What Is Personal Property Tax In Kansas Taxes are collected at the end of the year for items owned on January 1 of that year or pro ratable items purchased prior to September 1 of that year Kansas law makes

Kansas law states that all real property and personal property in this state not expressly exempt is subject to taxation All tangible personal property owned as of January 1st What personal property is taxable Article 11 Section 1 of The Kansas Constitution provides that Tangible personal property shall be classified into six subclasses and

What Is Personal Property Tax In Kansas

What Is Personal Property Tax In Kansas

https://legalinquirer.com/wp-content/uploads/2023/01/What-Is-Personal-Property-Tax.jpg

Property Tax Receipt November 30 1896 UNT Digital Library

https://digital.library.unt.edu/ark:/67531/metapth198866/m1/1/high_res/

Hecht Group The Process Of Appealing Your Property Taxes In California

https://img.hechtgroup.com/how_to_request_a_lower_commercial_property_tax_in_california.png

K S A 79 306 requires all taxable personal property to be listed by the taxpayer on a rendition also referred to as a statement of personal property and filed with the What is Personal Property Personal property is every tangible thing which is the subject of ownership not forming part of a parcel of real property K S A 79 102

What personal property is taxable How is personal property classified and assessed in Kansas Kansas personal property is classified by the Kansas Constitution and Why is personal property taxed in Kansas Tax dollars are used by local government to provide funding for roads parks fire protection police protection health and other

Download What Is Personal Property Tax In Kansas

More picture related to What Is Personal Property Tax In Kansas

Should You Pay Your Commercial Property Taxes Early Hegwood Group

https://www.hegwoodgroup.com/wp-content/uploads/2022/11/pay-commercial-property-taxes-in-the-fall.jpg

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

Hecht Group Paying Real Property Taxes In Bulacan A Step By Step Guide

https://img.hechtgroup.com/1662839570804.jpg

What is Personal Property Kansas property tax law requires that all property be taxed uniformly and equally as to class and unless otherwise specified be valued at its fair What is personal property Personal property is every tangible thing which is the subject of ownership not forming part or parcel of real property K S A 79 102 2

While the typical homeowner in Kansas pays just 2 445 annually in real estate taxes property tax rates are fairly high The state s average effective property tax rate annual What is personal Property A key characteristic of personal property is the ability to move it without damage either to itself or to the real estate to which it is attached

Property Tax May Rise Up To 3 In East Delhi East Delhi Civic Body

https://aquireacres.com/wp-content/uploads/2019/11/Tax-1-2048x1536.jpg

Kansas Sales Tax Sales Tax Kansas KS Sales Tax Rate

https://1stopvat.com/wp-content/uploads/2022/07/1stopVAT_Kansas.png

https://www.jocogov.org/.../property-tax/personal-property-taxes

Taxes are collected at the end of the year for items owned on January 1 of that year or pro ratable items purchased prior to September 1 of that year Kansas law makes

https://www.ksrevenue.gov/pdf/PPVG.pdf

Kansas law states that all real property and personal property in this state not expressly exempt is subject to taxation All tangible personal property owned as of January 1st

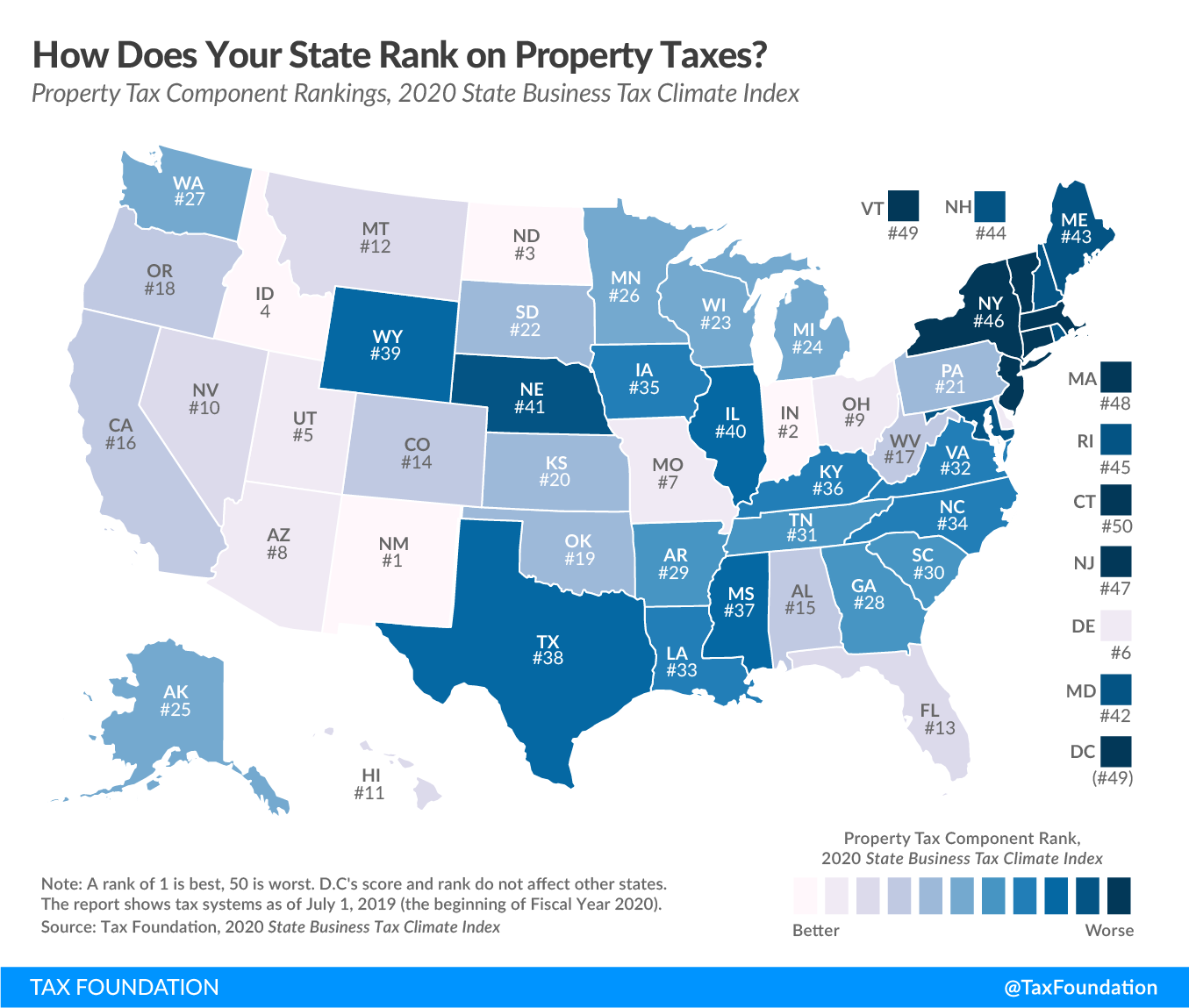

Ranking Property Taxes On The 2020 State Business Tax Climate Index

Property Tax May Rise Up To 3 In East Delhi East Delhi Civic Body

Personal Property Tax SDG Accountants

How Much Does Your State Collect In Property Taxes Per Capita

Hecht Group Do I Have To Pay Personal Property Tax On My Office

How Much Is Property Tax In Miami Hauseit Florida New York

How Much Is Property Tax In Miami Hauseit Florida New York

Hecht Group Can I Pay My Personal Property Taxes Online In Arkansas

Understanding Low Level State Capacity Property Tax Collection In

Kansas Has Some Of The Nation s Highest Property Tax Rates Kansas

What Is Personal Property Tax In Kansas - Homeowners should receive their real estate and personal property tax statements for the current year on or after November 1st but no later then December 15th If only the first