What Is Tax Benefit Of Owning A Home In the U S owning a home can lead to significant tax benefits which might include deductions for mortgage interest property taxes and home sale exclusion among others A financial advisor can help you determine

Taxes Top Tax Advantages of Buying a Home Save money with these deductions and credits By Tim Parker Updated December 08 2023 Reviewed by Lea D Uradu Fact checked by Suzanne Kvilhaug Here are brief descriptions of tax benefits of owning a home the deductions the credits and an exclusion that encourage homeownership Tax benefits of buying a home The tax code

What Is Tax Benefit Of Owning A Home

What Is Tax Benefit Of Owning A Home

http://www.letsdotaxes.com/wp-content/uploads/2012/10/Tax-benefits-of-owning-a-house.png

Tax Breaks And Benefits Of Owning A Home

https://www.firstoptiononline.com/wp-content/uploads/2017/01/Taxes-and-Home-ownership.png

Tax Benefits Of Owning A Home Archives

http://realestate-ink.com/wp-content/uploads/2014/10/5-Financial-Reasons-To-Buy.jpg

Key Takeaways Buying a house comes with the tax benefit of deducting eligible discount points or eligible prepaid property taxes assessed at closing Owning a house includes ongoing possible deductions of mortgage insurance premiums qualifying mortgage interest and local and state property taxes The Tax Benefits of Owning a Home Must Know Deductions and Credits As a homeowner there are a number of tax breaks you might be eligible for such as a property tax deduction and a mortgage credit certificate here s how they work Miranda Marquit Edited by Chris Jennings Updated February 10 2023

Here are the tax benefits of owning a home such as mortgage interest property taxes a home office energy efficient upgrades and more A Homeowner s Guide to Taxes The Tax Benefits Work from home expenses Whether you work from home full time or part time or operate a side business from your home you can probably deduct your home office expenses and claim an amount for the actual space used to perform the work The current tax law will specify the value of the deduction often based on dollar value per square foot including

Download What Is Tax Benefit Of Owning A Home

More picture related to What Is Tax Benefit Of Owning A Home

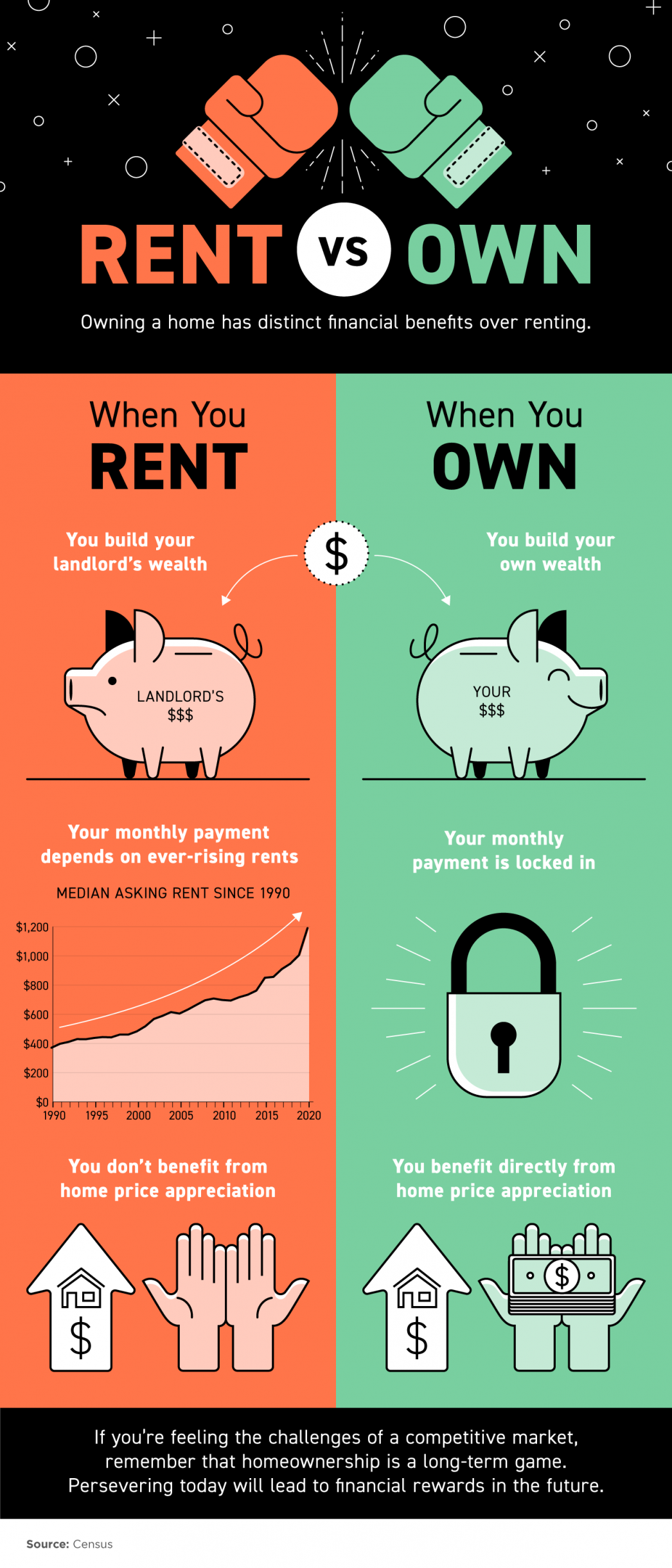

Renting Vs Owning Infographic Real Estate Infographic Rent Buy My House

https://i.pinimg.com/originals/15/bb/3a/15bb3a1e1cdd1b7330f75356ea75883b.jpg

What Are The Benefits Of Owning A Home

http://www.rochesterrealestateblog.com/wp-content/uploads/2017/07/Buying-A-Home-Can-Be-An-Excellent-Investment-A-Benefit-Of-Owning-A-Home-.png

Karvy Private Wealth Plan Your Taxes The Smart Way

http://1.bp.blogspot.com/-WmHjzoGbgKc/T3G_NRcrlWI/AAAAAAAABuw/OsvcVGMarrc/s1600/tax.jpg

6 You may get a tax deduction One major tax benefit of owning a home is the mortgage interest deduction Home mortgage interest is tax deductible which could mean a reduction in federal taxes you owe This benefit is typically the most helpful in the early years of a 30 year fixed mortgage when most of your monthly payments go toward A source of ready cash Tax advantages Helps build credit Freedom to personalize 1 More stable housing costs Buying a home comes with a lot of upfront expenses including the down payment and closing costs There are plenty of ongoing maintenance costs to consider too

A The main tax benefit of owning a house is that the imputed rental income homeowners receive is not taxed Although that income is not taxed homeowners still may deduct mortgage interest and property tax payments as well as certain other expenses from their federal taxable income if they itemize their deductions Taxpayers must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize their deductions to deduct home ownership expenses However taxpayers can t take the standard deduction if they itemize Non deductible payments and expenses Homeowners can t deduct any of the following

Tax Advantages Of Owning A Home Real Estate Articles Home Ownership

https://i.pinimg.com/originals/9c/cc/68/9ccc683a1c988c1cd276b6e3b27781a4.jpg

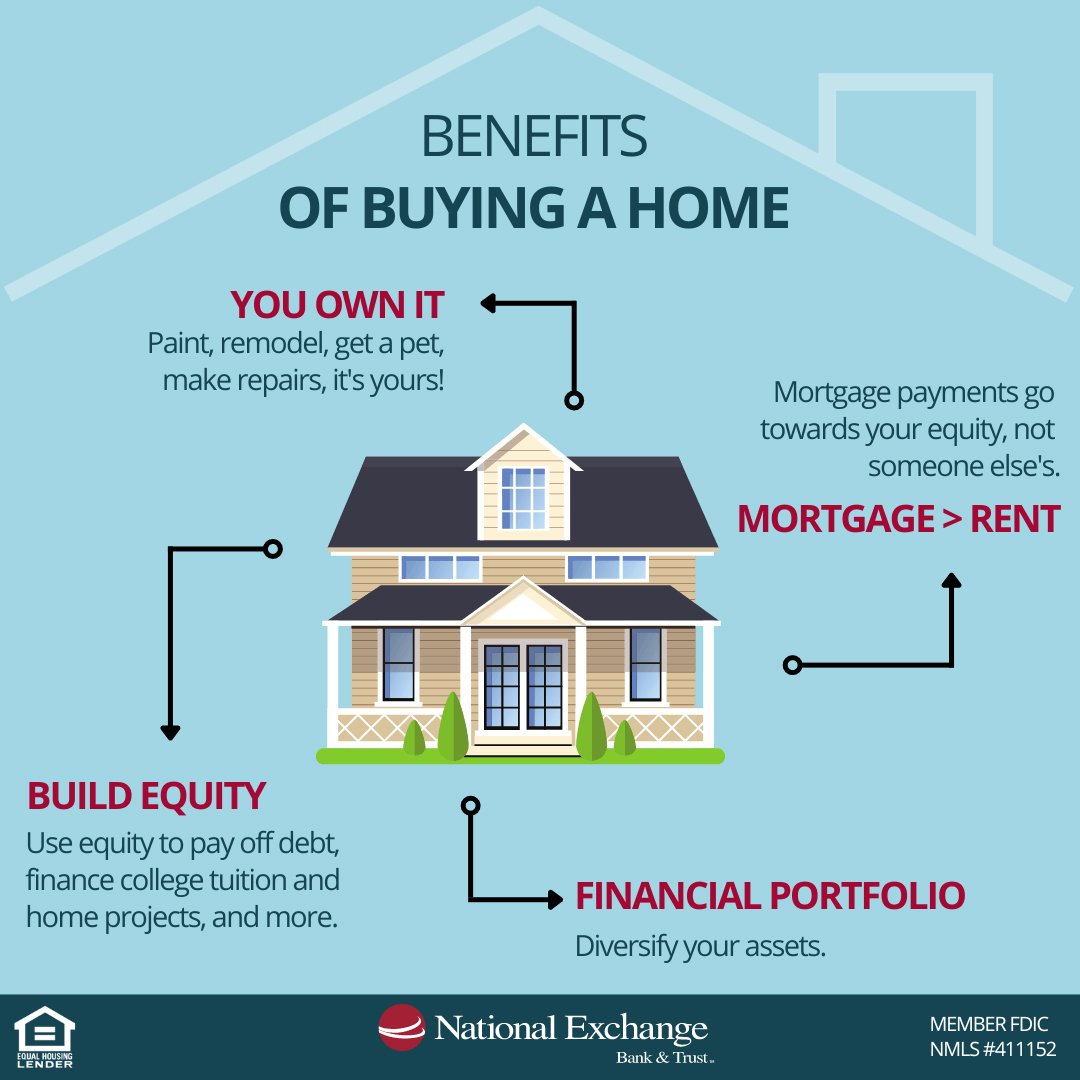

Benefits Of Buying A Home NEBAT Blog

https://nebat.com/sft1195/rent-vs-equity-infographic.jpg

https://smartasset.com/taxes/tax-benefits-of-owning-a-home

In the U S owning a home can lead to significant tax benefits which might include deductions for mortgage interest property taxes and home sale exclusion among others A financial advisor can help you determine

https://www.investopedia.com/articles/personal...

Taxes Top Tax Advantages of Buying a Home Save money with these deductions and credits By Tim Parker Updated December 08 2023 Reviewed by Lea D Uradu Fact checked by Suzanne Kvilhaug

Federal Solar Tax Credit What It Is How To Claim It For 2024

Tax Advantages Of Owning A Home Real Estate Articles Home Ownership

Owning A Home Has Distinct Financial Benefits Over Renting Mortgages

RENTING VS BUYING 4 Financial Benefits Of Owning A Home Rent Vs Buy

9 Tax Benefits Of Owning A Home Cape Coral Mortgage

PacRes Mortgage News Article

PacRes Mortgage News Article

8 Unexpected Costs Of Owning A Home Legal Guidance Now

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Buying Homeowners Insurance In California Progress Preferred

What Is Tax Benefit Of Owning A Home - One of the reasons that it can be difficult to keep up with the tax advantages of owning a home is that the tax code changes all the time Even if no new law has been passed tax deductions and credits may expire A case in point is the first time homeowners tax credit which used to provide a 7 500 repayable tax credit to first