What Is Real Property Tax Exemption A property tax exemption reduces the taxable value of your property which can significantly decrease your tax bill All property owners homeowners

Beginning tax year 2024 2025 the home exemption will be 120 000 for homeowners under the age of 65 as well as for homeowners who do not have their birthdate on file A senior property tax exemption is a program that provides eligible senior citizens with a reduction in their property taxes to help alleviate the financial burden of

What Is Real Property Tax Exemption

What Is Real Property Tax Exemption

http://theshoppersweekly.com/wp-content/uploads/2018/04/tax-1.jpg

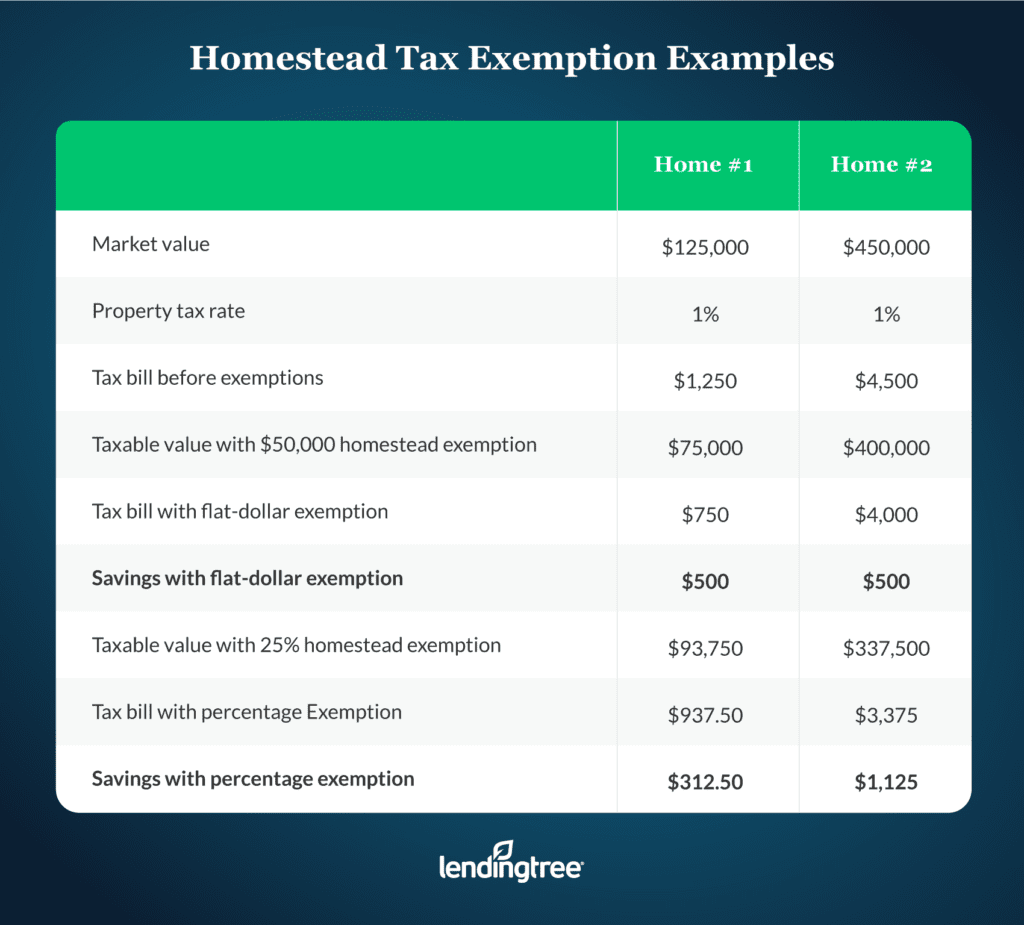

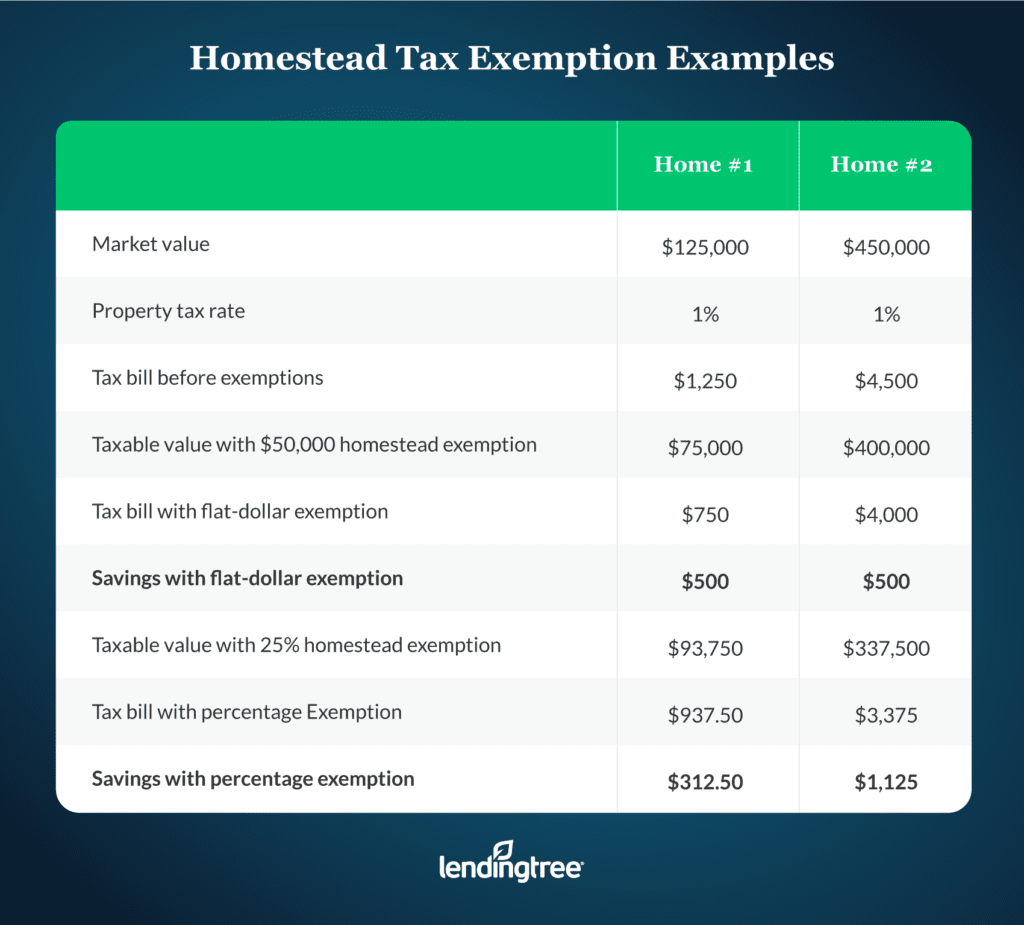

What Is A Homestead Exemption And How Does It Work LendingTree

https://www.lendingtree.com/content/uploads/2020/12/Homestead-Tax-Exemption-Examples-1024x925.png

Fillable Form Dte 23 Application For Real Property Tax Exemption And

https://data.formsbank.com/pdf_docs_html/343/3433/343306/page_1_thumb_big.png

In many states home and property owners above a certain age can receive a property tax exemption The specific details regarding the cutoff age and other How do I use my exemption The exemption amount may be applied to next year s tax bill on real property you own This amount will be reflected on your property tax bill mailed

Homestead tax exemptions shelter a certain dollar amount or percentage of home value from property taxes They re called homestead exemptions because they apply to primary residences not A property tax exemption is the elimination of some or all of the property taxes you owe A property may be eligible for exemption in a few different ways

Download What Is Real Property Tax Exemption

More picture related to What Is Real Property Tax Exemption

FREE 10 Sample Tax Exemption Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2016/11/Property-Tax-Exemption-Form.jpg

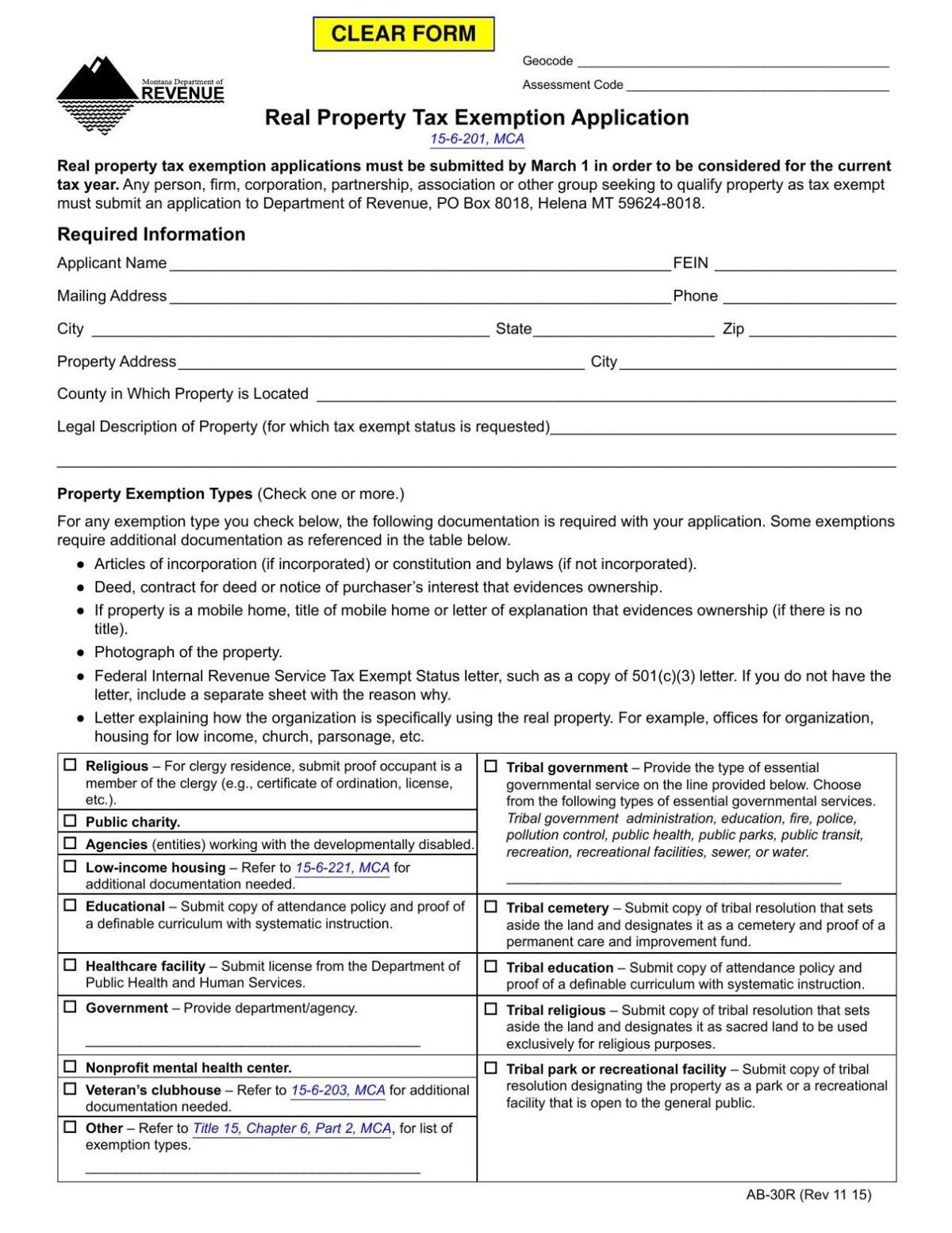

Real Property Tax Exemption Application Form AB 30R

https://bloximages.chicago2.vip.townnews.com/helenair.com/content/tncms/assets/v3/editorial/4/f7/4f7bd08d-b431-566e-98ac-193bf7623715/565e66ec34a60.preview.jpg?resize=1200%2C1554

Texas Property Taxes Homestead Exemption Explained Carlisle Title

https://www.carlisletitle.com/wp-content/uploads/2019/02/TexasPropertyTaxesHomestead2.jpg

Property tax exemption programs The Nevada Legislature provides for property tax exemptions to individuals meeting certain requirements Some of these include There is a 300 minimum real property tax as taxpayers are not completely exempt from paying a tax on real property except Public Service properties Sec 8 10 27 or Low

The homeowners property tax exemption is a tax relief program that alleviates the property tax burden for individuals who own a property and use it as their While all 50 states offer some sort of property tax exemptions for disabled veterans our new research and analysis uncovered 20 states with no property tax for

Understanding Property Tax Treasurer Tax Collector

http://sftreasurer.org/sites/default/files/2019-07/PT_Sample Bill_07-01-19.jpg

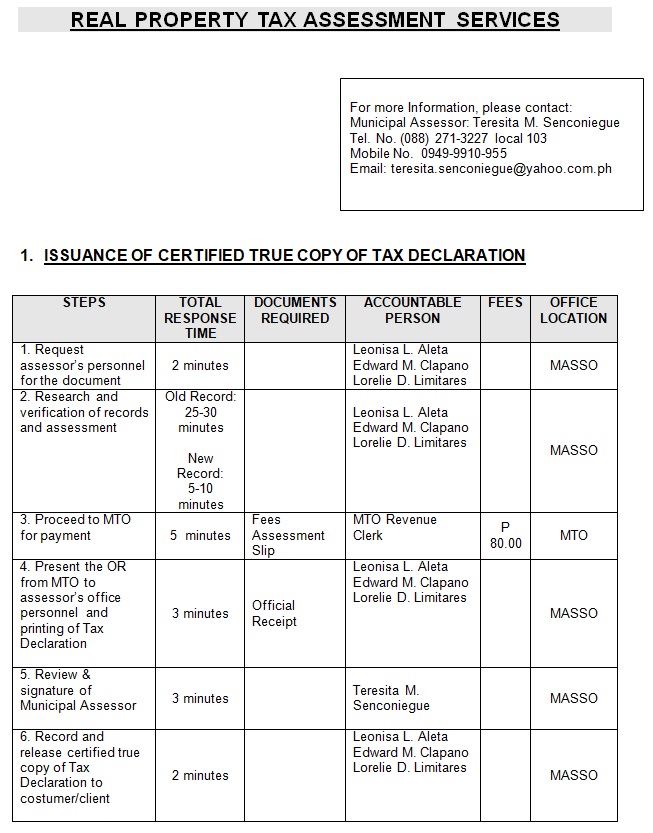

REAL PROPERTY TAX ASSESSMENT SERVICES

http://www.calambamisocc.gov.ph/images/Citizens_Charter_2016/ASES.jpg

https://www.taxfyle.com/blog/property-tax-exemptions

A property tax exemption reduces the taxable value of your property which can significantly decrease your tax bill All property owners homeowners

https://realpropertyhonolulu.com/tax-relief-and...

Beginning tax year 2024 2025 the home exemption will be 120 000 for homeowners under the age of 65 as well as for homeowners who do not have their birthdate on file

Certificate Of TAX Exemption PAFPI

Understanding Property Tax Treasurer Tax Collector

Texas Homestead Tax Exemption Cedar Park Texas Living

Easy Way In Filing Real Property Tax TAXGURO

How To Apply For Senior Property Tax Exemption In California PRORFETY

Real Property Tax In The Philippines Important FAQs Lamudi

Real Property Tax In The Philippines Important FAQs Lamudi

Pihak Berkuasa Tempatan Pengerang

How High Are Property Taxes In Your State

Everything You Need To Know About Real Property Tax In The Philippines

What Is Real Property Tax Exemption - How do I use my exemption The exemption amount may be applied to next year s tax bill on real property you own This amount will be reflected on your property tax bill mailed