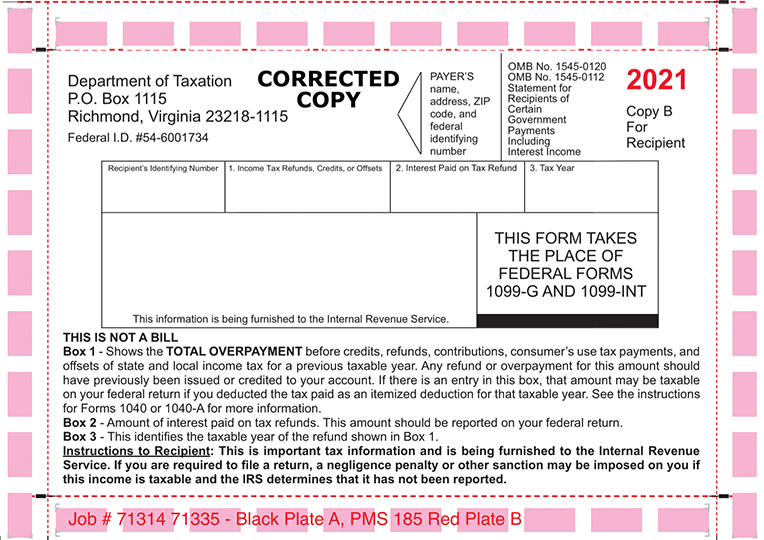

What Is State And Local Tax Refunds On Form 1099 G Web Enter the total taxes you paid to the state or locality for the same tax year as the refund this includes withholdings as well as estimated tax and other payments You can get

Web File Form 1099 G Certain Government Payments if as a unit of a federal state or local government you made payments of unemployment compensation state or local Web 1099 G Form for state tax refunds credits or offsets If the state issues you a refund credit or offset of state or local income that amount will

What Is State And Local Tax Refunds On Form 1099 G

What Is State And Local Tax Refunds On Form 1099 G

https://taxfoundation.org/wp-content/uploads/2023/11/Carbon-Tax-Research-scaled.jpeg

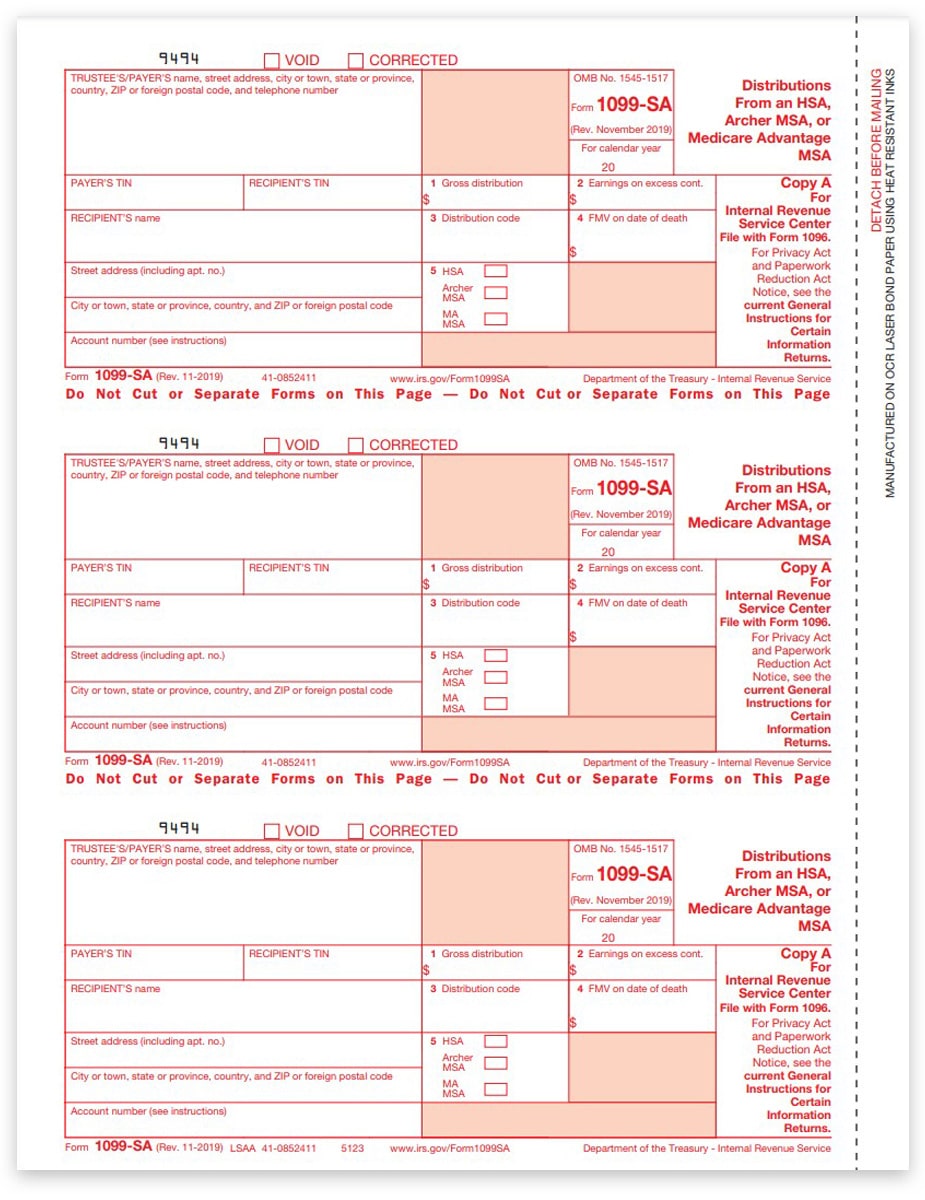

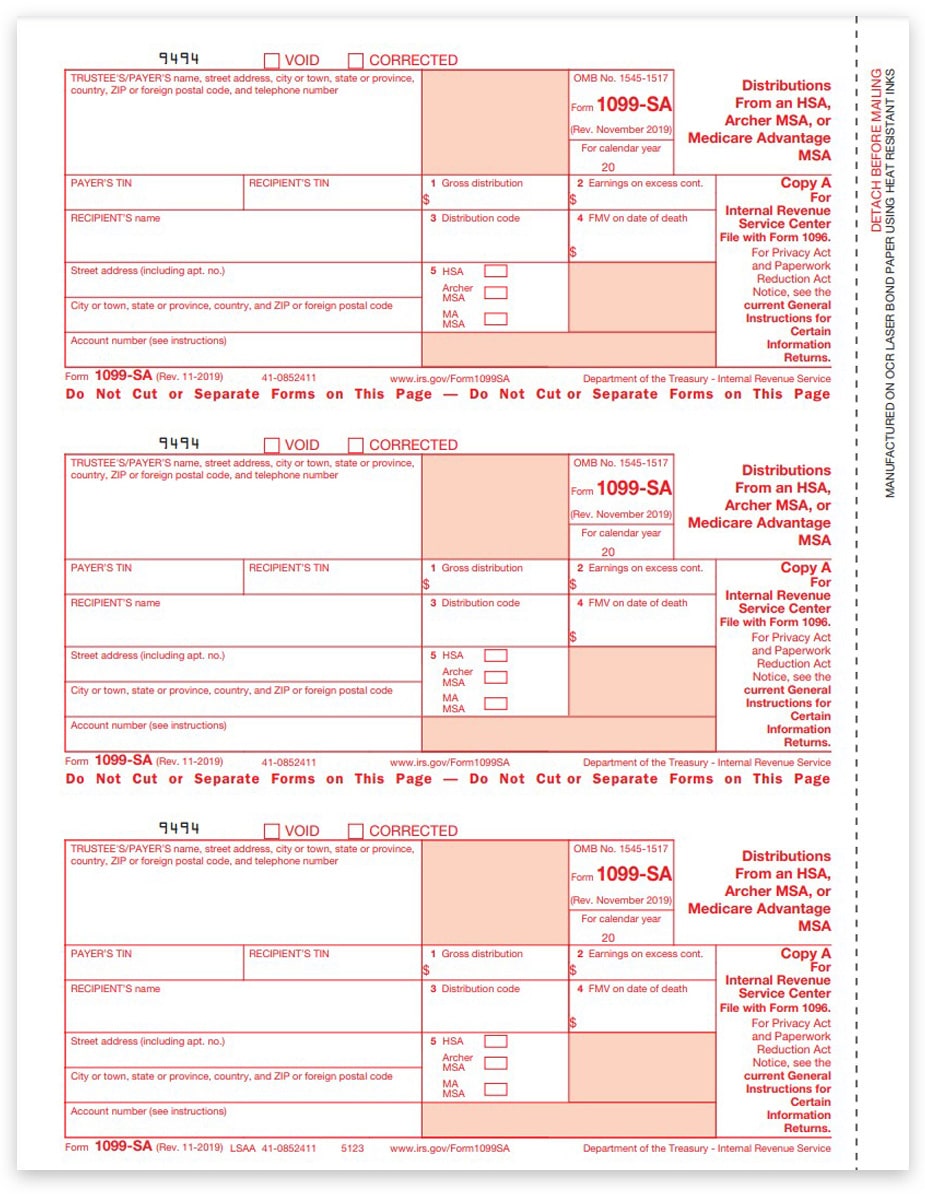

1099SA IRS Forms For Distributions From MSA Or HSA DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1099SA-Form-Copy-A-Federal-Red-LSAA-FINAL-min.jpg

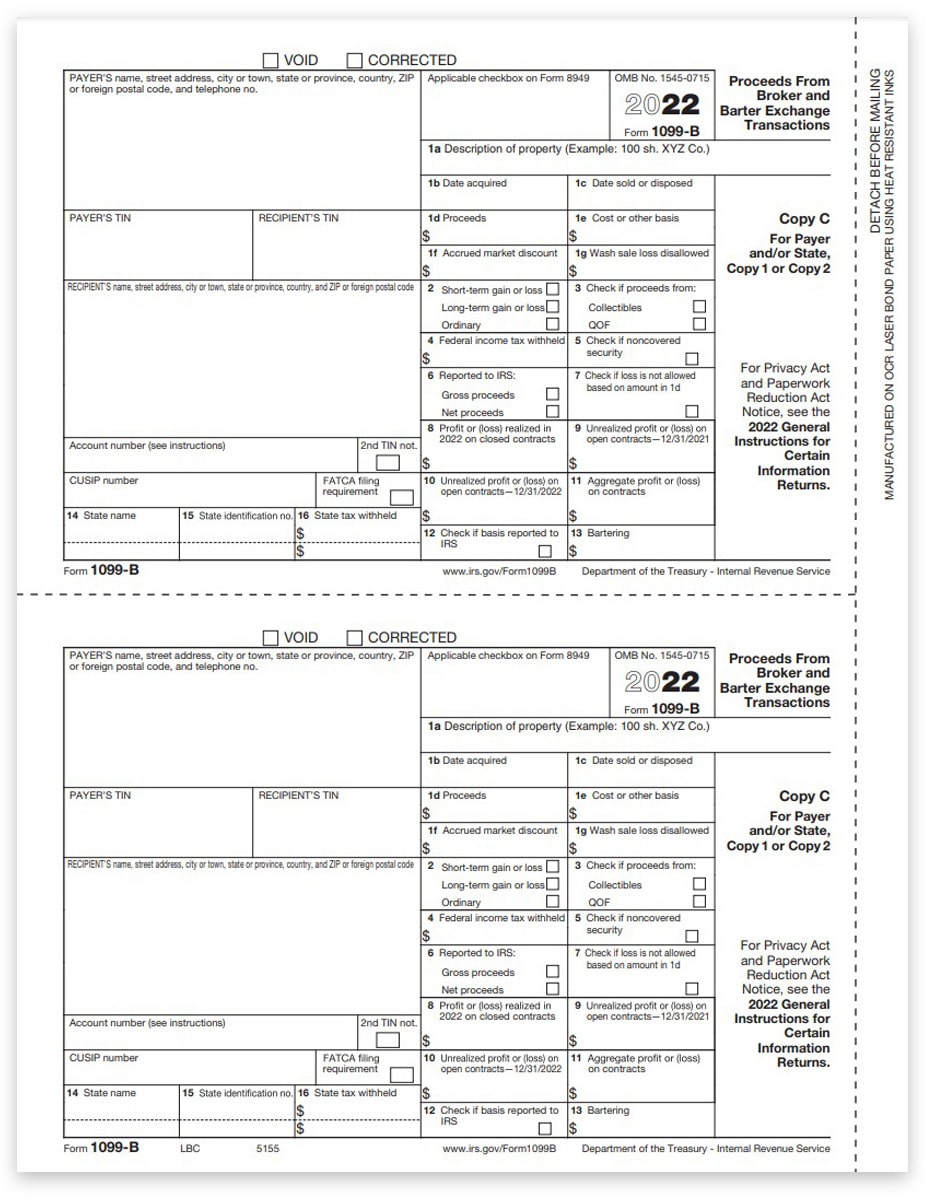

1099B Forms For Broker Transactions State Copy C DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1099B-Form-Copy-C-1-2-Payer-State-LBC-FINAL-min.jpg

Web 19 Okt 2023 nbsp 0183 32 state or local income tax refunds you received that year Taxable unemployment compensation Generally you must include in federal taxable income any Web 9 Jan 2023 nbsp 0183 32 Form 1099 G is a type of 1099 form that s used to report certain government payments most commonly unemployment benefits and state or local tax refunds If

Web Home Forms and Instructions About Form 1099 G Certain Government Payments Federal state or local governments file this form if they made payments of Web 10 Jan 2023 nbsp 0183 32 Common questions about state and local tax refunds unemployment 1099 G SOLVED by Intuit 5 Updated over 1 year ago Below are solutions to

Download What Is State And Local Tax Refunds On Form 1099 G

More picture related to What Is State And Local Tax Refunds On Form 1099 G

Taxable Refunds Credits Or Offsets Of State And Local Income Taxes

https://i.ytimg.com/vi/O0FErGyvHzY/maxresdefault.jpg

Demystifying IRS Form 1099 INT Your Complete Guide

https://zenmonics.com/wp-content/uploads/2023/07/c057aaf6-5eb7-4c71-ab7d-500c02524a9a.png

Republican Study Committee Budget Tax Plan Details Analysis

https://files.taxfoundation.org/20230614105632/RSC-budget-republican-study-committee-tax-plan-2024.jpg

Web File Form 1099 G Certain Government Payments if as a unit of a federal state or local government you made payments of unemployment compensation state or local income Web 31 M 228 rz 2023 nbsp 0183 32 State or local income tax refunds credits or offsets Reemployment trade adjustment assistance RTAA payments Taxable grants Agricultural payments If you receive the form the government is

Web 2 M 228 rz 2021 nbsp 0183 32 A state or local refund credit or offset may be reported on Form 1099 G even if you did not receive the amount shown This is likely to occur if you live in a state Web Income Desktop Form 1099 G Box 2 State and Local Refunds A refund of state or local income tax paid may in total or in part be considered income in the year that it is

E file 2022 1099 G Form Online Certain Government Payments

https://d2rcescxleu4fx.cloudfront.net/images/1099-G.jpg

Selecting The Correct IRS Form 1099 R Box 7 Distribution Codes Ascensus

http://static1.squarespace.com/static/59c529e3cd0f689fe65fe62d/59c53ff3cd39c39d4b3ce369/639a1e57ee683d6837a3922d/1671109478175/2022+1099R+with+callout+1000px.jpg?format=1500w

https://ttlc.intuit.com/turbotax-support/en-us/help-article/import...

Web Enter the total taxes you paid to the state or locality for the same tax year as the refund this includes withholdings as well as estimated tax and other payments You can get

https://www.irs.gov/instructions/i1099g

Web File Form 1099 G Certain Government Payments if as a unit of a federal state or local government you made payments of unemployment compensation state or local

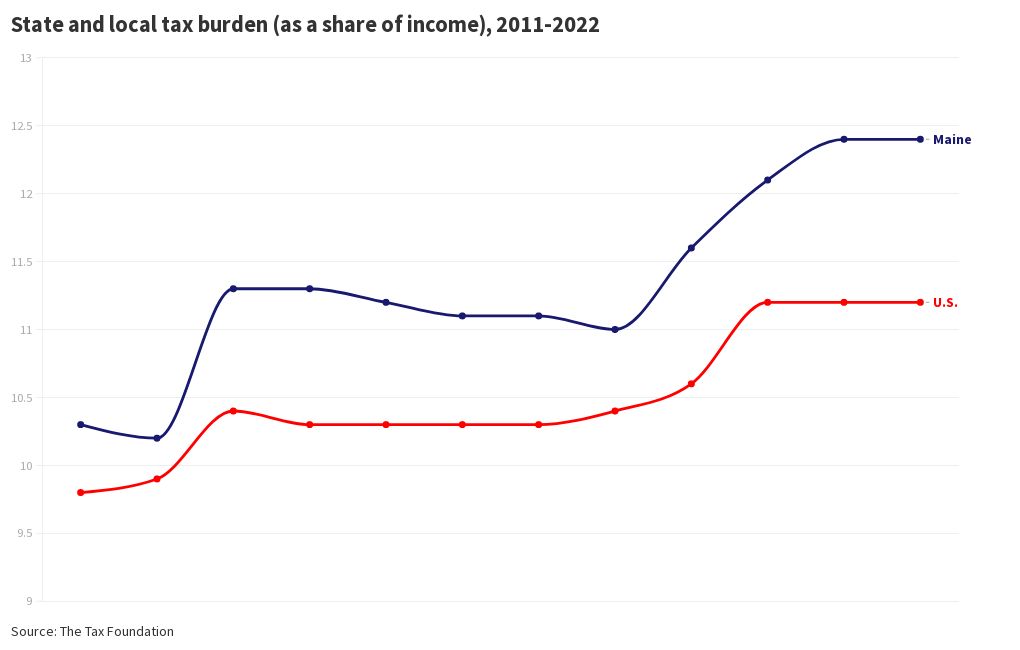

State And Local Tax Burden as A Share Of Income 2011 2022 Flourish

E file 2022 1099 G Form Online Certain Government Payments

1099 G FAQs

Reading A Consolidated 1099 M1 Finance Help Center

Americans Still Voting With Feet In Favor Of Lower Tax Burdens

What To Know About 1099 s Rules And Regulations The Doty Group CPAs

What To Know About 1099 s Rules And Regulations The Doty Group CPAs

Important 1099 G Update Virginia Tax

State And Local Tax Strategies And Solutions For Remediation Video

Tax Refunds 1 1B In Unclaimed Money Awaits Tax Returns

What Is State And Local Tax Refunds On Form 1099 G - Web These questions are intended to help you prepare your individual income tax return if you were issued a Form 1099 G because you received a North Carolina individual income