What Is Rebate Limit In Tax Section 87 A provides that anyone who is residing in India and whose income does not exceed Rs 5 00 000 is eligible to claim a rebate Thus full income tax rebate is available to individuals with less than Rs 5 Lakh of total

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount Rebate under section 87A will be lower of 100 of income tax liability or Rs 2 500 In other words if the tax liability exceeds Rs 2 500 rebate will be available to the

What Is Rebate Limit In Tax

What Is Rebate Limit In Tax

https://cljgives.org/wp-content/uploads/2017/08/20170809-MM0000809-rebates.png

How To Construct A Through Rebate Joint YouTube

https://i.ytimg.com/vi/WnG23WfOQqc/maxresdefault.jpg

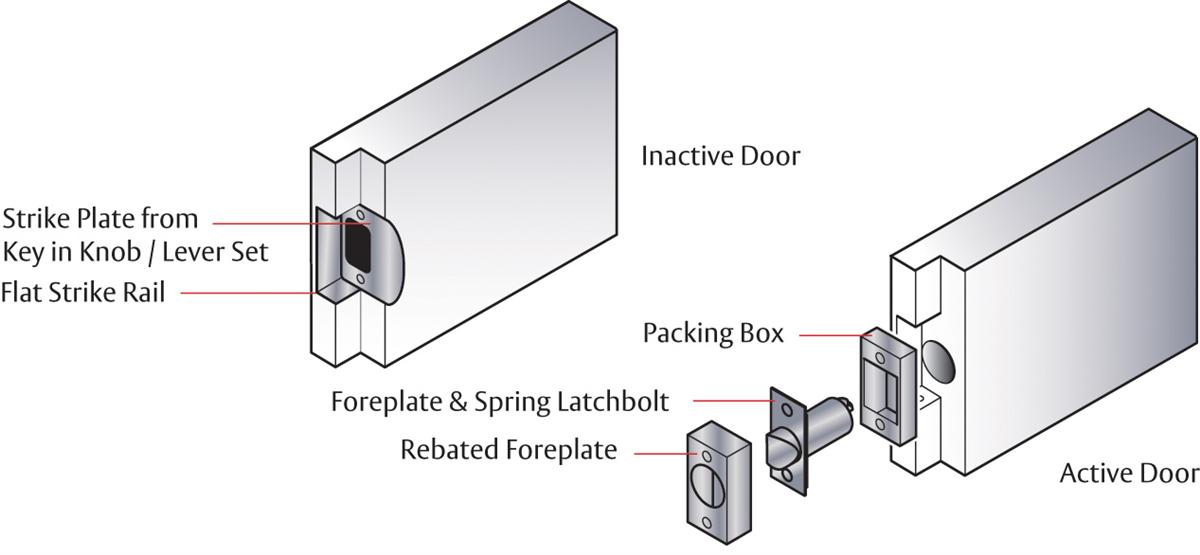

Lockwood Symmetry Series Universal Rebate Kit LOCKWOOD

https://www.lockweb.com.au/au/en/product-assets/door-locks/locksets/symmetry-series-universal-rebate-kit/assets/images/cbadc-130426071256135.jpg

Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of up to 12 500 or the total tax payable in an assessment 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an individual

What is Income Tax Rebate U S 87A Under the old tax regime a rebate u s 87A is provided if your taxable income does not exceed Rs 5 00 lacs in a financial year You will be eligible for a tax rebate of Rs 12 500 or the The Ontario government says it will send a 200 rebate cheque to roughly 15 million people in the province election and the decision to provide the tax free rebates These are tax dollars

Download What Is Rebate Limit In Tax

More picture related to What Is Rebate Limit In Tax

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully

https://i.ytimg.com/vi/R8TJaxFoAE8/maxresdefault.jpg

Menards Price Adjustment Rebate Form October 2022 RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/menards-price-adjustment-rebate-form-october-2022.jpg?resize=1536%2C1510&ssl=1

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

The maximum rebate under section 87A for AY 2024 25 FY 2023 24 is 25 000 under the new tax regime and 12 500 under the optional tax regime This rebate is applicable under section Rebate under section 87A provides a tax benefit to an individual taxpayer if his total taxable income does not exceed the threshold limit of 5 00 000 under the old tax regime and 7 00 000 under the new tax regime

Tax rebate under Section 87A is available for both old and new tax regimes for Financial Year 2021 2022 The assessment Year 2022 2023 The limit remains the same i e What is income tax rebate A tax rebate is a refund you are eligible for if the tax you have paid exceeds your tax liability You can avail of a refund every financial year You

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

https://cleartax.in › income-tax-slabs

Section 87 A provides that anyone who is residing in India and whose income does not exceed Rs 5 00 000 is eligible to claim a rebate Thus full income tax rebate is available to individuals with less than Rs 5 Lakh of total

https://tax2win.in › guide

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount

Income Tax Rebate Under Section 87A

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Consumer Rebates Are You Getting Your Fair Share A Rebate Is An

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

Section 87A Tax Rebate Under Section 87A Rebates Financial

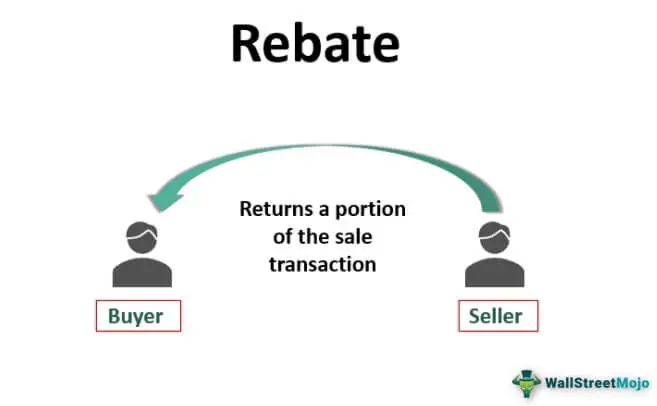

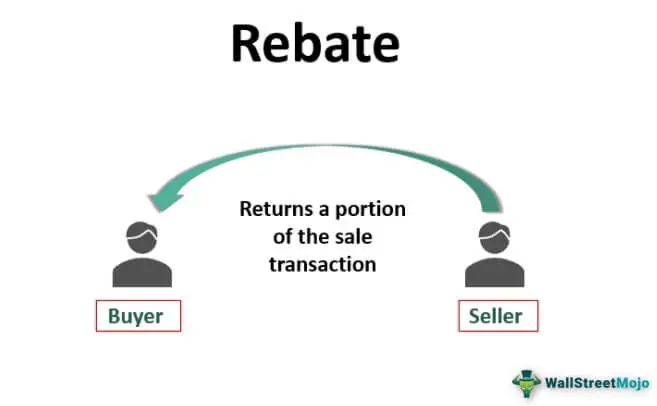

Rebate What Is It Example Vs Discount Types Regulations

Rebate What Is It Example Vs Discount Types Regulations

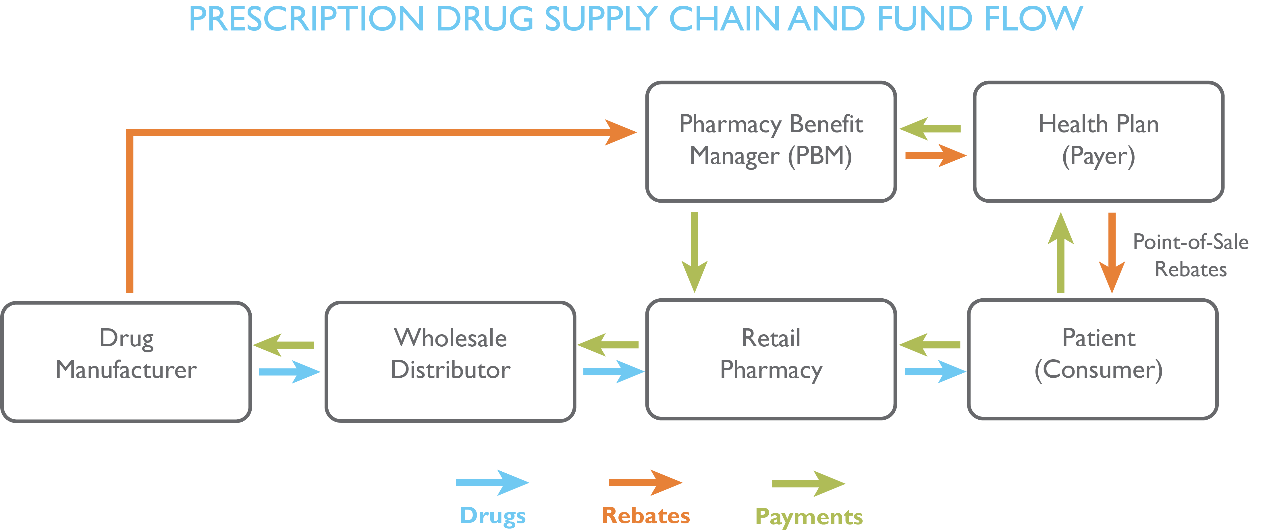

Plaintalk Blog What Is A Drug Rebate CIVHC

Rebate Definition Of Rebate YouTube

A Guide To Rebates On Discounted Bills

What Is Rebate Limit In Tax - Under Section 87A taxpayers are entitled to a rebate of up to Rs 12 500 effectively reducing their income tax liability This rebate is applicable to individuals whose