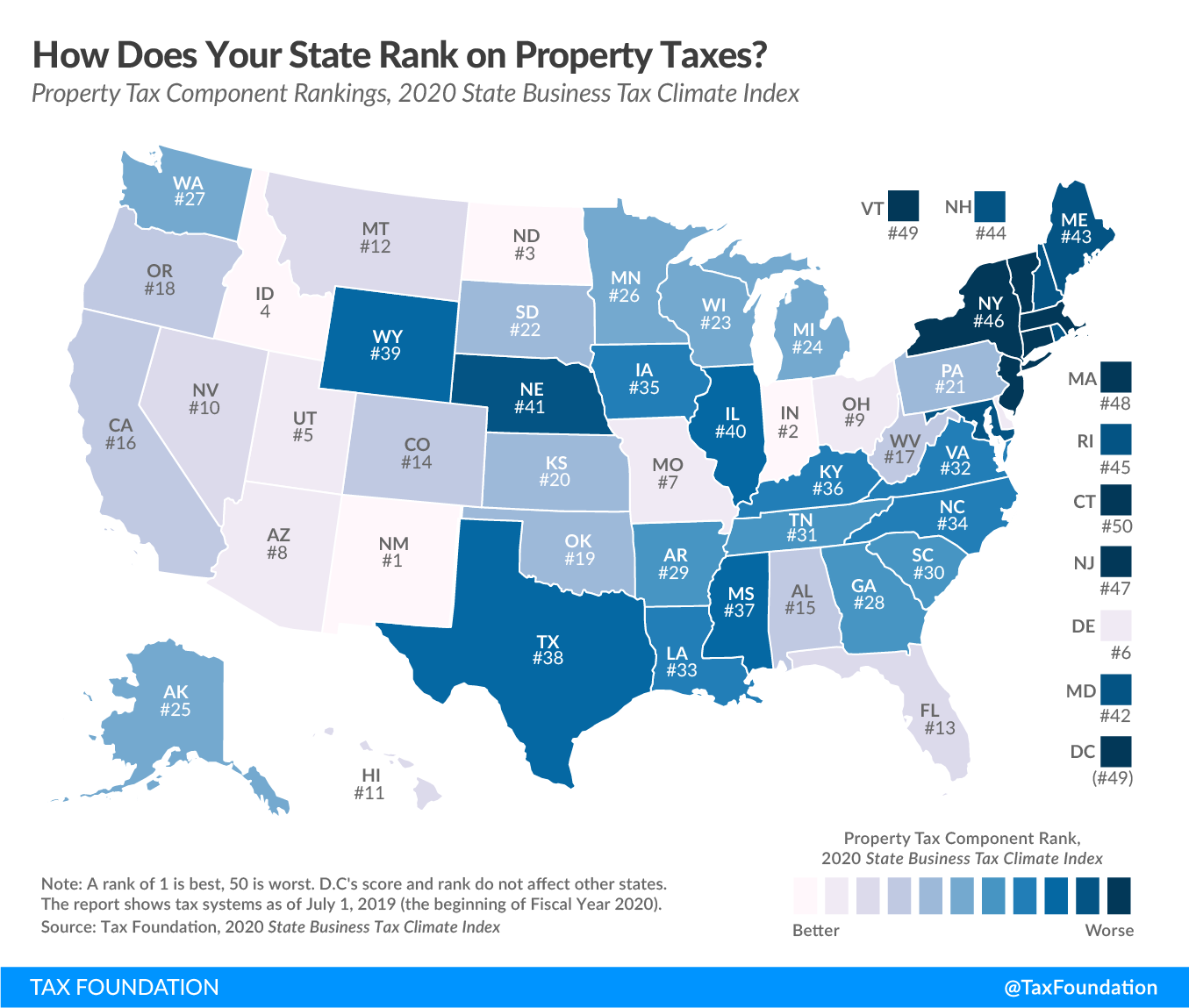

Ranking Property Taxes On The 2020 State Business Tax Climate Index

Ranking Property Taxes On The 2020 State Business Tax Climate Index

Tax Aspects Of Leasing In Georgia

Getting To Know Georgia Property Taxes WCH Homes

How Much Does Your State Collect In Property Taxes Per Capita

What Is Personal Property Tax In Georgia - Everything that is moveable inside or outside of the Short Term Rental Property is considered personal property This includes All appliances Any and all kitchen wares used to provide the