What Is Quant Elss Tax Saver Fund Quant ELSS Tax Saver Fund Direct Growth has 7 238 Crores worth of assets under management AUM as on 31 12 2023 and is medium sized fund of its

Quant ELSS Tax Saver Fund Growth Regular Direct Category ELSS Fund House Quant Mutual Fund NAV 342 4344 2 32 as on 12th February Quant ELSS TAX SAVER FUND Open Ended ELSS Regular Plan Option Growth NAV as on 02 Feb 2024 346 15 KNOW MORE In Indian mutual funds Quant

What Is Quant Elss Tax Saver Fund

What Is Quant Elss Tax Saver Fund

https://i.ytimg.com/vi/c7LO0Y4oB2Q/maxresdefault.jpg

The Ultimate Investment Guide To Best ELSS Funds Of 2019 Scripbox

https://content3.scripbox.com/content/attachment/3563/ELSS.jpg

Is The Quant Tax Plan ELSS Mutual Fund Good For The Long Term 5 Years

https://qph.cf2.quoracdn.net/main-qimg-4c5fc5bc7a62f09ec24b3082f7404a83-pjlq

The Quantum ELSS Tax Saver Fund QETSF invests in equities and also allows you to save tax u s 80 C of the Income Tax Act Please note that your Quantum ELSS Tax Saver Fund Previously called Quantum Tax Saving Direct G Equity Elss NAV as of Feb 09 2024 108 26 0 01 1D change Returns since

1 Current NAV The Current Net Asset Value of the Quant ELSS Tax Saver Fund as of Feb 09 2024 is Rs 350 58 for Growth option of its Regular plan 2 Returns Quantum ELSS Tax Saver Regular Plan Overview Performance Portfolio Mutual Fund Value Research Quantum ELSS Tax Saver Regular Plan Equity

Download What Is Quant Elss Tax Saver Fund

More picture related to What Is Quant Elss Tax Saver Fund

What Is ELSS Meaning Features Of This Tax Saving Mutual Fund Fintrakk

https://blogassets.fintrakk.com/uploads/2018/07/ELSS-funds-1-1024x683.png

Samco Mutual Fund Introduces A Differentiated ELSS Tax Saver Fund

https://www.equitybulls.com/equitybullsadmin/uploads/Samco ELSS Tax Saver Fund NFO.jpg

ELSS Funds Meaning Types Advantages How To Invest

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/07/elss-funds.jpg

1Y 3Y 5Y All Return calculator Monthly SIP One Time 5 000 per month Over the past 1 year 3 years 5 years Total investment of 0 Would have become 0 0 00 Fund Details quant ELSS TAX SAVER FUND The investment objective of the Scheme is to generate Capital Appreciation by investing predominantly in a

SAVER Under Section 80C of the Income Tax Act investments in tax saving or planning mutual funds qualify for tax deductions of up to Rs 1 5 lakh in a financial year The minimum SIP amount for Quant ELSS Tax Saver fund G is 500 and you can increase this in multiples of 100 In case you want to invest a lump sum the minimum

What Is Alpha And Beta In Mutual Funds Calculate Ratio

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2022/08/alpha-and-beta-in-mutual-funds-image.jpg

Mutual Funds India Quant Fund Quant Investments Quant AMC

https://www.quantmutual.com/images/Value-Logo.jpg

https://www.etmoney.com/mutual-funds/quant-elss...

Quant ELSS Tax Saver Fund Direct Growth has 7 238 Crores worth of assets under management AUM as on 31 12 2023 and is medium sized fund of its

https://www.moneycontrol.com/mutual-funds/nav/quant-tax-plan/MES003

Quant ELSS Tax Saver Fund Growth Regular Direct Category ELSS Fund House Quant Mutual Fund NAV 342 4344 2 32 as on 12th February

IIFL ELSS Nifty 50 Tax Saver Fund Best Index Fund ELSS Tax Saver

What Is Alpha And Beta In Mutual Funds Calculate Ratio

ELSS Mutual Fund Vs Other 80C Investments Why ELSS Is The Best Tax

Mirae Asset Tax Saver Fund Direct Growth ELSS Tax Saving Mutual

ELSS Tax Saving Mutual Funds Top 7 Reasons Why You Should Invest

Is The Quant Tax Plan ELSS Mutual Fund Good For The Long Term 5 Years

Is The Quant Tax Plan ELSS Mutual Fund Good For The Long Term 5 Years

ELSS Vs Equity Mutual Fund Which Is Better To Invest

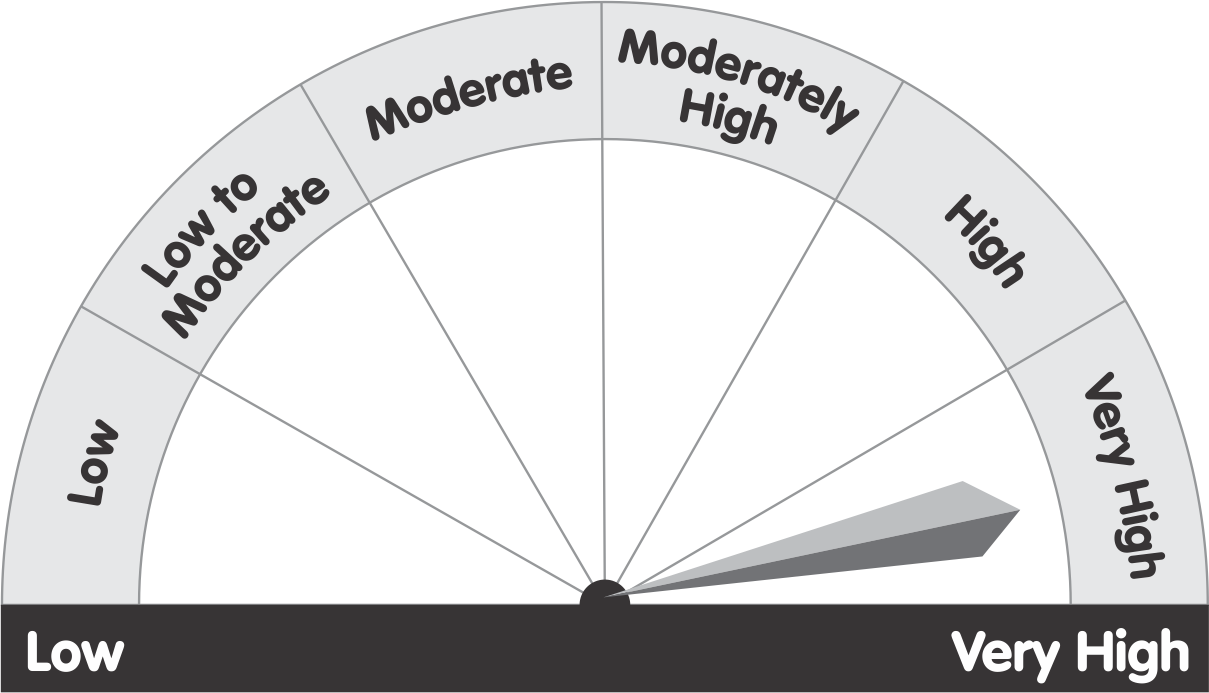

Riskometer

New To Equity Mutual Funds Start With ELSS Funds

What Is Quant Elss Tax Saver Fund - Quantum ELSS Tax Saver Fund Regular Plan Growth Option INF082J01366 Quote There is no data available for this component Overview Portfolio Detailed Portfolio