What Is Tax Exempt Mutual Fund Tax exempt mutual funds can offer a steady income stream and minimize your federal tax liability Here s what you need to know as an investor

Tax exempt mutual funds are simply composed of investments that generate tax free interest They are offered by many prominent investment firms and some even specialize in this Tax managed mutual funds aim to minimize investor taxes by using strategies that reduce taxable distributions and enhance overall tax efficiency These can include tax loss harvesting holding period management investing in municipal bonds and reducing frequent trading among other strategies

What Is Tax Exempt Mutual Fund

What Is Tax Exempt Mutual Fund

https://cdn1.npcdn.net/image/16094004327a9725299dbfb1df6fd7b1101a3e2cc2.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

What Is Floor Stocks Tax India Viewfloor co

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/07/tax-on-mutual-funds.jpg

Analyse Mutual Funds In Under 10 Minutes On Tickertape Blog By

https://www.tickertape.in/blog/wp-content/uploads/2020/12/Mutual-Funds.png

Learn about capital gains cost basis qualified dividends tax free dividends and other factors that go into how much you re taxed on mutual funds You may owe tax on mutual funds even if you haven t sold your shares See how and when you pay tax on mutual funds plus what you can do to pay less

Mutual funds are pass through investments meaning any dividend income they receive must be distributed to shareholders Dividends paid by a stock or mutual fund mostly are considered See how capital gains taxes work for mutual funds and ETFs exchange traded funds

Download What Is Tax Exempt Mutual Fund

More picture related to What Is Tax Exempt Mutual Fund

Mutual Fund Taxation How Mutual Funds Are Taxed

https://assets1.cleartax-cdn.com/s/img/2017/08/02121249/EBDSP-info-1-1024x714.png

American Balanced Fund R 6 American Funds

https://www.capitalgroup.com/institutional/investments/Chart/GetReturnsBarChartImage?fundnumber=11&shareClass=R6&period=Quarterly&navormop=NAV&indexId=76053&fundclassnumber=2611&isCentralCashFund=False

Tax exempt Meaning YouTube

https://i.ytimg.com/vi/ddrP_SUqw4A/maxresdefault.jpg

Certain accounts such as individual retirement and college savings accounts are tax advantaged If you have mutual funds in these types of accounts you pay taxes only when earnings or pre tax contributions are withdrawn This Interest income from municipal bonds is typically exempt from federal income taxes may be exempt from the alternative minimum tax AMT and in many cases state and local taxes if you reside

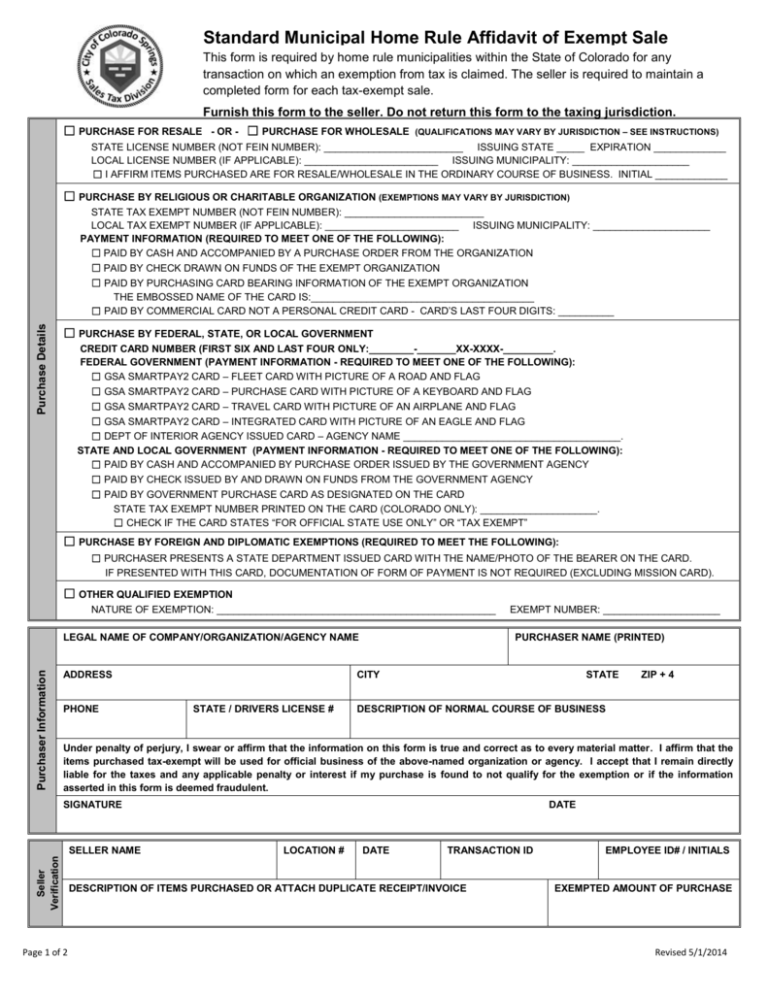

The fund invests in investment grade municipal bonds from issuers that are primarily state or local governments or agencies whose interest is exempt from U S federal income taxes and the federal alternative minimum tax There is also another class of mutual fund known as tax exempt funds that do guarantee that they will not produce taxable income during the year Municipal bond funds are a prime example of this type of fund although the shareholder may need to live in the state or locality where the fund is issued

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

https://economictimes.indiatimes.com/img/60155156/Master.jpg

Online Tax Online Tax Exempt Form

http://austinscreenprinting.net/wp/wp-content/uploads/2017/05/Resale_Cert__Tax_Exempt_Form_ENG-pdf.jpg

https://smartasset.com/investing/which-mutual-funds-are-tax-exempt

Tax exempt mutual funds can offer a steady income stream and minimize your federal tax liability Here s what you need to know as an investor

https://www.investopedia.com/ask/answers/091615/...

Tax exempt mutual funds are simply composed of investments that generate tax free interest They are offered by many prominent investment firms and some even specialize in this

Tax Loss Harvesting For The Fiduciary Pros And Cons

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

Illinois Tax Exempt Certificate Five Mile House

Haven t Filed Taxes In 5 Years Reddit Fear Column Image Library

What Are The Mutual Funds How They Help You Save Taxes Mutuals

State Tax Exemption Map National Utility Solutions

State Tax Exemption Map National Utility Solutions

New Tax Exempt Form

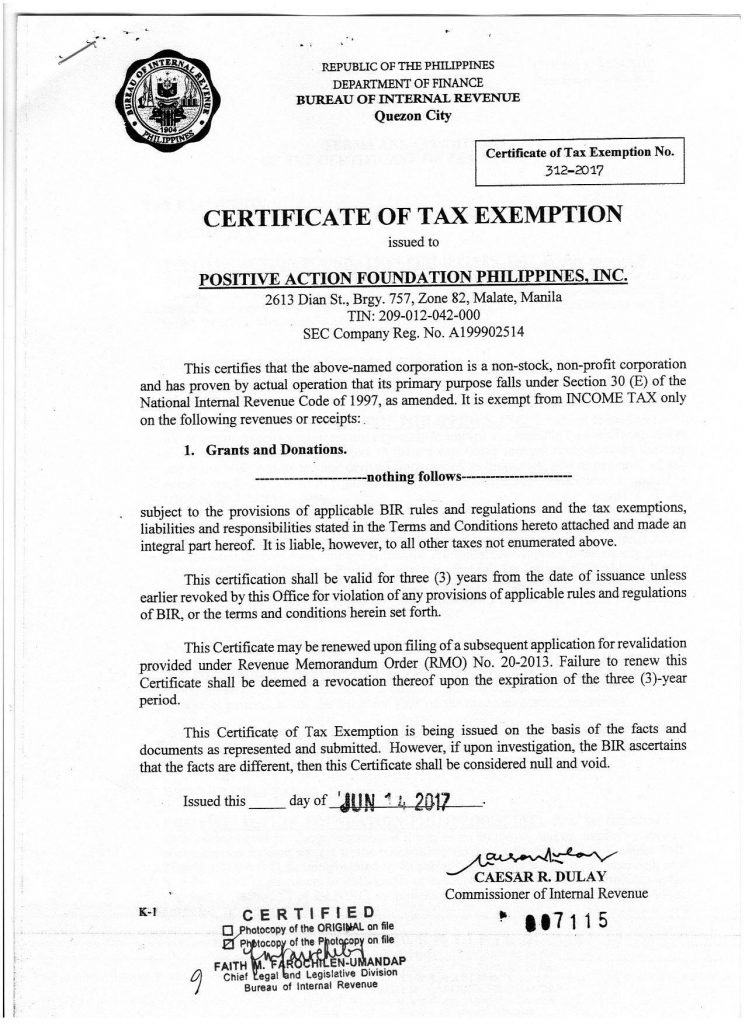

Certificate Of TAX Exemption PAFPI

Best ELSS Mutual Funds 2022 Top ELSS Tax Saving Mutual Funds In India

What Is Tax Exempt Mutual Fund - Mutual funds are pass through investments meaning any dividend income they receive must be distributed to shareholders Dividends paid by a stock or mutual fund mostly are considered