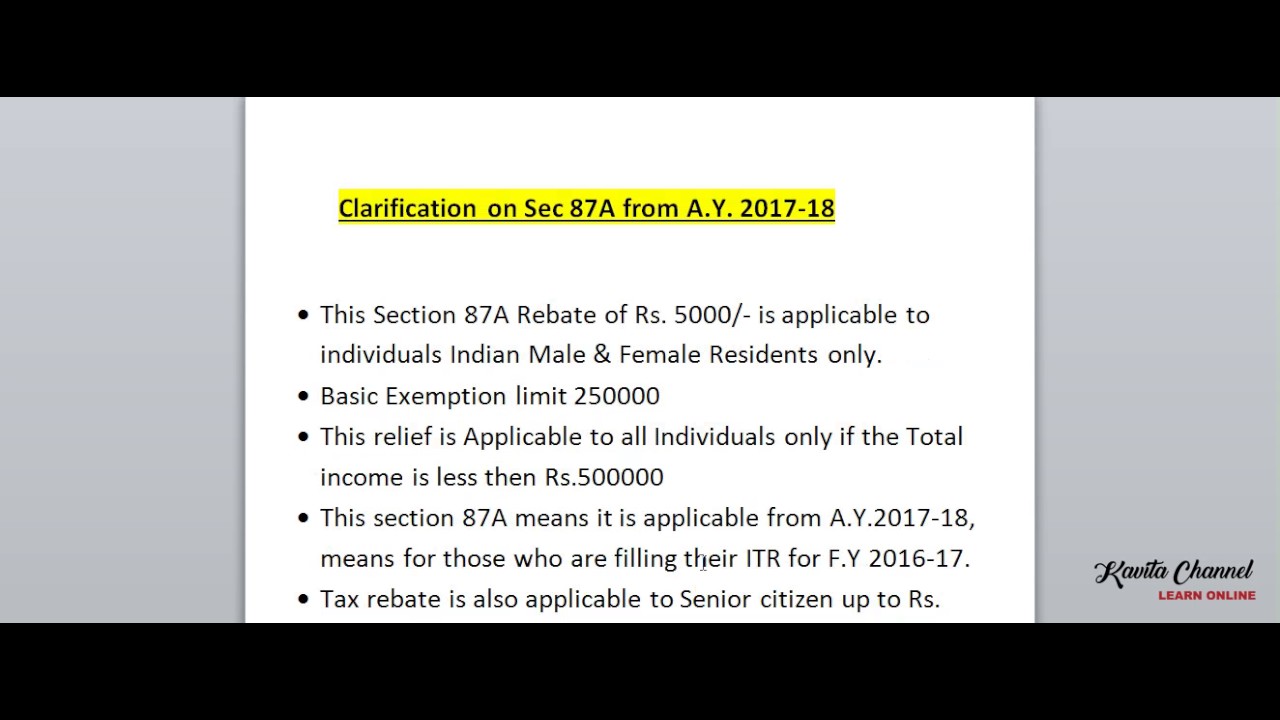

What Is Rebate Under Section 87a For Fy 2024 23 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2023 24 under the old regime

Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 The amount of rebate provided under the Section 87A is Rs 25 000 for the FY 2023 24 if the taxable income of a resident individual is within Rs 7 00 lacs Rebate u s 87A for FY

What Is Rebate Under Section 87a For Fy 2024 23

What Is Rebate Under Section 87a For Fy 2024 23

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/87a-rebate.jpg

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

https://www.gconnect.in/gc22/wp-content/uploads/2023/02/Finance-Bill-2023-1536x806.jpg

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/lgmblbkc7Qs/maxresdefault.jpg

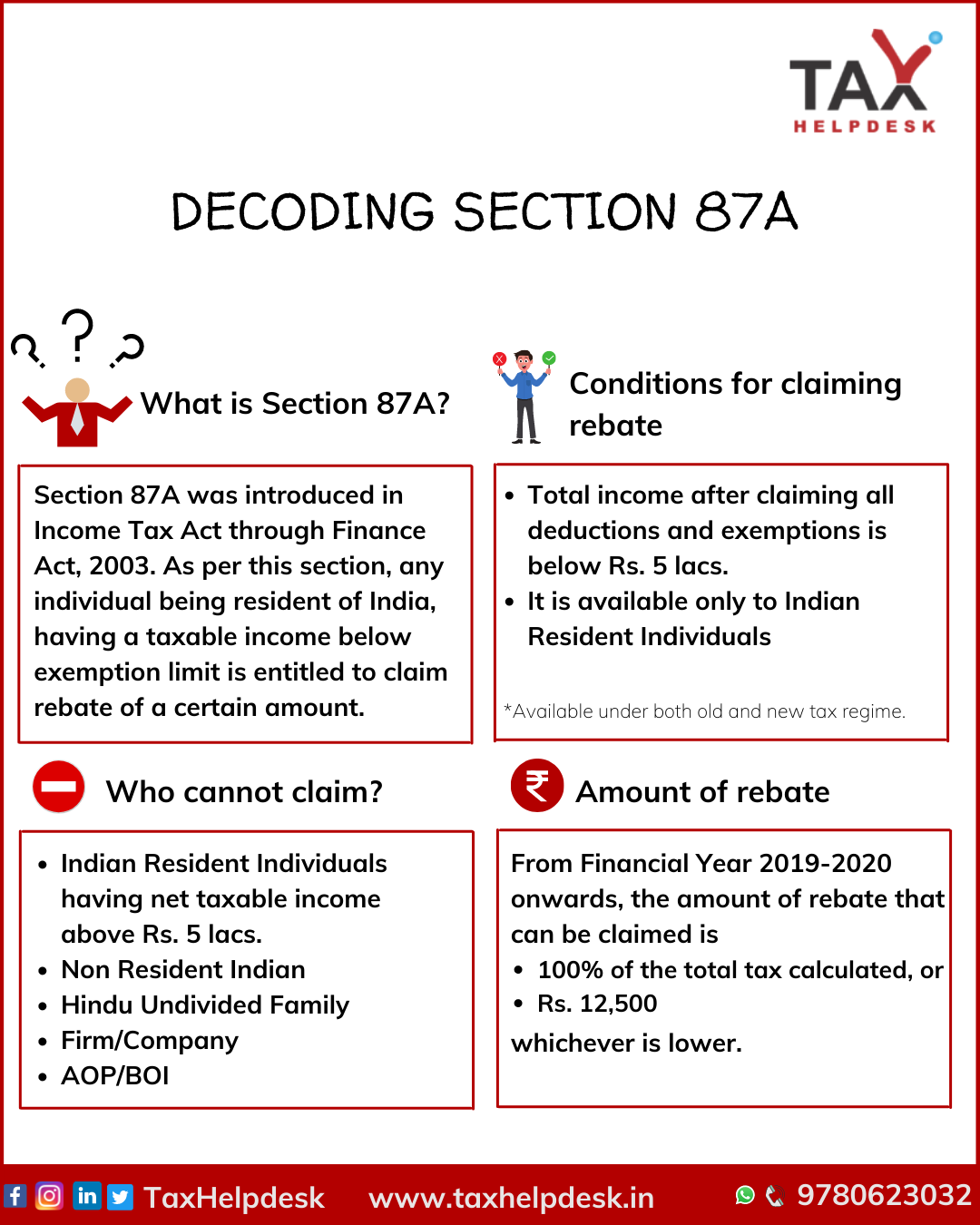

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an The maximum rebate under section 87A for the AY 2024 25 is Rs 25 000 under the new tax regime and Rs 12 500 under the optional tax regime See the

The new income tax regime which will be effective from FY 2023 24 AY 2024 25 has changed the rebate amount under Section 87A Under this regime if you are a resident Currently section 87A allows individuals to claim a tax rebate of Rs 12 500 under the old tax regime and Rs 25 000 under the new tax regime This means that

Download What Is Rebate Under Section 87a For Fy 2024 23

More picture related to What Is Rebate Under Section 87a For Fy 2024 23

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

https://stairfirst.com/blog/wp-content/uploads/2020/06/Adobe_Post_20200522_1633240.06060677195840691-1-1920x1440.png

Rebate Under Section 87A How It Works Eligibility Max Life Insurance

https://www.maxlifeinsurance.com/static-page/assets/homepage/Rebate_Under_Section_87_A_2_1_de5ad95a65.webp

Section 87A Tax Rebate FY 2019 20 How To Check Rebate Eligibility

https://www.relakhs.com/wp-content/uploads/2021/01/Rebate-Section-87A-1000x600.jpg

The new tax regime allows tax rebate under Section 87A for taxable incomes up to Rs 7 lakh It s important to note that the tax rules may change from the The maximum rebate under section 87A for AY 2024 25 FY 2023 24 is 25 000 under the new tax regime and 12 500 under the optional tax regime This rebate is applicable

Tax rebate under Section 87A was same under old and new tax regime till March 31 2023 FY 2022 23 The higher tax rebate of Rs 25 000 in new tax regime is Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Income Tax Rebate Under Section 87A Legalraasta

https://www.legalraasta.com/blog/wp-content/uploads/2021/08/Income-tax-rebate-tax-deduction-and-exemption-scaled.jpg

https://tax2win.in/guide/section-87a

The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2023 24 under the old regime

https://taxguru.in/income-tax/marginal-relief-u-s...

Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

Income Tax Rebate U s 87A For The Financial Year 2022 23

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

New Income Tax Slab And Tax Rebate Credit Under Section 87A With Automated Income Tax Revised

Is Section 87A Rebate For Everyone SR Academy India

Is Section 87A Rebate For Everyone SR Academy India

Income Tax Rebate Under Section 87A

Know New Rebate Under Section 87A Budget 2023 PowerRebate

Section 87A Tax Rebate FY 2023 24 Under Old New Tax Regimes

What Is Rebate Under Section 87a For Fy 2024 23 - Illustration Of Tax Rebate Under Section 87A For FY 2024 25 AY 2025 26 View 3 More Section 87A of the Income Tax Act provides tax rebates to individuals whose income