What Is Tax Exempt In Texas What purchases are exempt from the Texas sales tax While the Texas sales tax of 6 25 applies to most transactions there are certain items that may be exempt from taxation This page discusses various sales tax exemptions in Texas

A Guide to All Taxes in Texas In This Article What Taxes Do You Pay in Texas The Texas Franchise Tax Death Taxes Property Taxes Sales Taxes Photo RichVintage Getty Images Texas has no personal income tax but it does tax real and some tangible personal property as well as gasoline cigarettes and hotel stays What types of exemptions are available to a nonprofit organization in Texas How do I apply for exemption The application asks for a copy of the file stamped articles of incorporation Where do I get this document Are 501 c entities exempt from state taxes My organization has a federal tax identification number

What Is Tax Exempt In Texas

What Is Tax Exempt In Texas

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/alabama-state-sales-and-use-tax-certificate-of-exemption-form-ste-1-11.png

Texas Sales Tax Exemption Certificate Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/texas-sales-and-use-tax-exemption-certificate-1.png

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

https://www.sanpatricioelectric.org/sites/sanpatricioelectric/files/inline-images/SPEC SALES TAX FORM Example.jpg

Learn about Texas tax exemptions related to qualified organizations including school and sports related organizations 501 c organizations and others Common Texas sales tax exemptions include those for necessities of life including most food and health related items In addition goods for resale such as wholesale items are exempt from sales tax as well as newspapers containers previously taxed items and certain goods used for manufacturing

In the state of Texas sales tax is legally required to be collected from all tangible physical products being sold to a consumer An example of items that are exempt from Texas sales tax are items specifically purchased for resale Some customers are exempt from paying sales tax under Texas law Examples include government agencies some nonprofit organizations and merchants purchasing goods for resale

Download What Is Tax Exempt In Texas

More picture related to What Is Tax Exempt In Texas

How To Apply For A Sales Tax Exemption Certificate Tax Walls

https://img.yumpu.com/22272990/1/500x640/texas-sales-and-use-tax-exemption-certificate.jpg

Filing Exempt On Taxes For 6 Months How To Do This

https://mgtblog.com/wp-content/uploads/2021/05/download-2.png

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/50/825/50825271/large.png

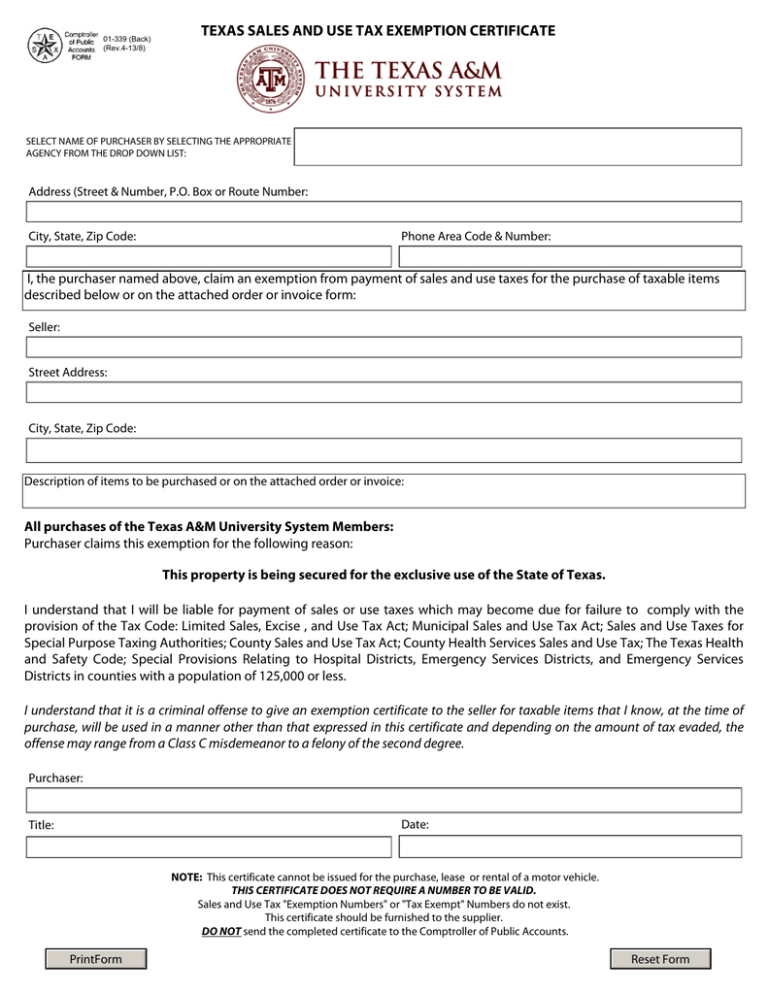

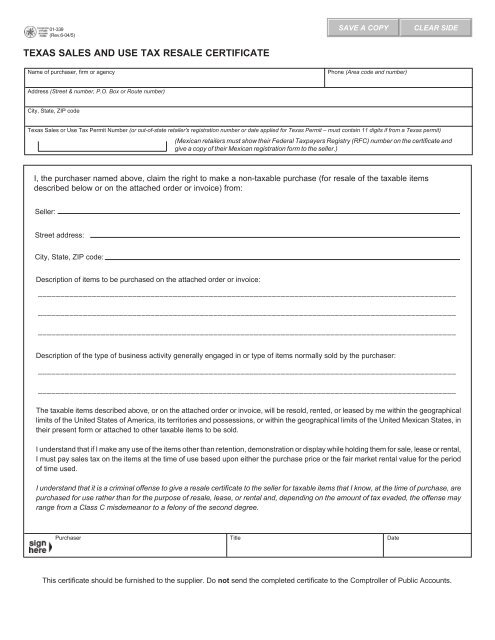

What is Exempt From Sales Tax In Texas The state of Texas levies a 6 25 state sales tax on the retail sale lease or rental of most goods and some services Local jurisdictions impose additional sales taxes up to 2 The range of total sales tax rates within the state of Texas is between 6 25 and 8 25 The Texas Resale Certificate and the Texas Exemption Certificate are literally two sides of the same form While both serve to substantiate exemptions for otherwise taxable transactions they operate in different circumstances

If you are a retailer making purchases for resale or need to make a purchase that is exempt from the Texas sales tax you need the appropriate Texas sales tax exemption certificate before you can begin making tax free purchases This page explains how to make tax free purchases in Texas and lists nine Texas sales tax exemption forms Neither a nonprofit corporation nor an unincorporated nonprofit association is automatically exempt from federal or state taxes

Illinois Tax Exempt Certificate Five Mile House

https://images.squarespace-cdn.com/content/v1/58cf3fa8e6f2e19aff948d4c/1593946918567-M3LZJC3J24BR72W9BKW6/Sales+Tax+Certificate.jpg

State Withholding Tax Form 2023 Printable Forms Free Online

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Form-W-4.png

https://www.salestaxhandbook.com/texas/sales-tax-exemptions

What purchases are exempt from the Texas sales tax While the Texas sales tax of 6 25 applies to most transactions there are certain items that may be exempt from taxation This page discusses various sales tax exemptions in Texas

https://www.thebalancemoney.com/taxes-in-texas-a...

A Guide to All Taxes in Texas In This Article What Taxes Do You Pay in Texas The Texas Franchise Tax Death Taxes Property Taxes Sales Taxes Photo RichVintage Getty Images Texas has no personal income tax but it does tax real and some tangible personal property as well as gasoline cigarettes and hotel stays

Busapcom Bir Form 1606 Download Sample Withholding Tax Invoice

Illinois Tax Exempt Certificate Five Mile House

Tax Letter Template Format Sample And Example In PDF Word

Tax Exempt Cert 1 Revelation Gardens

Government Tax Exempt Form Pdf Fill Online Printable Fillable

State Tax Exemption Map National Utility Solutions

State Tax Exemption Map National Utility Solutions

Texas Exemption Certificate TUTORE ORG Master Of Documents

State Sales Tax State Sales Tax Exemption Certificate New York

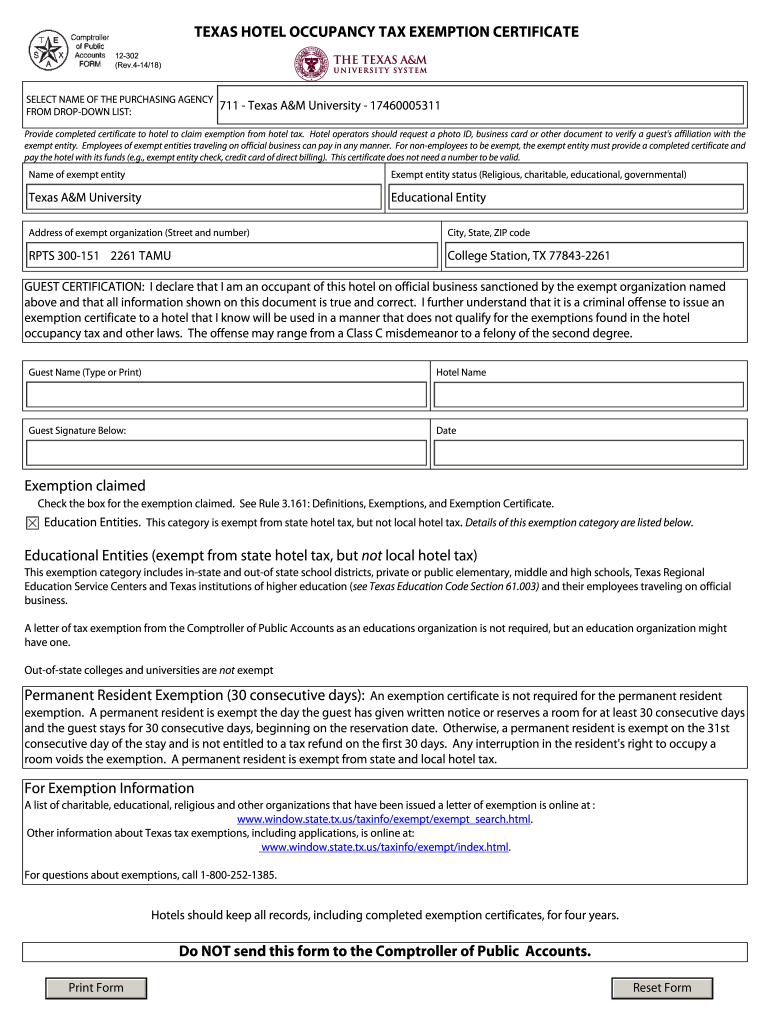

Texas Hotel Tax Exempt Form Fill Out And Sign Printable PDF Template

What Is Tax Exempt In Texas - Learn about Texas tax exemptions related to qualified organizations including school and sports related organizations 501 c organizations and others