What Is Solar Energy Tax Credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either

What Is Solar Energy Tax Credit

What Is Solar Energy Tax Credit

https://andrewstaxaccounting.com/wp-content/uploads/2022/02/solar-panels-install-rsz.jpg

Solar Energy Tax Credit Basics

https://s2.studylib.net/store/data/009906505_1-1c8209be4201d8616781301da40ba34d-768x994.png

Commercial Solar Tax Credit Guide 2023

https://propertymanagerinsider.com/wp-content/uploads/2022/12/Commercial-Solar-Tax-Credit-Guide-2023.png

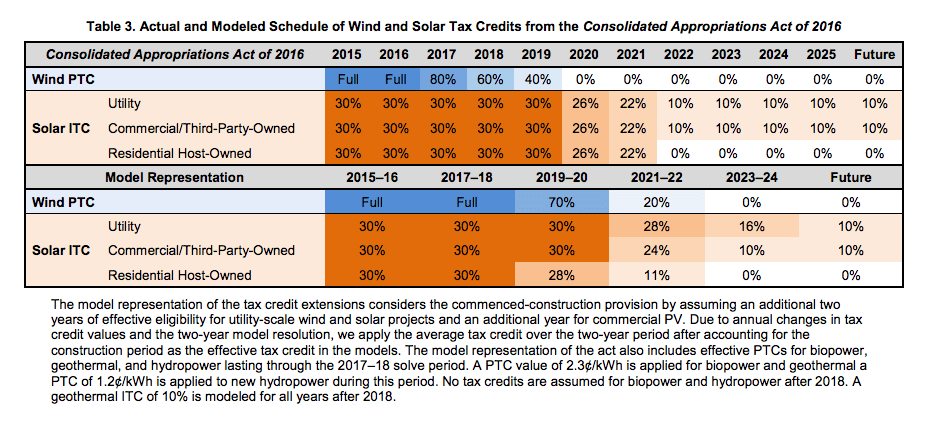

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in What is a tax credit A tax credit is a dollar for dollar reduction in the amount of income tax you would otherwise owe For example claiming a 1 000 federal tax credit reduces

Download What Is Solar Energy Tax Credit

More picture related to What Is Solar Energy Tax Credit

Home Energy Improvements Lead To Real Savings Infographic Solar

https://i.pinimg.com/originals/d9/ad/96/d9ad96393cb13907229e3e2b1609bcc1.jpg

Solar Energy Tax Credit For Businesses Faster ROI

https://blog.geoscapesolar.com/hubfs/solar-energy-tax-credit-for-businesses.jpg

Equipment Tax Credits For Primary Residences About ENERGY STAR

https://www.energystar.gov/sites/default/files/TaxCredit_Residential.png

OVERVIEW The Residential Clean Energy Credit for solar energy upgrades to your home has been extended through 2034 and expanded in value TABLE OF CONTENTS What is the Residential The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

The Residential Clean Energy Credit formerly known as the ITC is a tax credit worth 30 of the gross cost of your solar project parts labor the whole chalupa with no maximum incentive amount The federal Residential Clean Energy Credit is commonly known as the solar tax credit because it can help defray the considerable costs of adding solar panels to your home

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

How To Get Your Solar Energy Tax Credit Solar Technologies

https://solartechnologies.com/wp-content/uploads/2016/11/faq-commerical-3.jpg

https://www.energy.gov/eere/solar/homeown…

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual

New Mexico s Solar Energy Tax Credit Passes Legislature

Federal Solar Tax Credit What It Is How To Claim It For 2024

Federal Tax Credit For Saving Money On Solar Panels KC Green Energy

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

Solar Tax Credit 2016 Solar Investment Tax Credit FAQ NATiVE

California Solar Tax Credit LA Solar Group

California Solar Tax Credit LA Solar Group

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Federal Tax Credit ITC For Solar Energy Gets Extended

Unpacking The New Solar Energy Tax Credit BDO

What Is Solar Energy Tax Credit - The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems