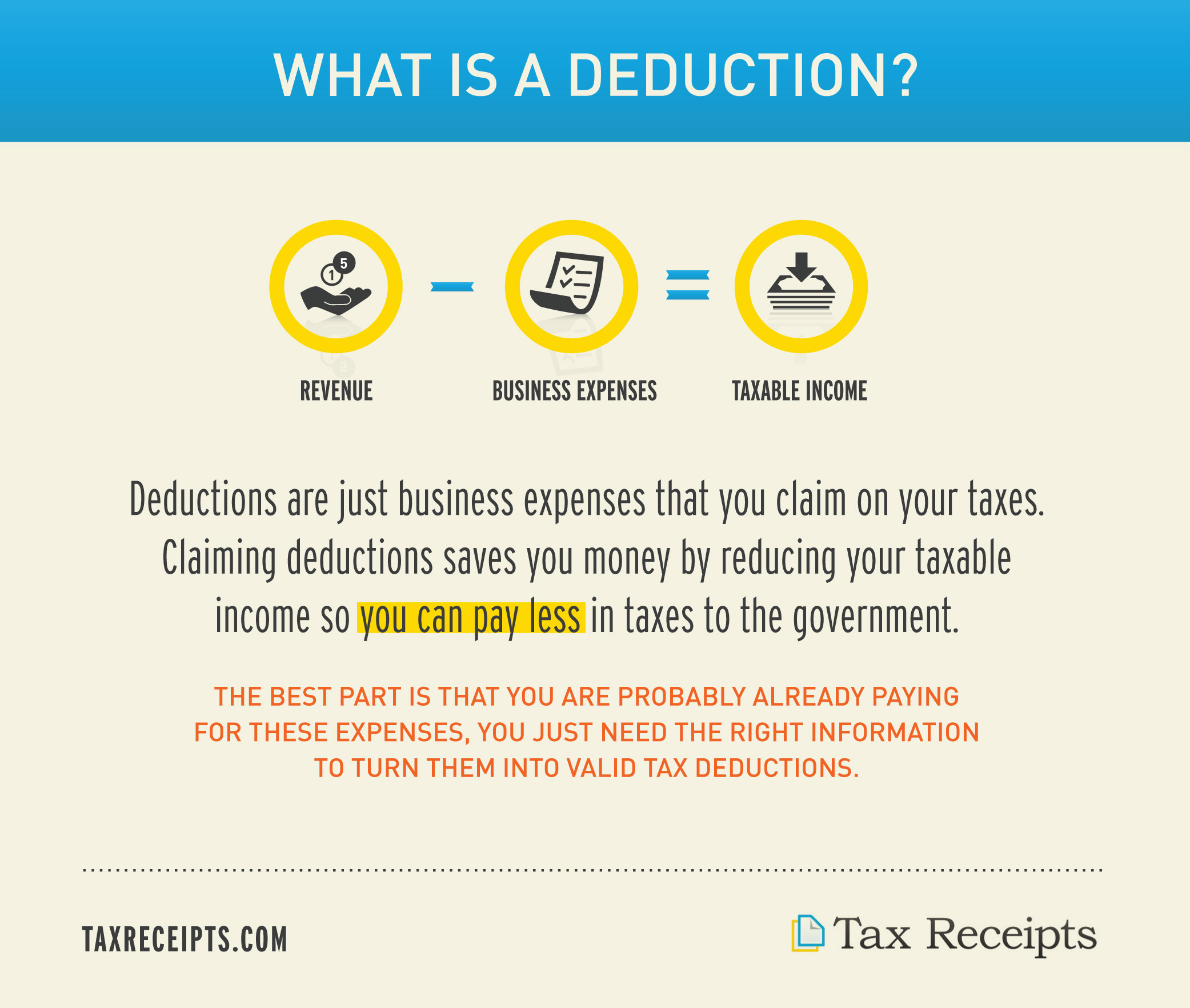

What Is Tax Deductible Mean What is a Tax Deductible A tax deductible expense is any expense that is considered ordinary necessary and reasonable and that helps a business to generate income It is usually deducted from the company s income before taxation

A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe You can choose the standard deduction a single deduction of a Tax deductibility refers to the process of reducing an individual s or a business s taxable income by accounting for certain allowable expenses known as tax deductions These deductions can be claimed when filing a federal income tax return effectively lowering the overall amount of income subject to tax

What Is Tax Deductible Mean

What Is Tax Deductible Mean

https://una-acctg.com/wp-content/uploads/2022/12/Lower-Your-Taxes-10-Deductible-Expenses-in-the-Philippines-scaled.jpg

Understanding Expenses What Is Tax Deductible

https://26891490.fs1.hubspotusercontent-eu1.net/hubfs/26891490/Blog/698e2356-755a-4c21-b339-907c8371e95f.jpg#keepProtocol

What Is A Tax Deduction

http://taxreceipts.com/wp-content/uploads/2012/03/what-is-a-deduction.jpg

A tax deduction is an item you can subtract from your taxable income to lower the amount of taxes you owe Browse Investopedia s expert written library to learn The federal tax law allows you to deduct several different personal expenses from your taxable income each year This can really pay off during tax season because the reduction to taxable income reduces the amount of income that is subject to federal income tax

Tax deductions reduce your taxable income by allowing you to write off certain expenses Learn more about this tax incentive and how you can leverage it A deduction reduces the amount of a taxpayer s income that s subject to tax generally reducing the amount of tax the individual may have to pay Most taxpayers now qualify for the standard deduction but there are some important details involving itemized deductions that people should keep in mind

Download What Is Tax Deductible Mean

More picture related to What Is Tax Deductible Mean

Ergeon How Your Fence Can Be Tax Deductible

https://assets-global.website-files.com/5ad551c41ca0c52724be6c55/6059e280542a77693a187cdc_Tax deductible.jpg

What Are Tax Deductions And Credits 20 Ways To Save Mint

https://blog.mint.com/wp-content/uploads/2022/12/tax-deductions-definition.png?resize=768

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

When something is tax deductible meaning that it s able to be legally subtracted from taxable income it serves as a taxpayer advantage When you apply tax deductions you ll lower Simply put a tax deduction is an expense that can be subtracted from your income to reduce how much you pay in taxes Tax deductions are a good thing because they lower your taxable income which also reduces your tax bill in the process

[desc-10] [desc-11]

What Is Copayment In Health Insurance With Example Dollar Keg

https://dollarkeg.com/wp-content/uploads/2022/12/image-57.png

WHAT DOES TAX DEDUCTIBLE ACTUALLY MEAN YouTube

https://i.ytimg.com/vi/nXsS_k4MVlw/maxresdefault.jpg

https://corporatefinanceinstitute.com/.../accounting/tax-deductible

What is a Tax Deductible A tax deductible expense is any expense that is considered ordinary necessary and reasonable and that helps a business to generate income It is usually deducted from the company s income before taxation

https://www.investopedia.com/terms/t/tax-deduction.asp

A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe You can choose the standard deduction a single deduction of a

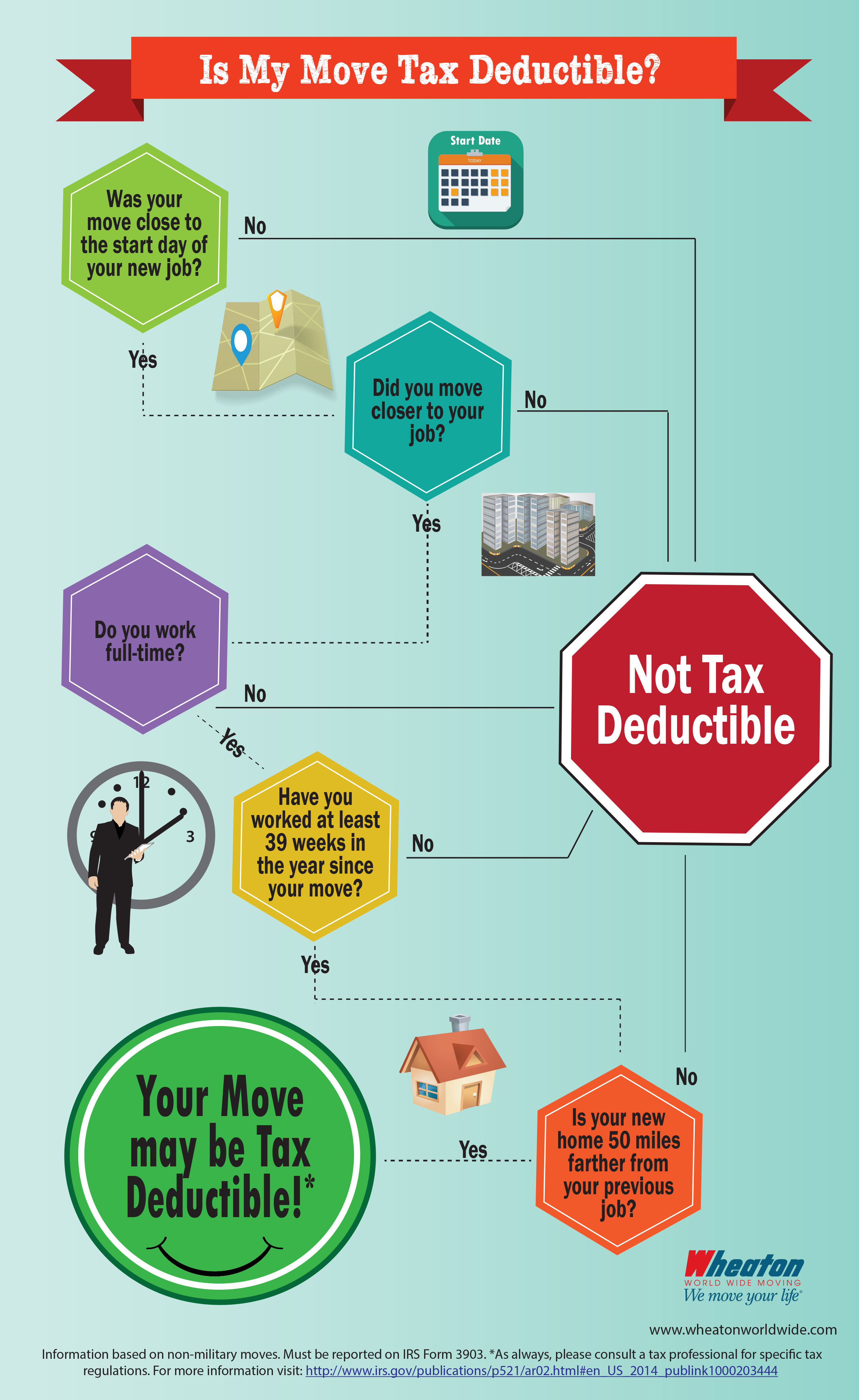

Infographic Is My Move Tax Deductible Wheaton

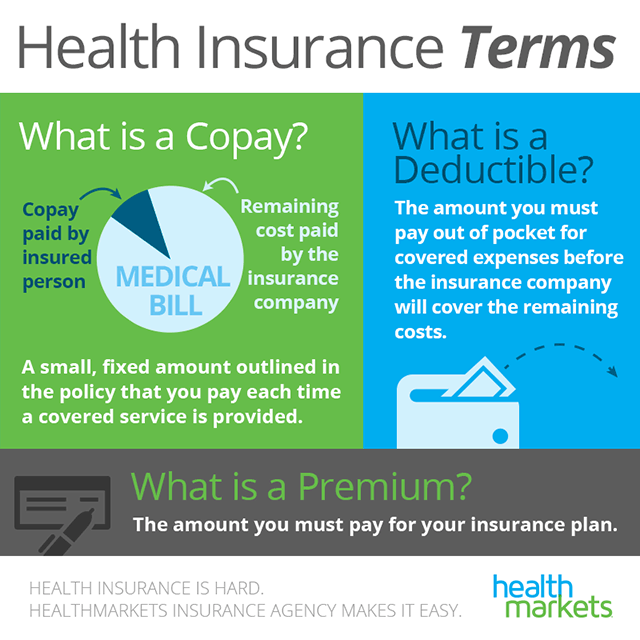

What Is Copayment In Health Insurance With Example Dollar Keg

Investment Expenses What s Tax Deductible 2024

What Are Tax Deductions And Credits 20 Ways To Save Mint

Tax Deductions In Germany 10 Deductible Expenses

How To Claim Tax Deductions For Donations And Gifts

How To Claim Tax Deductions For Donations And Gifts

What Does It Mean When Something Is Tax Deductible Business Partner

What Is A Deductible Learn More About Your Health Insurance Options

What Is A Tax Deduction Ramsey

What Is Tax Deductible Mean - The federal tax law allows you to deduct several different personal expenses from your taxable income each year This can really pay off during tax season because the reduction to taxable income reduces the amount of income that is subject to federal income tax