What Is Tax Rate On Dividends In Canada As of 2023 the federal tax rate for eligible dividends is 38 while the rate for non eligible dividends ranges from 6 87 to 27 57 Provincial tax rates also apply and they vary by province

If your dividend is eligible you must add back 38 of your received dividend and deduct 15 0198 from the gross taxable amount as a federal dividend tax credit Other than eligible dividends there are those Dividends in Canada are taxed through a mechanism that includes a gross up and a dividend tax credit DTC to reduce double taxation The actual tax rate on dividends depends

What Is Tax Rate On Dividends In Canada

What Is Tax Rate On Dividends In Canada

https://foreignpolicyi.org/wp-content/uploads/2022/09/How-Much-Tax-do-you-Pay-on-Dividends-in-Canada-870x527.jpg

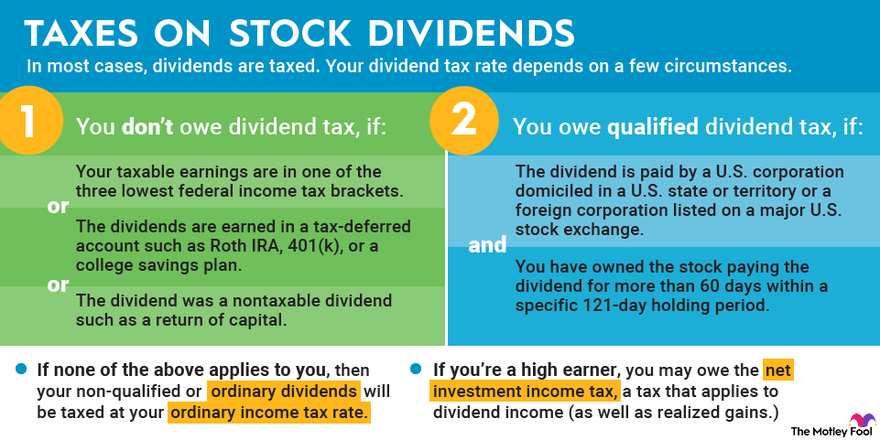

Dividends Are Taxable Income Sometimes They re Taxed At Ordinary Tax

https://i.pinimg.com/originals/08/e8/b9/08e8b9c1b902887532037108dcd6247b.jpg

Expatriation The Tax Rate In Canada Is Advantageous By Nomad Choice

https://miro.medium.com/v2/resize:fit:1200/1*cyhmOmu8HR7qO3soEDfhdw.jpeg

For example dividend income you receive from Canadian corporations is taxed at a preferential income tax rate In comparison foreign dividends are taxable at your marginal income tax rate The federal dividend tax credit rate for eligible dividends is approximately 15 02 This preferential treatment means that if you received eligible dividends you would be entitled

Most dividends in Canada are taxable dividends Because dividend income is already taxed by the corporation before it is given to shareholders the tax rate on it is lower The Dividend Tax Credit rate for eligible dividends is 15 0198 and 9 031 for non eligible dividends In this example you d be able to subtract your federal table payable

Download What Is Tax Rate On Dividends In Canada

More picture related to What Is Tax Rate On Dividends In Canada

How Dividends Are Taxed In Canada Dividend Tax Credit Gross Up

https://i.ytimg.com/vi/BQU4tUg5Npc/maxresdefault.jpg

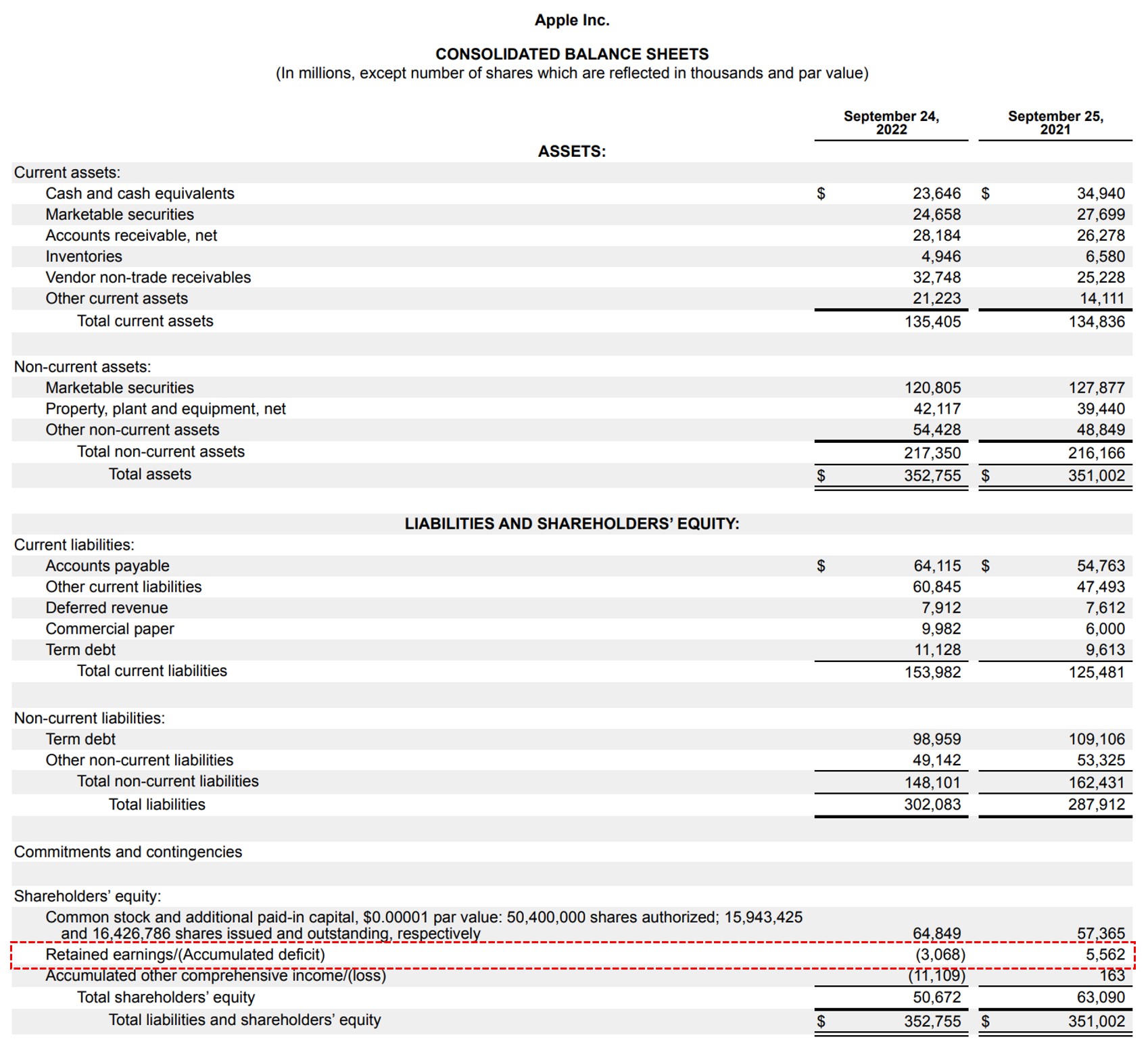

What Are Retained Earnings Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/10/09182412/Retained-Earnings-Example-Apple-AAPL.jpg

How Dividends Are Taxed In Canada Kinden CPA

https://www.kindencpa.ca/wp-content/uploads/2021/03/thumb.png

The tax rates used are as known on August 20 2024 Taxes Payable on Canadian Eligible Dividends Due to the alternative minimum tax changes for 2024 there is no alternative minimum tax in any of the cases below resulting Tax rates on dividends in Canada generally result in lower tax liabilities compared to regular income especially for eligible dividends Eligible dividends are grossed up by 38

This guide will walk you through the dividend tax credit the tax rates and the different types of dividends We ll break down the confusion around dividend income and how it affects your taxes Let s get started and learn more about In summary dividend income in Canada is taxed at a lower rate compared to interest income due to the dividend tax credit The dividend tax rate for investors in the highest

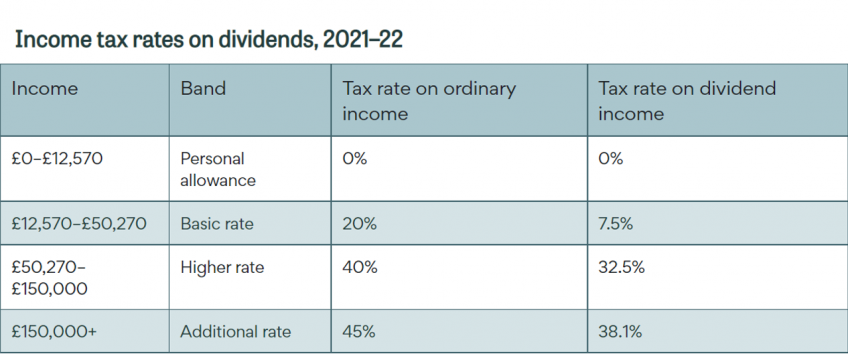

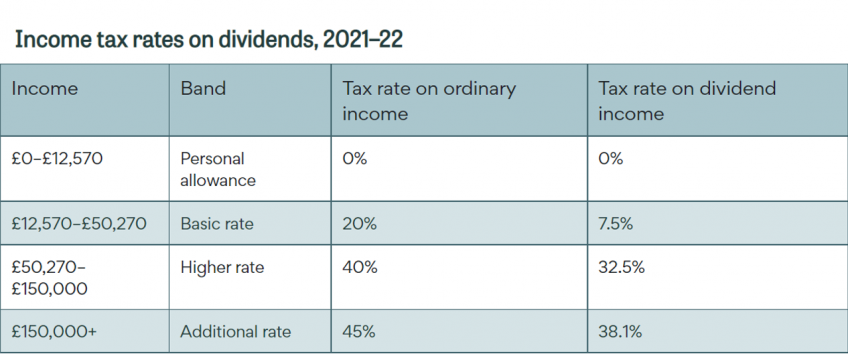

Income Tax Rates On Dividends 2021 22 IFS Taxlab

https://ifs.org.uk/sites/default/files/styles/wysiwyg_full_width_desktop/public/2021-06/Income tax rates on dividends%2C 2021–22.png?itok=lYbDEcrN

Understanding The Taxes On Dividends In Canada

https://taxcounting.com/mt-content/uploads/2021/08/picture2_611a4ee8cfea2.png

https://www.straight.com › guides › finance › dividend...

As of 2023 the federal tax rate for eligible dividends is 38 while the rate for non eligible dividends ranges from 6 87 to 27 57 Provincial tax rates also apply and they vary by province

https://mccayduff.com › everything-you-need-to-know...

If your dividend is eligible you must add back 38 of your received dividend and deduct 15 0198 from the gross taxable amount as a federal dividend tax credit Other than eligible dividends there are those

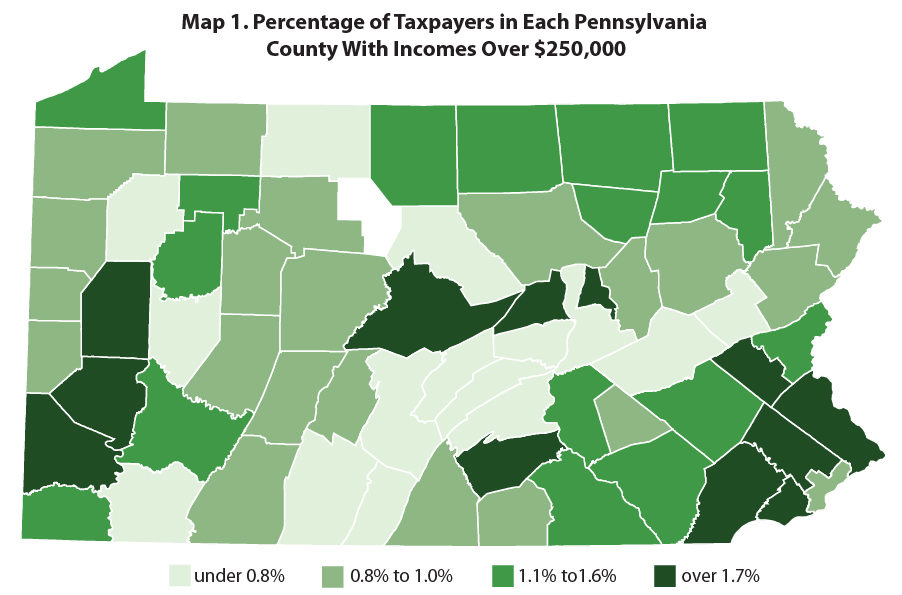

Few In PA Would Be Affected By Ending High income Tax Cuts KRC

Income Tax Rates On Dividends 2021 22 IFS Taxlab

How Are Dividends Taxed 2023 2024 Dividend Tax Rates The Motley Fool

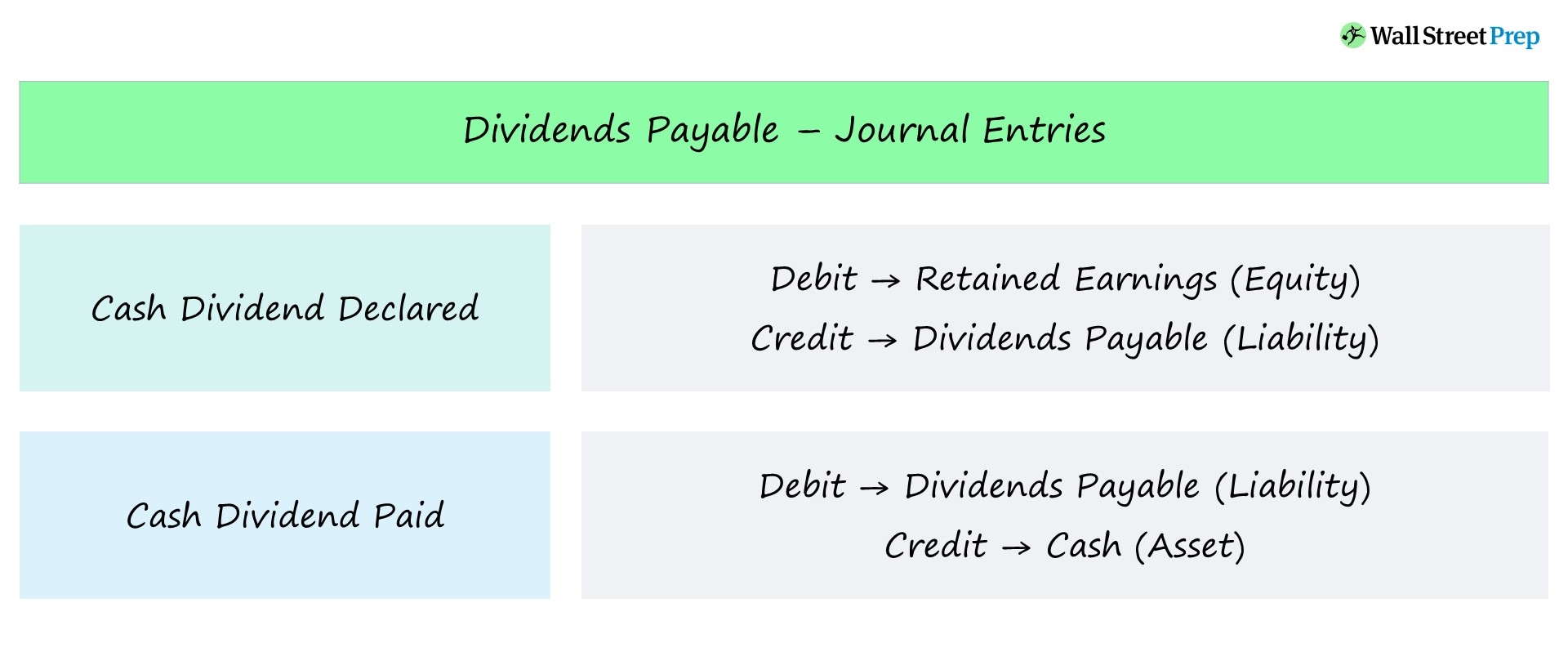

Dividend Paid Double Entry MakailataroMartin

Understanding The Taxes On Dividends In Canada

Tax Education All You Need To Know About Filing Due Dates Flavourway

Tax Education All You Need To Know About Filing Due Dates Flavourway

Understanding The Taxes On Dividends In Canada

Haven t Filed Taxes In 5 Years Reddit Fear Column Image Library

Actual Dividends VS Taxable Dividends In Canada In 2024

What Is Tax Rate On Dividends In Canada - For example dividend income you receive from Canadian corporations is taxed at a preferential income tax rate In comparison foreign dividends are taxable at your marginal income tax rate