What Is Section 80ccd 2 Section 80CCD 2 of the Income Tax Act gives employed individuals

Section 80CCD 2 of the Income Tax Act 1961 is a provision that allows Section 80CCD 2 allows employers to deduct up to 20 of their income in the

What Is Section 80ccd 2

What Is Section 80ccd 2

https://live.staticflickr.com/65535/49247202166_90551293ef_b.jpg

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

https://www.alankit.com/blog/blogimage/NPS-80CCD.jpg

Section 80CCC Tax Deductions On Pension Fund Contributions Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ccc.jpg

Learn how to claim deduction under Section 80CCD 2 of the Income Tax Act for Section 80CCD 2 is a subsection of the Income Tax Act 1961 which

Section 80CCD 2 Overview Section 80CCD 2 is a sub section of the Section 80CCD 2 This section deals with the employer s contribution

Download What Is Section 80ccd 2

More picture related to What Is Section 80ccd 2

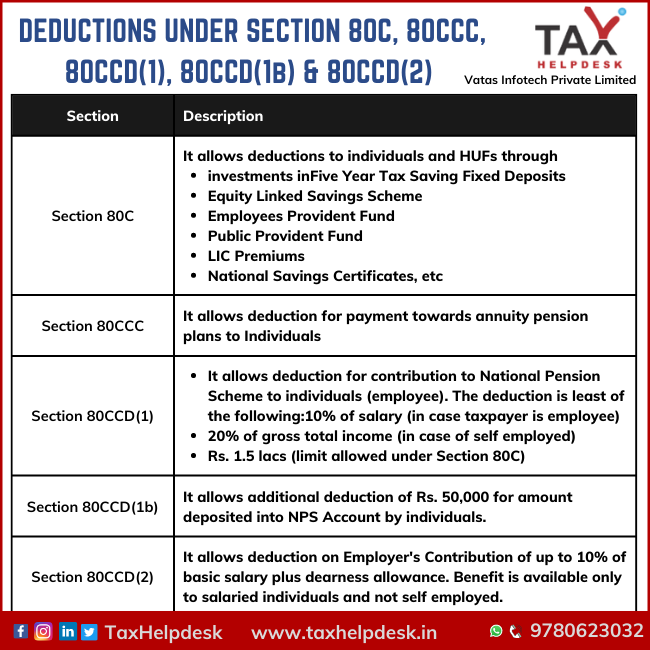

Section 80C 80CCC 80CCD 80CCE Deductions In Computing Total Income

https://i.ytimg.com/vi/GI9JwWO0QU4/maxresdefault.jpg

54F Requirements To Claim Exemptions Under Section 54F Of Income Tax Act

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/income-tax/Section.jpg

Deductions Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

Section 80CCD 2 is eligible in the case of salaried individuals Further 80CCD 2 can be availed in addition to 80CCD 1 Below are the deduction limits under this section Section 80CCD 1B Section 80CCD of the Income Tax Act 1961 allows individuals to claim tax deductions on contributions made towards certain pension plans These deductions can help reduce your taxable income

Income tax department with a view to encourage savings and investments amongst the Tax on income of individuals and Hindu undivided family Section 17 Salary

Section 80CCD Income Tax Deduction For NPS Scripbox

https://d2tomeq9arcjda.cloudfront.net/mf/wp-content/uploads/2020/10/section-80ccd-social.jpg

A Quick Look At Deductions Under Section 80C To Section 80U

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Section-80C-1.png

https://www.etmoney.com/learn/income-tax/section-80ccd-deductions

Section 80CCD 2 of the Income Tax Act gives employed individuals

https://margcompusoft.com/m/section-80ccd-2

Section 80CCD 2 of the Income Tax Act 1961 is a provision that allows

How To Claim Section 80CCD 1B TaxHelpdesk

Section 80CCD Income Tax Deduction For NPS Scripbox

What Is Section 80CCC Sharda Associates

What Is Dcps Nps Yojana Login Pages Info

What Is Section 80ccf Sharda Associates

What Is The National Pension System Section 80CCD 1B In Hindi

What Is The National Pension System Section 80CCD 1B In Hindi

Finance Fridays Ep 3 Section 80CCD 2 Employer s Contribution To

Section 80CCD Deductions For NPS And APY Contributions

Deductions Under Section 80CCD Of Income Tax Maximise Your Retirement

What Is Section 80ccd 2 - Section 80CCD 2 of the Income Tax Act 1961 allows salaried employees to claim a