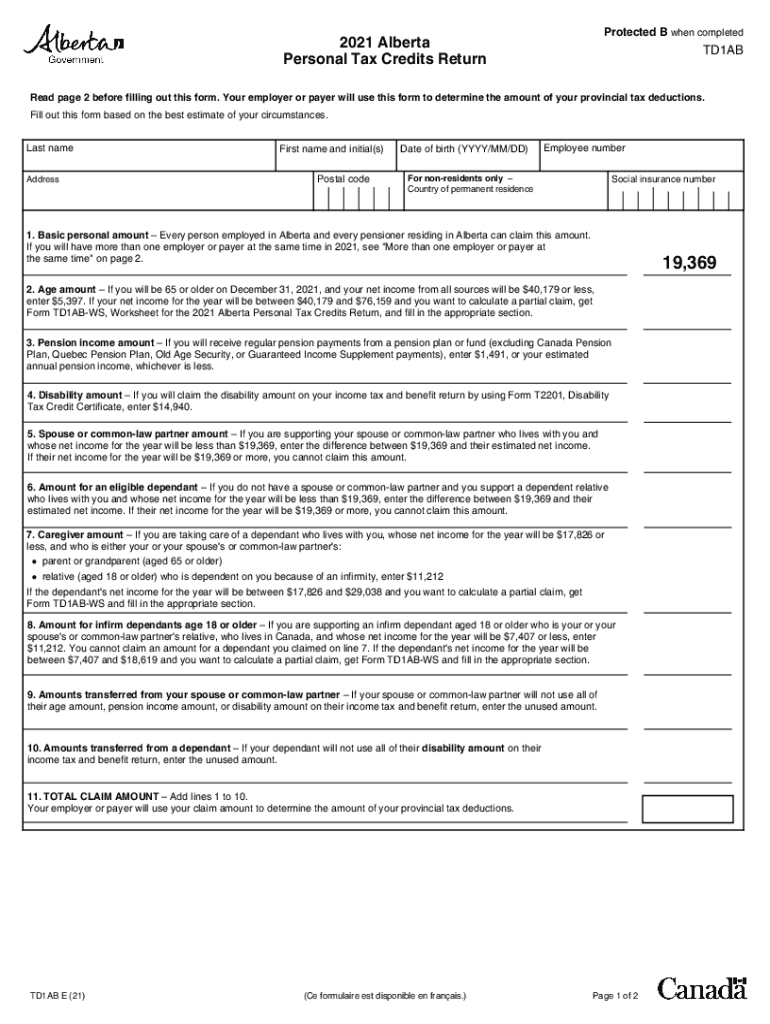

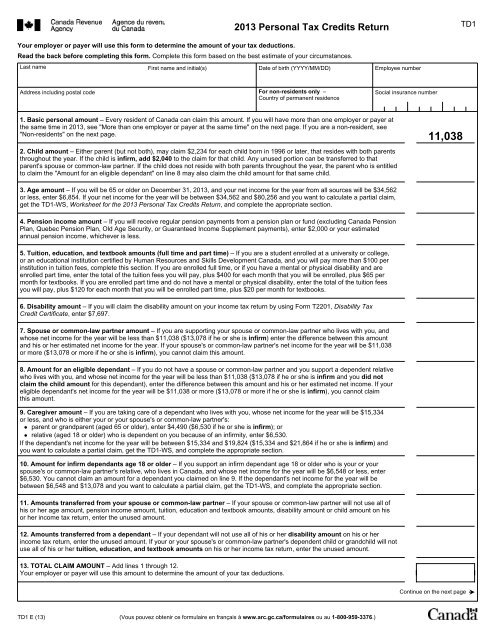

What Is Personal Tax Credit Return Simply put a TD1 Personal Tax Credits Return is a form that is necessary for calculating how much tax should be withheld from payments If you are an employer who has to run payroll in Canada or a pension payer you most likely will be asked to fill this form out to figure out how much tax should be remitted from any payouts to send back to

A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe Tax credits are more favorable than tax deductions because they reduce What is a TD1 tax form The TD1 Personal Tax Credits Return is used to calculate the amount of income tax that will be deducted or withheld from your employment or pension income

What Is Personal Tax Credit Return

What Is Personal Tax Credit Return

https://pbaltd.ca/wp-content/uploads/2016/01/iStock_000061472234_Large.jpg

What Is Personal Property Tax And Why Do Businesses Need To Pay It

https://legalinquirer.com/wp-content/uploads/2023/01/What-Is-Personal-Property-Tax.jpg

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

https://i.ytimg.com/vi/Hg0fOlxqHpU/maxresdefault.jpg

What is a TD1 or Personal Tax Credits Return A TD1 also called a Personal Tax Credits Return is an important tax document issued by the Canada Revenue Agency CRA It must be completed by all employees in an A TD1 federal form officially the Personal Tax Credits Return is used to determine the amount of tax to deduct from your income There are TD1 federal forms and provincial territorial TD1 forms depending on your province or territory of residence

TD1 Personal Tax Credits Returns TD1 forms for 2024 for pay received on January 1 2024 or later A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund Some credits are refundable they can give you money back even if you don t owe any tax To claim credits answer questions in

Download What Is Personal Tax Credit Return

More picture related to What Is Personal Tax Credit Return

TD1 Tax Form Personal Tax Credits Return In Canada 2023 TurboTax

https://turbotax.intuit.ca/tips/images/taxbasics-forms-schedules.jpg

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

What Is A Personal Tax Account KNNLLP

https://www.knnllp.co.uk/wp-content/uploads/2018/11/2017-11-03-608603.jpg

The federal TD1 form is a standard document that every employee resident in Canada must complete It covers the whole of Canada and specifies credits that apply to federal taxes Provincial forms which are labeled with additional letters such as TD1ON for Ontario and TD1NB for New Brunswick are used to claim provincial tax credits A tax credit is a benefit that lowers your taxes owed by the amount of the credit Tax credits can be nonrefundable refundable or partially refundable Some of the most popular tax

When your spouse or partner died and whether you have any dependent children You receive a higher tax credit in the year of bereavement It is the same amount as the married person or civil partner credit You may claim the Widowed Parent Tax Credit for five years if you have dependent children A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

TD1 Personal Tax Credit JoyVancouver

https://joyvancouver.com/wp-content/uploads/2019/08/td1-768x432.jpg

Personal Tax Credit Changes For 2017 Compass Accounting

https://www.compass-cpa.com/wp-content/uploads/2018/03/Axe-6.jpg

https://www.knitpeople.com/blog/td1-form

Simply put a TD1 Personal Tax Credits Return is a form that is necessary for calculating how much tax should be withheld from payments If you are an employer who has to run payroll in Canada or a pension payer you most likely will be asked to fill this form out to figure out how much tax should be remitted from any payouts to send back to

https://www.investopedia.com/terms/t/taxcredit.asp

A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe Tax credits are more favorable than tax deductions because they reduce

IRS How To Avoid A Surprise Tax Bill Before January 17 Marca

TD1 Personal Tax Credit JoyVancouver

Personal Property Tax SDG Accountants

Alberta Tax Form 2023 Printable Forms Free Online

TD1 2013 Personal Tax Credits Return

Personal Tax Accountant Toronto Tax Consultant For Small Business

Personal Tax Accountant Toronto Tax Consultant For Small Business

State Withholding Tax Form 2023 Printable Forms Free Online

Completing A Basic Tax Return Learn About Your Taxes Canada ca

TaxTips ca Canadian Non refundable Personal Tax Credits

What Is Personal Tax Credit Return - A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund Some credits are refundable they can give you money back even if you don t owe any tax To claim credits answer questions in