What Is Rebating In Insurance Terms Rebating is a type of incentive which is any benefit offered to persuade people to purchase an insurance policy from a particular agent Is insurance rebating legal Most of the time no The majority of states forbid insurance rebates Additionally even states without laws against insurance rebating strongly disapprove of the practice

Rebating in insurance refers to an illegal practice where an insurance agent or broker offers a customer a financial incentive such as a rebate or kickback to purchase an insurance policy Why is rebating considered illegal Rebating is a serious violation of insurance law that not only comes with legal penalties imposed by state regulators but also various sanctions from insurance companies In most cases of rebating the insurer will terminate its relationship with the agent broker and other companies may choose to refuse to establish a relationship with

What Is Rebating In Insurance Terms

What Is Rebating In Insurance Terms

https://i.ytimg.com/vi/WnG23WfOQqc/maxresdefault.jpg

Rebating In Insurance Sales

https://i.pinimg.com/originals/92/12/80/921280810e3846368fdf9a21f992ac95.jpg

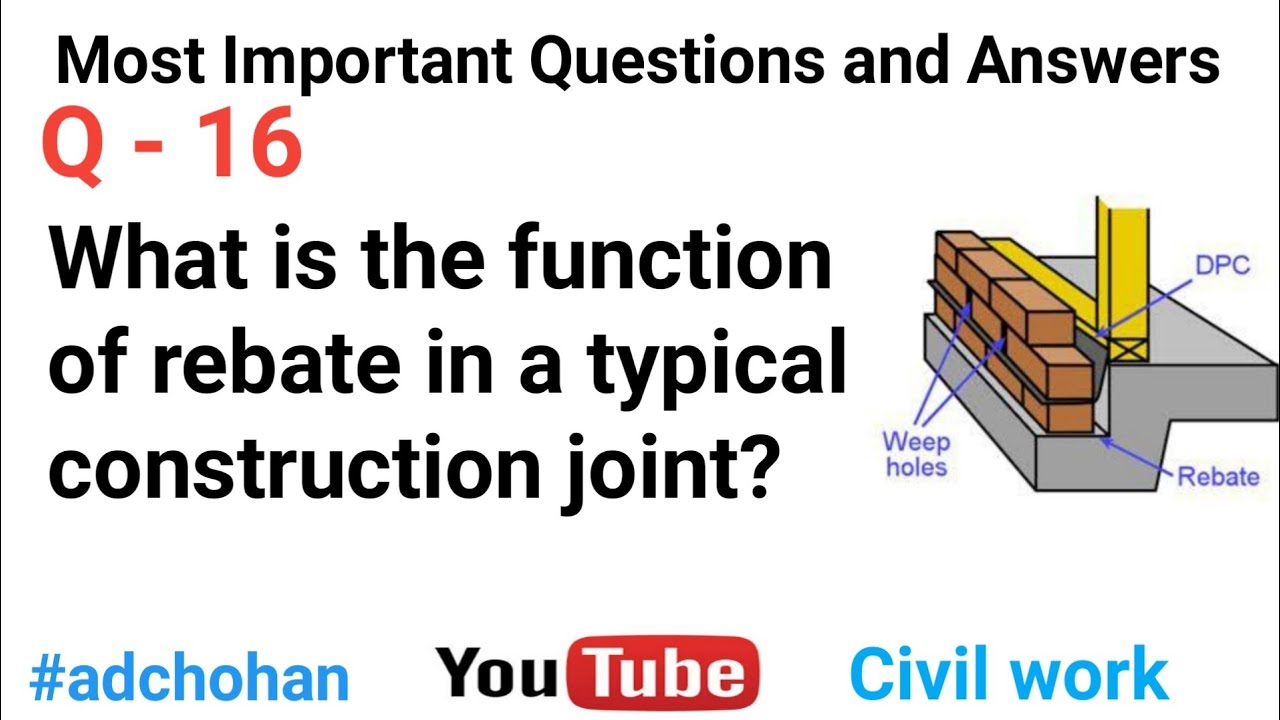

Function Of Rebate Construction Joint Most Important Questions And

https://i.ytimg.com/vi/ZNSQDuNEIag/maxresdefault.jpg

It s a term used in the insurance industry to describe the process of returning a portion of an insurance premium to the policyholder with the desire to induce an insurance sale Rebating can be done in various ways including cash back discounts on future premiums or refunds Rebating is a type of inducement which means any benefit or incentive that is used to lure customers into buying insurance Rebating can lead to unfair competition customer deception and industry damage In this article we ll expose the truth about rebating how it works and why it s forbidden

The term rebating in insurance refers to a practice of giving money back to a policyholder in order to incentivize or induce a sale Rebating can refer to an insurance producer passing on some of their commission to the policyholder but that s not the only method of rebating in insurance Rebating in insurance is when an agent offers something not included in a policy to incentivize the purchase of a new plan Common rebating examples include money gifts and even employment Rebating is illegal in most states because it allows unfair competition or inadequate customer coverage

Download What Is Rebating In Insurance Terms

More picture related to What Is Rebating In Insurance Terms

What Is Rebating In Life Insurance

https://freeinsurancetips.com/wp-content/uploads/2023/04/Insurance-Rebating-Everything-you-Need-to-Know.webp

Chapter 4 1

https://floridaschool.com/eschool/servlet/CourseZipServlet/154/40hour/images/jpegs/4_Rebating.jpg

Conflicts Of Interest And Rebating

https://www.insurancejournal.com/app/uploads/2016/04/insurance-sale.jpg

Rebating in the realm of commercial insurance refers to the practice of offering an individual or entity a financial incentive such as a rebate or refund in exchange for purchasing an insurance policy It involves providing an inducement or kickback that goes beyond the normal terms and conditions of the insurance contract Insurance rebating refers to the practice of offering incentives or rebates to potential policyholders in order to encourage them to purchase insurance policies These incentives can come in various forms such as cash refunds gift cards discounted premiums or additional coverage at no extra cost

Rebating in insurance refers to the practice of offering customers something of value as an inducement to purchase an insurance policy This can include providing cash gifts discounts or special favors that are not outlined in the policy terms or authorized by the insurance company Definition of Rebating in Insurance Rebating in insurance refers to the practice of offering a potential customer a benefit or incentive in exchange for purchasing an insurance policy This benefit can take various forms such as discounts on premiums cash rewards gifts or additional services

Operations Of Carpentry Lost Art Press

https://blog.lostartpress.com/wp-content/uploads/2023/03/Screenshot-2023-03-13-at-4.25.11-PM.png

8 Different Types Of Insurance ProGuide

http://proguide.ng/wp-content/uploads/2023/01/smngoz63le03c1cdu.3969a65c1.jpg

https://brokerininsurance.com/insurance/rebating-in-insurance

Rebating is a type of incentive which is any benefit offered to persuade people to purchase an insurance policy from a particular agent Is insurance rebating legal Most of the time no The majority of states forbid insurance rebates Additionally even states without laws against insurance rebating strongly disapprove of the practice

https://www.usinsuranceagents.com/what-is-rebating-in-insurance

Rebating in insurance refers to an illegal practice where an insurance agent or broker offers a customer a financial incentive such as a rebate or kickback to purchase an insurance policy Why is rebating considered illegal

What Is Rebating In Insurance Definition With Purpose Of Rebating Laws

Operations Of Carpentry Lost Art Press

Rebating In Insurance 10 Rebating Tactics In Top Insurance

What Is A Rabbit In Woodworking Quora

What Is Rebating In Insurance Explained

HUME DOOR EXTRA REBATING PAIR Of DOORS ONLY At TIME Of DOORS ORDER

HUME DOOR EXTRA REBATING PAIR Of DOORS ONLY At TIME Of DOORS ORDER

Is Rebating In Insurance Legal

Insurance Rebating Laws Financial Report

REBATING IN INSURANCE Definition And How It Works

What Is Rebating In Insurance Terms - Rebating is a type of inducement which means any benefit or incentive that is used to lure customers into buying insurance Rebating can lead to unfair competition customer deception and industry damage In this article we ll expose the truth about rebating how it works and why it s forbidden