What Is Section 80g Of Income Tax Act The amount donated towards charity attracts deduction under section 80G of the Income Tax Act 1961 Section 80G has been in the law

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction Section 80G of the Income Tax Act 1961 allows taxpayers to save tax by donating money to eligible charitable institutions By donating to eligible institutions and

What Is Section 80g Of Income Tax Act

What Is Section 80g Of Income Tax Act

https://www.narayanseva.org/wp-content/uploads/2022/11/1-section-80g.jpg

Section 80g Deduction 80g Section 80g Of Income Tax Act 2020 21

https://i.ytimg.com/vi/gJwepgBOgKE/maxresdefault.jpg

Section 80g Of Income Tax Act Section 80g 5

https://carajput.com/art_imgs/what-does-section-80g-for-ngo.jpg

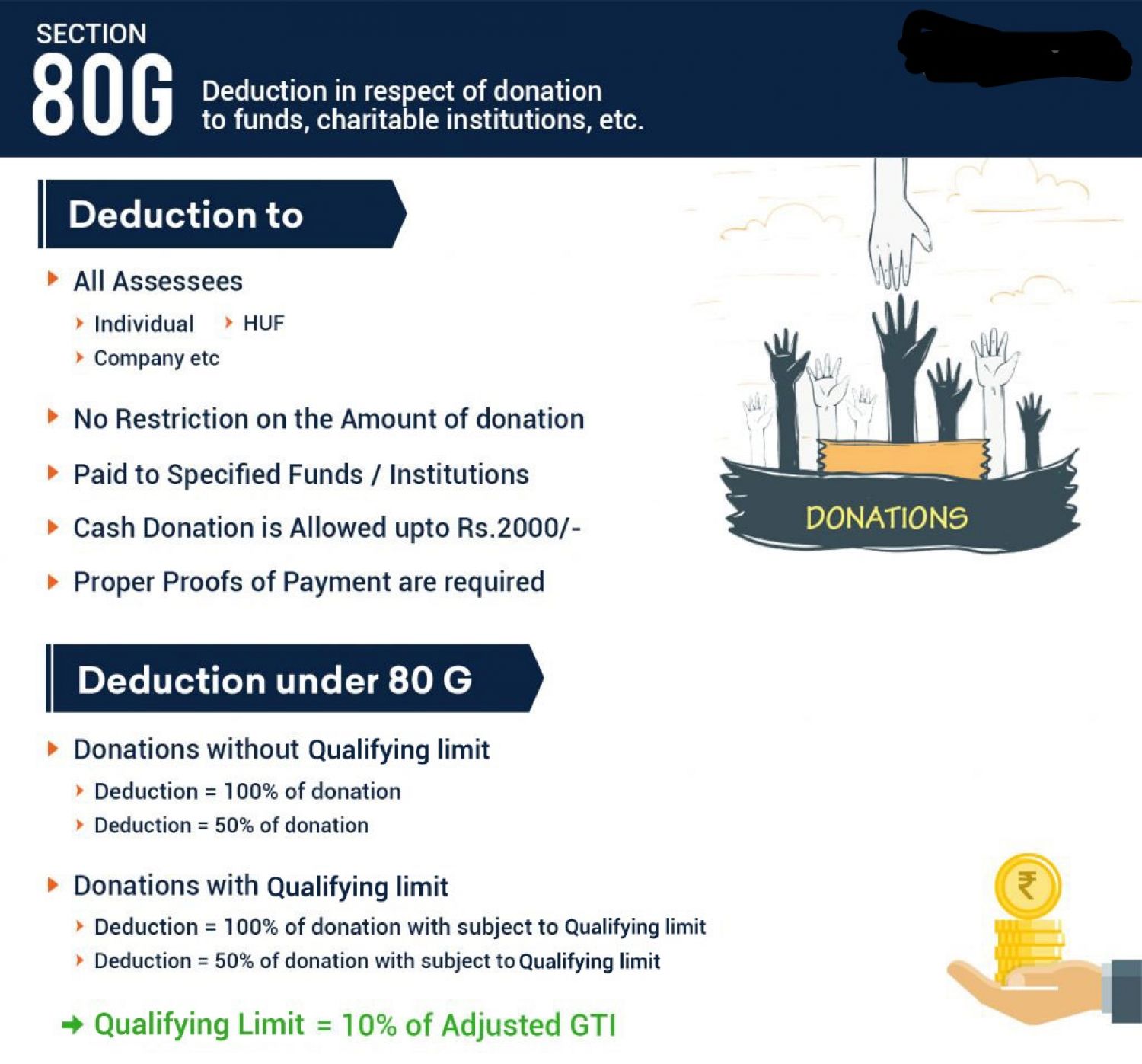

What is Section 80G The Income Tax Act allows deduction while calculating the total taxable income to every assessee One such deduction is allowed under section 80G of Income Tax Act 1961 for donations made to a Section 80G provides 50 100 exemption on contributions made to some government relief funds and 50 deduction up to 10 of income in case of some NGOs

Section 80G of income tax act allows tax deductions on donations made to certain organizations and relief funds This deduction encourages taxpayers to donate and avail the satisfaction of giving back to the community Under Section 80G contributions to relief funds and humanitarian organizations can be deducted and under Section 80GGA donations are made to scientific studies or

Download What Is Section 80g Of Income Tax Act

More picture related to What Is Section 80g Of Income Tax Act

Understanding Section 80G Of Income Tax Act A Comprehensive Guide

https://margcompusoft.com/m/wp-content/uploads/2023/03/20-4-1024x576.jpg

Section 80G Of Income Tax Act 1961

https://www.cabkgoyal.com/wp-content/uploads/2023/06/Section-80G-of-Income-Tax-Act-1961.png

Donations Under Section 80G And 80GGA Of Income Tax Act

https://corpseeds.blob.core.windows.net/corpseed/Donations Under Section 80G And 80GGA .png

Introduction Any assessee who has paid any sum by way of donation is eligible to claim deduction under this provision to the extent of 50 to 100 of the donation made For Section 80G and 80GGA Your guide to tax efficiency Learn about eligible donations recent budget updates and a step by step guide to claim deductions

Section 80G of the Income Tax Act IT Act allows you to claim a deduction on donations to specified funds and institutions This reduces your overall tax liability Here s Section 80G tax exemption is a provision in the Indian Income Tax Act that encourages charitable giving by offering tax deductions for donations made to specified

Section 80G 80GGA Of Income Tax Act Income Tax Deduction For

https://i.ytimg.com/vi/FQ6TZ4suYII/maxresdefault.jpg

Section 80G Of Income Tax Act Income Tax Deductions For Donations

https://cashzeni.com/wp-content/uploads/2023/07/Section-80G-of-Income-Tax-Act-1024x576.jpg

https://taxguru.in/income-tax/all-about-…

The amount donated towards charity attracts deduction under section 80G of the Income Tax Act 1961 Section 80G has been in the law

https://tax2win.in/guide/80g-deduction-d…

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction

What Is Section 80G Tax Deductions On Your Donations Deduction U s

Section 80G 80GGA Of Income Tax Act Income Tax Deduction For

Section 80G Deduction Income Tax Act IndiaFilings

Understanding Section 43B Of The Income Tax Act Case Laws And Key Insights

Understanding The Importance Of Section 80G Under The Income Tax Act

Section 80G Of IT Act Tax Deduction On Donations To Charity

Section 80G Of IT Act Tax Deduction On Donations To Charity

Section 10 14 i And Rule 2bb Of Income Tax Act 1961

54F Requirements To Claim Exemptions Under Section 54F Of Income Tax Act

Section 11 Of Income Tax Act 1961 Exemption For Trusts

What Is Section 80g Of Income Tax Act - What is Section 80G of the Income Tax Act and who can claim it Introduced and implemented in 1961 Section 80G of the Income Tax Act enables taxpayers to claim up to