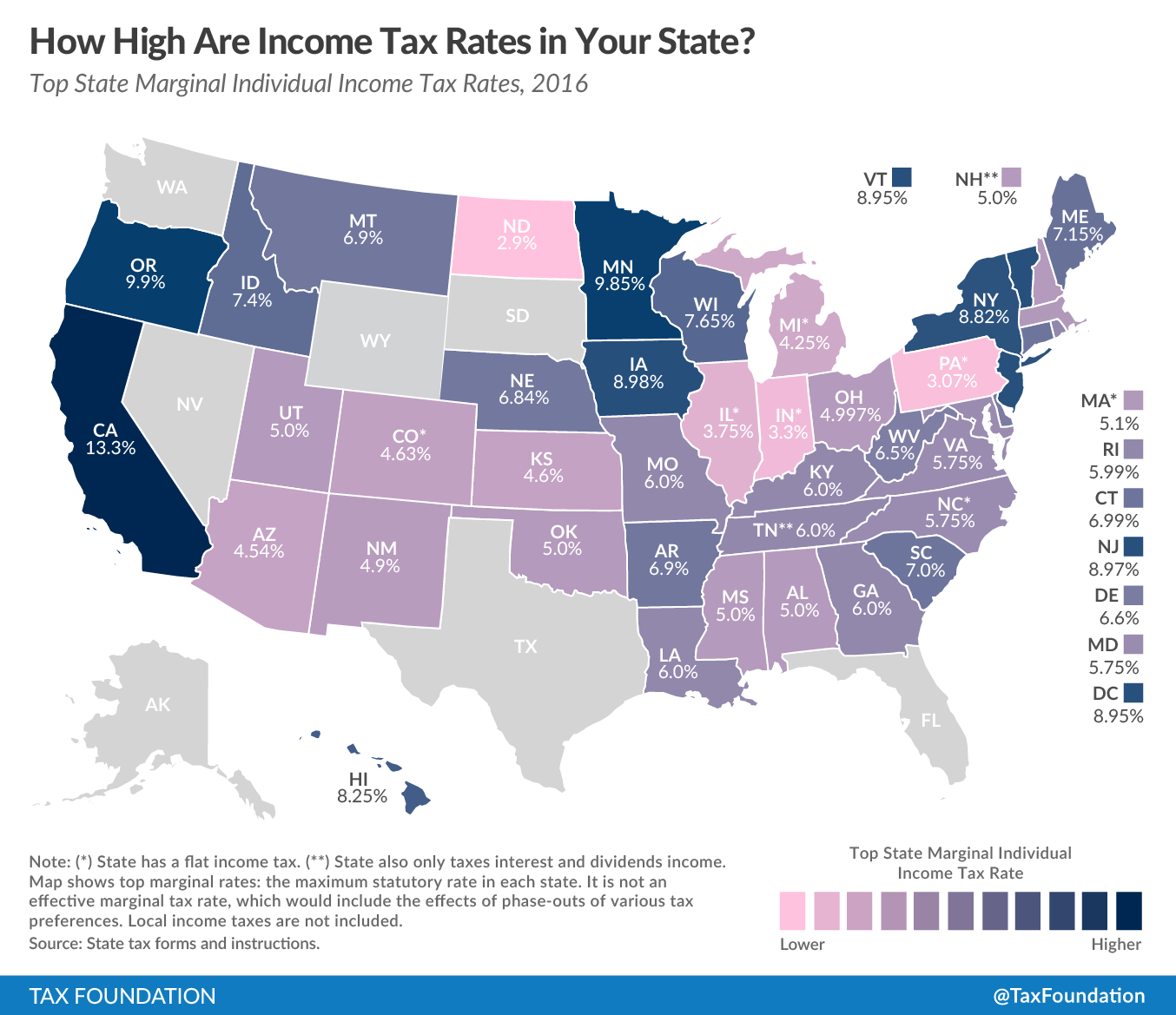

What Is Tax Rate In Massachusetts Massachusetts has a flat tax rate of 5 But new for the 2024 filing season an additional 4 tax on 2023 income over 1 million will be levied making the highest tax rate in the state 9

Your average tax rate is 10 94 and your marginal tax rate is 22 This marginal tax rate means that your immediate additional income will be taxed at this rate Use our income tax calculator Massachusetts has a progressive state income tax system that ranges from 5 to 9 That goes for both earned income wages salary commissions and unearned income interest and dividends While the state levies a 5 tax on

What Is Tax Rate In Massachusetts

What Is Tax Rate In Massachusetts

https://www.richardcyoung.com/wp-content/uploads/2016/02/income-tax-rate-map.png

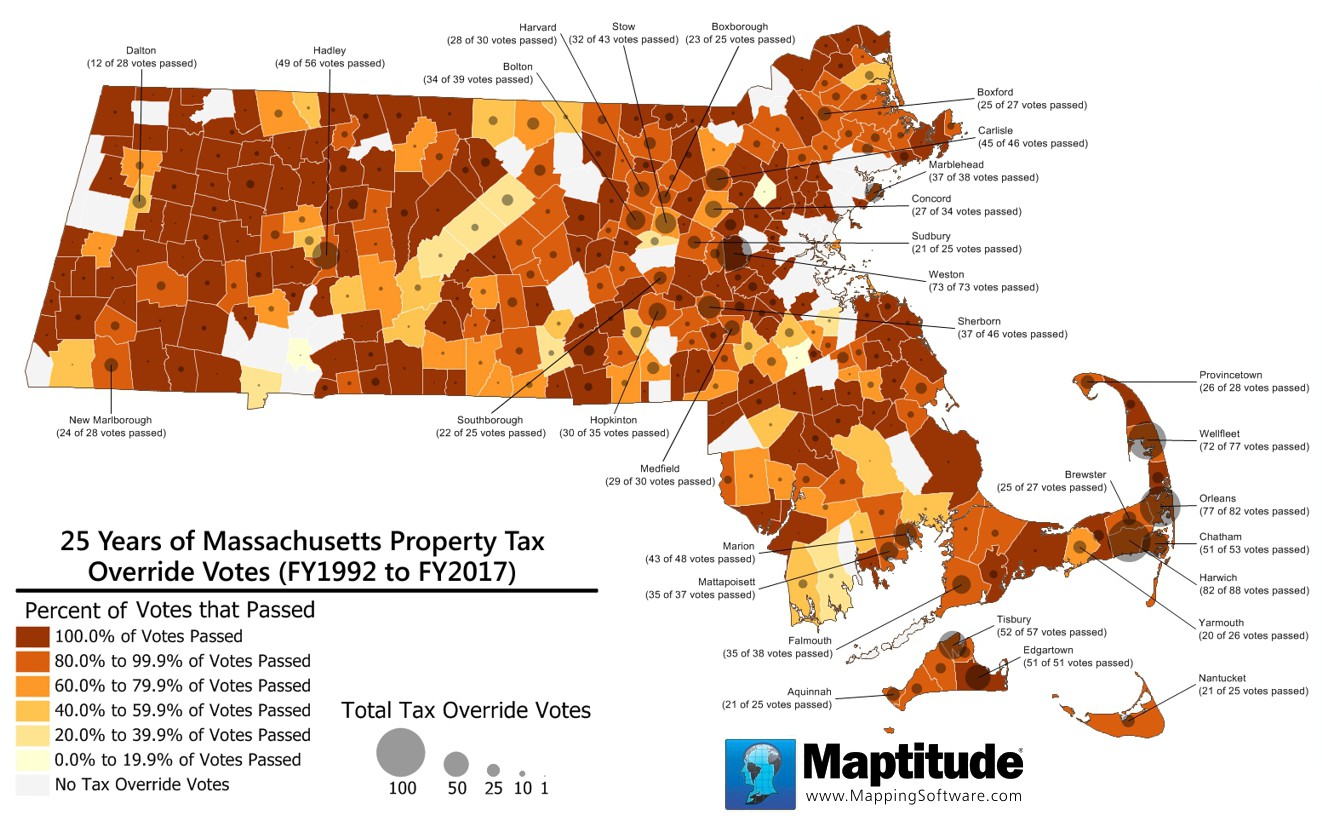

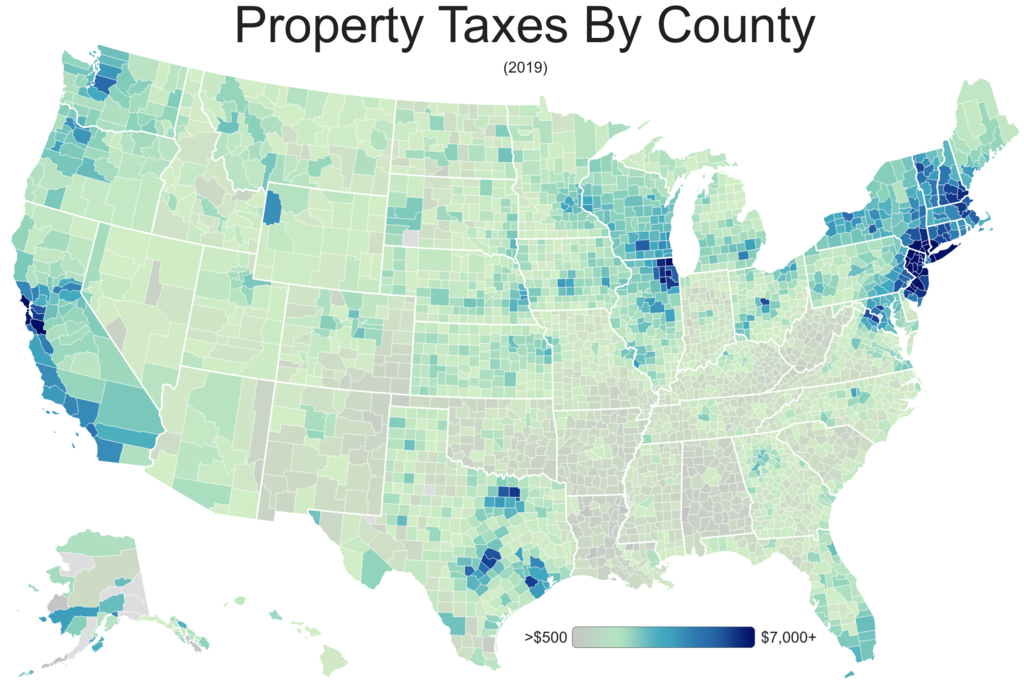

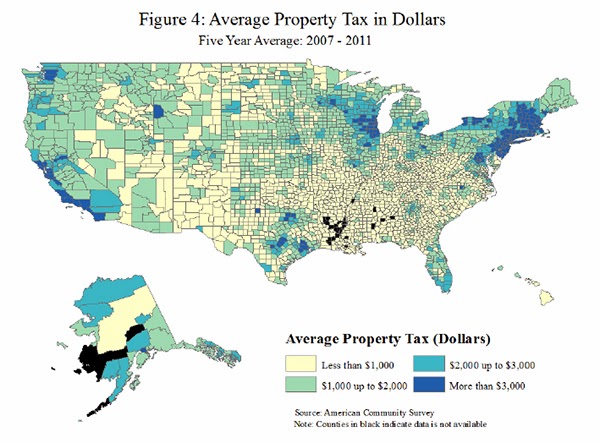

How Much Are Your Massachusetts Property Taxes MassLandlords

https://masslandlords.net/wp-content/uploads/mass-property-taxes-image-1-cc-by-sa-wikimedia.png

Massachusetts Income Tax Calculator State Tax Rate Community Tax

https://www.communitytax.com/wp-content/uploads/2019/11/masa-property.png

Massachusetts 2024 income tax ranges from 5 to 9 This page has the latest Massachusetts brackets and tax rates plus a Massachusetts income tax calculator Income tax tables and other tax information is sourced from the To calculate how much tax you owe first calculate your Massachusetts gross income Massachusetts gross income is federal gross income Plus income excluded from

The Income tax rates and personal allowances in Massachusetts are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include For tax year 2023 Massachusetts has a 5 0 tax on both earned salaries wages tips commissions and unearned interest dividends and capital gains income Certain

Download What Is Tax Rate In Massachusetts

More picture related to What Is Tax Rate In Massachusetts

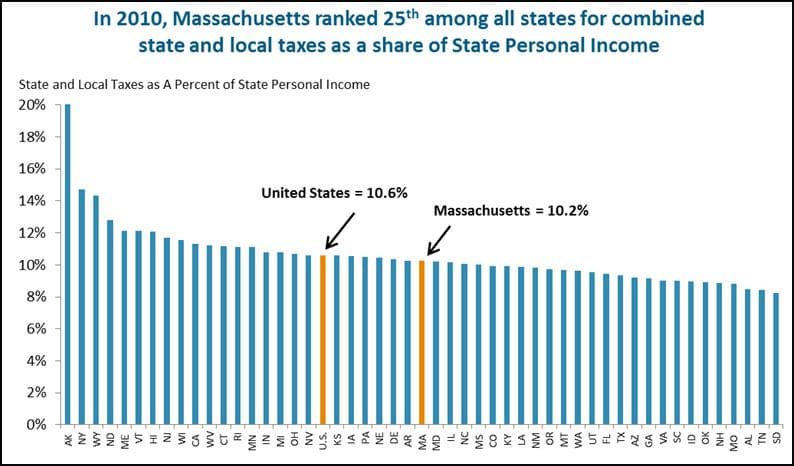

Report Mass Tax Burden In Middle Of Pack WBUR News

http://wordpress.wbur.org/wp-content/uploads/2012/09/0926_tax-graph.jpg

Top State Income Tax Rates In 2014

https://files.taxfoundation.org/legacy/docs/State income tax rates_2.png

State Corporate Income Tax Rates And Brackets Tax Foundation

https://files.taxfoundation.org/20220714115620/2022-CIT-rates-July-Update-FV2-01.png

The income tax rate in Massachusetts is 5 00 That rate applies equally to all taxable income up to 1 million As mentioned above incomes that exceed this threshold are subject to a 4 surtax that was first instituted in 2023 Massachusetts has state sales tax of 6 25 and allows local governments to collect a local option sales tax of up to N A There are a total of 228 local tax jurisdictions across the state collecting an average local tax of N A Click here

The Massachusetts income tax has two tax brackets with a maximum marginal income tax of 9 000 as of 2024 Detailed Massachusetts state income tax rates and brackets are available The Income tax rates and personal allowances in Massachusetts are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include

Massachusetts Income Tax Rate To Drop On Jan 1 2020 Boston Business

https://media.bizj.us/view/img/11064813/gettyimages-852667532*1200xx5000-2813-0-260.jpg

Maptitude Map Massachusetts Property Tax Override Votes

https://www.caliper.com/featured-maps/proposition-2-and-half-overrides-maptitude-map.jpg

https://www.nerdwallet.com › article › t…

Massachusetts has a flat tax rate of 5 But new for the 2024 filing season an additional 4 tax on 2023 income over 1 million will be levied making the highest tax rate in the state 9

https://www.forbes.com › advisor › income-tax...

Your average tax rate is 10 94 and your marginal tax rate is 22 This marginal tax rate means that your immediate additional income will be taxed at this rate Use our income tax calculator

Average Total Tax Rate By State Rating Walls

Massachusetts Income Tax Rate To Drop On Jan 1 2020 Boston Business

How Federal Income Tax Rates Work Full Report Tax Policy Center

Listed Here Are The Federal Tax Brackets For 2023 Vs 2022 FinaPress

Mass Sales Tax Calculator VerdunMaman

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Sales Tax By State Here s How Much You re Really Paying Sales Tax

The United States Of Sales Tax In One Map The Washington Post

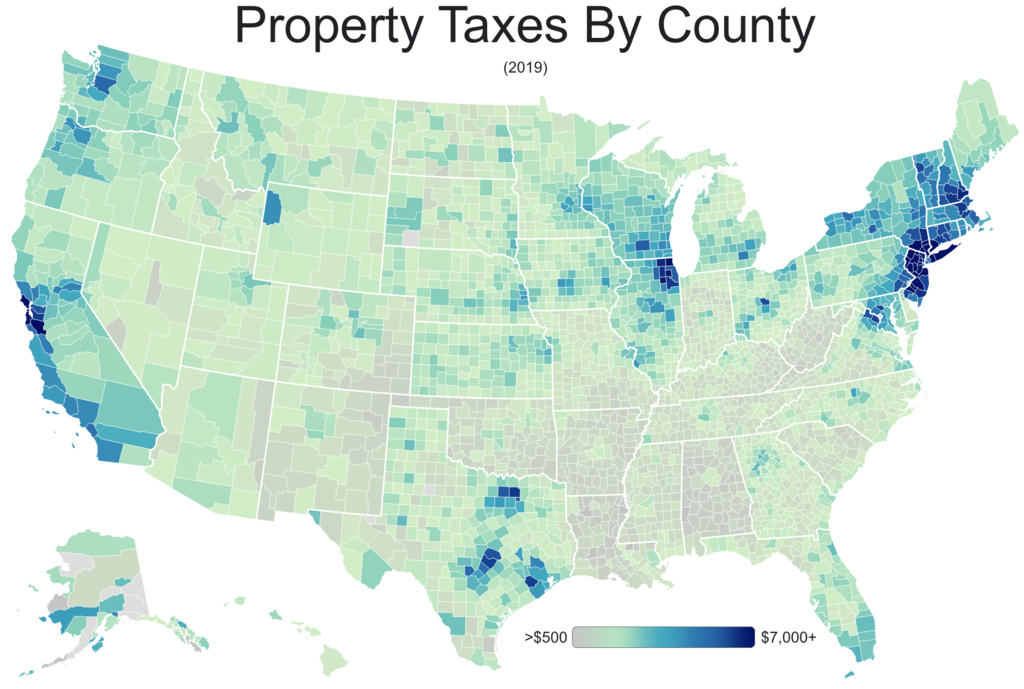

Useful Map Of Property Tax Rates Across The Country with Some

Taxes And Massachusetts Let s Look At The One Percent Mike The Mad

What Is Tax Rate In Massachusetts - What is the Massachusetts State Tax Rate The Massachusetts state tax rate is 5 on earned income like salaries commissions tips and wages and unearned interest dividends and