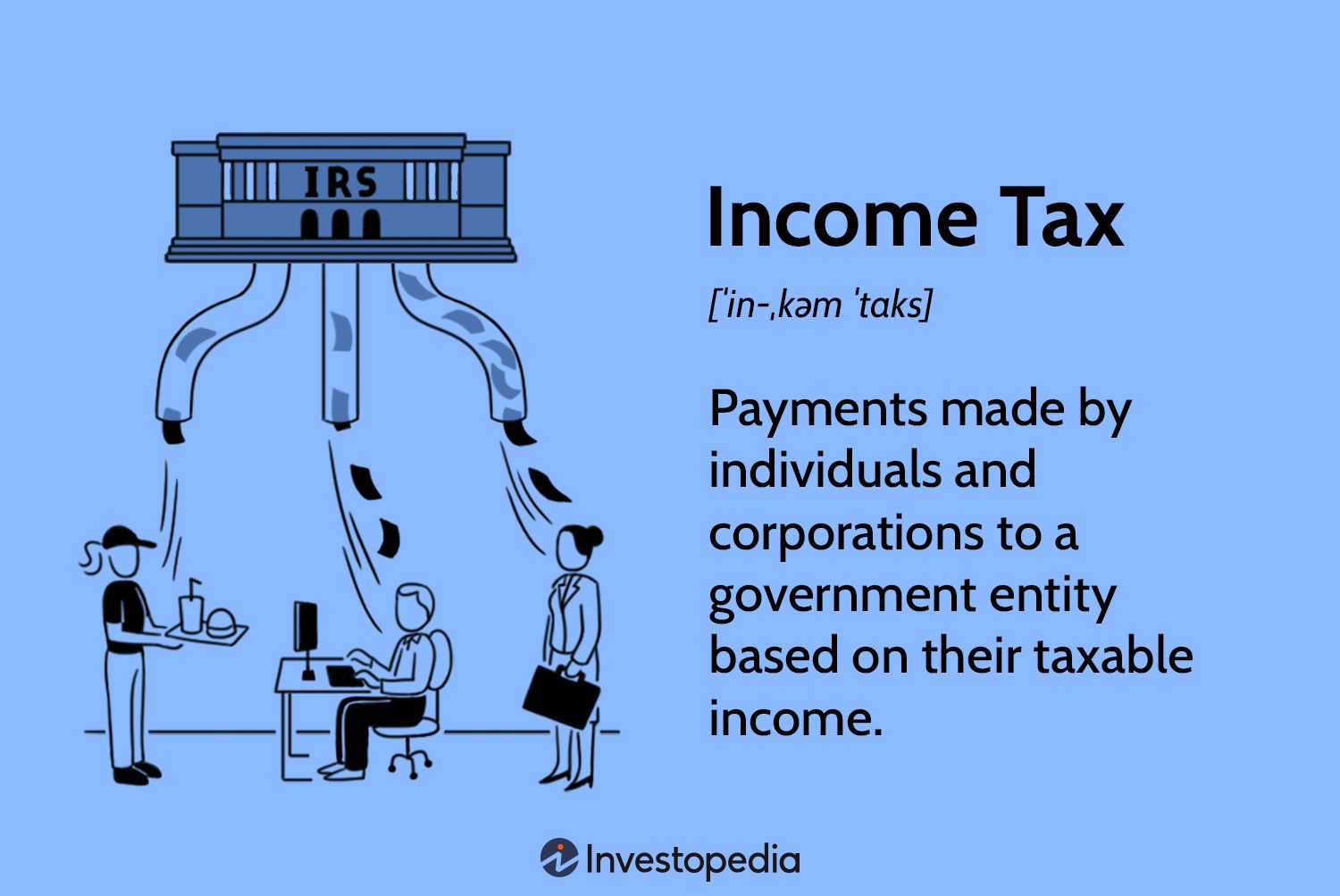

What Is Tax In Economics A tax is a charge levied by a government to raise revenue The main types of taxes include Income tax a percentage of income Corporation tax a percentage of a firm s profit Sales tax VAT an indirect tax on the sale of goods Excise duties taxes on alcohol tobacco petrol

Taxation is a term for when a taxing authority usually a government levies or imposes a financial obligation on its citizens or residents Paying taxes to Taxation is the compulsory financial charge or some other type of levy imposed upon a taxpayer an individual or legal entity by a governmental organization in order to fund various public expenditures Consider the progressive income tax

What Is Tax In Economics

What Is Tax In Economics

https://www.taxcalgary.com/wp-content/uploads/2018/12/personal-tax-return.jpg

What Is Tax And Why Is It Necessary Debt Equity Investment

https://debtequityinvestment.com/wp-content/uploads/2021/11/taxes-1568x1086.jpg

How Are Income Taxes Calculated The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10-1.jpg

Taxation imposition of compulsory levies on individuals or entities by governments Taxes are levied in almost every country of the world primarily to raise revenue for government expenditures although they serve other purposes as well Tax A tax is a mandatory payment or charge collected by local state and national governments from individuals or businesses to cover the costs of general government services goods and activities Why Do We Pay Taxes

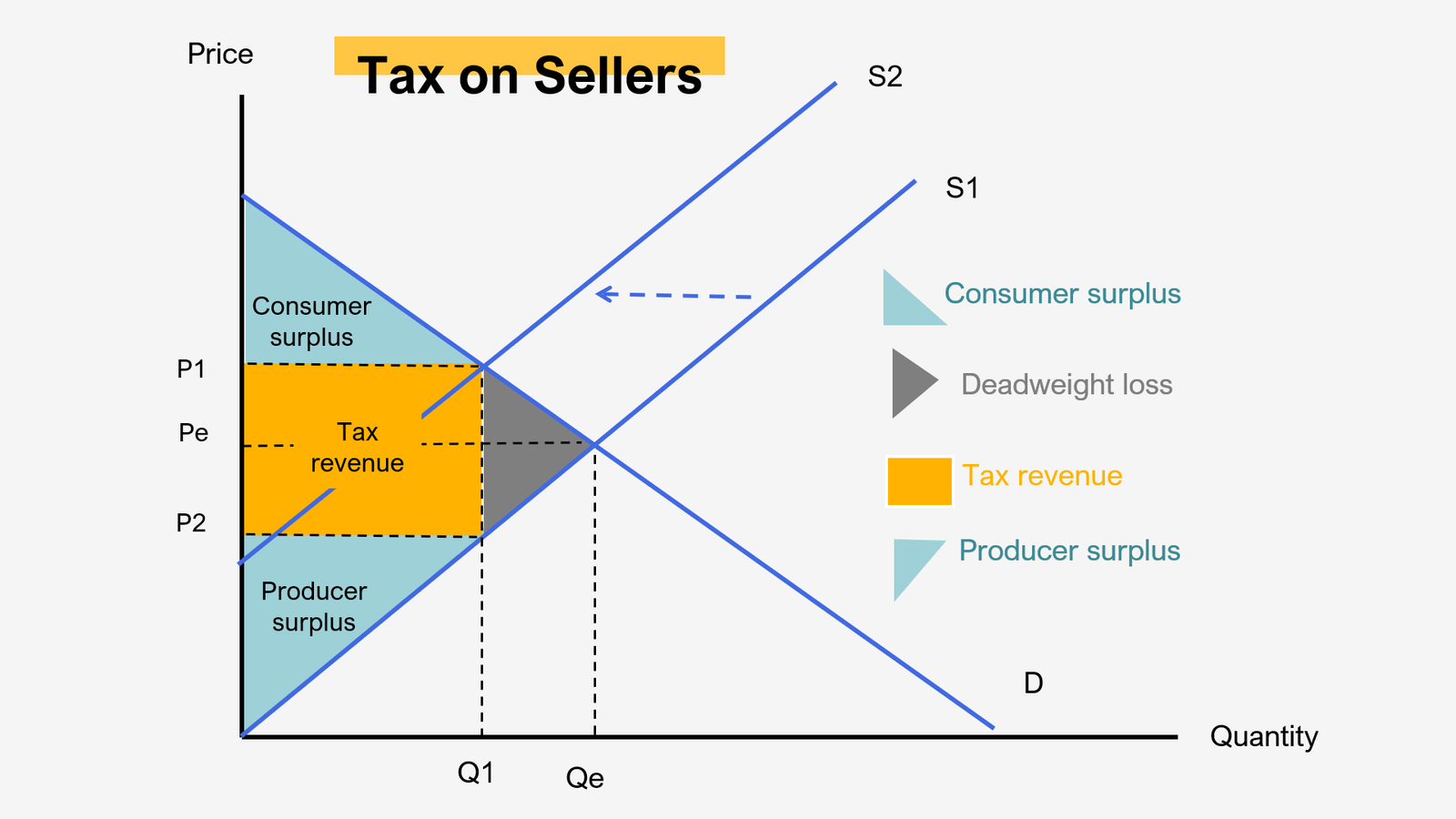

The theory of economic tax incidence characterizes the effect on the economic equilibrium of a change in taxes measuring the utility of agents before and after the tax change The utility here means that in a world without taxes consumers and producers behave in reflection of their preference or utility functions Taxation Our World in Data Taxes are the most important source of government revenue Who is paying how much and how do tax systems differ By Esteban Ortiz Ospina and Max Roser This page was first published in September 2016

Download What Is Tax In Economics

More picture related to What Is Tax In Economics

Income Tax Rates By State INVOMERT

https://i2.wp.com/www.richardcyoung.com/wp-content/uploads/2016/02/income-tax-rate-map.png

Small Business Hub Taxes Invoice2go

https://invoice2go.imgix.net/2021/10/How-Long-To-Keep-Tax-Records.jpg?auto=format&ixlib=react-9.3.0&w=400&h=225&dpr=4&q=23

What Is Tax In Hindi What Is VAT Tax In Hindi

https://stockmarketgyani.com/wp-content/uploads/2022/12/What-is-tax-in-hindi-1024x536.jpeg

Tax revenue is the dollar amount of tax collected For an excise or per unit tax this is quantity sold multiplied by the value of the per unit tax Tax revenue is counted as part of total surplus The tax framework of a country is considered a crucial instrument for influencing the country s economy Tax policies have significant implications for specific groups within an economy such as households firms and banks

[desc-10] [desc-11]

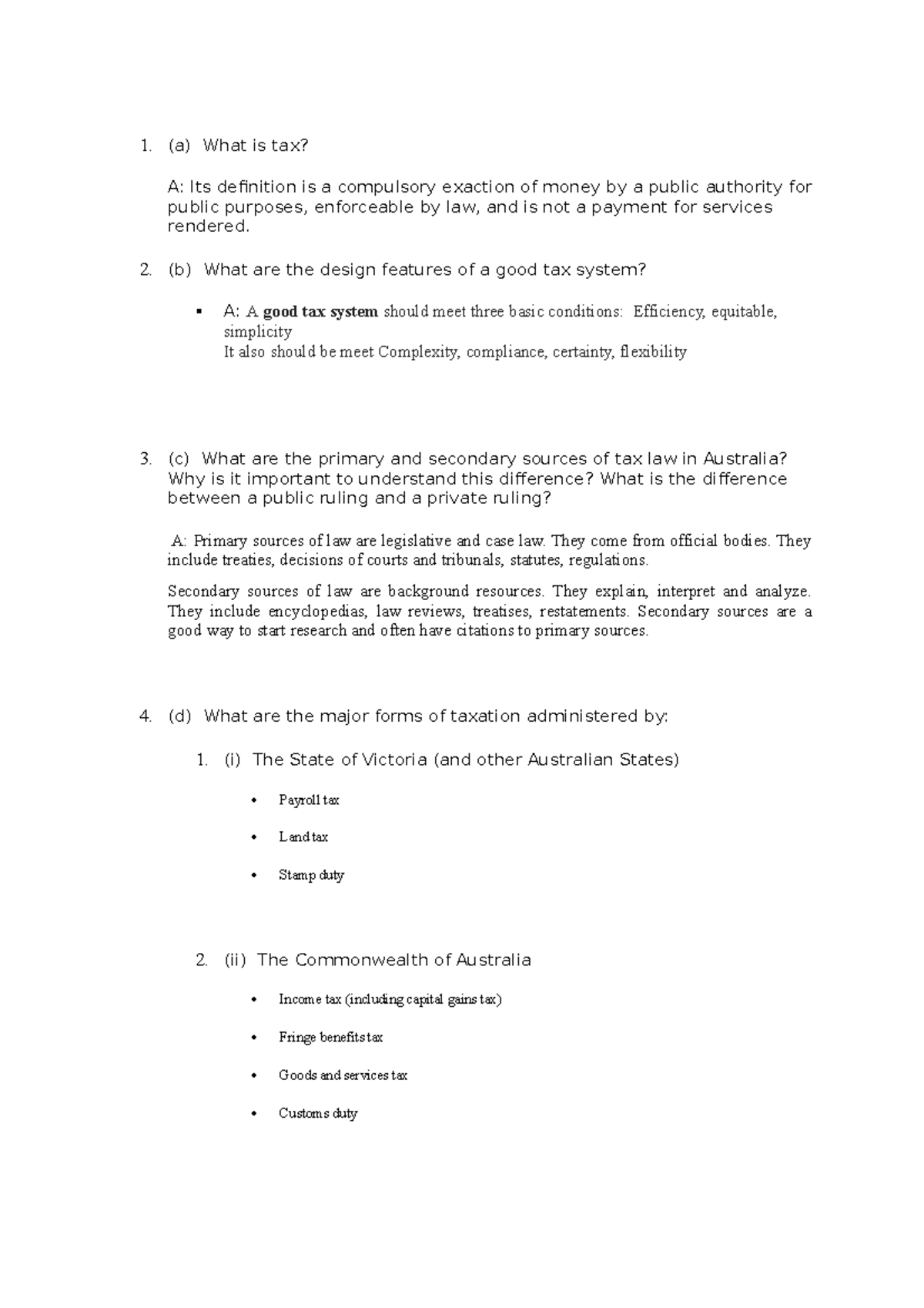

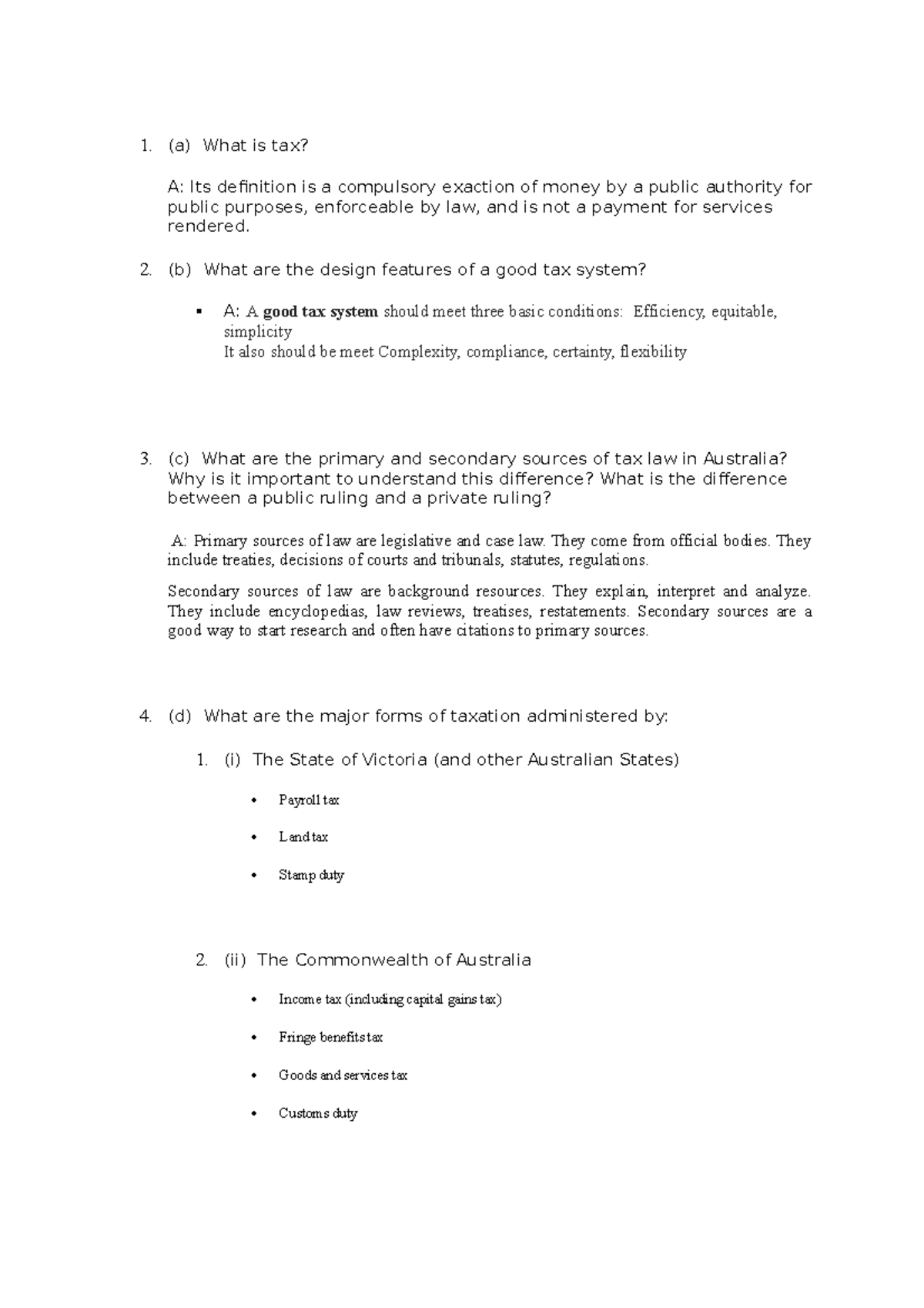

Tutorial 2 Answer a What Is Tax A Its Definition Is A Compulsory

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/aa83bfc2aecd746246d040344255711d/thumb_1200_1698.png

Image Gallery Economics Definition

http://4.bp.blogspot.com/-0onXc0KxbvU/Vi0PooREEDI/AAAAAAAACLM/FLLjL0pJV8o/s1600/ECONOMICS.jpg

https://www. economicshelp.org /.../types-of-tax

A tax is a charge levied by a government to raise revenue The main types of taxes include Income tax a percentage of income Corporation tax a percentage of a firm s profit Sales tax VAT an indirect tax on the sale of goods Excise duties taxes on alcohol tobacco petrol

https://www. investopedia.com /terms/t/taxation.asp

Taxation is a term for when a taxing authority usually a government levies or imposes a financial obligation on its citizens or residents Paying taxes to

How To Calculate Deadweight Loss With A Price Ceiling

Tutorial 2 Answer a What Is Tax A Its Definition Is A Compulsory

Tax Accounting Definition And Types Of Tax Accounting

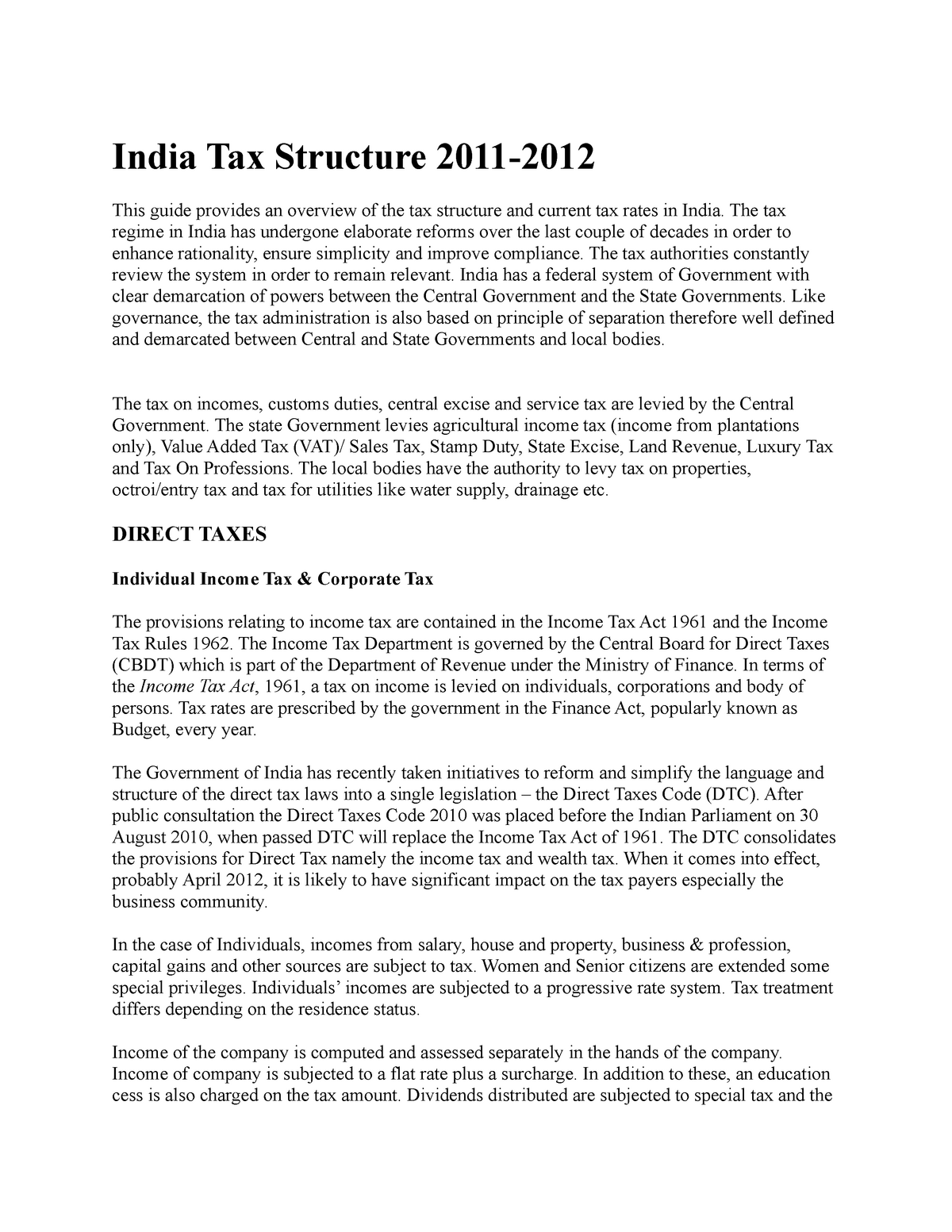

Tax Lecture Notes 11 India Tax Structure 2011 This Guide Provides

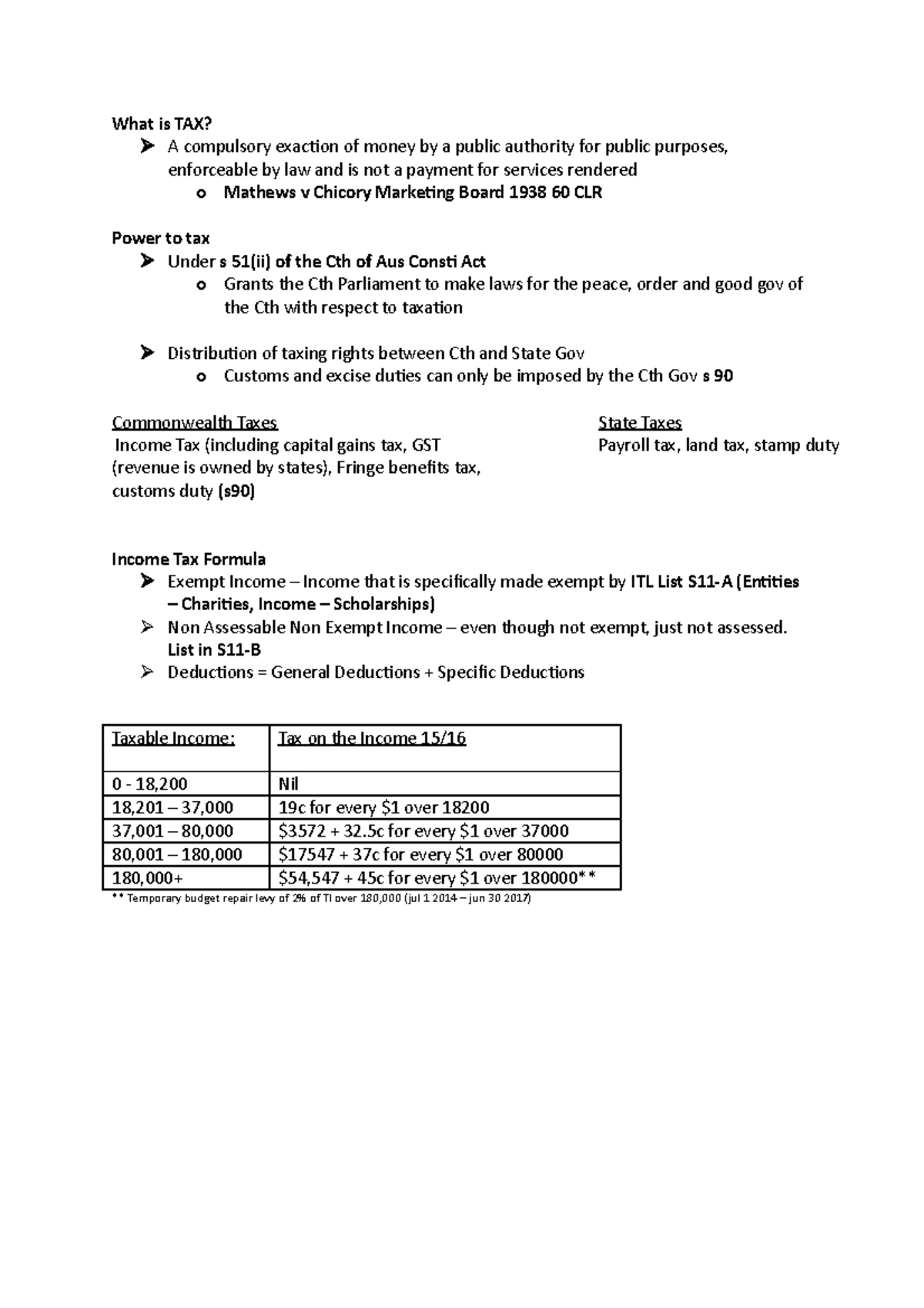

What Is TAX Chapter 1 What Is TAX A Compulsory Exaction Of Money A

TAX BSA What Is Tax Accounting Tax Accounting Refers To The Rules

TAX BSA What Is Tax Accounting Tax Accounting Refers To The Rules

Types Of Taxes UPSC Taxes In India UPSC Types Of Taxes In India UPSC

Tax Incidence Microeconomics

What Are The Benefits Of Filing Your Income Tax Return Regularly

What Is Tax In Economics - Taxation Our World in Data Taxes are the most important source of government revenue Who is paying how much and how do tax systems differ By Esteban Ortiz Ospina and Max Roser This page was first published in September 2016